Global stocks and US equity futures jumped to start the new week, with the S&P 500 poised to extend last week’s rally as traders grew increasingly confident in the likelihood that the Fed will cut interest rates this year. As of 7:40am, S&P 500 and Nasdaq 100 futures added 0.3%, tracking gains in European and Asian markets although trading volumes were lower than average as UK and Japanese markets are shut for a holiday. Apple slid in pre-market trading after Berkshire Hathaway trimmed its stake for a second consecutive quarter. German 10-year yields fell and the yen weakened. Oil advanced after Saudi Arabia raised prices for customers in Asia. On today’s calendar we get the latest Senior Loan Officer Opinion Survey (SLOOS) which will signal whether demand for tight credit remains dismal.

In premarket trading, Apple dropped 1.2% after rising strongly over the past two sessions and as Berkshire Hathaway reported it had trimmed its stake in the company. Shares in cryptocurrency-linked companies rally as Bitcoin nears $65,000 level after adding around 10% in the last four sessions. Some of the biggest movers are Marathon Digital (MARA US) +5.6%, Riot Platforms (RIOT US) +4.1%. Steward Health Care filed voluntary petitions for relief under Chapter 11. Here are some other notable premarket movers:

- Luminar Technologies shares fall as much as 17% after the company confirmed it will cut about 20% of jobs and sub-lease parts or all of some facilities.

- Paramount rises 4.5% as it weighs Apollo and Sony’s $26 billion offer to buy the company.

- Perficient gains 55% after EQT agreed to buy the technology consultant in a deal valued at about $3 billion including debt.

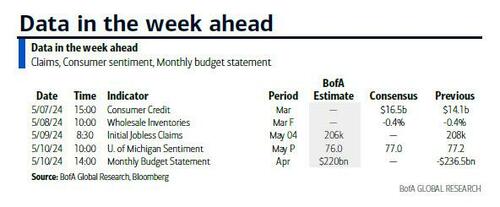

With a light US economic calendar this week, the market’s direction may come from central bank officials, as well as policy meetings in the UK, Australia and Sweden. European Central Bank Chief Economist Philip Lane said recent data have made him more certain that inflation is returning to the 2% goal, according to an interview with Spanish newspaper El Confidencial, raising the likelihood a first interest-rate cut in June. New York Fed President John Williams and the Richmond Fed’s Thomas Barkin are due to make remarks on Monday, followed by Neel Kashkari of Minneapolis on Tuesday.

“This week is expected to be calmer on the economic front: few economic data releases and limited central bankers’ intervention,” wrote Credit Agricole strategists led by Jean-Francois Paren.

But while this week may be boring, strategists are already starting to hone in on the importance of next week’s US inflation print for April. “The price reaction on the back of this release may be more important than the data itself given how influential price action has been on investor sentiment amid an uncertain macro set up,” Michael Wilson wrote in a note.

Europe was broadly higher, tracking US equity futures, with the Stoxx 600 rising 0.6% and trading near session highs although volumes were low due a UK public holiday. Among individual stocks in Europe, PostNL NV shares declined after it reported weak volumes. Demant A/S also fell as it reported a miss in sales driven by soft retail. Atos SE jumped after it received four offers that will frame the discussions with its stakeholders around its restructuring. Here are the biggest movers Monday:

- Indra Sistemas shares jump as much as 11%, after the Spanish defense company beat estimates in the first quarter and forecast Ebit for the full year of above EU400 million

- Know IT gains as much as 6% after Handelsbanken raised its short-term recommendation for the Swedish IT consultancy to hold from sell, noting small green shoots in end markets

- Maurel & Prom rise as much as 10%, the most since October, after the French oil firm received a license for operations in the Urdaneta Oeste field in Lake Maracaibo in Venezuela

- Demant falls as much as 5.3%, the most since November, after the Danish hearing-aid group reported softer-than-expected 1Q sales, with retail a stand-out disappointment, Citi says

- Castellum falls as much as 3% after DNB cut its recommendation for the Swedish landlord to hold, noting “rather soft” 1Q earnings which showed that vacancy rates is a concern

- ING Bank Slaski falls as much as 4.3% after the bank reported first-quarter results below estimates. Citi attributed the earnings miss to low non-core revenue figures and higher net provisioning

Earlier in the session, Asia stocks rose led by Chinese shares which led gains as mainland markets played catchup following a holiday break, although here too conditions were holiday-thinned with Japan and South Korea shut for holidays. The CSI 300 Index jumped as much as 1.8%, while stocks in Hong Kong took a breather following a nine-day winning streak.

- Hang Seng & Shanghai Comp were somewhat varied as Hong Kong stocks took a breather after the recent hot streak and as attention shifted to the mainland where stocks outperformed as they played catch up on their return from the Labour Day Golden Week holidays with property stocks boosted by recent support pledges, while participants also digested Caixin Services PMI data which matched estimates.

- ASX 200 was led higher by continued outperformance in the rate-sensitive sectors, while financials were also underpinned following Westpac’s earnings, special dividend and buyback announcement.

In FX, the Blooomberg Dollar index steadied as the Norwegian krone, British pound and Australian dollar led Group-of-10 gains; The prospect of central bank easing boosted risk sentiment sending global stocks higher. USD/JPY advanced as much as 0.6% to 154, paring some of last week’s more than 3% drop as short dollar positions by fast-money accounts were squeezed, according to an Asia-based FX trader. EUR/USD steadied around 1.0768, after composite PMI data for April came in above estimates and euro-area PPI for March fell 0.4% month-on-month in line with forecasts; ECB Chief Economist Philip Lane said recent data has made him more confident inflation will return to the 2% goal.

In rates, Treasuries reopened with yields lower by around 2bps at 4.48% after being closed for Japan and UK holidays. Gains have support from bunds, rallying on comments from ECB Chief Economist Philip Lane. US yields lower by around 2bp to 3bp across the curve with German yields down 3bp to 5bp after ECB’s Lane said recent data has improved his confidence that inflation will return to the 2% goal. Treasury auction cycle begins Tuesday with $58b 3-year note sale, followed by $42b 10- and $25b 30-year new issues Wednesday and Thursday.

In commodities, oil rebounded strongly after tumbling on Friday as hopes for a ceasefire in the Middle East once again died a miserable death. WTI traded 1.2% higher above $79 and Brent rose to $83.70. Gold was also significantly higher, trading about $2320.

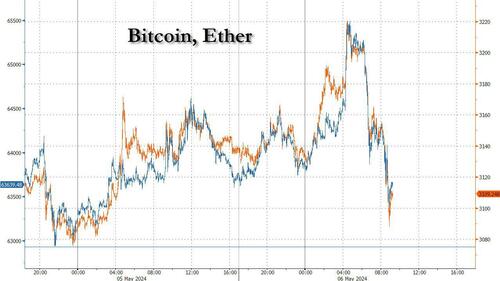

In crypto, Bitcoin is back on a firmer footing and now holds around $65k, while Ethereum hovers around $3.2k, both have erased last week’s sharp losses. The next potential objective/resistance level for Bitcoin is at $67,200 and that represents a 61.8% correction of the 73,797-56,527 fall, via market contacts.

Looking at today’s calendar, the US economic data slate empty for the session, though Fed releases Senior Loan Officer opinion survey on bank lending practices at 2pm New York time. The calendar is light this week, leaving focus on Treasury refunding auctions and about a dozen Fed speakers scheduled. Fed members’ scheduled speeches include Barkin (12:50pm) and Williams (1pm). Ahead this week are Kashkari, Jefferson, Collins, Cook, Daly, Bowman, Logan, Goolsbee, Barr and Mester

Market Snapshot

- S&P 500 futures up 0.2% to 5,165.25

- STOXX Europe 600 up 0.3% to 506.89

- MXAP up 0.3% to 178.04

- MXAPJ up 0.7% to 551.80

- Nikkei little changed at 38,236.07

- Topix little changed at 2,728.53

- Hang Seng Index up 0.6% to 18,578.30

- Shanghai Composite up 1.2% to 3,140.72

- Sensex little changed at 73,916.80

- Australia S&P/ASX 200 up 0.7% to 7,682.37

- Kospi down 0.3% to 2,676.63

- German 10Y yield little changed at 2.46%

- Euro up 0.1% to $1.0775

- Brent Futures up 0.9% to $83.74/bbl

- Gold spot up 0.8% to $2,319.71

- US Dollar Index little changed at 105.03

Top Overnight News

- China’s May Day holiday saw aggregate spending rise 13.5% above pre-pandemic levels, although spending per capita lagged behind 2019 levels. RTRS

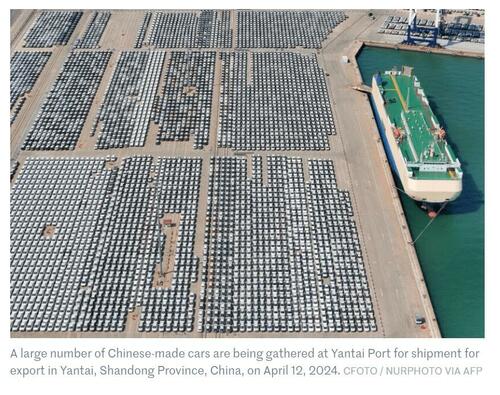

- China’s effective exchange rate is back to where it was in 2014 in real terms (given CNY weakness and the absence of domestic inflation) and this is turbocharging the country’s exports, creating trade friction with the US, EU, and other economies. WSJ

- The case for a ECB interest rate cut in June is getting stronger as services inflation is finally starting to ease, ECB Chief Economist Philip Lane told Spanish newspaper El Confidencial on Monday. The ECB has all but promised a rate cut on June 6, provided incoming data strengthen policymakers’ belief that inflation will head back to its 2% target by the middle of next year. RTRS

- A US crackdown on banks financing trade in goods for Vladimir Putin’s invasion of Ukraine has made it much more difficult to move money in and out of Russia, according to senior western officials and Russian financiers. Moscow’s trade volumes with key partners such as Turkey and China have slumped in the first quarter of this year after the US targeted international banks helping Russia acquire critical products to aid its war effort. FT

- The Israeli military has told tens of thousands of Palestinians to leave the southern Gazan city of Rafah as Israel’s defense minister warned of an imminent military “operation” as talks to free Israeli hostages appeared to have stalled. At least 100,000 civilians in eastern Rafah, along the border with Israel, should move to what Israel calls a humanitarian zone on the Mediterranean, an Israel Defense Force spokesperson told reporters, in “a limited scope” operation as part of a “gradual plan”. FT

- Saudi Arabia and its allies in OPEC+ are likely to keep oil production unchanged for a further three months when ministers review output allocations on June 1. The tightening of petroleum supplies and depletion of inventories widely anticipated at the start of the year has failed to materialize so far. RTRS

- Maersk warned that ongoing Red Sea shipping disruptions will reduce industry capacity between the Far East and Europe by 15-20% in Q2. RTRS

- The final chief executive of Credit Suisse, Ulrich Körner, is set to leave UBS in the coming weeks, as the Swiss bank prepares to complete a crucial step in the integration of its former rival. FT

- Warren Buffett said Apple is “even better” than AmEx and Coca-Cola. The stock will remain Berkshire’s top holding despite selling a large chunk. The sale bolstered his firm’s cash pile to a record $189 billion. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with a positive bias after a dovish jobs report from the US but with the upside limited amid holiday-thinned conditions with Japan and South Korea shut for holidays. ASX 200 was led higher by continued outperformance in the rate-sensitive sectors, while financials were also underpinned following Westpac’s earnings, special dividend and buyback announcement. Hang Seng & Shanghai Comp were somewhat varied as Hong Kong stocks took a breather after the recent hot streak and as attention shifted to the mainland where stocks outperformed as they played catch up on their return from the Labour Day Golden Week holidays with property stocks boosted by recent support pledges, while participants also digested Caixin Services PMI data which matched estimates.

Top Asian News

- PBoC Shanghai is reportedly to support the renewal of large-scale equipment.

- Chinese President Xi said the China-France relationship is a model of peaceful coexistence and win-win cooperation between countries with different systems, while he added they are ready to consolidate the traditional friendship, enhance political mutual trust, build strategic consensus, as well as deepen exchanges and cooperation with France, according to Xinhua.

- EU is lobbying China to exclude agriculture from a series of escalating commercial disputes and called for the ‘strategic sector’ to be protected from trade tensions in the renewable energy and electric vehicle industries, according to FT.

- A magnitude 6.1 earthquake was reported in Seram, Indonesia, according to GFZ.

European bourses, Stoxx600 (+0.3%) are entirely in the green, albeit modestly so, taking impetus from a positive APAC session. EZ Final PMIs were generally revised higher, though ultimately sparked little reaction in the equities complex. European sectors are mostly firmer, though with the breadth of the market fairly narrow. Insurance takes the top spot, alongside Energy. The latter is benefitting from broader strength in the crude complex given the recent updates around Rafah. US Equity Futures (ES +0.2%, NQ +0.2%, RTY +0.5%) are entirely in the green, building on the strength seen on Friday. Apple (-1.1%) is lower pre-market after Berkshire Hathaway declared it had decreased its stake in the Co. in Q1 and in a breather from Friday’s post-earnings strength.

Top European News

- UK PM Sunak reportedly cancelled plans for a summer general election after local election defeats with the election anticipated to occur in Autumn, according to The Telegraph.

- UK PM Sunak was warned by Conservative MPs to show some vision and start digging his party out of a hole after a disastrous set of local election results, while it was also reported that the Labour Party comfortably won the London mayoral contest to give Sadiq Khan an unprecedented third term as London Mayor, according to FT.

- ArcelorMittal (MT NA) warned the UK government that one of its main divisions could be forced to exit the UK if an application to close and redevelop a commercial port in south-east England receives approval this week, according to FT.

- ECB’s Lane said in an interview with El Confidencial that the April slowdown in services inflation marks significant progress and confidence on inflation is improving, while he added exaggerating the impact of the ECB and Fed divergence is not necessary and Fed decisions have limited impact on the euro area.

- Fitch affirmed Italy at BBB; Outlook Stable and affirmed Denmark at AAA; Outlook Stable on Friday.

FX

- DXY is modestly softer and within a very tight 105.02-20 range, should selling pressure intensify, the 105.00 mark could be brought into focus.

- EUR is marginally firmer/flat vs the Dollar, though losing in the EUR/GBP cross. Price action today has been contained within a tight 1.0756-75 range, well within the prior session’s bounds. EZ final PMIs today were generally revised higher, albeit slightly, and provided little lasting move in the EUR.

- GBP is slightly firmer against the Dollar, despite UK equities/gilt markets closed on account of the region’s bank holiday and with catalyst light. Currently trading just off session highs of 1.2584.

- JPY is by far the biggest underperformer vs the Dollar, going as high as 154.00, paring much of Friday’s USD/JPY losses, amid holiday-thinned conditions with Japan away.

- Antipodeans are both marginally firmer vs USD, though very much within a contained range as catalysts remain thin. Over in China, the Caixin PMI were in-line with expectations which helped to lift sentiment on the region’s return from holiday.

- PBoC set USD/CNY mid-point at 7.0994 vs exp. 7.2127 (prev. 7.1063).

- S&P upgraded Turkey’s rating to ‘B+’; Outlook Positive on Friday and cited economic rebalancing.

Fixed Income

- Bunds are bid with specific drivers limited, though upside was trimmed by unusually large upward revisions to the French and then EZ Final PMIs though the internal commentary around German continues to point to stagnation/incremental growth. Current 130.98-131.62 parameters surpassed Friday’s best by a handful of ticks with little of note thereafter until 132.00.

- USTs are a touch firmer, in-fitting with EGBs, but with magnitudes thin given the UK Bank Holiday and Japan’s absence; docket ahead a touch busier with Fed’s Barkin & Williams due after the latest Employment Trend numbers.

Commodities

- Crude benchmarks are bid with geopols in focus. WTI and Brent have been grinding higher throughout the morning as the geopolitical narrative around Rafah continues to gradually escalate. Most recent developments have civilians being evacuated and the Israeli Finance Minister saying the army must enter Rafah today.

- Supported on geopols; XAU to a USD 2324/oz peak but one that leaves it over USD 20/oz shy of last week’s best but with the USD 2339/oz 21-DMA the first point of resistance.

- Base metals are bid on China’s return to the market with the metal following suit to APAC performance where the region was propped up by Friday’s NFP-tailwinds and in-line Chinese PMIs.

- Saudi Arabia raised its oil prices for all grades to Asia for June with Arab Light OSP to Asia set at a premium of USD 2.90/bbl vs Oman/Dubai average and OSP to NW Europe set at a premium of USD 2.10/bbl vs ICE Brent, while it set the OSP to the US at a premium of USD 4.75/bbl vs ASCI.

- UAE’s Sharjah announced the discovery of a new gas field which is said to carry ‘promising quantities’, according to a statement cited by Reuters.

Geopolitics: Middle East

- Israeli forces are now launching raids east of Rafah, via Sky News

- Israel military says not going to put a timeframe on the Rafah evacuation and will make “operation assessments”

- Israeli military says evacuating Rafah as part of a “limited scope” operation

- The Israeli army has ordered civilians in several parts of Rafah to leave the city as it begins an invasion of the southern city, via journalist Soylu

- Israeli Defence Minister, speaking with US Defence Secretary Austin, that action in Rafah is required due to Hamas’ refusal of hostage-release proposals

- Senior Hamas Official says to Reuters that Israel’s Rafah evacuation order is a “dangerous escalation that will have consequences”; Hamas may withdraw from truce talks due to Rafah operations.

- Israel’s military said the Kerem Shalom Crossing with Gaza is now closed to aid trucks after it came under fire with mortar shelling which killed 3 Israeli soldiers and wounded 12 others from the Givanti and Nahal brigades, while Hamas claimed responsibility for the mortar attack on Kerem Shalom and said it targeted an Israeli army base, according to Reuters.

- Israeli PM Netanyahu said they cannot accept Hamas’s demands for an end to the war and the withdrawal of forces from Gaza, while he noted that ending the Gaza war now would keep Hamas in power and Israel would not accept terms that amount to a capitulation with Israel to keep fighting until its war aims are achieved. It was separately reported that Israel’s Defence Minister said Hamas appears uninterested in a deal meaning strong military action in Gaza’s Rafah could happen very soon, according to Reuters.

- Israeli army is said to have started to evacuate civilians from parts of Rafah, according to Haaretz cited by Walla’s Guy Elster. Subsequently, Bloomberg reported that the Israeli military asks some Rafah civilians to move out of the city, according to Bloomberg.

- Hamas’ leader said they are still keen on reaching a comprehensive agreement, while the group said the round of negotiations in Cairo has ended and the delegation will leave to consult with the group’s leadership, according to Reuters. It was separately reported that Hamas agrees that Israel can commit to ending the war in the second stage of the hostage deal not the first, according to Times of Israel via social media platform X.

- CIA chief Burns is to travel to Doha for an emergency meeting with Qatar’s PM as Gaza talks are said to be ‘near to collapse’, while Qatar and the US are to exert maximum pressure on Israel and Hamas to continue negotiations, according to an official briefed on talks cited by Reuters. It was separately reported that Burns will stay in Qatar on Monday and likely travel to Israel this week to meet with Israeli PM Netanyahu, according to an Axios reporter.

- US reportedly put a hold on an ammunition shipment to Israel last week, according to two Israeli officials cited by Axios.

- Iraqi armed factions announced they targeted an Israeli air base in Eilat with drones, according to Al Arabiya.

- Israeli Cabinet decided to close Qatari TV network Al Jazeera’s operations in Gaza, according to a statement cited by Reuters. It was later reported that Israel’s communications ministry said a police raid was conducted at an Al Jazeera premises in Jerusalem.

Geopolitics:

- Russia said it took full control of Ocheretyne village in eastern Ukraine, according to the Defence Ministry, cited by Reuters.

- Russian Defence Ministry says preparations are beginning for the commencement of a missile exercises in the southern district, incl. aviation & navy forces

US Event Calendar

- 14:00: Senior Loan Officer Opinion Survey on Bank Lending Practices

Central Bank Speakers

- 12:50: Fed’s Barkin Speaks on Economic Outlook

- 13:00: Fed’s Williams Participates in Fireside Chat

- 14:00: Senior Loan Officer Opinion Survey on Bank Lending Practices

DB’s Peter Sidorov concludes the overnight wrap

Filling in for Jim with the UK off for the May Day bank holiday. As the calendar takes a quieter turn after the deluge of macro events last week, the focus will be on whether markets can continue to find a more solid footing. The latter half of last week saw strong gains for most asset classes thanks to an FOMC meeting that avoided hawkish surprises coupled with a softer payrolls report on Friday that reignited hopes of a soft landing for the US economy. 10yr Treasury yields saw their largest weekly decline of the year so far (-15.5bps) while the S&P 500 posted its best 2-day run in 10 weeks (+2.18%). See the full recap at the end.

Looking forward, the health of the US economic cycle will remain in focus with today’s Senior Loan Officer Survey from the Fed. The SLOOS has seen a gradual improvement in the past few quarters after the sharp tightening following the regional banking stress last March. A key question is whether the rise in yields since the start of the year could derail the nascent improvement in bank credit conditions. In their latest chartbook, Jim and Henry highlighted the delayed pass through of higher rates as one of their “What keeps us awake at night?” themes, while my own earlier note (see here) discussed how further improvement in the bank credit cycle may be unlikely without rate cuts materialising. Later in the week, the University of Michigan consumer survey will attract attention on Friday given the recent softening in US consumer confidence indicators.

The main macro event in Europe will be the latest BoE decision on Thursday. Our UK economist expects this week’s meeting to set the stage for the first rate cut in June and foresees dovish shifts in the MPC’s modal CPI projections and its forward guidance. You can see the full preview here. We will also have the RBA decision on Tuesday (see our economists’ preview here), while on Wednesday the Riksbank could deliver the first rate cut of the cycle there. Finally, we’ll have the accounts of April ECB meeting due on Friday. These are unlikely to deliver major surprises, with April’s clear if conditional signal of a June rate cut having solidified in recent ECB commentary. But we will watch for any hints on the ECB reaction function beyond June, including on what sort of data might justify consecutive ECB cuts.

The earnings season will begin to taper off this week, with almost 400 of S&P 500 members having already reported. Notable releases will include Walt Disney, Vertex, Uber and Airbnb in the US, Ferrari, Telefonica and Leonardo in Europe and Toyota and Nintendo in Japan.

Asian equity markets are mostly trading higher this morning in holiday thinned trading, catching up to the strong end of last week for US equities. As I type, mainland Chinese stocks are leading gains in the region with the CSI (+1.3%) and the Shanghai Composite (+1.05%) both trading notably higher after returning from a long holiday break while the S&P/ASX 200 (+0.60%) is also edging higher and on pace for a third straight day of gains. Elsewhere, the Hang Seng (-0.05%) is swinging between gains and losses in early trade while markets in Japan and South Korea are closed for a public holiday. Outside of Asia, US stock futures are trading marginally higher (+0.08% for the S&P 500).

In terms of early morning data, China’s Caixin Services PMI came in line with expectations at 52.5 in April (vs. 52.7 the previous month). The Composite PMI edged up from 52.7 to 52.8, its highest level since May 2023, so suggesting a reasonably positive performance of the Chinese economy.

In the FX space, the yen is trading moderately down (-0.57%) against the dollar at 153.92 as I type. The yen had been on course to breach its 1990 lows early last week, but ended up seeing its strongest weekly gain against the dollar since late 2022 (+3.45%) amid suspected FX intervention.On this topic, we heard from US Treasury Secretary Janet Yellen over the weekend, who didn’t comment on whether Japan had intervened but added that “we would expect these interventions to be rare and consultation to take place”.

Events in the Middle East have been in focus over the weekend. Hopes of a ceasefire in Gaza had risen on Friday following comments by Hamas officials that it was studying Israel’s latest proposals with a “positive spirit” but weekend talks ended inconclusively. Israel’s prime minister Netanyahu said on Sunday that it would not agree to Hamas demands to end the war in Gaza completely and Israel closed a crossing into Gaza after a rocket attack by Hamas. Oil prices have moved a little higher this morning with Brent futures (+0.31%) trading at $83.22/bbl, also on news that Saudi Arabia increased its monthly selling oil price to Asia. Geopolitics will remain in focus this week, not least with a visit by China’s President Xi Jinping to Europe that lasts until Friday.

Recapping last week in detail, the US payrolls release on Friday came in softer than expected across an array of indicators. The headline payrolls result rose 175k month-on-month (vs 240k expected), the smallest monthly gain in the last six months. The unemployment rate also ticked up to 3.9% (vs 3.8% expected), while average hourly earnings (+0.2% month-on-month vs +0.3%) and hours worked (34.3 vs 34.4) were both a tenth below expectations. So on the whole, the payrolls print was soft landing positive, with our US economists noting that some ad hoc factors may have overstated the weakening. See their post-payroll labour market chart book here for more.

Off the back of this, markets raised their expectations of rate cuts, with thenumber of Fed cuts priced in by the December meeting rising +11.4bps (and +4.8bps on Friday) to 45bps.The hope for additional Fed rate cuts was given further fuel on Friday after the April ISM services PMI came in at 49.4 (vs 52 expected), its lowest level since December 2022. On the other hand, the ISM services prices paid index rose to a three-month high of 59.2 (vs 55.0 expected), but this was largely driven by an increase in energy prices. This sent 2yr Treasury yields down -5.7bps on Friday, building on the earlier post-FOMC rally and down -17.8bps over the week. 10yr Treasuries also rallied, as yields fell -15.5bps to 4.51% (and -7.2bps on Friday) in their strongest week of the year so far. Lower yields saw the broad dollar index post its worst week in eight weeks (-0.86%).

For Europe, it was a similar story, as investors become increasingly certain that the ECB would be cutting rates at their June meeting. By the end of Friday, markets were pricing in a 95% chance of a rate cut in June, up from 88% at the beginning of the week. That lent support to European fixed income, as 10yr German bund yields fell -8.0bps (and -4.6bps on Friday). 10yr gilts fell -10.2bps (and -6.4bps on Friday).

With the payrolls print boosting soft landing hopes, equities enjoyed a strong end to the week, with the S&P 500 rising +1.26% on Friday and paring back earlier losses (+0.55% on the week). Markets were buoyed by the strong results from Apple, which gained +8.32% last week (and +5.98% on Friday). This saw the tech heavy NASDAQ outperform, rising +1.99% (and +1.43% last week). Overall, the rally was broad-based, as the Russell 2000 index of small caps rose +1.68% (and +0.97% on Friday), returning into positive territory year-to-date (+0.43%). It was a bit gloomier over in Europe, as the STOXX 600 fell -0.48%, although the index posted a small rally on Friday (+0.46%).

Finally in commodities, a more positive geopolitical backdrop and an increase in US oil inventories saw oil prices retreat last week. Brent crude fell -7.31% to $82.96/bbl (-0.85% on Friday), and WTI crude -6.85% to $78.11/bbl (-1.06% on Friday), their lowest levels in seven weeks. Gold retreated for the second week in a row, falling -1.55% to $2302/oz (+0.09% on Friday).