Fed’s Actions Have Obliterated True Price Discovery Mechanism

Tyler Durden

Sat, 06/20/2020 – 12:10

Authored by Bruce Wilds via Advancing Time blog,

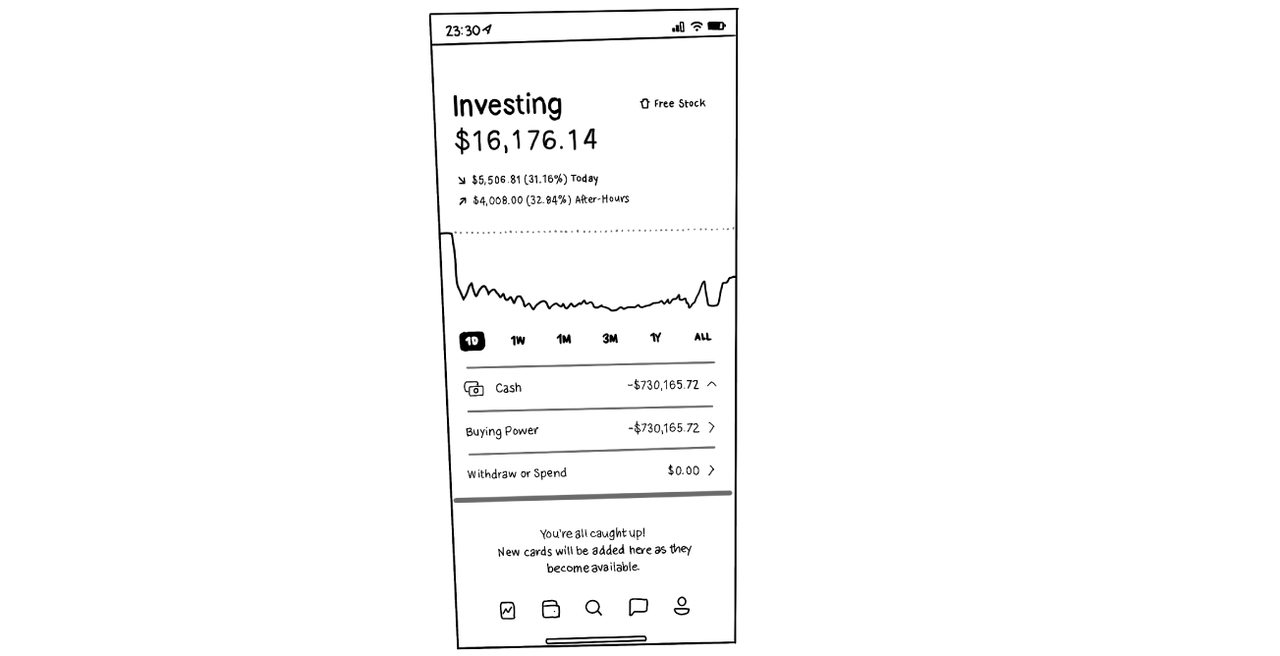

The Federal Reserve continues to destroy true price discovery in this market by executing short squeeze after short squeeze. Moral hazard be damned, the Fed’s desire to support the market has overruled common sense. We have seen this time after time with well-timed announcements being made simply to fire up bullish enthusiasm and spark a rally. We recently observed this when a Fed announcement resulted in a dramatic intraday reversal causing the S&P500 to surge more than 100 points from session lows and closing above its 200-day moving average.

Fed’s Action Obliterates True Price Discovery

This time it was because the Fed announced it would start to buy corporate bonds the next day. A late Bloomberg report that Trump was seeking a $1 trillion infrastructure proposal to stimulate the economy also added fuel to the fire. Trump’s proposal focused on 5G and rural broadband. The report added it was still under discussion and would need the backing of Congress to move forward. Still, this is an indication the false economy continues to ramp up. Government stimulus has been a key feature of the global equities rally even as unemployment has soared and signs that a second wave of the virus has started to emerge.

Until now, the size and pace of Fed balance sheet expansion have put a floor under global equity markets and driven equities higher. Yet Powell is going out of his way to signal that more economic support is on the way. The problem with market manipulation is that once it starts, where does it end? This is an area of moral hazard that once breached is difficult to turn back. Another issue is that the Fed is not alone in playing this game, the Trump administration also has invested a great deal in keeping markets moving higher. In recent years we have witnessed more central banks and government intervention in markets. This supports the argument that true price discovery has been massively distorted.

The BOJ Buying ETFs Is Distorting Markets

In many ways, government entities investing in or buying stock, are transferring part of industry or commerce from the private-sector to state ownership or control. While the state may not choose to exercise control over various decisions a company makes the entity that owns the stocks can control perceived valuations by being the market maker that sets prices. True price discovery and properly pricing assets are the bedrock of free markets. The feedback loops between asset prices and input signals are critical in determining value, this is especially true when we focus on assets such as stocks, bonds, currencies, or paper promises that carry no utility value and can perform no useful task.

The Federal Reserve was intended to act as the “lender of last resort” but as Nomi Prins says, “As if the Fed hasn’t done enough to destroy honest markets, now it plans to start buying individual corporate bonds. It’s just another step closer to the Fed deciding the winners and losers in the market.” This has forced even the most bearish of us to finally concede that, for whatever reason you want to claim, the Fed under the leadership of its Chairman J. Powell has crossed the Rubicon and the point of no return.

Crossing the Rubicon means the point of no return. This high-level idiom comes from an event in ancient Roman history. In 49 BC Julius Caesar’s army crossed the Rubicon River, this was forbidden. It was an event from which he knew there is no way back. When Julius Caesar crossed the Rubicon, he started a five-year Roman civil war. At the war’s end, Julius Caesar was declared dictator for life. Putting the Fed’s recent actions into context and what it means for investors, the miserable policies adopted by the Fed, which has allowed other central banks to do the same, has created a new environment redefining risk and value. This highlights the fact there is nothing normal about what is happening, this is far from normal.

Savers, investors, and a new wave of speculators as a result of Central banks expanding balance sheets while reducing interest rates are now embracing any investment that promises yield. This combined with rising government spending has disaster written all over it, not just in America but across the globe. This and a slew of other horrible moves have created a bubble in bond and equities. Only the claim that no inflation exists and this is the only way to halt deflation allows this reckless policy to continue, however, when people realize the fallacy of this assertion it will be to late too stop the economic and financial carnage it will create.

The Shrinking Private Sector

Unfortunately, the money flowing from the Government-Financial complex is not reaching the parts of the economy where it is most needed. For a small business, the economy remains a disaster. Investors should remember the true unemployment picture has yet to reveal itself. As the government grew larger it seems to have become oblivious to the importance and fragility of many small businesses or how much it cost a community when they close. Small business has been the big loser over the last several months and hundreds of thousands will soon have to close. With so many tenants looking at foregoing rent small landlords that don’t have deep pockets also face huge problems.

The idea we are about to experience a “V-shaped recovery” is rubbish. Many people are afraid to fly, travel, or eat out at a restaurant. The government’s solution to give the masses just enough to silence their outrage is a bizarre extension of crony capitalism. It feeds large businesses with access to cheap capital are the winners and the big losers are the middle-class, small businesses, and social mobility. All those people that want a higher minimum wage can forget that ever happening as tens of millions remain out of work. It is difficult to argue true price discovery exists and risk is not being discounted when prices fail to reflect unemployment at around 20% and ignore news of a sharp escalation in Korean tensions or the deadly clashes between Indian and Chinese border troops.

Bubbles always pop, this time is not different. Exacerbating the current situation, many of those invested in paper promises have become over-leveraged putting themselves at great risk if a sudden decline in the value of these assets occurs. The disconnect that has taken place between Wall Street and the economy is not logical. We are in uncharted waters and should consider the possibility the destruction of true price discovery will only add to the demise of fiat currencies across the world. I contend this will fuel the desire of people to once again hold tangible assets rather than trusting the promises now being made. To say things are messed up is an understatement.

via ZeroHedge News https://ift.tt/2NhL3IC Tyler Durden