Happy New Year? New Census Data Shows Illinois Lost Population For The Sixth Year In A Row

Authored by Ted Dabrowski and John Klingner via Wirepoints.org,

New U.S. Census data shows that Illinois’ population fell again in 2019, making this the sixth year in a row Illinois has shrunk.

Here are the key facts you need to know:

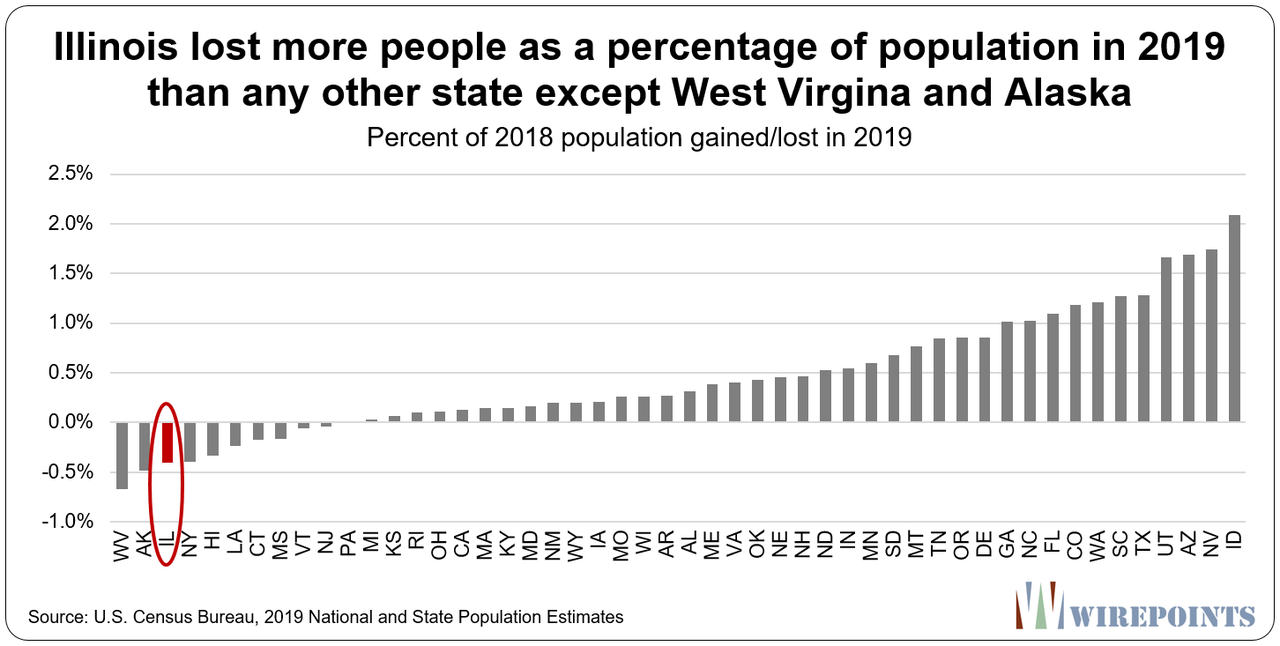

1. Illinois’ population fell by 51,000 in 2019, the 2nd-most in the nation.

Only New York lost more people than Illinois in 2019.

Illinois also had the third-worst loss as a percentage of population. Only West Virginia and Alaska lost more in percentage terms.

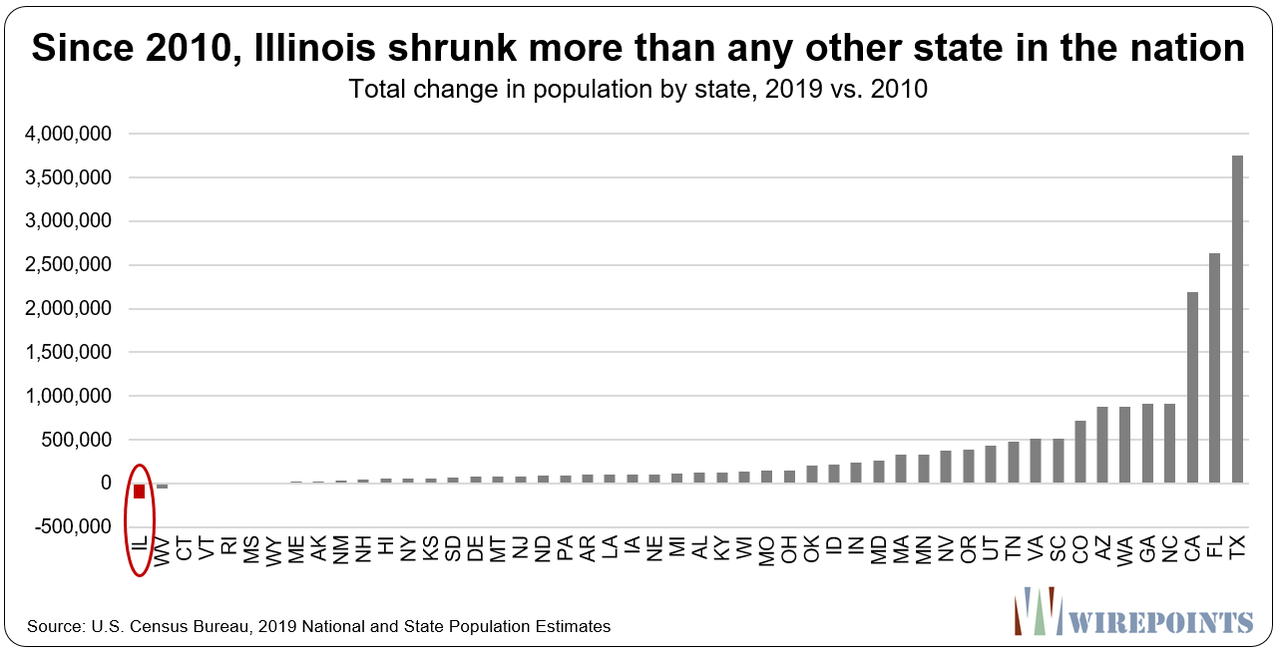

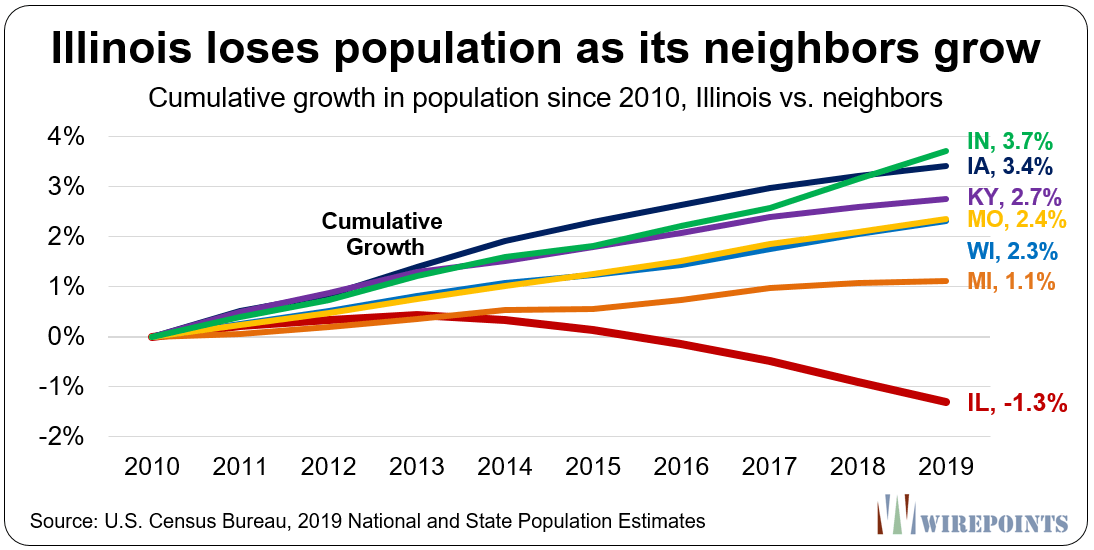

Overall, Illinois shrunk the most of any state in the nation between 2010 and 2019. There are now 170,000 fewer people in Illinois today than in 2010.

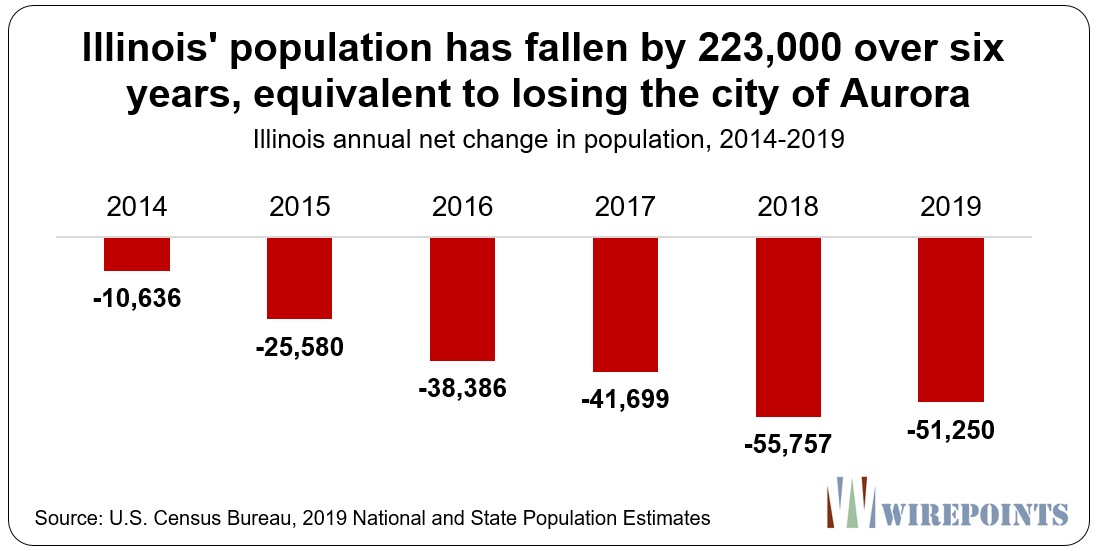

2. Illinois has lost population six years in a row.

Cumulatively, the state has lost 223,000 people since 2014. That’s the equivalent of losing the entire city of Aurora.

Only West Virginia and Connecticut have also lost population for six years or more.

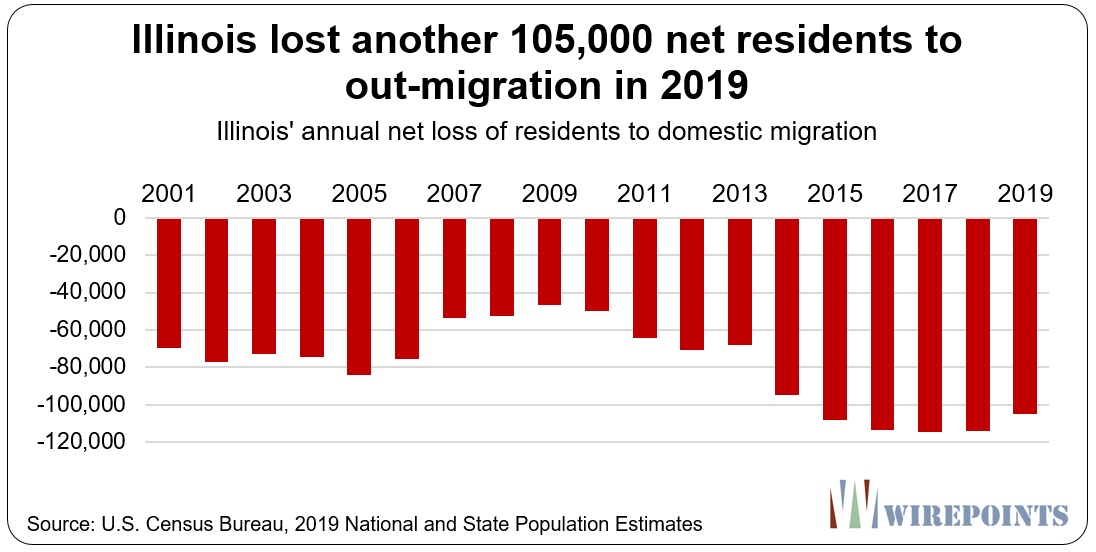

3. Illinois netted a loss of nearly 105,000 residents to domestic out-migration in 2019.

A key reason for Illinois’ loss in population is its continuous stream of residents leaving the state. Illinois lost a net of 105,000 residents to other states in 2019.

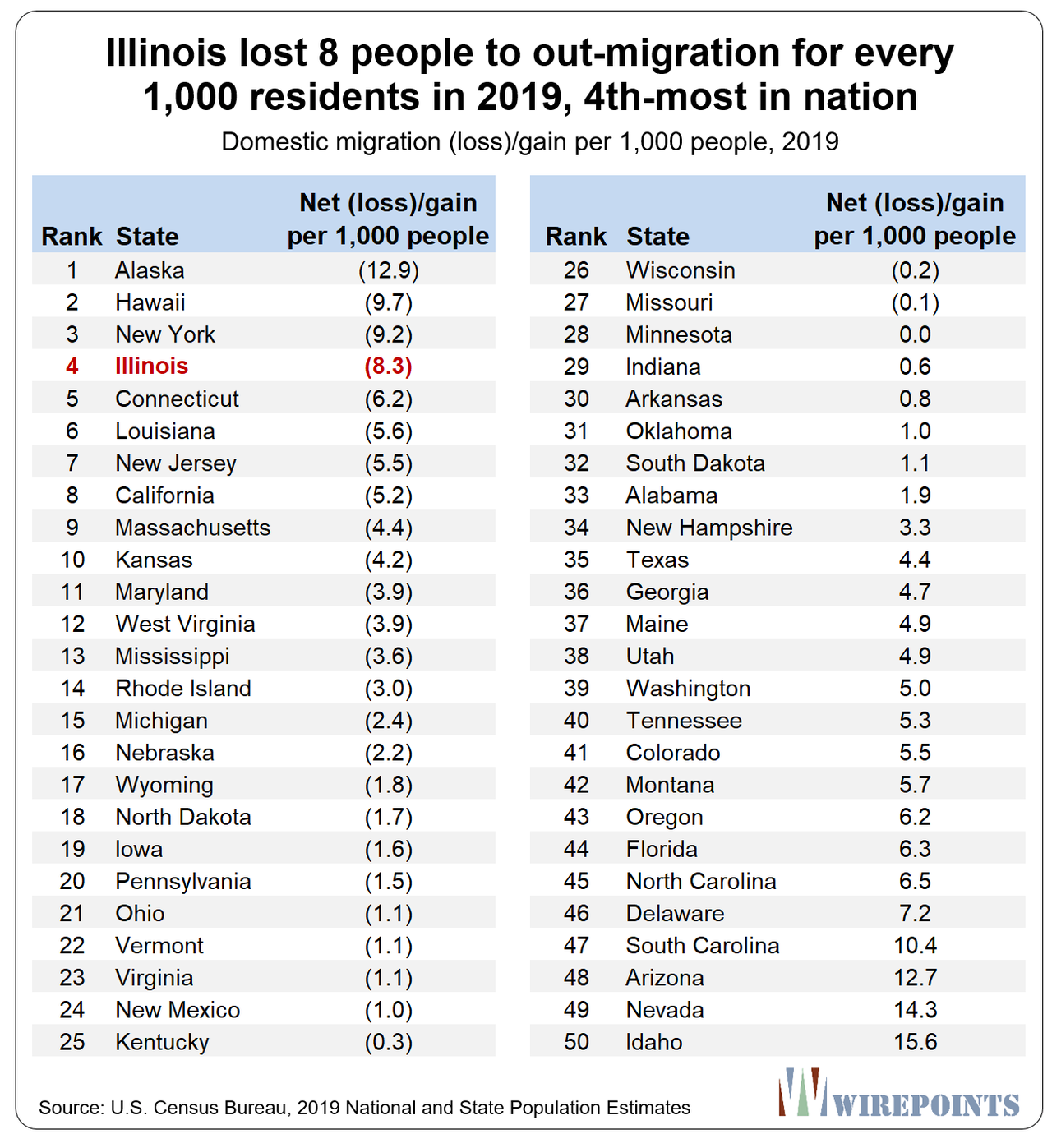

4. Illinois has one of the worst rates of domestic out-migration.

Illinois’ domestic migration losses are some of the nation’s worst. When measured per 1,000 people, Illinois lost over 8 people to out-migration in 2019, the 4th-highest in the nation.

And as the list below shows, none of Illinois’ neighbors come close to those losses. Michigan lost 2.4 people per 1,000 residents. Kentucky, Missouri and Wisconsin were almost flat. And Indiana actually had positive net migration.

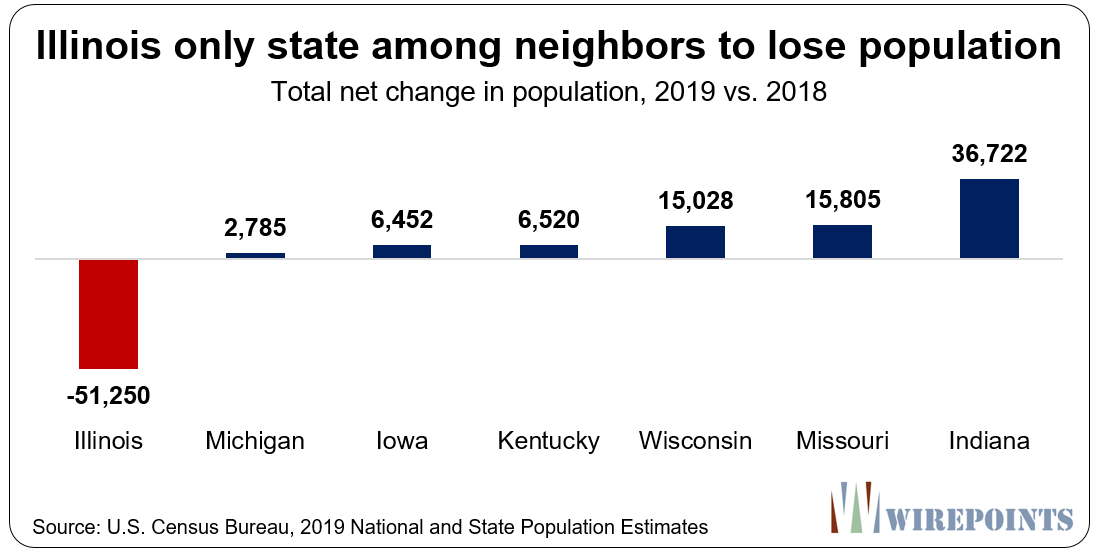

5. Illinois’ neighbors are gaining population.

Bad weather – the favorite excuse of those who deny Illinois’ population problems – is not to blame for the state’s ills.

All of Illinois’ neighboring states gained population in 2019. In fact, Indiana gained nearly 37,000 people last year – 2/3rds of what Illinois lost.

Overall, Illinois has lost about 1.3 percent of its population since 2010. And while Illinois has shrunk six years in a row, none of its neighbors have shrunk even once in that time period.

* * *

Illinois politicians seem to have no plan to stem the state’s population losses. There’s no talk of an amendment to the pension protection clause nor are there plans to address the drivers of Illinois’ second-highest-in-the-nation property taxes.

Instead, their only plan is a for of a multi-billion dollar progressive tax hike – something that will only chase even more people out.

Read more about Illinois and its many crises:

-

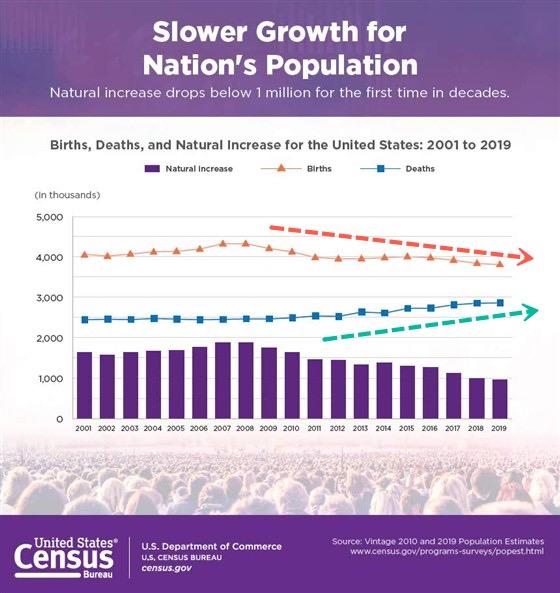

Illinois’ demographic collapse: fewer immigrants, fewer babies and fleeing residents

-

Illinois enacting a progressive tax is like Sears attempting a turnaround by hiking prices

-

This One Chart From Moody’s Illustrates Chicago’s Fiscal Plight

-

Pritzker, don’t blame Wirepoints. Math diminishes your ‘monumental’ claims, not us.

-

Moody’s shows Illinois is nation’s extreme outlier when it comes to pension debts

-

It’s not just property taxes Illinoisans should be worried about. It’s home values, too.

Tyler Durden

Wed, 01/01/2020 – 13:00

via ZeroHedge News https://ift.tt/2SPXG1P Tyler Durden