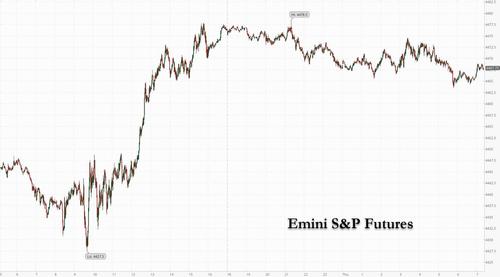

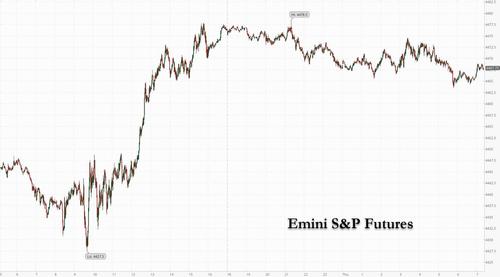

US equity futures slid, fading Wednesday’s torried one-day rally, as investors awaited data on jobless claims and retail sales which are expected to show another decline as US consumers retrench. European markets were solidly in the green while Asian stocks fell after the ongoing debt crisis at Evergrande – which halted all bond trades for the day – and China’s latest push to rein in private industries hurt sentiment. The dollar gained as Treasuries dipped while Bitcoin was little changed as gold and oil fell. S&P 500 E-minis were down 8.75 points, or 0.19% at 730 am ET, Dow E-minis were down 14 points, or 0.04%, while Nasdaq 100 E-minis were down 34.25 points, or 0.22%.

Once again, US-listed Chinese stocks extended losses in the premarket with Beijing’s regulatory overhaul of gambling in Macau coming as the latest source of consternation for a sector already hurt by crackdowns on technology and education services. Casino operators such as Las Vegas Sands, Wynn and MGM Resorts again fell 1-3% before the opening bell, extending this week’s declines following an announcement from Macau officials seeking tighter restrictions on operators. Among other movers, videogame publisher EA rose nearly 2%, as it maintained its guidance despite delaying the launch of its widely anticipated “Battlefield 2042” title by a month. Here are some of the other notable movers today:

- IronNet (IRNT US) shares rise 34% in U.S. premarket trading, adding to the past two sessions of gains for the stock amid retail-trader touts for the cyber-security company.

- Electronic Arts (EA US) rises 2.2% in premarket trading, on track to recoup some of Wednesday’s losses after co. confirmed delaying the launch of Battlefield 2042 to Nov. 19, which some analysts said wouldn’t be a surprise.

- MedAvail Holdings (MDVL US) rose 21% in Wednesday postmarket trading after signing a pact with IMA Medical Group to roll out four new SpotRx locations this year in central Florida

- Beyond Meat (BYND US) shares off 2.6% in premarket trading after Piper Sandler says retail trends are running below levels needed to support consensus shipment expectations for 3Q21, and potentially 4Q21, downgrading to underweight

- Travere Therapeutics (TVTX US) slipped 5.4% in extended trading from Wednesday after it reported a joint collaboration and licensing agreement with Vifor Pharma for the commercialization of sparsentan in Europe, Australia and New Zealand

- Aerie Pharmaceuticals (AERI US) shares dropped 18% in postmarket trading on Wednesday, after a Phase 2b study of the company’s experimental treatment for dry eye disease failed to meet the main goal of the trial

- Atyr Pharma (LIFE US) slid 7.3% postmarket Wednesday before recovering some ground following a discounted share offering, the move comes on the back of 76% jump in the last one month

- ION Geophysical Corp. (IO US) shares soared 27% in extended trading after it said its board had initiated a process to evaluate a range of strategic alternatives

- Ashford Hospitality Trust (AHT US) falls 0.7% in extended trading after the hotel REIT said revenue per available room (RevPAR) fell 11% in August compared to July

- Carver (CARV US) fell 12% postmarket after registering a mix of securities for potential sale

Wall Street indexes enjoyed strong gains on Wednesday on the back of Microsoft’s $60 billion stock buyback, with economically sensitive cyclical stocks benefiting the most from a rally in oil prices and data suggesting that factory activity growth remained steady in the country. Data also showed a dip in import prices, which coupled with a recent reading that showed consumer prices were slowing, implied that inflation had likely peaked and would fall to more manageable levels eventually.

“We have an unusual situation where the overall market is sideways to lower but with a risk-on trend underneath and that’s down to signs the Delta variant may be peaking in the U.S., which is driving people into reflation and recovery plays,” said Kiran Ganesh, head of cross asset at UBS Global Wealth Management. “At the same time there are concerns about fiscal consolidation and worries about China moving to lockdowns. We’ll need 3-4 months of quiet before people start moving back (to buy Chinese stocks). Big tech companies more exposed to social issues – whether property or education – are subject to regulatory risks.”

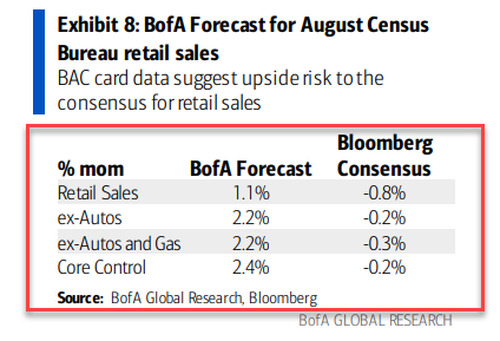

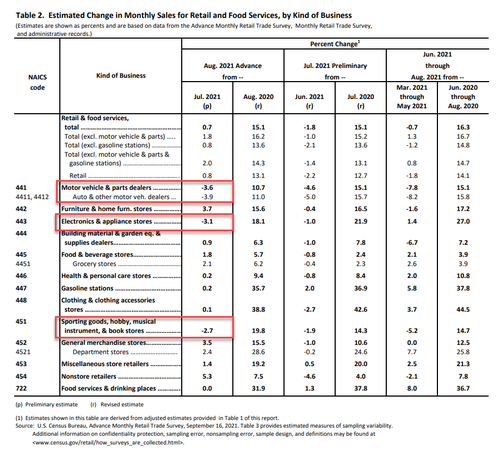

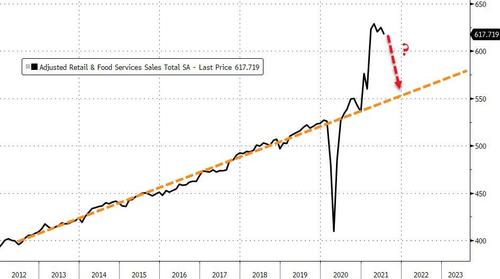

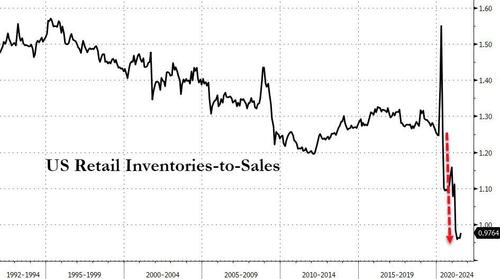

Focus is now on U.S. data on weekly jobless claims and August retail sales, both of which are due at 8:30 AM ET.

“Retail sales figures are expected to have fallen in August,” Saxo Bank’s chief investment officer, Steen Jakobsen, wrote in a note to clients. “Although the drop is largely priced in the market, it could still support US Treasuries pushing yields down by a couple of basis points. Yet, we expect yields to remain rangebound between 1.25% and 1.35% until next week’s FOMC meeting.”

Europe’s STOXX 600 was up 0.8% on the day, reversing all the previous day losses, having fallen 0.8% on Wednesday and gained 0.2% so far this week; FTSE MIB outperforms, rising as much as 1.3%. Travel is the best performing sector, up as much as 3.25%. Miners, utilities and autos underperform. Energy companies also advanced as crude oil hovered near a six-week high. Here are some of the biggest European movers today:

- Ryanair shares jump as much as 6.7% after it lifted its growth target to 50% over the next five years, planning expansion at European airports

- CNH shares gain as much as 4.1% after analysts note new details on plan for On-Highway spinoff reported by Il Sole 24 Ore

- Inditex shares rise as much as 3.6% after Kepler Cheuvreux upgrades stock to buy, citing a V-shaped earnings recovery and rich cash position

- Acciona shares lose as much 5.6% as Spain announces a gas clawback that risks the legal certainty of renewables development in the country, RBC says in a note

- Games Workshop shares fall as much as 4% after it said it’s seen pressure on freight costs and currency exchange rates

- THG shares decline as much as 3.8% after the e-commerce company reported 1H results in which sales and Ebitda both missed consensus estimates

Earlier in the session, Asian stocks dropped, as a sell-off in technology shares across the region more than offset gains in energy names with oil prices hovering near a six-week high. The MSCI Asia Pacific Index dropped as much as 0.8%, with TSMC, Alibaba Group and Keyence being the biggest contributors to the declines. Hong Kong’s Hang Seng Index led losses among the region’s stock gauges, while Japanese equities extended their drop from a peak of more than three decades into a second day. Fear that China Evergrande Group’s debt woes may spill over into Chinese property sector, combined with Beijing’s move to tighten grips on Macau casino operators, has pulled down Asian stocks this week. The real estate sector was the second-worst performer in the region on Thursday as Evergrande’s onshore property unit suspended bond trading for a day. Evergrande Market Fallout Grows as Local Unit Halts Bond Trading “The ongoing issues surrounding Evergrande could be weighing on investor sentiment” and impacting broadly in the region, said Hajime Sakai, chief fund manager at Mito Securities Co. in Tokyo. “It will loom over investors’ minds, especially if the problem bleeds into Chinese real estate market overall.” Asia’s benchmark stock gauge has fallen 1.8% so far this week, on pace to snap a three-week winning streak. It is lagging behind S&P 500, which has gained 0.5% in the same period. Elsewhere, Korean stock benchmark declined 0.7% as tech names like Samsung SDI dragged the Kospi Index. Philippine stocks were the region’s best performer of the day, gaining as virus restrictions were eased in the Manila capital region. Australia’s S&P/ASX 200 Index advanced despite the country’s disappointing employment data.

Japanese stocks declined, erasing earlier gains, as the yen headed for a three-day advance against the dollar. The Topix fell 0.3% to 2,090.16 at the 3 p.m. close in Tokyo, while the Nikkei 225 slid 0.6% to 30,323.34. Out of 2,184 shares in the index, 891 rose and 1,183 fell, while 110 were unchanged. The yen rose 0.1% to 109.31 per dollar. Stocks also dropped after a finance ministry report showed gains in Japanese exports slowed for a third month in August as a delta-driven wave of the coronavirus weighed on the global trade recovery. “Japanese stocks may be in a corrective mood for a while,” said Hajime Sakai, the chief fund manager at Mito Securities Co. in Tokyo.

In rates, Treasuries were marginally cheaper across the curve following muted price action during Asia and early European sessions. 10-year TSYs yield 1.3124% is ~1bp cheaper vs Wednesday’s close with curves marginally steeper; gilts cheapen further vs Treasuries — 10-year spread approaching YTD low 51bp — as Goldman Sachs predicts BOE will lift rates to 1% by end of 2023. Gilts underperformed, in a continuation of Wednesday’s strong U.K. inflation data, while bunds marginally outperform Treasuries.

In FX, the Bloomberg Dollar Spot Index advanced and the dollar was steady or higher against all of its Group-of-10 peers apart from the New Zealand dollar. The kiwi rallied after New Zealand GDP data exceeded all estimates. The economy expanded 2.8% in the second quarter from the first, compared to economists forecast for a 1.1% rise. Overnight indexed swaps are now pricing a 44% probability of a 50-basis-point hike next month, up from around 10% on Wednesday. Australia’s dollar dropped toward a two-week low after jobs data showed that Australian employment dived in August as coronavirus lockdowns in Sydney and Melbourne forced businesses to lay off workers and slash hours.

The yen stayed near a one- month high as a weak risk sentiment supported demand for havens. Bonds fell after a lukewarm 20-year debt sale. The offshore yuan weakened the most in nearly a month as concern on China Evergrande Group’s debt crisis and Beijing’s latest push to rein in private industries hurt market sentiment.

In commodities, gas and power prices pared losses in Europe as supply concerns remain ahead of the winter season and worries grow that costs will pressure profit marginsfor companies. The world is facing high energy prices for the foreseeable future, Chevron Corp.’s top executive said in a Bloomberg interview on Wednesday. Iron ore headed for its longest run of losses in more than three years as declining Chinese steel output threatened to push futures back below $100 a ton. WTI is little changed near $72.67, Brent drifts near $75.60. Spot gold trades poorly, dropping ~$12 to the worst levels this week near $1,781/oz. Base metals are also under pressure with LME copper and nickel the worst performers.

Looking at the day ahead now, and data releases include US retail sales for August, the Philadelphia Fed’s business outlook for September, and the weekly initial jobless claims. Otherwise from central banks, we’ll hear from ECB President Lagarde and the ECB’s Rehn.

Market Snapshot

- S&P 500 futures little changed at 4,483.00

- STOXX Europe 600 up 0.64% to 466.86

- MXAP down 0.6% to 203.16

- MXAPJ down 0.7% to 649.46

- Nikkei down 0.6% to 30,323.34

- Topix down 0.3% to 2,090.16

- Hang Seng Index down 1.5% to 24,667.85

- Shanghai Composite down 1.3% to 3,607.09

- Sensex up 0.5% to 59,044.46

- Australia S&P/ASX 200 up 0.6% to 7,460.21

- Kospi down 0.7% to 3,130.09

- Brent Futures down 0.12% to $75.37/bbl

- Gold spot down 0.53% to $1,784.58

- U.S. Dollar Index up 0.18% to 92.72

- German 10Y yield little changed at -0.307%

- Euro down 0.3% to $1.1775

Top Overnight News from Bloomberg

- China slammed a move by the U.S. and U.K. to help Australia build nuclear submarines, saying the new partnership will stoke an “arms race” as tensions heat up in Asia-Pacific waters

- The economic outlook of the euro area is overshadowed by production bottlenecks and the prospect of a worsening pandemic, European Central Bank Governing Council Member Olli Rehn says

- A new Japanese prime minister due to be installed in the coming weeks is unlikely to change fiscal or other policies sufficiently to force the central bank to amend its monetary settings, a Bloomberg survey showed

- Rallying energy prices are stoking concerns about a challenging stagflation-like environment for markets of elevated price pressures and a slowing economic recovery

- Europe’s energy crunch has forced a major fertilizer maker to shut down two U.K. plants, the first sign that a record rally in gas and power prices is threatening to slow the region’s economic recovery

- Winter blackouts are now a real possibility after a fire took out a key cable that ships electricity to the U.K. from France. Electricity is now so scarce in Britain that any more grid mishaps or unexpected plant outages could leave millions without power

- About 40% of respondents said their living costs have increased since the onset of the pandemic, according to a YouGov survey of 18,983 people conducted in 17 countries. That proportion was closer to half in the U.K. and U.S., compared to just a fifth of Danes and Swedes

- An outbreak of Covid-19 inside the Kremlin has sickened dozens of people working close to Vladimir Putin, the Russian president said Thursday, highlighting the scale of the outbreak in one of the country’s most carefully guarded areas

- India’s monetary policy makers cannot cut interest rates further because of elevated inflation, but there’s a need to keep borrowing costs low and liquidity ample to help the economy as it recovers from the pandemic’s fallout, a central banker said

A more detailed look at global markets courtesy of newsquaw

Asian equity markets traded mostly lower as the region failed to sustain the momentum from Wall St where all major indices finished higher after risk appetite was spurred by stronger than expected NY Fed Manufacturing data and with plenty of attention on a bullish note from JPMorgan which expects the SPX to reach 4,700 by the end of 2021 and surpass 5,000 in 2022 on better-than-expected earnings. The ASX 200 (+0.6%) was led higher by the energy sector following similar outperformance stateside after oil prices surged by more than 3% during the prior session amid the constructive mood across risk assets and recent bullish inventory data, with Australian defence contractor Austal among the biggest gainers in the local benchmark after the US, UK and Australia announced a new security partnership for the Indo-Pacific region in which the US will provide Australia with the capability to deploy nuclear-powered submarines in an effort to counter China. The Nikkei 225 (-0.6%) failed to hold on to early gains with sentiment dampened by recent currency strength and weaker than expected Exports data, while the KOSPI (-0.7%) was pressured following hawkish rhetoric from North Korea concerning the recent missile launch which was from a new railway-borne missile system and reportedly serves as an efficient counter strike weapon to threatening forces. The Hang Seng (-1.5%) and Shanghai Comp. (-1.3%) declined with Hong Kong pressured by underperformance in the property sector and with several casino names extending on yesterday’s slump amid regulatory concerns. Sentiment was also clouded by the recent ‘AUKUS’ partnership to counter China and ongoing Evergrande default woes with Co. shares at decade lows and its onshore bonds suspended after Chinese authorities told lenders not to expect any interest payments due next week and following the credit rating downgrade by S&P due to depleted liquidity. Finally, 10yr JGBs were kept rangebound as headwinds from the selling in USTs were offset by the lacklustre risk appetite in Asia and with demand also sapped by weaker metrics from this month’s 20yr JGB auction.

Top Asian News

- China Has Fully Vaccinated More Than 1 Billion People

- Credit Suisse Rejigs Asia Investment Bank, Veterans Step Aside

- Battery- Swapping Startup Gogoro to Go Public in SPAC Merger

- Evergrande Market Fallout Grows as Local Unit Halts Bond Trading

Stocks in Europe have conformed to a more constructive risk mood (Euro Stoxx 50 +0.7%; Stoxx 600 +0.6%) after experiencing a mixed open, which followed on from a varied APAC session that saw Mainland China and Hong Kong under pressure. US equity futures, meanwhile, have seen a divergence from Europe and trade modestly softer ahead of US retail sales. Back to Europe, bourses experience broad-based gains with marginal underperformance in the FTSE 100 (+0.5%) – weighed on by the underperforming Basic Resources sector (the only sector in the red) as base metals remain pressured. On the flip side, Travel & Leisure stands as the outperformer amid tailwinds from a Ryanair (+6.3%) traffic growth guidance update, alongside reports that UK ministers are to announce that vaccinated travellers will no longer be required to take a COVID test before entering England under new proposals – also supporting the likes of easyJet (+3.3%) and IAG (+2.7%). Banks are bolstered by the higher yield environment whilst Oil & Gas continue to cheer oil prices north of USD 70/bbl. Overall, the sectors do portray somewhat of an anti-defensive bias. In terms of individual movers, Continental (-11%) listed its drive division, Vitesco Technologies, on the Dax 30 today. Vitesco will be listed as an additional value on the Dax for today only, after which it will not be eligible for a regular place in the bourse and will be demoted accordingly. Elsewhere, Thales (+1.3%) and Safran (+2.6%) have shrugged reports that Australia terminated its submarine programme with France.

Top European News

- Swedish IPO Rush Intensifies With Storskogen’s Listing Plan

- U.K. Faces Winter Blackouts Risk After Fire Knocks Out Cable

- Stagflation Fears Cast Longer Shadow on Markets as Energy Surges

- Atlantic Sapphire Plunges 29% After Fire at Denmark Facility

In FX, bears have been prowling and knocking hard on the door for a while in Eur/Usd following a couple of dead cat bounces, but no material recovery rallies beyond 1.1850 and the pressure has finally told as underlying bids around 1.1800 are filled or pulled. Moreover, the headline pair has breached technical support just shy of the round number in the form of 21 and 50 DMAs that align at 1.1798 today and is now probing new post-ECB lows around 1.1766 amidst almost all round Euro weakness that has pushed Eur/Gbp down towards a double bottom around 0.8510 and Eur/Jpy through 129.00. Conversely, the Buck has regrouped and recharged after another retreat below 92.500 in the index, albeit shallower in wake of Wednesday’s strong NY Fed manufacturing survey that helped to erase post-CPI losses and more. Indeed, the DXY has rebounded further towards Monday’s current w-t-d peak (92.887) to 92.794 and cleared a couple of chart hurdles along the way, including its 50 and 21 DMAs, at 92.635 and 92.694 respectively. Ahead, jobless claims, retail sales and the Philly Fed.

- CHF – The major casualty or loser in the face of the Greenback revival, as Usd/Chf retests recent 0.9240+ highs, but the Franc is not benefiting from Euro weakness given that the Eur/Chf cross is holding firmly above 1.0850, and this could be a sign of official intervention or simply caution ahead of next Thursday’s Quarterly SNB policy review.

- AUD/GBP/CAD – All unable to evade the clutches of their US counterpart, and the Aussie also labouring within a 0.7347-09 range in wake of a disappointing jobs report that only beat consensus in unemployment rate terms due to a fall in labour market participation caused by COVID-19 lockdowns. Meanwhile, Sterling is back under the 200 DMA and hovering near 1.3800 irrespective of the aforementioned outperformance against the Euro and another bank revising its BoE rate outlook to forecast an earlier hike on the back of yesterday’s hot UK inflation data (GS now seeing tightening in May 2022). Elsewhere, the Loonie has stalled on approach to 1.2600 alongside a pull-back in crude and now eyeing Canadian housing starts before wholesale trade following similarly frothy CPI prints on Wednesday.

- NZD/JPY – The Kiwi is bucking the overall trend and still clinging to the 0.7100 handle, while consolidating gains vs its Antipodean peer around 1.0300 with bullish impetus from NZ Q2 GDP surpassing expectations significantly to ensure the domestic economy entered pandemic restrictions on a very solid footing. Conversely, the Yen has broadly overlooked a much wider than anticipated Japanese trade deficit impacted by exports missing the mark by some distance, as Usd/Jpy meanders between 109.46-21 parameters, albeit off midweek lows closer to 109.00.

In commodities, WTI and Brent front month futures are choppy and essentially flat intraday at the time of writing, with the former around USD 72.50/bbl (72.34-99 range) and the latter around USD 75.50/bbl (75.21-87). News flow for the sector has been relatively light, but prices remain elevated near recent highs. The morning saw constructive commentary from Ryanair, which feeds into jet fuel demand. On the flip side, Libya’s NOC announced the resumption of crude exports from the Sidra and Ras Lanuf ports following protests. It’s also worth being cognizant of potential Chinese intervention at these levels via the release of state reserves, as Chinese PPI last month remained elevated partially on crude prices – and Beijing also pledged continued efforts to stabilise prices if needed. On that note, China announced the release of another batch of copper, aluminium and zinc from state reserves to guide prices gradually lower to a reasonable range. As such, LME metals are mostly lower but off worst levels, although copper remains under USD 9,500/t. Turning to precious metals, spot gold and silver are on the backfoot as they fall victim to the firmer Dollar, with the former losing further ground under USD 1,800/oz (1,796-81 range) and the latter back to levels around USD 23.50/oz (23.96-54 range).

US Event Calendar

- 8:30am: Sept. Initial Jobless Claims, est. 322,000, prior 310,000

- 8:30am: Sept. Continuing Claims, est. 2.74m, prior 2.78m

- 8:30am: Aug. Retail Sales Advance MoM, est. -0.7%, prior -1.1%

- 8:30am: Aug. Retail Sales Ex Auto MoM, est. 0%, prior -0.4%

- 8:30am: Aug. Retail Sales Control Group, est. 0%, prior -1.0%

- 8:30am: Sept. Philadelphia Fed Business Outl, est. 18.9, prior 19.4

- 9:45am: Sept. Langer Consumer Comfort, prior 57.9

- 10am: July Business Inventories, est. 0.5%, prior 0.8%

- 4pm: July Total Net TIC Flows, prior $31.5b

DB’s Jim Reid concludes the overnight wrap

It’s my daughter7s 6th birthday today. How am I celebrating? By having major knee surgery and possibly not being back from the hospital in time to see her. It’s been a grave oversight on my behalf dates wise (he has little other operating space over the next few weeks) so I’ll be sweet talking the surgeon this morning to get me near the top of the list to ensure that I’m not late home. It’ll be crutches and no weight bearing for me for the next 6 weeks which again is going to make me very unpopular at home with three hyperactive kids and one wayward dog. In terms of before and after see the front cover of “Fiat, fifty and frail” for how I look now (right) and how I intend to look by November (left).

Markets were also a little bit frail for most of yesterday in European hours but a rally in the US after Europe went home turned the day around. Indeed the S&P 500 (+0.85%) rose by its most in nearly 3 weeks as cyclical industries and technology stocks combined to take the index back to within 1.3% of its all-time highs. Energy stocks were the best performers (+3.81%), which came amidst a further sharp rise in commodities. Indeed by the close of trade, Bloomberg’s Commodity Spot index was up +1.76% at a fresh high for the decade, which just emphasises how there are still inflationary pressures in the pipeline, even if a few specific commodities have moved lower in recent months. Looking at the moves, Brent Crude (+2.53%) rose to $75.46/bbl, having now bounced back by more than $10 since its closing low of $65.18/bbl less than a month ago, whilst WTI (+3.05%) was also up to $72.61/bbl.

Staying on energy, yesterday witnessed even further advances for natural gas prices, with European futures up another +7.52% as they marked their 8th consecutive rise. And there were also growing concerns in the UK as a cable bringing power in from France was knocked out by a fire, which will put it out of action until at least October 13, possibly into 2022 for full capacity. Indeed, I looked at this issue in my chart of the day yesterday (link here), which demonstrates the astonishing surge we’ve seen over recent weeks and months. Tight supplies that haven’t been replenished as much as expected after a cold winter are partly responsible, but there’s also a lack of coal options as increasing numbers of plants are phased out, and Russia has sent less supplies to Europe than expected. We also speculate that this might be a dress rehearsal for ESG issues further down the line.

While we’re on the topic of inflation, there may have been a weaker-than-expected reading from the US on Tuesday, but yesterday saw fresh support for those believing in higher inflation thanks to upside surprises from the UK and Canada. Here in the UK, headline CPI rose to +3.2% (vs. +2.9% expected), which is also above the BoE’s staff estimate of +3.0% back in their August monetary policy report. That saw investors bring forward their expectations for future BoE rate hikes, which in turn sent short-dated gilt yields to their highest levels in over a year. By the close, the 2yr yield (+3.2bps) had hit a post-pandemic high of 0.263%, whilst the 5yr yield (+3.4bps) was similarly at a post-pandemic high of 0.453%. For Canada, with just 4 days left until their federal election on Monday, CPI rose to +4.1% (vs. +3.9% expected), marking the highest reading since 2003.

Given that inflation concerns were resurfacing again, sovereign bonds lost ground on both sides of the Atlantic yesterday, with 10yr US Treasury yields up +1.5bps to 1.299%, mostly thanks to higher inflation breakevens (+1.5bps). Europe saw more prominent moves, with yields on 10yr bunds up +3.4bps to -0.31%, their highest level in 2 months, as German 10yr breakevens rose (+1.6bps) for the ninth time in the last ten sessions and ended just off their 8 year highs. Meanwhile, yields on 10yr OATs (+4.3bps) and BTPs (+5.5bps) also moved higher.

Before the US rally, European indices lost ground as the session went on, as the STOXX 600 (-0.80%) fell to its lowest closing level since late July. Nearly 80% of constituents and every major sector in the index moved lower with the exception of energy, with bourses underperforming their US counterparts across the continent. As mentioned at the top, the S&P 500 (+0.85%) rallied later in the session and turned positive on the week. The rise was led by energy as discussed but other cyclicals such as banks (+1.31%) and capital goods (+1.29%) also rallied. However, the equity gains were broad based as software (+1.21%) and media (+0.78%) caused the NASDAQ (+0.82%) to finish higher for the first time in six sessions.

Sentiment is weak in Asia with the Nikkei (-0.81%), Hang Seng (-1.97%), CSI (-0.75%), Shanghai Comp (-0.68%) and Kospi (-0.66%) all losing ground. There are no new drivers behind the move besides the risks associated with China’s ongoing regulatory crackdown, the recent spike in covid cases there, and the indebtedness of China’s Evergrande group’s which has led to one of its onshore real estate unit suspending bond trading. Futures on the S&P 500 are only a touch lower at -0.08% but those on the Stoxx 50 are up +0.13% as they catch up with yesterday’s late move in US markets.

On the pandemic, Pfizer announced that data from the US and Israel point to waning efficacy of its vaccine over time, and that the additional booster shot was both safe and effective. The data will be submitted to outside advisers to the US FDA on Friday. Overnight, the New England Journal of Medicine published research based on data from short-term analysis in Israel stating that a third dose of the Pfizer/ BioNTech’s Covid vaccine can dramatically reduce rates of Covid-related illness in people 60 and older. The analysis stated that starting 12 days after the extra dose, confirmed infection rates were 11 times lower in the booster group compared with a group that got the standard two doses and added that rates of severe illness were almost 20 times lower in the booster group.

Winding up now and back to yesterday, on the data front, US industrial production rose by +0.4% in August (vs. +0.5% expected), with the Fed estimating that shutdowns related to Hurricane Ida held down the reading by 0.3 percentage points.

To the day ahead now, and data releases include US retail sales for August, the Philadelphia Fed’s business outlook for September, and the weekly initial jobless claims. Otherwise from central banks, we’ll hear from ECB President Lagarde and the ECB’s Rehn.