The Fed’s $250 Billion Debt-Buying “Index” Loophole

Tyler Durden

Tue, 06/16/2020 – 13:20

In the aftermath of yesterday’s announcement by the Fed that the central bank is starting to buy corporate bonds (not ETFs), something it had said it would do three months ago yet which either the algos or the Robinhooders never quite grasped and which sent stocks soaring even though it wasn’t actual news, some have asked what exactly was the purpose of the Fed’s market-moving press release. As it turns out, there was a very strategic purspose for the Fed to do what it just did, and it involves around the just announced Broad Market Index, which effectively grants the Fed a $250 billion monetization loophole.

BMO’s Daniel Krieter explains below.

What did the Fed do? Initially, the SMCCF was structured to hold two types of investments, “Eligible Individual Corporate Bonds” and “Eligible ETFs”. Yesterday, the Fed introduced a third category: “Eligible Broad Market Index Bonds”. This new category allows the Fed to immediately begin buying individual corporate bonds in much larger volume than previously anticipated. However, while the creation of this category came as a surprise, the announcement that the Fed would buy individual corporate bonds initially came in March.

What are Eligible Broad Market Index Bonds? Bonds that are included in the Fed’s newly created Broad Market Index. These are corporate bonds that, at the time of purchase, (i) are issued by an issuer that is created or organized in the United States or under the laws of the United States; (ii) are issued by an issuer that meets the rating requirements for eligible individual corporate bonds; (iii) are issued by an issuer that is not an insured depository institution, depository institution holding company, or subsidiary of a depository institution holding company, as such terms are defined in the Dodd-Frank Act; and (iv) have a remaining maturity of 5 years or less.

What is the difference between Eligible Individual Corporate Bonds and Eligible Broad Market Index Bonds? Very little. In addition to the requirements for Eligible Broad Market Index Bonds, Eligible Individual Corporate Bonds must also be issued by a company: 1) with “significant operations and a majority of its employees based in the United States,” 2) that has not received specific support under the CARES Act; and 3) satisfies the conflict of interests requirement in the CARES Act. Thus, Eligible Individual Corporate Bonds must meet a stricter set of criteria for purchase by the Fed.

Why is this important? The SMCCF is funded with money from Treasury authorized by the CARES Act, and therefore comes with restrictions. As stated in Section 4003(c)(3)(c) of the CARES Act, any Fed facility to which Treasury makes a contribution shall only purchase obligations or other interests (other than securities that are based on an index or that are based on a diversified pool of securities) from…[businesses] that have significant operations in and a majority of its employees based in the United States.”

The requirement that businesses have significant U.S. operations and a majority of its employees in the U.S. proved problematic for the Fed since the only way the central bank could realistically adhere to this was by having individual corporations certify their compliance with these prerequisites. Having a large percentage of hundreds of American corporations certify compliance was very difficult from an operational standpoint to begin with, and became even more so when certification potentially became stigmatized after credit spreads rallied so significantly. Without certification, the Fed was potentially left with a huge liquidity facility that wasn’t allowed to buy anything but ETFs.

How did the Fed get around certification? By identifying a loophole. Section 4003(c)(3)(c) requires purchases of only companies with “significant operations in and a majority of its employees based in the Untied States” unless the purchases are (emphasis ours) “securities based on an index or that are based on a diversified pool of securities.” This clause was likely included to allow the Fed to buy ETFs. Instead, the Fed created its own index of corporate bonds, the “Broad Market Index,” and will now purchase individual corporate bonds based on this index under this clause. In one swift stroke, the Fed essentially made the entire universe of non-financial corporate debt under five years immediately eligible for purchase.

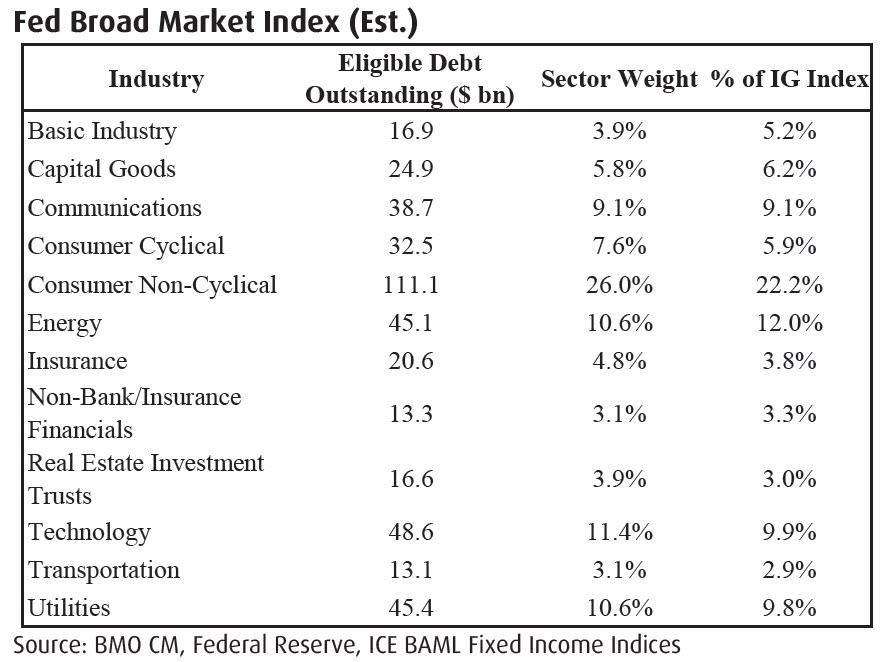

How will purchases work mechanically? The Broad Market Index is intended to track the composition of the broad, diversified universe of secondary market bonds that meet the criteria specified in the Term Sheet for Eligible Broad Market Index Bonds, subject to generally applicable issuer-level caps specified by the Term Sheet. Each time the index is refreshed (approximately every month), the SMCCF will identify all secondary market bonds that meet the criteria for Eligible Broad Market Index Bonds. Next, limits relevant to each issuer, calculated on a par basis as the lesser of the cap of 10% of an issuer’s maximum historical outstanding bonds and 1.5% of the maximum combined CCF facility size, will be applied to generate the index contribution for each eligible issuer. These contributions will then be aggregated, and the proportion of each issuer’s bonds in the aggregate form their weight in the index. Individual issuer weights will form the basis of sector weights, with each issuer mapped to one of twelve sectors (shown below). Purchases will track as closely as possible the sector weights in the index, and any overage or shortfall during a month will be addressed in the following month’s purchases.

It will not be possible for the SMCCF’s purchases to exactly replicate the index at all times. As a result, the primary focus of the SMCCF’s Eligible Broad Market Index Bond purchases will be to track as closely as possible the sectoral weights of the index. Eligible Broad Market Index Bond purchases will also generally track the ratings and maturity profile of the index. However, the maturity profile of the purchases is expected to be several months longer than the index’s maturity profile, as the SMCCF will likely underweight purchases of bonds maturing within six months of the date of purchase.

What are the estimated sector weights? We estimate the total size of the Fed’s Broad Market Index will initially be around $400-450 bn, with our proxy index having a face value of $426.9 bn and sector weights shown below.

Do any individual borrowers benefit from the Fed’s announcement? USD debt of corporations incorporated in the United States but without significant operations or a majority of its employees in the United States theoretically benefit. These bonds are now eligible for Fed purchase, but were originally expected to be excluded. In its FAQs, the Fed defines “significant operations in the U.S.” as a company with greater than 50% of its consolidated assets in, annual consolidated net income generated in, annual consolidated net operating revenues generated in, or annual consolidated operating expenses (excluding interest expense and any other expenses associated with debt service) generated in the United States as reflected in its most recent audited financial statements. However, in reality, we do not expect to see significant outperformace for this type of borrower. While difficult to quantify given difficulty in isolating borrowers that meet this criteria, we do not expect a significant discount ever developed for this type of borrower that would now be corrected.

How big will SMCCF purchases be? The total size of the program (up to $250 bn through Sept 30) gives the Fed plenty of room to ramp up purchases quite aggressively, although the Fed will leave purchases well below the implied maximum pace as long as market conditions remain constructive. As of last Wednesday, the Fed had purchased $5.5 bn in cumulative ETFs through just over four weeks.

We expect the pace will grow as the Fed begins to buy individual bonds, although it will remain dependent upon market functioning. To this point, conditions deteriorated significantly late last week, and this may have been a catalyst for yesterday’s announcement. In normal times, we expect the Fed to purchase around $2-5 bn each week with the potential to ramp up purchases to several times that amount.

Will the Fed still buy “Eligible Individual Corporate Bonds”? Yes. The Fed’s updated FAQs are very clear that the central bank still intends to buy eligible individual corporate bonds. A borrower would need to certify compliance with the significant operations and majority of employees prerequisites in order to be eligible. Upon certification, it appears that the Fed would then buy more secondary market debt of a certified borrower than they otherwise would, according to the Broad Market Index weights. Alongside the PMCCF, these purchases are “expected to become operational in the near future,” according to the Fed’s announcement yesterday.

How can the Fed provide further support to the market, if necessary, with the known corporate buying programs? It is unlikely that any further announcements regarding the PMCCF or SMCCF purchases of Eligible Individual Corporate Bonds result in incremental risk asset performance because these facilities are now truly emergency facilities. We can’t imagine any borrower certifying given associated stigma unless market conditions worsen materially. Therefore, the only thing the Fed can do to existing facilities now is increase/change their size limits. Currently, PMCCF capacity is $500 bn and SMCCF capacity is $250 bn for a total of $750 bn. With the expectation that the PMCCF will not likely get much utilization unless market conditions worsen materially, the Fed could reduce some of the PMCCF’s capacity and add it to the SMCCF. Or, they could increase the aggregate size of the programs.

via ZeroHedge News https://ift.tt/3d6Yupi Tyler Durden