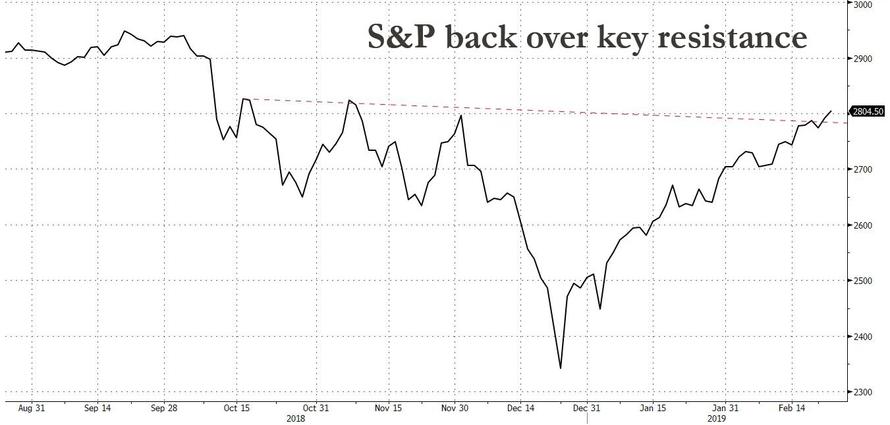

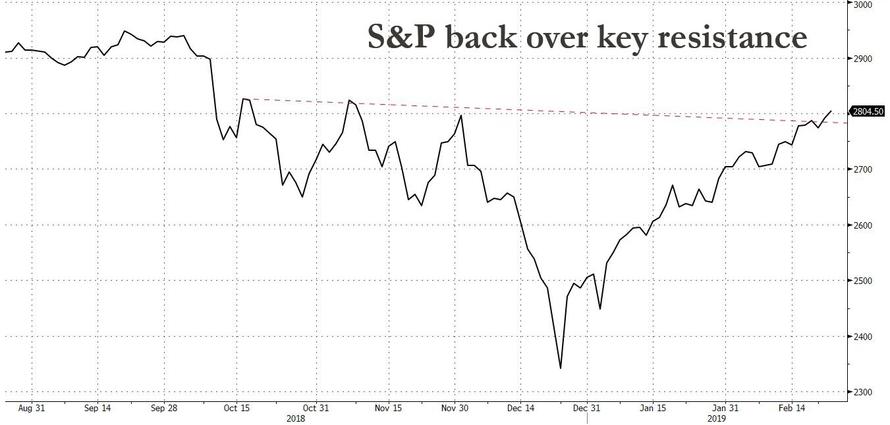

For the past two months, stocks were buying the rumor that a trade deal would happen, and since Sunday night they have been also buying the news, after Donald Trump announced he would postpone the date for boosting tariffs on Chinese imports, taken as a sign of progress in the trade talks. While bonds fell and the dollar retreated, it was the S&P that finally broke above the key 2,800 resistance level that had proven too much for market for the past four months…

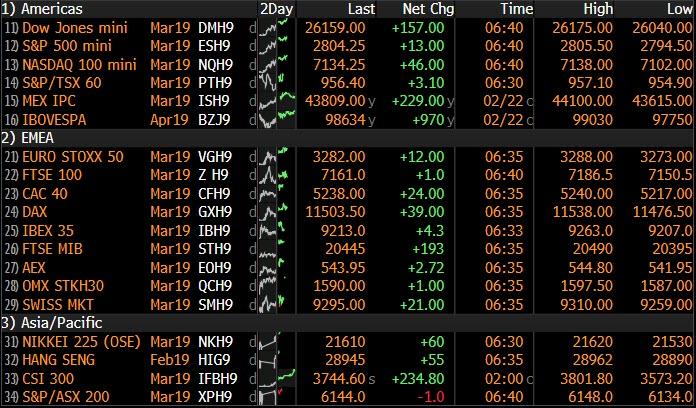

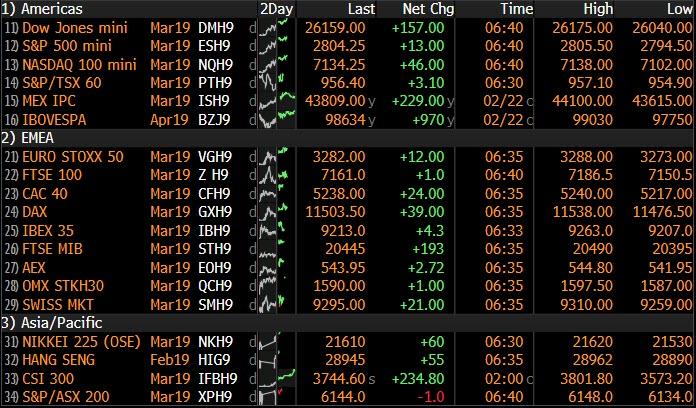

… while global markets were a sea of green.

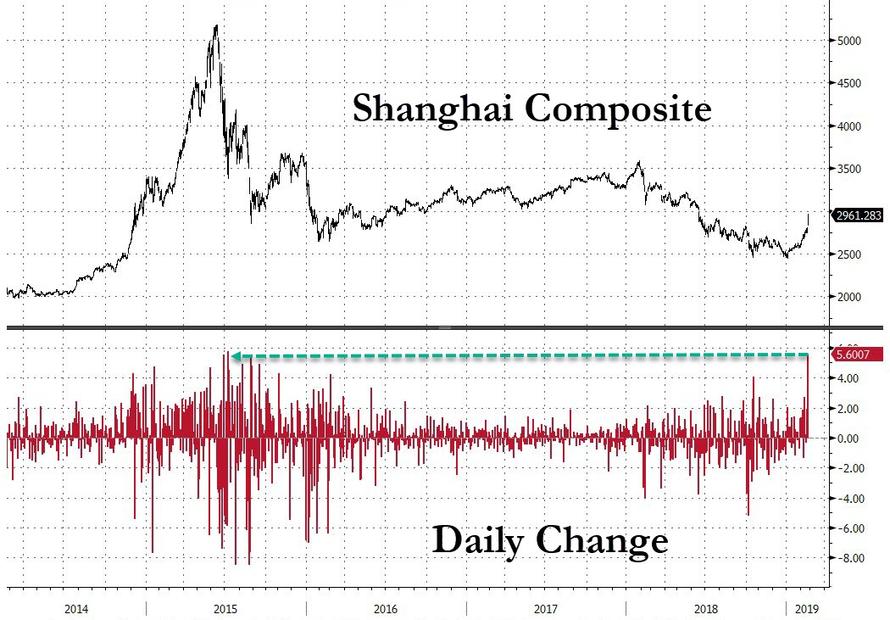

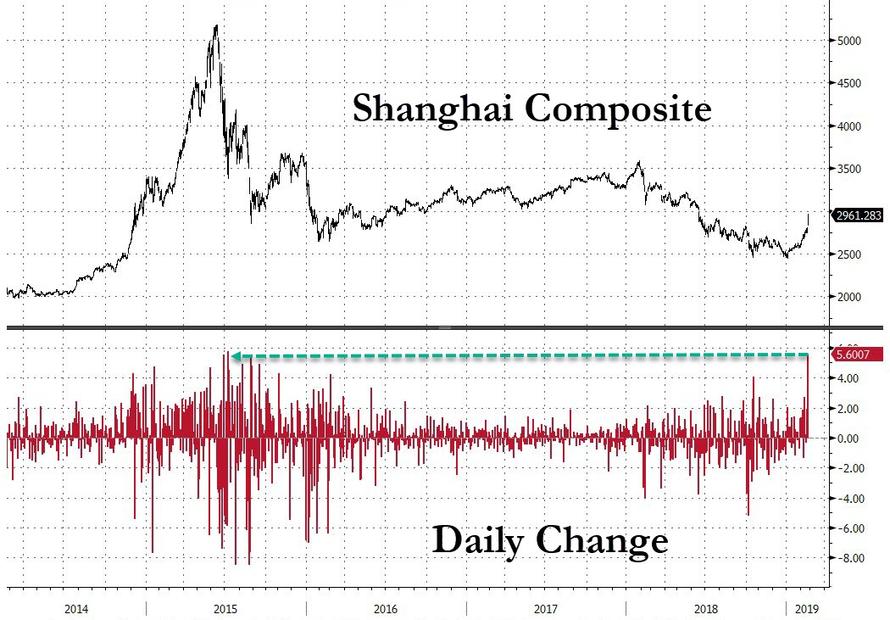

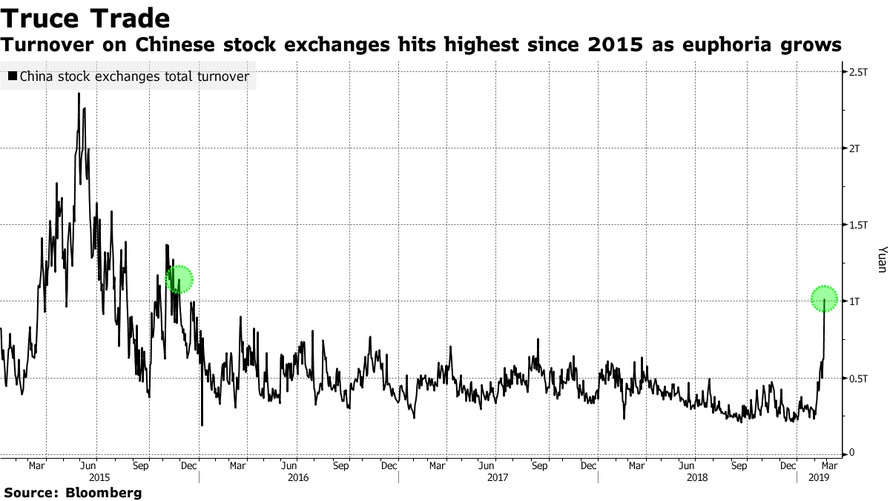

But no market was as excited to surge on the late Sunday news as China, where the recent $1 trillion rally pushed two more indexes into bull markets overnight on an explosion of volume: China’s CSI 300 Index surged 6% Monday and the Shanghai Composite Index climbed 5.6%, its biggest daily, gain in nearly 4 years and extending their gains from a Jan. 3 low to more than 20%, entering a bull market.

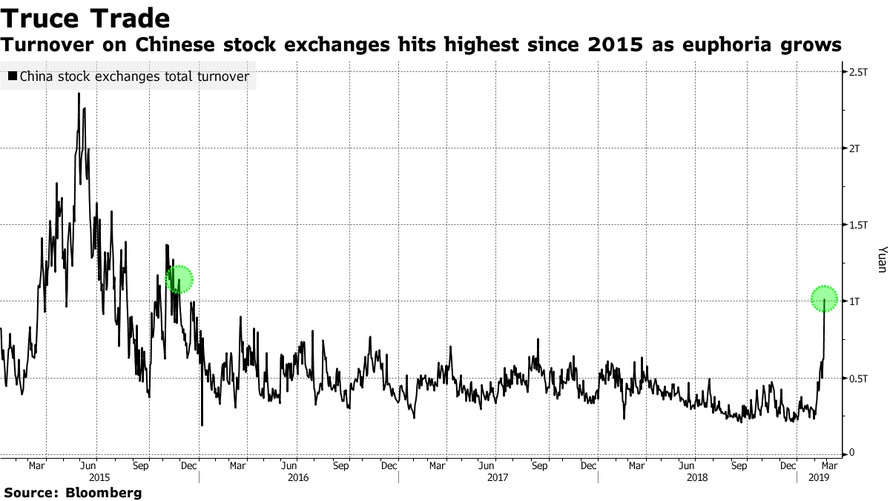

The ChiNext Index of small caps and technology stocks, which entered a bull market Friday, rose a further 5.5 percent. Turnover on Chinese exchanges rose beyond 1 trillion yuan to the most since 2015.

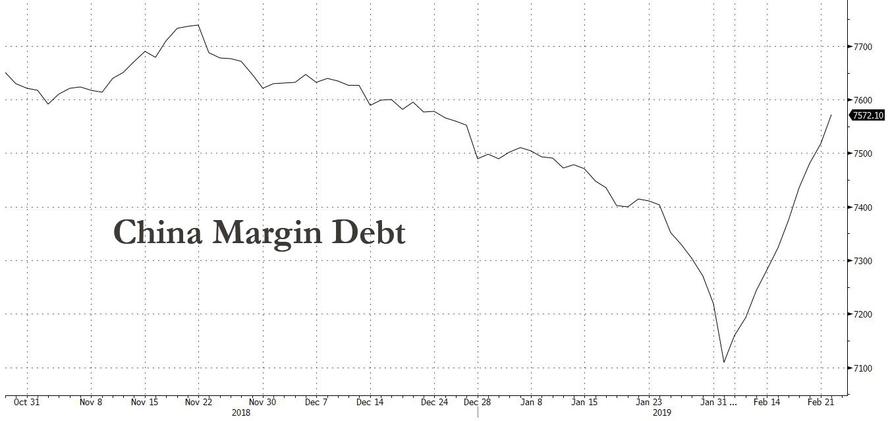

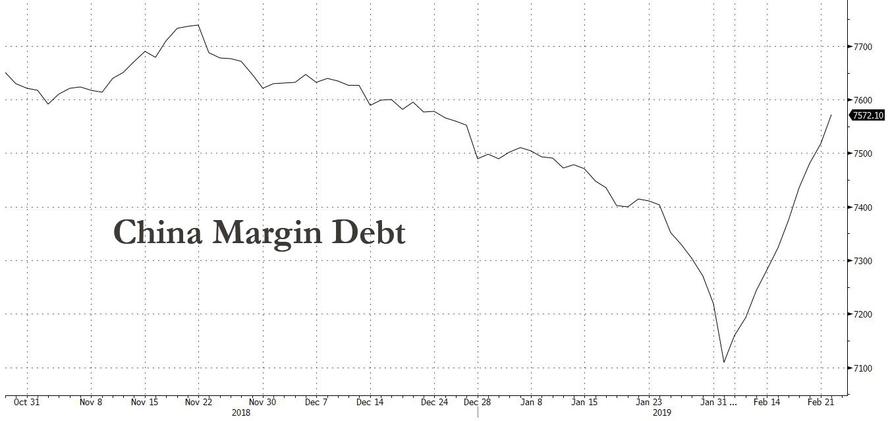

A big driver for this surge in Chinese stocks where the government now appears ok with reflating yet another stock bubble, is the recent increase in margin debt, which has exploded higher over the past two weeks at the fastest pace since 2015.

“Even if stocks retreat in the short term, there’s still room for further gains as leverage is still way below the peak despite the increase,” said Shen Zhengyang, a Shanghai-based strategist with Northeast Securities Co. “Investors also have to bear in mind that economic fundamentals are still bad, so in order to avoid getting burned in a likely more volatile market, it’s key to always remain wary.”

Meanwhile, suggesting that Beijing is indeed greenlighting another stock bubble, Chinese brokerage stocks were especially hot, after President Xi said in a Politburo meeting that China will deepen reform in the finance sector and further open the industry. Huatai Securities Co. was among the brokerages to climb by the 10 percent daily limit in Shanghai, closing at its highest since June 2015. Actually as Bloomberg notes, all 30 Shanghai and Shenzhen-listed stocks with the word “securities” in their names rose by the 10% daily limit. The market is reacting quite positively as it’s rare to see the capital market and financial industry the main focus of that top policy meeting, says XuFunds partner Wang Chen.

It wasn’t just China as MSCI’s broadest index of Asia-Pacific shares outside Japan added 0.8%, touching its highest since September, and is now up 10% so far this year. The Japanese Nikkei also gained, closing half a percent up at its highest since December.

The euphoric investor sentiment also boosted the yuan, which is the best performer among major currencies since Feb. 1, strengthening 0.8 percent against the dollar. The currency was up 0.34 percent at 6.6928 as of 3:14 p.m. in Shanghai.

The fresh trade deal optimism quickly spread across the globe and boosted European carmakers and miners, sparking a rally in the Stoxx Europe 600 Index, and by mid-morning, MSCI’s world equity index was up 0.2 percent at its highest since October. There was some mild underperformance in the SMI (U/C) as index heavyweight Roche (-0.6%) is down as the Co. are to purchase Spark Therapeutics in a deal valued at USD 4.8bln, which is at a 122% premium to Spark’s Friday close and at a 19% premium to their 52-week intraday high. Sectors were mixed, with some slight outperformance in Financial names. Other notable movers include PostNL (+9.1%) who are at the top of the Stoxx 600 following their earnings. UK housebuilders are underperforming after Persimmon (-5.7%) are reportedly facing removal of their right to participate in the government’s Help to Buy scheme, following reports of poor standards and hidden charges; as such, Taylor Wimpey (-2.3%) and Barratt Developments (-1.8%) are down in sympathy.

Italy’s bonds rallied after Fitch Ratings kept the country’s credit rating unchanged, easing fears that it will be downgraded to junk anytime soon

Emerging-market currencies and shares advanced despite China’s state-run Xinhua news agency later publishing a commentary saying talks will be harder at the final stage. Treasuries and core European bonds slipped, while Italy’s securities advanced and the euro strengthened. Following Trump’s tweet, developing-nation equities headed for the longest rally in nine months. South Africa’s rand led currency gains, with its biggest advance this month, and Russia’s ruble was set to post its longest winning streak since April 2015. “Given this string of positive news, it is hard to see an inflection in the positive EM momentum today,” Guillaume Tresca, a Paris-based strategist at Credit Agricole SA, wrote in a report. “This could help to support EM sentiment, which has been fragile,” with emerging-market portfolio inflows decelerating in the past two weeks.

The official delay from the U.S. may give fresh impetus to extend a global rally in equities that was being tested amid an uncertain future on global trade and forecasts for global economic growth to ebb. Meanwhile, it is unlikely that the market euphoria will fizzle any time soon: Fed Chairman Jerome Powell, whose dovish capitulation has also helped to boost markets, will testify on U.S. monetary policy on Tuesday and Wednesday.

“Expect him to emphasize patience, stating that any more hikes this year would likely require some pickup in inflation,” wrote analysts at TD Securities in a note. Participants in currency markets shared that sentiment. “We expect more of the same…, with Powell generally supportive of risky assets,” said Adam Cole, chief currency strategist at RBC Market. “We think the mood of optimism and better bid for risk is probably something we live with for the week.”

The trade news was largely priced in to currency markets, with the risk-on mood nudging the dollar down 0.1 percent against a basket of currencies to 96.518. The pound gained after U.K. Prime Minister Theresa May pushed back the deadline for a so- called meaningful vote in Parliament on her Brexit deal as she tries to give herself more time to renegotiate the agreement with the EU. Aussie and Kiwi rose to a fresh day’s high versus the U.S. dollar in early London trading after whipsawing in Asian session amid conflicting headlines around the progress of U.S.- China trade talks; China’s official Xinhua News Agency echoed Trump’s tweet, citing “substantial” progress, but a commentary published later cautioned that the talks may face “new uncertainties,” noting that bilateral trade frictions are “long term, complicated and arduous.” The euro ticked up 0.1 percent against the greenback, trading around $1.1350 and staying within the $1.1213/1.1570 range that has held since mid-October.

In commodities, oil prices edged up toward 2019 highs on the trade news, and as sanctions and political uncertainty tightened supply in several producer countries. However, oil quickly reversed and tumbled to session lows after Trump tweeted just before 7am EDT that “Oil prices getting too high. OPEC, please relax and take it easy. World cannot take a price hike – fragile!”

Economic data include wholesale inventories. Earnings due from Oneok, Mosaic

Market Snapshot

- S&P 500 futures up 0.4% to 2,801.75

- STOXX Europe 600 up 0.4% to 372.70

- MXAP up 0.7% to 160.73

- MXAPJ up 0.7% to 528.35

- Nikkei up 0.5% to 21,528.23

- Topix up 0.7% to 1,620.87

- Hang Seng Index up 0.5% to 28,959.30

- Shanghai Composite up 5.6% to 2,961.28

- Sensex up 0.9% to 36,189.95

- Australia S&P/ASX 200 up 0.3% to 6,186.32

- Kospi up 0.09% to 2,232.56

- German 10Y yield rose 2.0 bps to 0.116%

- Euro up 0.1% to $1.1350

- Brent Futures up 0.07% to $67.17/bbl

- Italian 10Y yield rose 1.4 bps to 2.487%

- Spanish 10Y yield fell 0.7 bps to 1.168%

- Brent Futures up 0.07% to $67.17/bbl

- Gold spot down 0.06% to $1,328.55

- U.S. Dollar Index down 0.1% to 96.42

Top Overnight News

- There could be “new uncertainties” in the final stage of the China-U.S. trade negotiations and Beijing should do its best while preparing for the worst, Xinhua said in a commentary

- U.S. President Donald Trump said he’ll extend a deadline to raise tariffs on Chinese goods beyond this week, citing “substantial progress” in the latest round of trade talks

- The U.S. and China haven’t yet agreed on the critical issue of enforcement in a proposed currency deal that would ensure Beijing lives up to its promise to not depreciate the yuan, four people familiar with the matter said

- Theresa May once again postponed a final vote on her Brexit divorce agreement, setting a new deadline of March 12 for Parliament to vote on the accord she’s still trying to renegotiate. EU officials may tell the U.K. that if it wants to delay its departure date, the country must stay in the bloc until 2021

- New York Fed President John Williams voiced concerns that inflation expectations may have slipped downward after years in which price rises have failed to reach the central bank’s 2% target

- A Chinese state-backed borrower’s failure to make good on a payment on a dollar bond on Friday threatens to overturn assumptions that officials would step in to avert defaults by companies closely linked to local authorities

- JPMorgan Chase & Co. gained some of the biggest shares in both fixed-income and equities trading last year, solidifying its leadership in one and nearing the top in the other. Deutsche Bank AG lost ground in both markets while trying to restructure its business

- The U.K. and U.S. sought to allay fears of disruption in the multitrillion-dollar derivatives market, vowing to put in place emergency policies to ensure trading continues uninterrupted in the event of a no-deal Brexit

Asian stocks kick-started the week with modest gains following a strong lead from Wall Street where the DJIA notched a 9-week winning streak and reclaimed the 26,000 level to the upside amid optimism surrounding US-China trade talks. ASX 200 (+0.3%) opened marginally firmer but gains in the material sector were offset by underperformance in the utility and telecom names, whilst Nikkei 225 (+0.5%) advances were led by the IT and material sectors. Elsewhere, Shanghai Comp (+5.6%) outperformed as investors cheered US President Trump’s announcement of an extension to the China tariff deadline, citing good progress on key issues whilst also noting plans for a Summit with Chinese President Xi. Meanwhile the CSI 300 (+5.9%), formed of major companies listed in Shanghai and Shenzhen, surged into bull market territory, marking a 23% gain from cycle lows. Finally, Hang Seng (+0.5%) failed to grasp onto the same momentum as its mainland peers, as the index was weighed on by the utilities sector after China Resources Power fell over 5% amid reports of delisting.

Top Asian News

- Ping An Is Said to Plan IPO of Fintech Unit at $8 Billion Value

- China’s Stock Surge Puts World-Beating Bond Rally in Shade

- Failed Hijacker Was on Bangladesh’s Anti-Terror Agency Watchlist

- Fortis Asks Indian Regulator to Arrest Founders Accused of Fraud

Major European equities are in the green [Euro Stoxx 50 +0.4%] continuing the gains seen in Asia which were spurred by strong US markets. There is some mild underperformance in the SMI (U/C) as index heavyweight Roche (-0.4%) is down as the Co. are to purchase Spark Therapeutics in a deal valued at USD 4.8bln, which is at a 122% premium to Spark’s Friday close and at a 19% premium to their 52-week intraday high. Sectors are mixed, with some slight outperformance in Financial names. Other notable movers include PostNL (+9.9%) who are at the top of the Stoxx 600 following their earnings. UK housebuilders are underperforming after Persimmon (-4.4%) are reportedly facing removal of their right to participate in the government’s Help to Buy scheme, following reports of poor standards and hidden charges; as such, Taylor Wimpey (-2.5%) and Barratt Developments (-1.5%) are down in sympathy.

Top European News

- Twinings Owner Warns of Food Shortages After a No-Deal Brexit

- Huawei Frightens Europe’s Data Protectors. America Does, Too

- Italian Bonds Surge After Fitch Calms Fears of Rating Downgrades

- PKO Says Poland’s Stimulus Should Keep Economic Growth Above 4%

In FX, AUD/NZD/SEK/NOK The Aussie and Kiwi are just eclipsing the Swedish Crown at the helm of the G10 pack, partly on latest US-China trade news that has lifted broad risk sentiment, and for the Nzd also much stronger than expected data in the form of Q4 retail sales overnight. Aud/Usd has rebounded further from recent sub-0.7100 lows through the 50 DMA (0.7134) and just above the 0.7161 (100 DMA) to a high of 0.7174 with last Thursday’s high (0.7207) next on the rader for bulls. Nzd/Usd is hovering just below the top of a 0.6883-27 range as the cross pivots 1.0400 again. Similarly, the Sek and Nok are benefiting from the general appetite for risk assets, with Eur/Sek extending its post-Riksbank minutes retreat to just under 10.5600 at best, while Eur/Nok has been down through 9.7400.

- GBP/EUR The next best majors, but mainly at the expense of a softer Usd with the DXY slipping back below 96.500 on the aforementioned US-Sino tariff truce, as Cable maintains 1.3000+ status and the single currency keeps its head above 1.1300. However, the Pound has been choppy again amidst ongoing Brexit uncertainty and a barrage of contrasting headlines, and the Eur is still encountering chart hurdles above 1.1350, like the 30 DMA around 1.1365.

- CAD/CHF/JPY All narrowly mixed vs the Greenback, but the Loonie is consolidating closer to highs vs its US counterpart alongside crude prices and eyeing 1.3100 within a 1.3150-22 range and the Franc appears more settled above parity, while the Jpy has pared some overnight losses from 110.85 towards 110.50.

- EM Understandably, the Yuans have greeted ‘substantial’ or ‘concrete’ progress between the US and China on the trade issue with delight/huge relief, and from another softer PBoC Usd/Cny reference point have rallied further to test 6.6900+ levels. However, other regional currencies are also getting a boost on the prospect of a deal and wider repercussions for the global economy, with Usd/Zar down sharply from 13.9930 to 13.8480 at one stage, Usd/Rub under 65.2500 and Eur/Huf probing below 318.00 (Forint also appreciating Fitch’s Hungarian upgrade to BBB/stable outlook).

In commodities, WTI futures gave up opening gains despite the overall trade-driven optimism, although it is worth noting that Nigerian election polls have now closed with reports of dozens killed in election violence, however, there has been no reports of disrupted oil flow from the OPEC producer. Oil tumbled after president Trump tweeted a warning to OPEC that oil prices were getting too high. Also, in spite of the Baker Hughes rig count showing a drop of four active rigs, US production reached a record high last week at 12mln BPD according to EIA data. Elsewhere, spot gold benefitted from the easing buck and hovered near Friday’s highs, while copper traded choppy as initial trade-induced upside waned after Xinhua noted that US-China trade talks are said to become more difficult at the final stage. Iranian Supreme National Security Council Secretary said Iran has designed and put into practice initiatives to neutralise the US sanctions against Iranian oil exports. He also noted that Iran has options to stop oil flow if threatened, other than closing Strait of Hormuz.

US Event Calendar

- 8:30am: Chicago Fed Nat Activity Index, est. 0.2, prior 0.3

- 10am: Wholesale Inventories MoM, est. 0.3%, prior 0.3%

- 10am: Wholesale Trade Sales MoM, est. -0.3%, prior -0.6%

- 10:30am: Dallas Fed Manf. Activity, est. 4.9, prior 1

DB’s Jim Reid concludes the overnight wrap

Can you believe at the end of this week it will be March? Where does time go? The weather was unseasonably unbelievable across most of Europe over the weekend and I’ve caught the sun a little and have spent the entire weekend rubbing my eyes and sneezing non-stop. I now look forward to a week in polluted London to calm me down from countryside pollen. We move into our new house in around 8 weeks but as a measure of the banality of my life at the moment over the weekend we were told that the carpets we ordered throughout the house can only be laid on time if we have various joins between pieces. If we want one without joins anywhere it will be 10 weeks, more expensive and will delay the move date. My vote is for the joins and to get in the house on time but my wife is insistent that she’d rather wait. This debate has to be concluded one way or another tonight over dinner. When I woke this morning to watch clips of the Oscars I was desperately hoping I’d see subtle joins all down the red carpet so I could show my wife that if it’s good enough for Hollywood it’s good enough for us. Sadly I couldn’t see any.

From red carpets to colourful politics this week. Indeed if you’ve had enough of politics I suggest you go on holiday for a few days as this topic should dominate proceedings. We have continued US-China trade discussions but with the March 1st tariff deadline pushed back overnight, a second summit between Trump and Kim Jong Un (Weds/Thurs), another Brexit parliament vote (Weds), Michael Cohen (Mr Trump’s ex-lawyer) giving two days of congressional testimony, including an open session on Wednesday, and the Mueller Russia investigation may be completed even if the results aren’t expected this week. Away from that we’ve got Powell’s semi-annual testimonies to Congress (Tues/Weds), US Q4 GDP (Thurs) and PCE data (Fri), European inflation data (Thurs/Fri) and final PMIs (Friday), and PMIs due out in China (Thurs).

Touching on the highlights of these, Friday was the original deadline that the US and China set to negotiate an agreement before US tariffs on $200bn of Chinese imports rise from 10% to 25%. However Trump has tweeted overnight that “I will be delaying the U.S. increase in tariffs now scheduled for March 1,” citing productive talks with China while adding, “the U.S. has made substantial progress in our trade talks with China on important structural issues including intellectual property protection, technology transfer, agriculture, services, currency, and many other issues.” He also said that if both sides make further headway in negotiations then he will meet China’s Xi Jinping at his Mar-a-Lago resort in Florida to conclude an agreement, though he didn’t offer any details on the timing of the meeting or how long he expects the tariff extension to last. However, Mnuchin had said last week that the meeting between Trump and Xi is being tentatively planned for late March. Elsewhere, China’s state-run Xinhua news agency published a commentary on trade talks overnight saying that talks will be harder at the final stage. We should note that Lighthizer is due to testify to the House Ways and Means Committee on Wednesday which should shed some light on where things stand although the media are picking up on disagreements between Trump and Lighthizer. So lots of moving parts.

This morning in Asia risk has gained on the tariff delay tweet with Chinese bourses leading the advance – the CSI (+3.55%), Shanghai Comp (+3.32%) and Shenzhen Comp (+4.08%) are all up. The Nikkei (+0.53%) and Hang Seng (+0.39%) are also up while the Kospi (+0.00%) is trading flat. China’s onshore yuan (+0.39%) is also up – trading at the highest level since July while most EM FX is strong against the greenback this morning. Elsewhere, futures on the S&P 500 are up +0.28% erasing some of the gains after the more cautious news from the Xinhua news agency trickled in. In commodities, US corn and soybean futures are up +0.52% and +0.70% respectively.

Here in the UK the latest Brexit Parliament vote is scheduled for Wednesday with UK PM May updating the House of Commons the day prior. However yesterday Mrs May said that there will be no meaningful vote this week but promised one by March 12th. At this stage it’s not clear whether that will help stave off a Letwin/Cooper revolt which would effectively force the government to extend Article 50. Earlier, on Saturday, three cabinet ministers – Amber Rudd, David Gauke and Greg Clark – wrote a joint article warning that they cannot allow the UK to leave without a deal and suggested that they will vote to stop it on Wednesday, partly indicating that they might vote for a Letwin/Cooper amendment. Expect a delicate few days of negotiations and rumours ahead before MPs go into that vote. Bloomberg reported yesterday that many in the EU are leaning towards a 21-month extension to article 50, partly in an attempt to scare Brexiteers into voting for the existing deal as 21-months is a very long time and anything could happen to Brexit in that period. Sterling is trading (+0.13%) up this morning.

As an aside it’s been interesting to watch the opinion polls (like Survation, YouGov and Deltapoll) in the U.K. Since the new centrist Independence movement started a week ago, the initial polling has suggested that support for the opposition Labour Party is declining most with at least three polls (two over the weekend) suggesting the Tories have at least an 8 point lead. It’s possible this poor showing and threats of more departures could finally prompt Labour to endorse a second referendum so watch this space. It’s also remarkable that the Tories support remains rock solid at or just below 40% considering the perception of how they’ve handled Brexit. It could be argued though that if you voted to leave and still feel that way, then the only viable option is to vote Tory. However the party have a huge dilemma. Keep pursing Brexit (including leaving no-deal on the table) but risk multiple resignations/defections from pro-EU Tory MPs, or alternatively soften their stance and risk voter support and splits on the right wing of the party. The papers (like Guardian, Sky News) at the weekend suggested lots of moderate Tories are close to rebelling so the disunity that Labour is currently suffering from could easily spread to the Government this week. If Labour switch to a second referendum policy it might swing the momentum back towards them. Interesting and fluid times.

Politics also mixes with central bankers this week as we have Fed Chair Powell’s testimonies to the Senate Banking Committee on Tuesday and House Financial Services Committee on Wednesday where he will deliver the Fed’s semi-annual monetary policy report. Expect the focus to be on the balance sheet, the current thinking on inflation and also how Powell now views the economic outlook, particularly as it relates to the various crosscurrents that Powell has previously referred to.

Ahead of this many Fed speakers spoke at a conference in New York on Friday, including Vice Chair Clarida who said that yield curve control, where 10-year yields are pegged, is one potential option to fight a future recession. The Fed will conduct a thorough review of its policy framework later this year. NY Fed President Williams also spoke about potential changes to the framework, citing the risk of unanchored inflation expectations as a reason to reassess the current ‘inflation-targeting’ regime. While he said he takes the Phillips curve seriously and remains attentive to upside risks to inflation given the tight labour market, he noted that downside risks to inflation are elevated as well. San Francisco Fed President Daly spoke about targeting an average inflation rate of 2%, which could be interpreted dovishly as it would imply appetite to let inflation run higher in the near term to compensate for recent downside misses. Clarida also spoke about a higher inflation target, though he noted some of the negative effects of such a policy. Overall, it appears that there are many options on the table for the Fed to consider, and this story will remain in focus through the June conference where they will begin the office policy review which is likely to result in a final assessment next year.

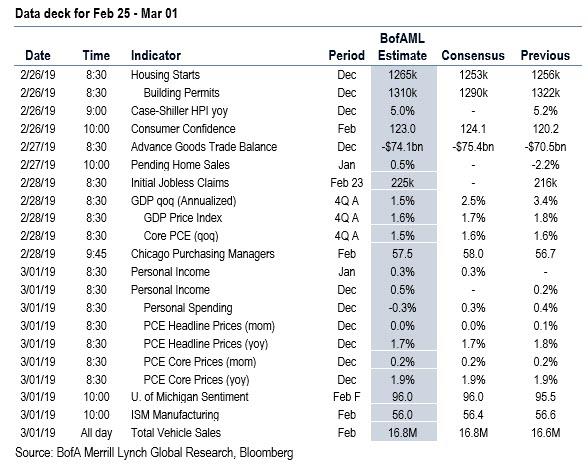

In terms of data this week, the main highlights are at the back end with a first look at US Q4 GDP on Thursday and then the December PCE reading due on Friday. Expectations for Q4 GDP are for a +2.5% qoq annualized reading which would be down from +3.4% in Q3, while core PCE is expected to rise +0.2% mom which would be enough to hold the annual rate at +1.9% yoy and therefore more or less in line with the Fed’s target. Other data worth highlighting in the US next week include December housing starts, building permits and consumer confidence on Tuesday, the December advance goods trade balance on Wednesday, and February ISM manufacturing on Friday.

In Europe the main highlights this week are the preliminary February CPI readings in France and Germany on Thursday and the Euro Area on Friday, as well as the final February manufacturing PMIs, including a first look at the non-core. China’s February PMIs on Thursday is likely to be the main highlight in Asia. We should also note that China’s NPC Standing Committee is due to meet for two days from Tuesday ahead of the annual NPC which begins the week after.

The rest of the day by day week ahead guide is at the end. Before that let’s look at recap of Friday and last week.

On Friday, attention was focused on trade negotiations and communications from central banks. Equities rallied broadly on Friday taking the week into positive territory, with the S&P 500, DOW, and NASDAQ ending the week +0.62%, +0.57%, and +0.74% (+0.64%, +0.70%, and +0.91% on Friday), respectively. In Europe, the STOXX 600 gained +0.62% (+0.22% Friday), with the DAX outperforming, up +1.40% (+0.30% Friday). Commodities rallied as well, with Brent crude oil advancing +1.15% (-0.09% Friday) and copper posting its best week since last September to reach its highest level since last June, gaining +5.40% (+1.81% Friday).

On the trade front, President Trump met with Vice Premier Liu He, and both sides described the discussions as productive. Trump specifically mentioned a potential extension of the March 1 deadline, and top trade negotiator Lighthizer, who is one of the more hawkish members of the administration, said the sides had “made a lot of progress.” That said, he did say that some great hurdles remain, but markets seemed to focus more on the broader optimism, including Treasury Secretary Mnuchin’s announcement that the two sides reached an agreement in principle on currency-related matters. The offshore yuan appreciated +0.91% on the week (+0.21% Friday) to reach its strongest level since last July.

Quickly recapping Friday’s central bank speak. Banque de France Governor Villeroy mentioned that the ECB should “study pragmatically how to contain possible adverse effects on the bank transmission of our monetary policy”. That mirrored earlier comments from the BoJ Governor Kuroda, who said that any future easing would come via tools that have the “least side-effects”. These could be references to some alleviation of the harm from negative interest rates.

It is a quiet day for data with the releases focused in the US where we get the January Chicago Fed national activity index, December wholesale inventories and trade sales and February Dallas Fed manufacturing activity index. Away from that, the BoE’s Carney and Fed’s Clarida are due to speak.

via ZeroHedge News https://ift.tt/2XnL0io Tyler Durden

It was shortly after Donald Trump took office that the father of one of my son’s taekwondo classmates approached me in our small, reliably Republican Arizona town to chat about the new White House resident.

It was shortly after Donald Trump took office that the father of one of my son’s taekwondo classmates approached me in our small, reliably Republican Arizona town to chat about the new White House resident.