Submitted by Michael Every of Rabobank

Yesterday afternoon I was listening online to a UK radio host complaining about US President Donald Trump’s claim there were no protestors against him on his recent state visit. The view was that such deliberate misstatements are designed to blur the line between truth and reality, dragging us all down the path to the permanent victory of Fake News. That happened on the same day as Aussie police raided the publicly-owned Australian Broadcast Corporation with a warrant allowing them to not just seize, but alter, documents on national security concerns; and another raid was made on the home of a journalist over a report detailing how the authorities are aiming to win powers to spy on citizens’ communications.

We live in strange times…but what I wanted to shout back at the screen was that we have been on this journey for a long time. As Orwell stated, “He who controls the past controls the present” – and we are misrepresenting that past. Were we really living in halcyon days of truth, justice, and honesty before November 2016?

Does anyone recall the Obama administration aggressively going after leakers, whistle blowers, and journalists? Or the Bush II administration and its infamous Willie Horton election ad, its sneering condescension towards “the reality-based community”, its ruinous war in Iraq based on zero evidence, and its legal arguments for a “Unitary Executive”, a continuation of the Nixonian argument that “If the president does it, that means its legal”? How about ‘Debate Gate’, or ‘Savings & Loan’, or ‘Iran-Contra’ under Reagan, the latter only capped when Bush II pardoned Caspar Weinberger before his trial began? Yes, it was all sunshine and flower pre-2016.

Yet this isn’t a US issue by any means. Does nobody recall the Brexit debate saw outrageous claims from both sides? A few weeks before the vote I recall turning on the BBC six o’clock news and seeing B&W footage of a WW2 German Stukka dive-bomber and the main headline that voting for Brexit meant a risk of war. Nobody seems to be in court for that as opposed to stating the gross weekly figure transferred by the UK to the EU rather than the net number.

Nor is this a Western matter: anyone remember Chinese President Xi Jinping speaking at Davos and getting a standing ovation for his passionate defence of free trade and multilateralism even as he presides over an aggressively mercantilist state that refuses to accept the international law of the sea? Or how about India’s recent military spat with Pakistan, and how many planes and terrorists were or weren’t shot down or bombed?

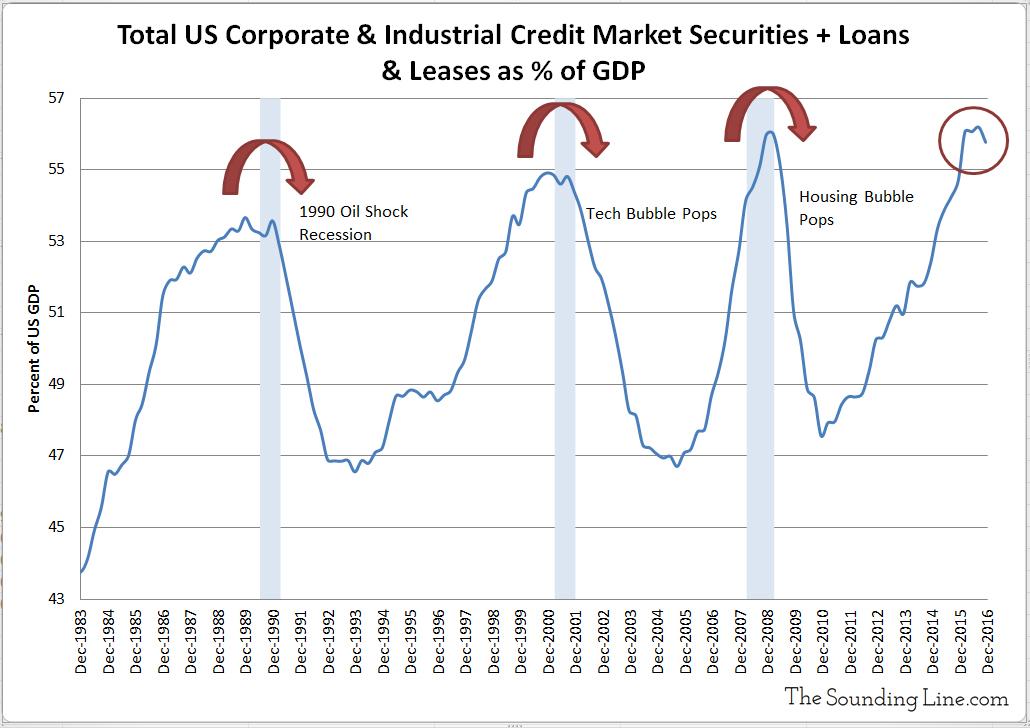

Nor is this just about politics – which is why it matters to the Daily. I lose track of how many times I have heard central bankers, key economists, and management consultants spread blatantly Fake News that misrepresents facts, data, and history. How about the meme that we have to beware government spending because it might cause hyperinflation and lead to Nazism? Any historian can tell you it was DEFLATION under austerity-Chancellor Brüning that lead to the rise of Hitler. How about the myth that low rates and QE lead to business investment and rising wages when any heterodox economist can point out that as far back as 1943 they were predicted to just lead to asset bubbles and the rich getting richer? How about telling us that markets can efficiently regulate themselves, when anyone could see that they couldn’t? Or that “subprime was contained”? Or how about the slew of Fed speakers now pointing to future rate cuts ahead when they couldn’t see any of the same underlying arguments to cut mere months ago? After all, the Fed’s own Beige Book, based on what people on the ground see, says there was “a slight improvement over the previous period” and that tariff threats were being shrugged off – though that predates the Mexico Sit On that has since erupted.

Indeed, perhaps this Fake News thing seems more in our faces today because of social media; or perhaps it is infuriating more people now because in the “Good Old Days” politicians lied through their teeth, but nobody dared to touch free trade and free movement.

Of course, that’s no longer the case. The talks between the US and Mexico over the border and tariffs failed to reach a conclusion meaning we are just two working days away from a 5% tariff being imposed on everything heading north over the border. The US and China are also still at loggerheads, with the former preparing to find alternative suppliers to Chinese rare earths and Chinese scientists, and the latter warning its citizens not to go on holiday to the States. The US is also responding to China’s Ministry of Peace/Ministry of War regional actions by pressing ahead with USD2bn of arms sales to Taiwan, which will **infuriate** Beijing. None of the above is Fake News – but what is fake is the view that lower interest rates will somehow mean close-to-high equities won’t be hit as a result.

Meanwhile, there are other Orwellian challenges out there. In the EU we had the decision to press ahead with punishing Italy for its debt position while choosing not to do the same for France, when both are in breach of the Brüning-esque fiscal rules. “All fiscal deficits are equal, but some fiscal deficits are more equal than others” apparently. I would imagine that this will put the wind in the sails of the Italian populists as they continue to steer the ship towards outright confrontation with Brussels: tax-scrip/fiscal money/Mini-Bots ahoy? Or is that just Fake News?

In short, we are drowning in Orwell…and it won’t end well.

via ZeroHedge News http://bit.ly/2MveWrt Tyler Durden