Authored by Lance Roberts via RealInvestmentAdvice.com,

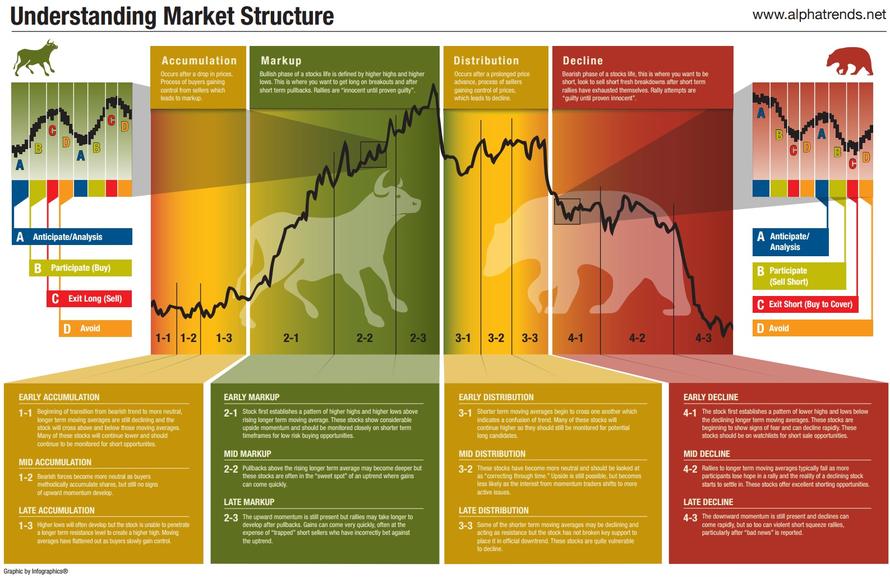

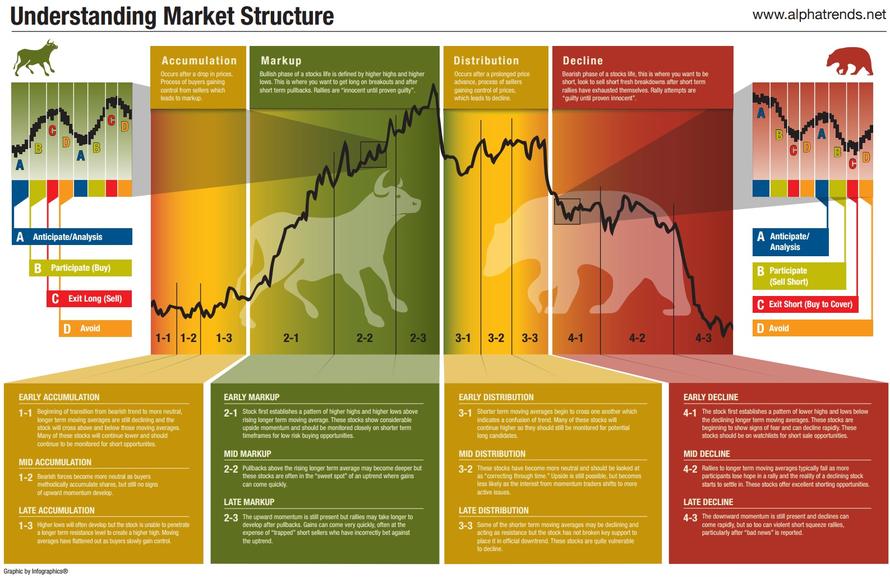

I was digging through some old charts over the weekend and stumbled across this gem from AlphaTrends which explains the “best time to buy stocks.”

“Is it possible to time the market cycle to capture big gains?

Like many controversial topics in investing, there is no real professional consensus on market timing. Academics claim that it’s not possible, while traders and chartists swear by the idea.

The following infographic explains the four important phases of market trends, based on the methodology of the famous stock market authority Richard Wyckoff.

The theory is that the better an investor can identify these phases of the market cycle, the more profits can be made on the ride upwards of a buying opportunity.”

So, the question to answer, obviously, is:

“Where are we now?”

I’m glad you asked.

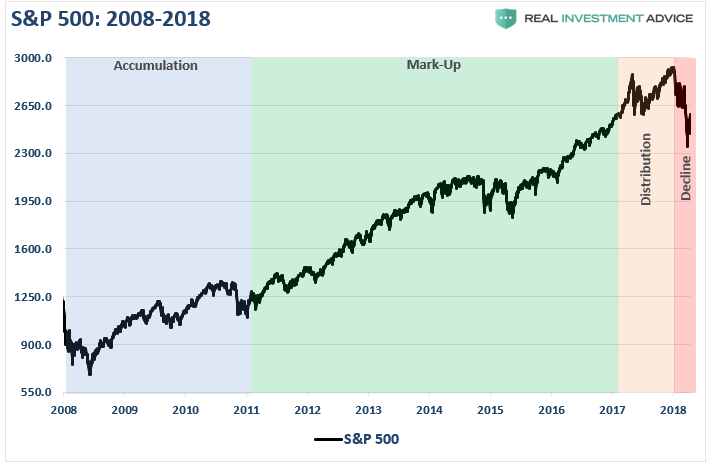

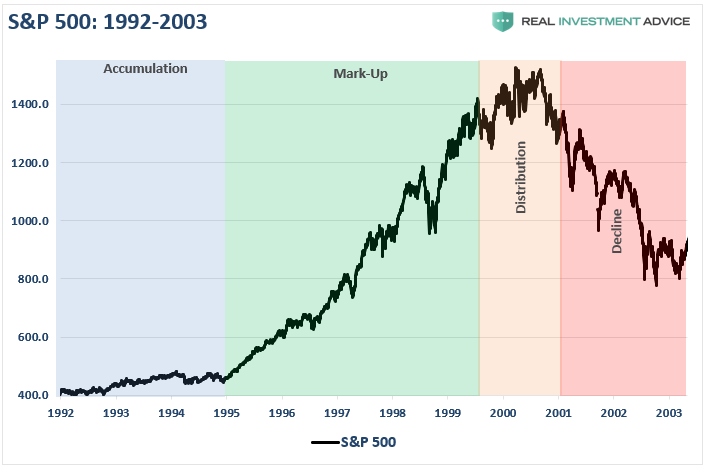

Let’s take a look at the past two full-market cycles, using Wyckoff’s methodology, as compared to the current post-financial-crisis half-cycle. While actual market cycles will not exactly replicate the chart above, you can clearly see Wyckoff’s theory in action.

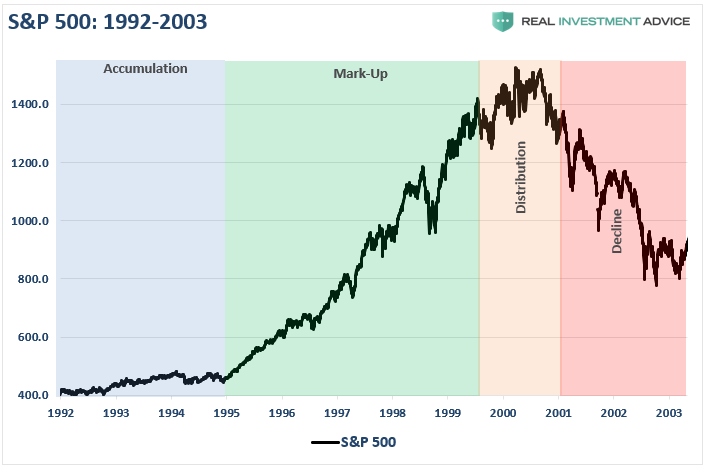

1992-2003

The accumulation phase, following the 1991 recessionary environment was evident as it preceded the “internet trading boom” and the rise of the “dot.com” bubble from 1995-1999.

As I noted last week:

“Following the recession of 1991, the Federal Reserve drastically lowered interest rates to spur economic growth. However, the two events which laid the foundation for the ‘dot.com’ crisis was the rule-change which allowed the nations pension funds to own equities and the repeal of Glass-Steagall which unleashed Wall Street upon a nation of unsuspecting investors.

The major banks could now use their massive balance sheet to engage in investment-banking, market-making, and proprietary trading. The markets exploded as money flooded the financial markets. Of course, since there were not enough “legitimate” deals to fill demand and Wall Street bankers are paid to produce deals, Wall Street floated any offering it could despite the risk to investors.”

The distribution phase became evident in early-2000 as stocks began to struggle.

While the names of Enron, WorldCom, Global Crossing, Lucent Technologies, Nortel, Sun Micro, and a host of others are “ghosts of the past,” relics of an era the majority of investors in the market today are unaware of, they were the poster children for the “greed and excess” of the preceding bull market frenzy.

As the distribution phase gained traction, it is worth remembering the media and Wall Street were touting the continuation of the bull market indefinitely into the future.

Then, came the decline.

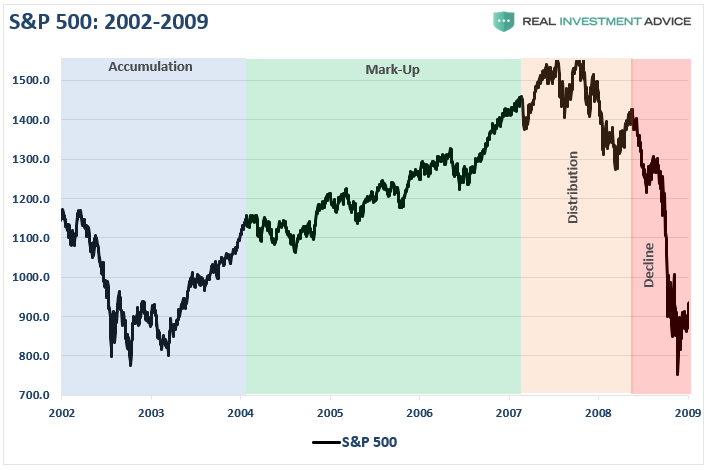

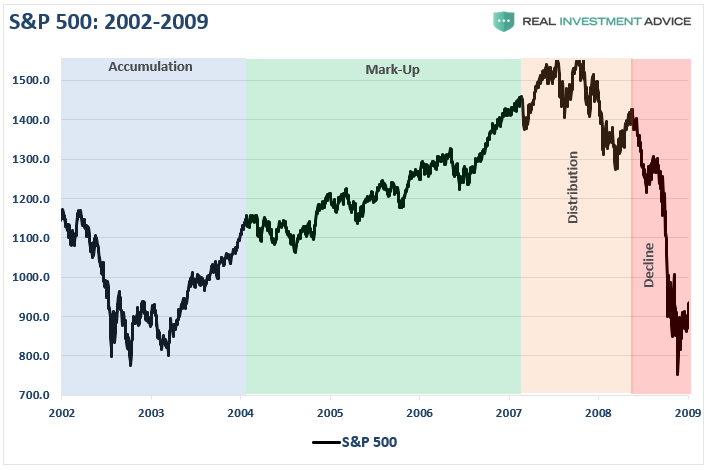

2003-2009

Following the “dot.com” crash investors had all learned their lessons about the value of managing risk in portfolios, not chasing returns and focusing on capital preservation as the core for long-term investing.

Okay. Not really.

It took about 27 minutes for investors to completely forget about the previous pain of the bear market and jump headlong back into the creation of the next bubble leading to the “financial crisis.”

During the mark-up phase investors once again piled into leverage. This time not just into stocks, but real estate, as well as Wall Street, found a new way to extract capital from Main Street through the creation of exotic loan structures. Of course, everything was fine as long as interest rates remained low, but as with all things, the “party eventually ends.”

Once again, during the distribution phase of the market, the analysts, media, Wall Street, and a rise of bloggers, all touted “this time was different.” There were “green shoots,” it was a “Goldilocks economy,” and there was “no recession in sight.”

They were disastrously wrong.

Sound familiar?

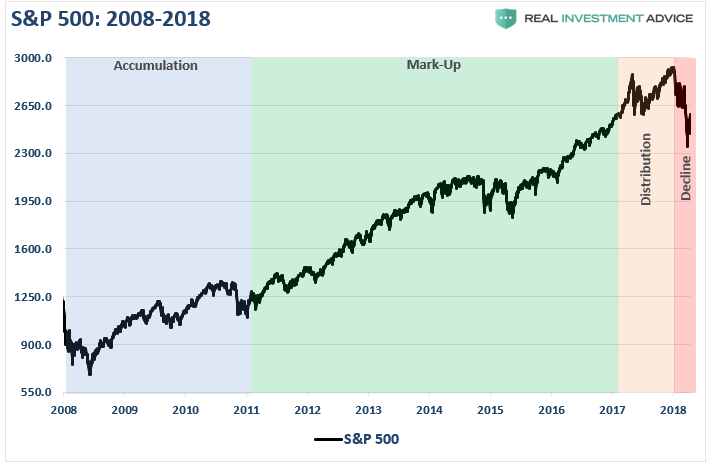

2009-Present

So, here we are, a decade into the current economic recovery and a market that has risen steadily on the back of excessively accommodative monetary policy and massive liquidity injections by Central Banks globally.

Once again, due to the length of the “mark up” phase, most investors today have once again forgotten the “ghosts of bear markets past.” Despite a year-long distribution in the market, the same messages seen at previous market peaks have been steadily hitting headlines: “there is no recession in sight,” “the bull market is cheap” and “this time is different because of Central Banking.”

Lost And Found

There is a sizable contingent of investors, and advisors, today who have never been through a real bear market. After a decade long bull-market cycle, which only seems to go up, you can certainly understand why mainstream analysis continues to believe the markets can only go higher.

What is concerning is the rather cavalier attitude the mainstream media takes about bear markets.

“Sure, a correction will eventually come, but that is just part of the deal.”

What gets lost during these bullish cycles, and is found in the most brutal of fashions, is the devastation caused to financial wealth during the inevitable decline.

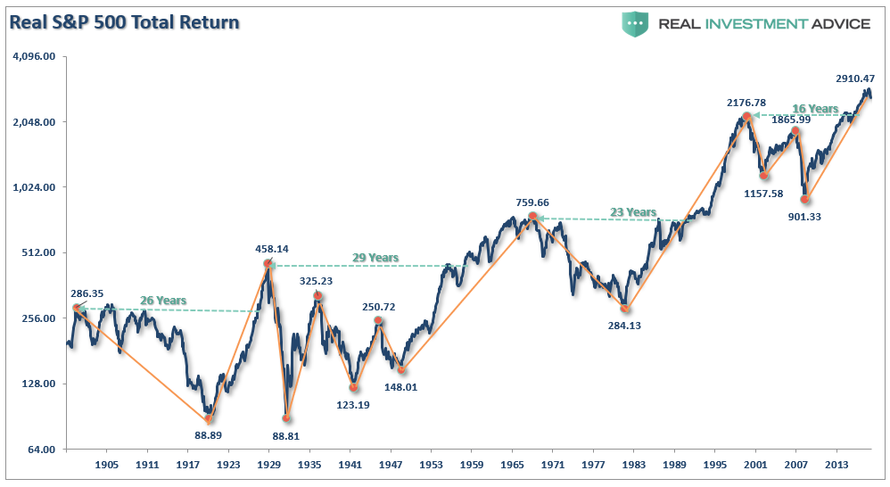

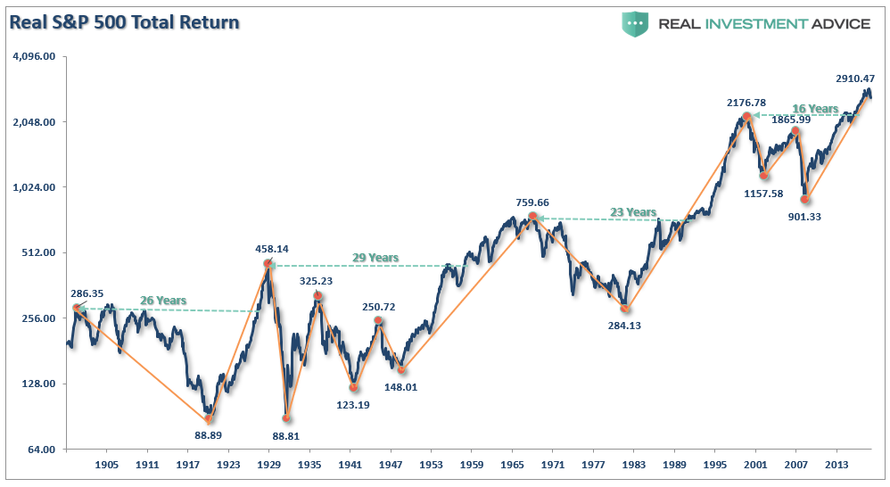

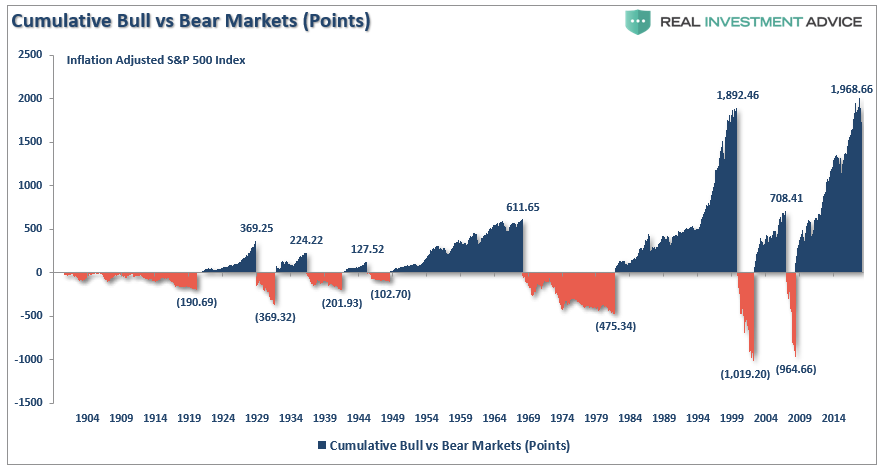

Let’s look at the S&P 500 inflation-adjusted total return index in a different manner. The first chart shows all of the measurement lines for all the previous bull and bear markets with the number of years required to get back to even.

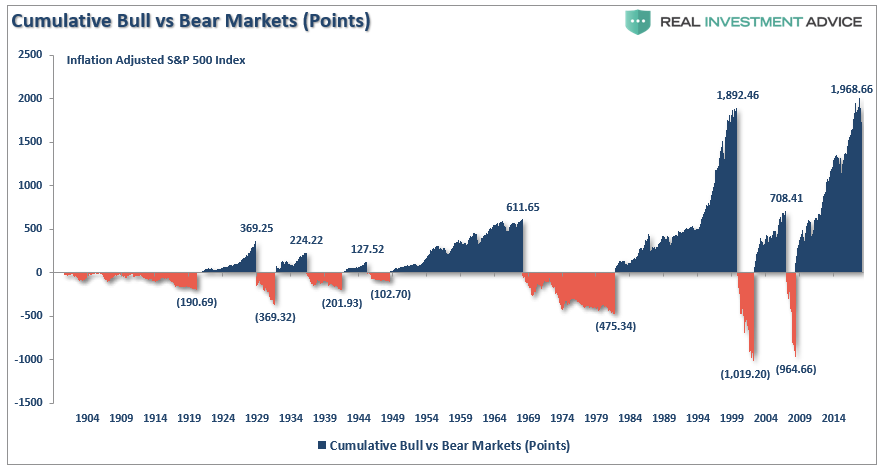

What you should notice is that in many cases bear markets wiped out essentially a substantial portion, if not all, of the previous bull market advance. This is shown more clearly when we look at a chart of bull and bear markets in terms of points.

Whether or not the current distribution phase is complete, there are many signs suggesting the current Wyckoff cycle may be entering its final stage of completion.

Let me remind you of something Ben Graham said back in 1959:

“‘The more it changes, the more it’s the same thing.’ I have always thought this motto applied to the stock market better than anywhere else. Now the really important part of the proverb is the phrase, ‘the more it changes.’

The economic world has changed radically and will change even more. Most people think now that the essential nature of the stock market has been undergoing a corresponding change. But if my cliché is sound, then the stock market will continue to be essentially what it always was in the past, a place where a big bull market is inevitably followed by a big bear market.

In other words, a place where today’s free lunches are paid for doubly tomorrow. In the light of recent experience, I think the present level of the stock market is an extremely dangerous one.”

He is right, of course, things are little different now than they were then.

For every “bull market” there MUST be a “bear market.”

While “passive indexing” sounds like a winning approach to “pace” the markets during an advance, it is worth remembering that approach will also “pace” the decline.

The recent sell-off should have been a wake-up call to just how quickly things can change and how damaging they can be.

There is no difference between a 100% gain and a 50% loss.

Understanding that investment returns are driven by actual dollar losses, and not percentages, is important in the comprehension of how devastating corrections can be on your financial outcome. So, before sticking your head in the sand and ignoring market risk based on an article touting “long-term investing always wins,” there is a huge difference between just making money and actually reaching your financial goals.

via RSS http://bit.ly/2TLUIZe Tyler Durden