Blain’s Morning Porridge, submitted by Bill Blain of Shard Capital

“All political lives end in failure…”

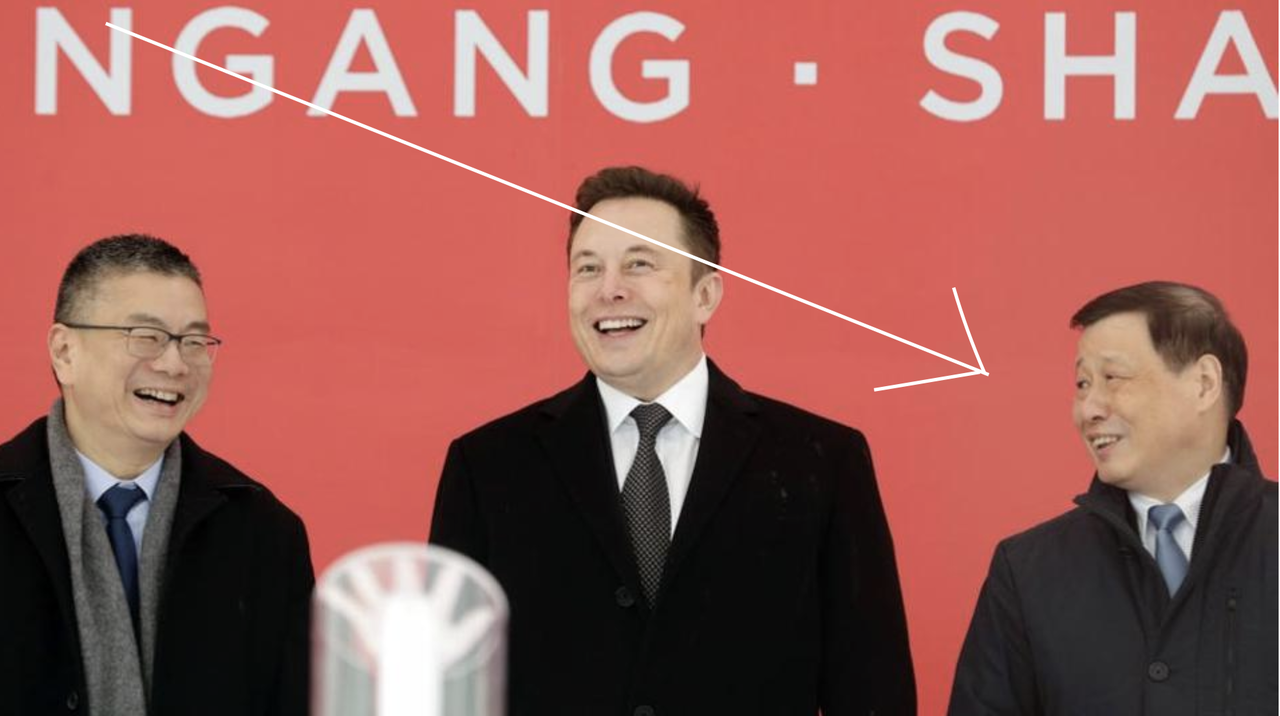

What a week: Covid19 virus out of control? Fears of global recession? Tesla doing a $2 bln rights issues (which I can’t fault: impeccable timing and signposted clearly by Mush when he said 2 weeks ago the company did not need money and would definitely not raise any)? Yield curve inversions? Greek bonds tumbling below 1% as a Europe stumbles into another slowdown? Nothing to worry about.. the Chinese have the virus in hand, (really?) and Central Banks are poised and ready to save us all.

Lord have mercy on us all…..

For years now, The Morning Porridge has been arguing one of the clearest dangers to markets is the Atrophy of Politics. Quality has fallen. Markets tend to panic about the left – fearing muddled political lightweights like Jeremy Corbyn might just get elected and destroy Western Civilisation over an afternoon. Not going to happen. Recent events in Ireland aside, the risk of populist political shifts to the Right are more dangerous, fuelled by protectionism, isolationism and political vanity.

If there is one article you should probably read this weekend it’s this from the FT – The revenge of the middle-class anti-elitist. If you don’t recognise yourself or someone close – then get out from under your stone and spend some time among your fellow humans and listen to what peeves them. Economics and politics are about the behaviour of crowds.

The political landscape sets the tone for growth and the mood driving consumption. If the political classes deliver and please their voter, then economies are likely to thrive – it’s a circular argument, a virtuous circle. The problem is – politics have never looked so broken and dismal. The political picture is bleak with political solids are hitting the fan everywhere from Aberdeen to Zetland. The political mess is likely to impact market sentiment.

Here at the Morning Porridge, my job is predict just how the current political disappointments are likely to morph into market moves. Tricky. But let me throw some risks at you –

The UK

After my note about Javid’s dismissal and Rishi Sunak’s appointment, I’m not best popular with the political classes here in the UK. I was bluntly told Sunak is there to deliver what he’s told to deliver. Yep, I get that. Nobody else seems concerned at his lack of obvious political background, his sudden explosion onto the political scene, or who and how wealthy his father-in-law is. Maybe I am just an angry anti-elitist?

Javid was forced out because he refused to accept the Treasury being run by Dominic Cummings from Boris’ office. Under the new Boris “Presidential” model, government has shifted British Politics from Cabinet to direct rule through Boris and Dom. It’s a path unlikely to appeal to authority hungry MPs, overturns the traditional check and balances through the Civil Service, and breaks the cabinet lines of accountability.

It does mean Dom and Bor can flood the papers with headlines about tax cuts and spending plans, and glossy photo spreads about our new high spending Chancellor this morning, but a cabinet full of yes-men rubber stamping the decisions from inside No 10 is not particularly appealing. Creative tension is a good thing. I would not be surprised if it doesn’t provoke considerable resentment within the Conservative parliamentary party – especially when it starts going wrong.

And go wrong it will.

Dom and Bor are dedicating their presidency to Getting Things Done. What happens when they don’t happen and fail to deliver? When negotiations with Europe stumble, when projects are delayed, when departments fail to deliver? Accountability and the buck stops with Boris.

Personally, I like the idea of shaking up the way things are done in Westminster. But, there are limits…

Risk Prediction: Political instability in the UK is not over. The parliamentary majority has been squandered to demonstrate control. Last year we saw the Tories self-destruct as the May government collapsed. Political infighting is likely to continue and escalate, unbalancing hopes for a Brexit Bounce, and hold back the UK as it tries to re-enter the global economy as a free-player. The Nationalists face their own legal problems in Scotland, but will see Bor/Dom distractions as political opportunity. There are elevated risks for gilts and sterling.

The US

Surely there are no political threats in the US? Markets are currently utterly unconcerned about the 2020 election. The simple and obvious assumption is Trump is going to win because the Democrats have already so conclusively beaten themselves.

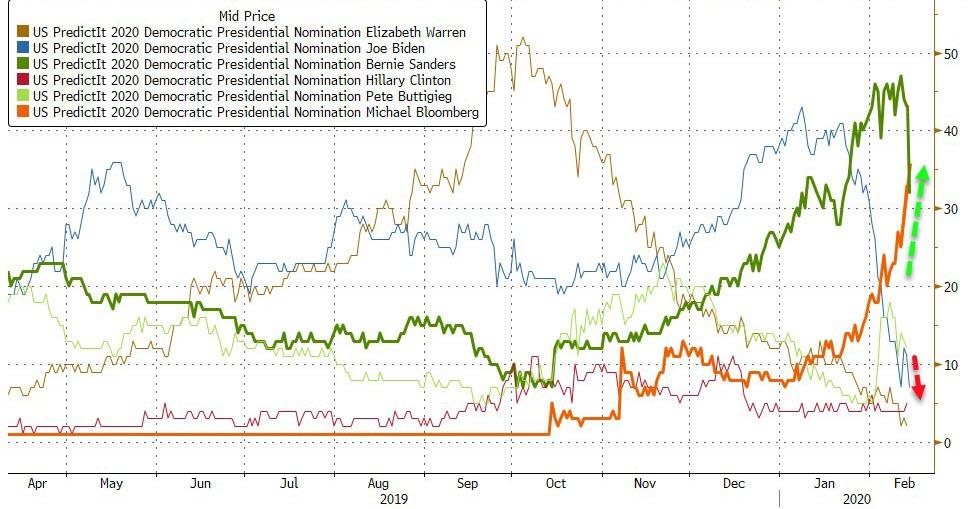

Bernie Sanders might appeal to a limited number of Wobblies in the North East. Biden looks a lost cause – tired and irrelevant before the thing even started. Elizabeth Warren wasn’t near the top 3 in the New Hampshire primary. Who are the other two? Paul Buttigieg and Amy Klobuchar? National poling suggests, despite wall-to-wall advertising, Bloomberg is even lower on the voter preference scale.

And after the pointless distraction that was the impeachment trial, the Democrats seem to have thrown away their prime advantage – just how polarising and detached from consensus Trump has become. Trump can say whateva he wants about criminal trials, the DoJ and act more and more like a Roman Emperor.

The market – even though no one will admit it – likes Trump. He makes participants rich. He may say outrageous things, lacks self-control and have the moral compass of a jack-ass, but he delivers the right noises to line market pockets. Tax cuts have fuelled prices higher. His harangue of the Fed to cut rates and boost markets hits the right chord with investors who want to see prices go up forever. Who cares that his trade wars have pushed back growth by years – it’s the fact China played to him that counts.

More to the point, Trump is lucky – he got lucky on Iraq. His approval rating soared after the impeachment trial.

Which is where this gets interesting. What are the chances the Democrats stop being idiots, stop trying to replicate the recent stunning success of the UK Labour party by not adopting unelectable candidates and non-sensical policies, and actually get back on track to fight the election to win? That would require a centrist moderate candidate who is unlikely to do anything radical to upset the current market, appeal to voters as a good compromise, and show willing to unite the country… does such a woman exist? A decent compromise Democrat could yet over-turn expectations of Trump infinity.

Risk Prediction: A turnaround in Democrat prospects seems unlikely, it definitely looks a long shot, but it may yet happen. Trump may push too far, or a serious contender may arrive, or more likely be crafted – which I why I’m reading up on Buttigieg and Klobuchar. If the Election looks to be a contest – it’s likely to get interesting in market terms.

Yoorp

The biggest danger to Europe is a distracted Germany – which is exactly what we have as the Merkel wends into political senility. A looming recession, her succession planning tumbling into irrelevance, and massive problems likely within the EU underlie the problems. Germany threatens to branch right and left, leaving a vacuum just as Europe gets more difficult. Yet another recession in Italy, pressures in Spain, France continuing to struggle with domestic strikes and budget issues, and the entire Northern, Germanic part of Europe begining to see the light as to why the UK chose to exit Europe.

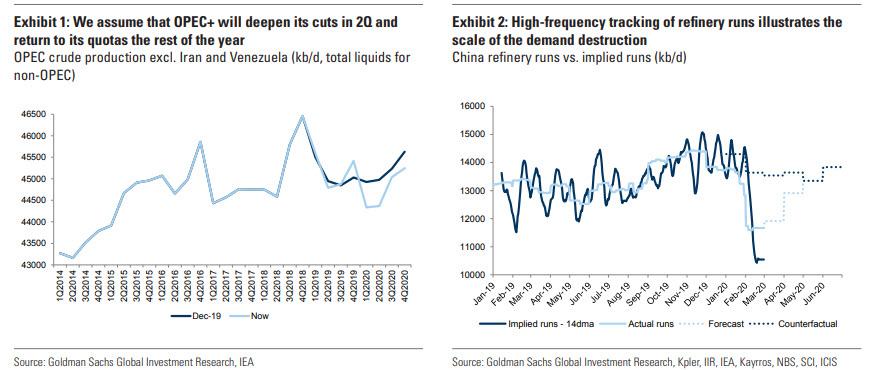

The big questions about fiscal policy, banking union, and who will make up UK budget contributions, are tough to answer when Germany and others are increasingly distracted. How will Europe cope with a Covid19 generated wider recession?

Risk Prediction: Europe is always a fine balance politically – it’s been held together because the ECB was able to step in and sort it. However, the credibility is stretching thinner and thinner – and will be stressed if we see another summer of immigrants triggering right-wing issues, a rejection of Lagarde’s efforts to politicise the ECB, and insularity from Germany. The Euro could weaken further and Europe’s economy is still going nowhere.

Five Things to Read Today

BBerg – UK Political Shock Opens the Door to Trump-Style Stimulus

BBerg – German GDP Report Shows Economy Stagnating

FT – Barr says Trump Tweets make it impossible to do his job

FT – Global Shipping market reels from coronavirus

WSJ – Tesla Raising More than $2bln, Discloses New SEC inquiry

Have a great weekend!

Bill Blain

Shard Capital