‘Team Transitory’ Loses Another One – OECD Warns Of Higher Inflation For Next Two Years

The Organization for Economic Co-operation and Development (OECD) released its quarterly report Tuesday and warned about increasing inflation risks for the next two years as the growth rate of the economic recovery has stalled.

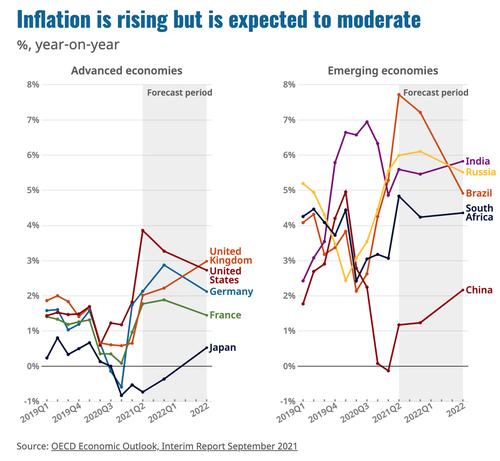

“The economic impact of the Delta variant has so far been relatively mild in countries with high vaccination rates, but has lowered near-term momentum elsewhere and added to pressures on global supply chains and costs,” the Paris-based research body wrote, adding that “inflation has risen sharply in the United States, Canada, the United Kingdom, and some emerging-market economies, but remains relatively low in many other advanced economies, particularly in Europe and Asia.”

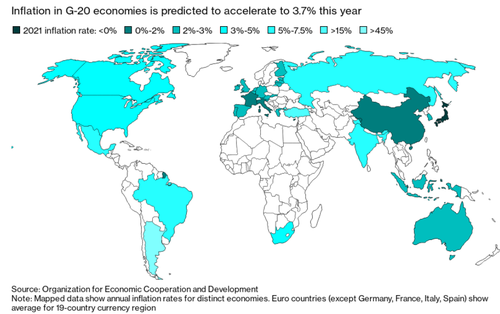

The OECD expects price increases in 2021 and 2022 above its previously forecast for G20 countries.

Laurence Boone, the OECD chief economist, said taming inflation would be a juggling act for policymakers.

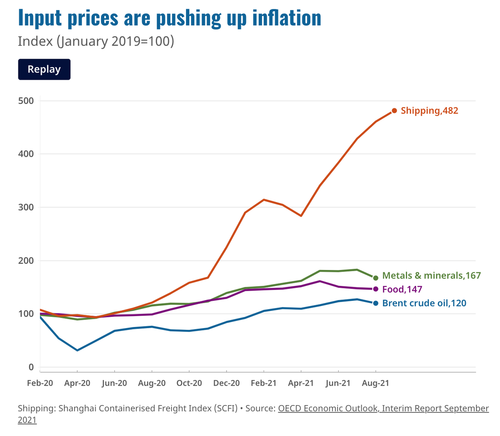

“The speed of the recovery has increased inflationary pressures, quickly pushing up prices to where we expected them to be before the pandemic,” the OECD said. “Policymakers in advanced economies should monitor these developments without delay.”

The OECD’s forecast expects G20 inflation at 3.7% in 2021 and 3.9% in 2022. It also expects US inflation pressures to subside next year but be well above 3%.

“Inflation is expected to settle at a level above the average rates seen prior to the pandemic,” the OECD said. “This is welcome after many years of below-target inflation outcomes, but it also points to potential risks.”

The revised outlook was released ahead of the Federal Reserve Chair Jerome Powell’s press conference today after the two-day meeting. Investors are eagerly awaiting the Fed’s decision to taper monetary policy.

According to the OECD, global growth has lost momentum due to uneven economic growth – in return, this forced the research body to slash the global growth forecast for 2021 to 5.7% from 5.8%.

“Sizable uncertainty remains,” it said. “Faster progress in vaccine deployment or a sharper rundown of household savings would enhance demand and lower unemployment but also potentially push up near-term inflationary pressures.”

The question we have is if Powell’s “transitory” inflation narrative is falling apart at the seams, as US CEOs warned last week at the annual Morgan Stanley Laguna conference about “unprecedented” inflation becoming “structural.”

DoubleLine Founder Jeffrey Gundlach told investors in a webcast last week that he doesn’t believe the history books will say inflation was transitory.

The macro backdrop is starting to look like growth rates are decreasing, but inflation is either persistent or rising, an ominous sign of stagflation.

Tyler Durden

Tue, 09/21/2021 – 20:25

via ZeroHedge News https://ift.tt/39scPxm Tyler Durden