Is This The Beginning Of A Nuclear Power Race In The Gulf States?

Tyler Durden

Tue, 08/04/2020 – 19:25

Authored by Tsvetana Paraskova via OilPrice.com,

One of the world’s largest oil producers and exporters, the United Arab Emirates (UAE), has just launched the first nuclear power plant in the Arab world. Touted as a major milestone for the UAE and its energy diversification, the project raises questions about the economic viability of an expensive nuclear power plant in one of the best spots for solar energy in the world.

More importantly, the project also raises questions about the geopolitical implications of a nuclear facility in the restive Middle East region, where tensions increased after the assasination of Iranian General Qassem Soleimani earlier this year.

Iran could trigger a nuclear arms race, experts say.

The Emirates Nuclear Energy Corporation (ENEC) successfully started up on Saturday Unit 1 of the Barakah Nuclear Energy Plant in Abu Dhabi, saying that the process was undertaken in line with regulatory requirements and the highest international standards for nuclear quality and safety.

“We are now another step closer to achieving our goal of supplying up to a quarter of our Nation’s electricity needs and powering its future growth with safe, reliable, and emissions-free electricity,” said ENEC’s chief executive Mohamed Ibrahim Al Hammadi.

With the start-up of the Barakah nuclear power plant, the UAE became the first country in the Arab world, and the 33rd nation globally, to develop a nuclear energy plant to generate electricity, helping the oil-rich emirates to move towards electrification of its energy sector and decarbonization of its electricity production, ENEC says.

Rafael Mariano Grossi, Director General of the International Atomic Energy Agency (IAEA), said that the agency supports the UAE and other countries “that opt for introducing nuclear power, which plays a key role in achieving clean & affordable energy and in tackling #ClimateChange.” While the UAE touts the safe and zero-emission electricity generation from nuclear power, some experts question the ‘safety’ part of that claim because of the lack of additional (and costly) safety features in the South Korean technology that the UAE uses for its first nuclear power facility. Rising sea levels also pose risks for the coastal Barakah nuclear plant, while radioactive waste could endanger marine life in the Gulf, Paul Dorfman, Founder and Chair of the non-profit Nuclear Consulting Group, wrote in an overview of UAE’s new reactors in December 2019.

But the most concerning aspect of the first civil nuclear project in the Arab world is that it could spark a nuclear arms race and facilitate nuclear proliferation options for actors in the Gulf that choose to pursue it, experts warn.

“The tense geopolitical environment in the Gulf makes nuclear a more controversial issue in this region than elsewhere, as new nuclear power provides the capability to develop and make nuclear weapons,” Dorfman said.

“It’s worth noting that emergent back-channels exist which may facilitate Gulf states obtaining advanced nuclear fuel cycle enrichment technologies if the decision is made to pursue a military proliferation option,” he noted.

The simmering tensions between the Arab Gulf states – led by the UAE’s ally Saudi Arabia – on the one hand, and Iran, on the other hand, is a concern for energy and nuclear power experts. Iran is already under U.S. sanctions because of its nuclear ambitions.

In March 2018, Saudi Arabia’s Crown Prince Mohammed bin Salman told CBS in an interview that “Saudi Arabia does not want to acquire any nuclear bomb, but without a doubt if Iran developed a nuclear bomb, we will follow suit as soon as possible.”

The UAE has an agreement with the United States in which the emirates have renounced any intention to develop domestic enrichment and reprocessing capabilities.

“For Gulf Arab rulers who fear that Washington is not a reliable long-term guardian, nuclear power generation may offer an alternate path to maintaining a US strategic interest in securing their regimes,” Jim Krane, a Wallace S. Wilson Fellow for Energy Studies at Rice University’s Baker Institute, wrote earlier this year.

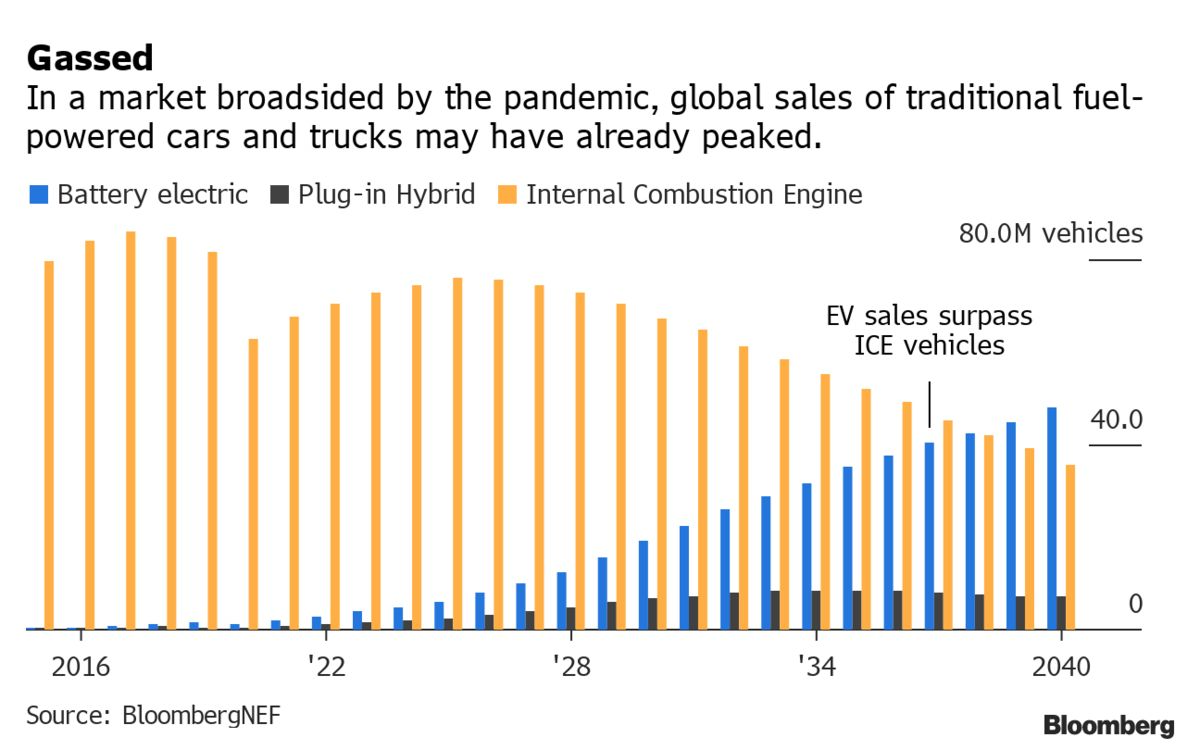

Last but not least, the UAE nuclear power plant raises questions about the economics of pursuing costly nuclear electricity generation while solar power generation could thrive in the region endowed with sunlight.

Just last week, the Emirates Water and Electricity Company (EWEC) announced the awarding of contracts to develop the world’s largest solar power plant of 2 gigawatts (GW) of capacity.

According to Nuclear Consulting Group’s Dorfman, new nuclear power generation can now only be built with very significant government subsidy, unlike renewables.

“Since new nuclear makes little apparent sense in the Gulf, which has some of the best solar energy resources in the world, the nature of the interest in nuclear may lie hidden in plain sight,” he argues.

via ZeroHedge News https://ift.tt/2XvwXsR Tyler Durden