Here’s Who Made A Real Killing On Wirecard (Hint: Not The Stock Shorts)

Tyler Durden

Fri, 06/19/2020 – 14:50

With Wirecard emerging as one of the biggest corporate frauds of the post-crisis era (at least until the emperor of a certain other company is finally exposed as naked and stoned), one which has terminally crushed the reputation of Germany’s regulator Bafin – which instead of exposing the biggest German fraud ever was targeting short sellers and journalists and banning shorting – it has been quite a payday for the shorts such as Armin S, and numerous others who patiently waited until the hammer dropped.

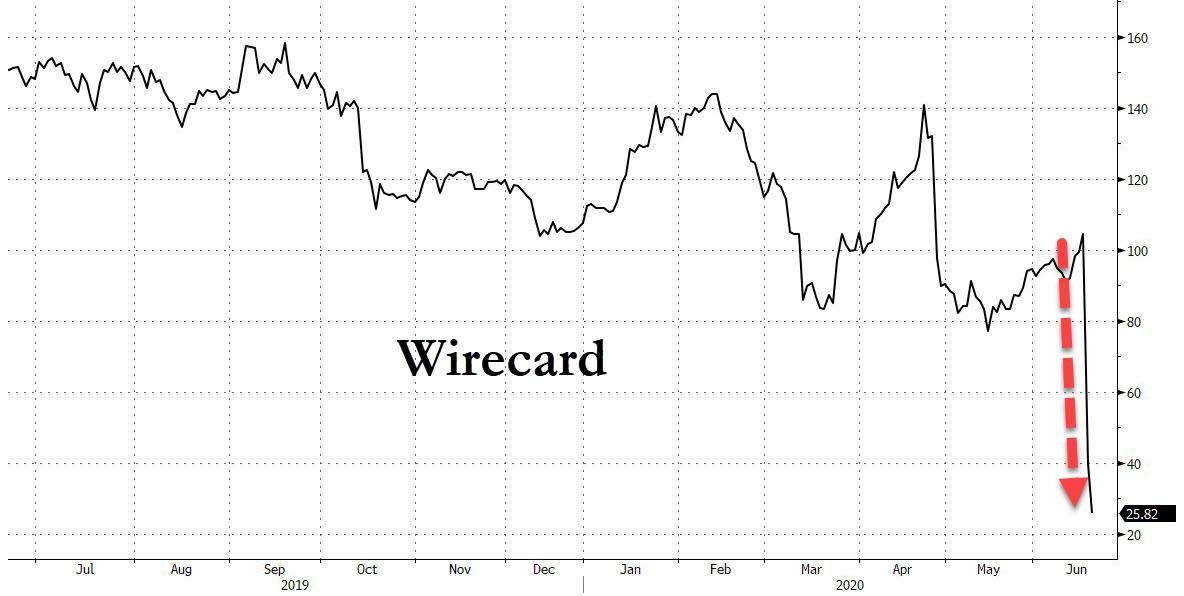

Indeed, with the stock plunging more than 80% since news of the missing billions broke, the result has been a $2.2 billion payday for shorts.

Yet while the shorts most certainly deserve to be congratulated for their patience, the victory did not come without pain, and in addition to being targeted by a hostile regulator, the stock recently surged more than 60% since the March lows, likely forcing many bears to cover their positions at sizable losses.

So who is the biggest winner here?

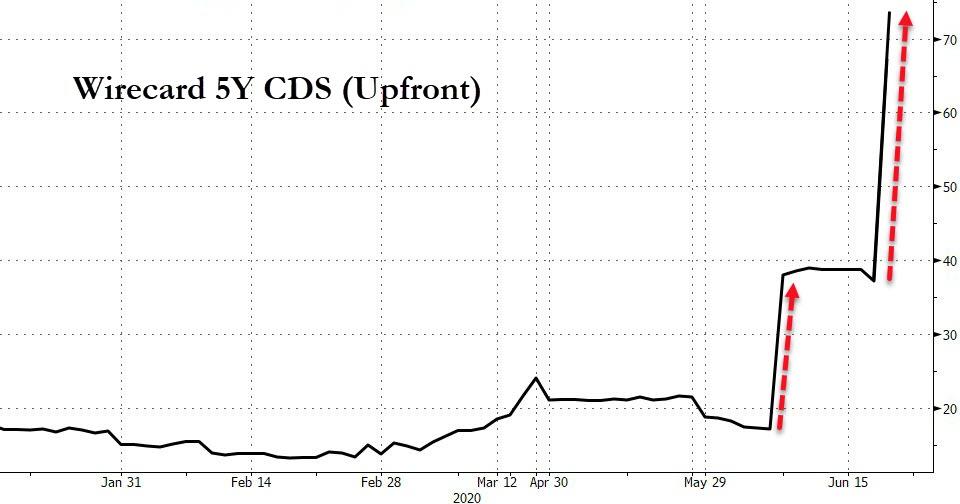

Well it is the shorts, but not in the stock – which as a reminder can only generate profits that are capped at 100% assuming the stock plummets to zero – but in the bonds, in the form of long CDS position, where the upside was virtually unlimited.

As the chart below shows, Wirecard’s 5Y CDS has blown out from a spread of just over 500bps (or 18 points up) two weeks ago to 8600bps, or roughly 73 points upfront, a gain.

This means that the biggest winners in this case were the CDS longs (i.e., bond shorts), whose only limitation was the initially available capital (the theta, or coupon, is tiny by comparison).

Which begs the question: are we about to witness the second coming of CDS, whose very use by its reflexive definition, forces markets to reasses the fair value of credits… and will the ECB (or Fed) be forced to go company by company and bail them out by purchasing their bonds out of bankruptcy? We will find out soon.

Meanwhile, for those who have yet to catch up on the Wirecard saga, here is a good recap courtesy of Donut Shorts:

2/

Winners: @FD Dan McCrum has literally been on this story for years, and became the subject of a criminal investigation in Germany as a result of exposing the truth of Wirecard. He’s an exemplar of investigative journalism.— Donut Shorts (@DonutShorts) June 18, 2020

4/

Winners con’t:@RodboydILM for being very early on this story and being right. Roddy is also an exemplar of investigative journalism and his org https://t.co/Nd4WxSic7Q is worthy of your support if you care about the truth in financial markets

— Donut Shorts (@DonutShorts) June 18, 2020

6/

Winners con’t:

The shorts that were active in exposing this fraud include@AIMhonesty @alderlaneeggs @lordshipstrade @QCMfunds @WallStCynic

Apologies to those I have missed

— Donut Shorts (@DonutShorts) June 18, 2020

8/

Losers con’t:Not only did BaFin fail to detect this massive, obvious fraud, it actively did $WDI ’s bidding by instigating a criminal investigation against $WD , the @FT (a first by a regulator AFAIK) and short sellers.

It also instituted a short selling ban to prop up $WDI

— Donut Shorts (@DonutShorts) June 18, 2020

10/

Losers con’t:DAX/Deutsche Borse – For putting this POS in the premier German equity index to start with, for keeping it there as the fraud was unearthed, and for not delisting it long ago.

— Donut Shorts (@DonutShorts) June 18, 2020

12/

Losers con’tWhen the $WDI scandal is viewed in the context of many German banking frauds & the VW stock rigging by Porsche, investors can rightly ask whether German financial regulation is anything but a fig leaf. @muddywatersre phrase ‘Moscow on the Main’ is quite apt.

— Donut Shorts (@DonutShorts) June 18, 2020

14/

Losers con’t:The German press – With a few exceptions, the German press was happy to parrot the official line of $WDI and BaFin rather than taking the mounting evidence at face value. Imagine printing this on BaFin’s short ban without a hint of skepticism (Handelsblatt) pic.twitter.com/5DVWCx4zAK

— Donut Shorts (@DonutShorts) June 18, 2020

16/

Losers con’t:$WDI played this game too. It is well past time for these ‘security’ firms to be exposed and regulated and for the lawyers (looking at you David Boies) and the corporations that hire them to be held accountable.

— Donut Shorts (@DonutShorts) June 18, 2020

18/

Losers con’t:

Similar to the black hat security firms, this rock needs to be turned over to expose the parties who engage in this for a living and the almost certain violation of securities laws they are complicit in.

— Donut Shorts (@DonutShorts) June 18, 2020

20/

In summary, the $WDI fraud has all the features of today’s highly evolved art of corporate financial fraud. Its scale, duration, and brazenness (faked cash!) highlight just how free a hand financial fraudsters enjoy to ply their trade.

— Donut Shorts (@DonutShorts) June 18, 2020

22/If there are any people in these areas that retain a conscience (debatable, but one can hope), this should be a come-to-Jesus moment to assess what purpose they serve

If you are still baffled about the rise of populism vs financial interests, this should be your wake-up call

— Donut Shorts (@DonutShorts) June 18, 2020

24/

What will be learned will be revelatory, IMO, and could help reset the rules so that truth once again is a touchstone in financial markets, as opposed to the rampant fake narratives, bogus financials and see no evil oversight that pervades corporate disclosure today.— Donut Shorts (@DonutShorts) June 18, 2020

26/

You can add Herbert Smith Freehills to the list of enablers.

Consider this list a work in progress.https://t.co/nHq8xqrZjP

— Donut Shorts (@DonutShorts) June 18, 2020

via ZeroHedge News https://ift.tt/2YPEyCq Tyler Durden