Stockholm Syndrome is defined as “…a condition that causes hostages to develop a psychological alliance with their captors as a survival strategy during captivity.” While observers would expect kidnapping victims to fear and loathe the gang who imprison and threaten them, the reality is that some don’t.

There is a loose analogy between being held hostage and being an investor in a regime of irredeemable paper currency and zero interest rates. In both cases, the victim has little hope of escape and must seek to somehow survive under malevolent conditions.

Key behaviors in Stockholm Syndrome are positive feelings for their captors, a refusal to work with law enforcement afterwards, and even a belief in the terrorist’s humanity.

Key behaviors of investors today show eerie parallels: a desire to bid on dollars with their assets, a refusal to support the gold standard, and even a belief that the dollar is money. This last always shows when someone—even a gold bug—says gold is going up, or gold is the best performing currency, or gold has good returns.

These words up, performance, and returns indicate that the victim accepts the dollar as money, the dollar as the measure of value, the dollar as the unit of account. The victim seeks to view gold in terms of his captor’s paradigm. Much the way the kidnapping victim seeks to understand his capture and even geopolitics in terms of his captor’s world view.

Many victims are so thoroughly in thrall, that they scoff at the very idea of earning interest from a productive enterprise. They seek only the latest bubble, wherein they can make a profit: more dollars. Or, if not more dollars, at least more purchasing power. For years, they sought to do this in the gold and especially silver markets. Some gold bugs go even farther, and opposed a gold standard. Perhaps they don’t want sound money, they want gold to go up which means something external that gold can go up against.

We watched bemused, as a speaker at the Metal Writers Conference in Vancouver on May 29 told a standing-room-only crowd that bitcoin would hit $1 million (it went up after that, but is now down about 15% from that day). A 436X return would be nice, but of course the profits can only come from later speculators. There is an ugly little word for schemes in which profits come from those who buy in later. It is named for a gentleman who came from Italy, promoting his scheme in Boston.

We blame the game, not the player. It is important to emphasize this—don’t blame the players, blame the game—and we probably don’t do it enough. The fault lies not with those who bet on gold or bitcoin or anything else, nor even with those who regard betting as investing. The fault lies with the Fed and the other central banks who have the hubris to think they can centrally plan their way to prosperity. And the gun to force it on us, whether we agree or not. And the madness to cause the interest rate to fall for 36 years and counting (the Fed is not going to push the interest up much farther in this cycle, if they even dare one more hike). When freedom seems so remote as to be hopeless, it may be natural (we leave this to psychologists to say) to find a way to compromise, to get along to go along.

As to us, we will go on working towards that day of freedom, a big part of which is helping people see the monetary system for what it is: the current implementation of the fifth plank proposed by Karl Marx. Another part is to pay interest on gold…

Last week, we said:

“Peak hype, peak desperation, all selling in the streets with little buying… we are not technicians and do not focus on sentiment… but this description sounds like the definition of capitulation.

…

Also, we would add something important. Even if this is a capitulation low, that does not necessarily a mean a moonshot to $5,000 or even $2,000. We don’t expect that, and won’t expect it without evidence of a much more serious shift in the fundamentals. We would expect a normal trading bounce within the range and perhaps a few bucks over $1,300.”

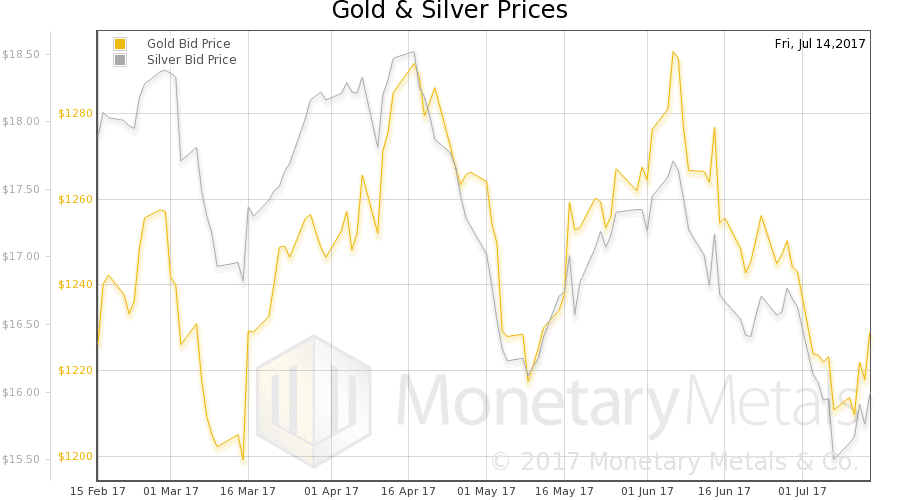

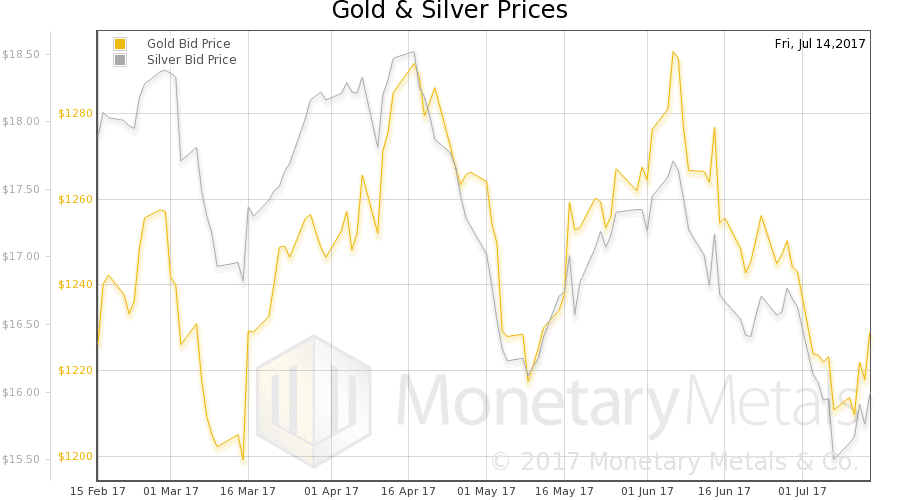

This week, the prices of the metals bounced somewhat, within the trading range. Gold closed last week at $1212, and this week at $1229. In silver, last week’s close was $15.56, and this’s week was $15.96.

Will the bounce continue? Have the fundamentals firmed up?

We will show graphs of the true measure of the fundamentals. But first charts of their prices and the gold-silver ratio.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio moved down this week.

In this graph, we show both bid and offer prices for the gold-silver ratio. If you were to sell gold on the bid and buy silver at the ask, that is the lower bid price. Conversely, if you sold silver on the bid and bought gold at the offer, that is the higher offer price.

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The dollar fell a bit this week (the mirror image of the rising price of gold). Now it is the dollar hostages who use gold as their preferred hostage-bargaining chip to feel a bit better. One ounce of this commodity now fetches 17 more of the kidnapper’s paper scrip than it did a week ago.

As the dollar fell, the cobasis fell (especially in farther-out contracts). The August cobasis is still above zero (i.e. temporary backwardation).

Our calculated gold fundamental price is not much changed, still above the market price by a goodly margin (chart here).

Now let’s look at silver.

As the dollar has dropped (i.e. silver trades for more gang-scrip than last week), the cobasis has come down. But it’s still higher than gold’s cobasis, and this is the September contract, a month further from expiry than the August gold contract.

Our calculated silver fundamental is rising again, also a healthy margin above the market price.

We thought it would be worth addressing the question: “is there a shortage in silver?” Let’s do it with a device that’s famously worth 1,000 words. This picture shows the term structure of the silver futures market.

What we see is what Sherlock Holmes observed that people heard in the night in the story Silver Blaze. There are no interesting features. Other than the temporary backwardation in the September contract, we see a rising basis and falling cobasis as we look out to December 2018. The rising basis looks a lot like the yield curve in the dollar, though slightly lower (6-month LIBOR is 1.5%).

If a real shortage developed in silver, the above curve would look quite different. And we would be publishing pictures of it.

Monetary Metals will be exhibiting at FreedomFest in Las Vegas in July. If you are an investor and would like a meeting there, please click here. Keith will be speaking, on the topic of what will the coming gold standard look like.

© 2017 Monetary Metals

via http://ift.tt/2tw73mM Monetary Metals