Overnight Risk Rally Fizzles After Iran Vows “Historic Nightmare” Retaliation

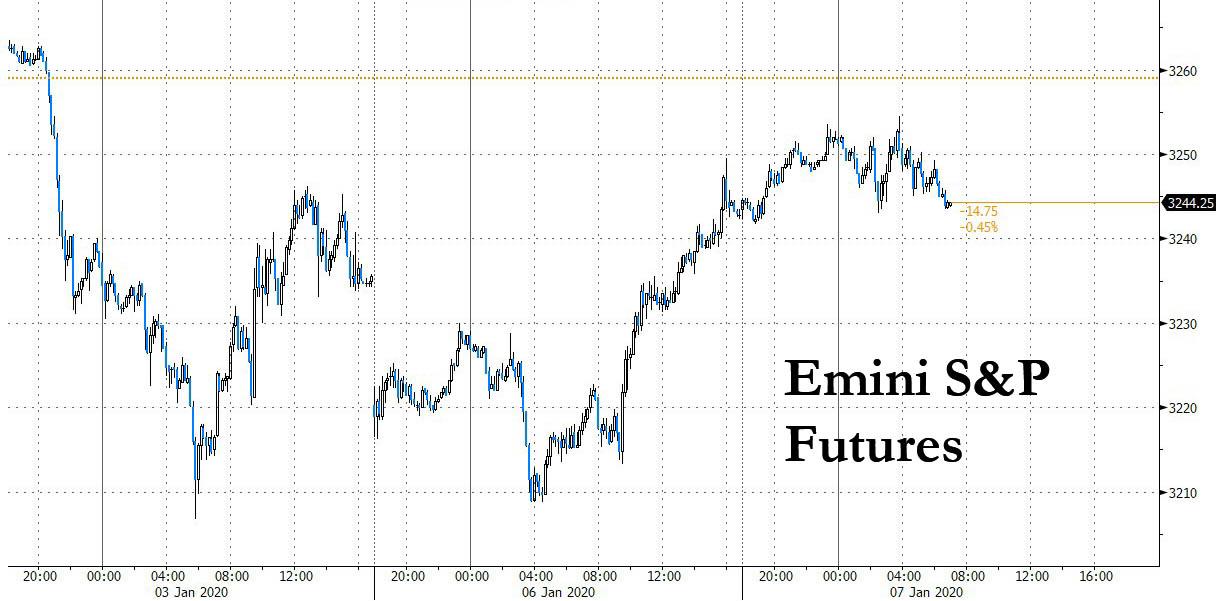

After putting fears about World War III aside on Monday, when stocks opened sharply lower only to close at session highs and the S&P on the verge of a new record, overnight concerns about the impending middle east conflict returned when shortly after 2am ET, Ali Shamkhani, the head of Iran’s national security council, roiled markets when he said that Iran is evaluating 13 possible retaliations on the U.S. for killing a Solemani, adding that “even if the weakest of these scenarios gains a consensus, its implementation can be a historic nightmare for the Americans.” The menacing comments from Shamkhani briefly roiled markets, and established a ceiling for the Emini.

Following the Iranian threat, S&P 500 futures gave up all of the morning’s advance before steadying. Despite the wobble in S&P futures, world shares steadied in delayed response to Monday’s US rally, while oil and gold pulled back from multi-month/year highs on Tuesday after dramatic post-new year moves, as investors judged that prospects of an all-out conflict between the United States and Iran had eased.

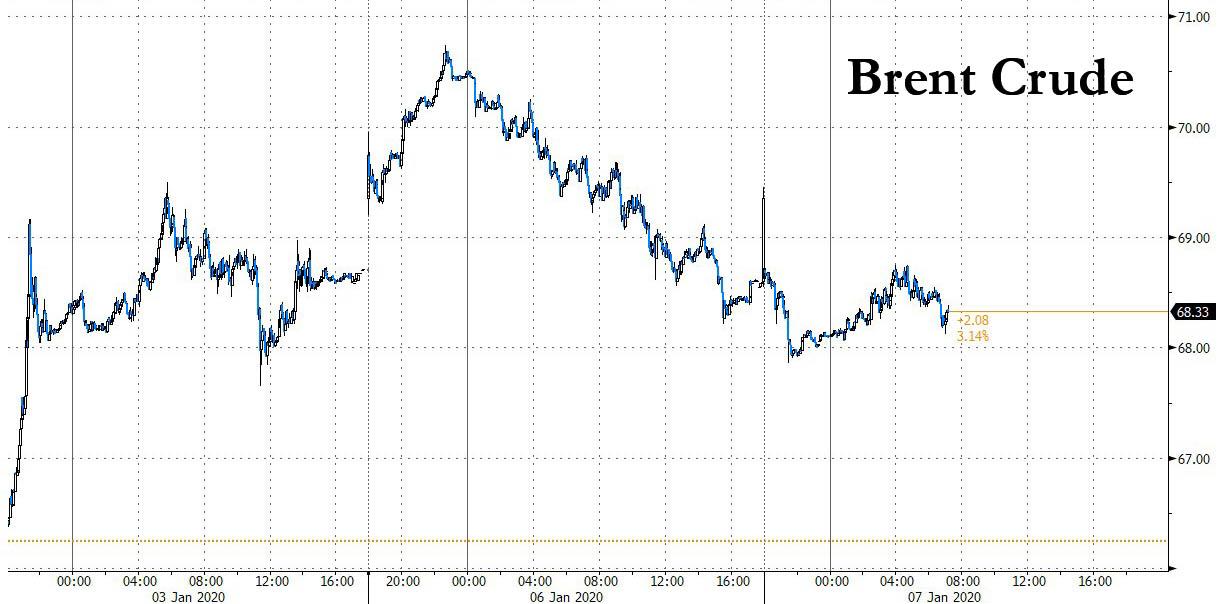

After a strong rally, oil gave back much of its gains amid signs that Iran would be unlikely to strike against the United States in a way that would disrupt supplies. Brent crude futures fell 44 cents to $68.48 a barrel, having been as high as $70.74 on Monday, while U.S. crude dropped 34 cents to $62.93.

European equities meanwhile rose as much as 0.7%, tracking similar gains in Asia, before cutting gains in half. Technology stocks were among the top picks in Europe, mirroring trends in the U.S. overnight.

Earlier in the session, MSCI’s index of Asia-Pacific shares ex-Japan recouped almost all of Monday’s losses, led by health care and consumer staples, and rebounding from a drop on Monday amid U.S.-Iran tensions. Investor concerns over the Middle East flare-up have begun to ease, even as the U.S. ordered additional forces into the region, and Iran said it is assessing 13 scenarios to respond to the American killing of its top general, Qassem Soleimani. Most markets in the region were up, with Japan’s Topix index gaining the most since Nov. 5. Kweichow Moutai Co. and Industrial and Commercial Bank of China Ltd. led China’s Shanghai Composite Index higher, while Reliance Industries Ltd. and HDFC Bank Ltd. drove gains in India’s S&P BSE Sensex Index.

Meanwhile emerging markets, which had been hit hardest by spiking oil prices, bounced back on Tuesday, with stocks up 0.4%. That left the MSCI world equity index, which tracks shares in 49 countries, just 0.5% from a record high.

“Geopolitical risk has always felt much worse for markets in the heat of the moment than it does in hindsight, but it’s always possible that the next one will bring us into a different era,” Deutsche Bank strategist Jim Reid said (see more below). “Markets got a lift from the lack of follow-through (after the air strike) as yesterday progressed, and by the end of the session had actually staged a reasonable recovery,” Reid added.

With risky assets starting 2020 on the back foot as Tehran and Washington traded threats after a U.S. air strike on Baghdad airport killed a top Iranian commander, on Monday the mood began to calm, helping U.S. shares recover ground. The Dow ended 0.24% higher, the S&P 500 0.35% and the Nasdaq 0.56%.

Marija Veitmane, a senior strategist at State Street, said she sticks to her expectation of a slight improvement in economic and earnings outlook: “The world is well stocked with oil and can stomach short disruptions, while large U.S. shale production should soften its impact,” said Veitmane, brushing aside worries that an oil price spike would dent global growth.

“There are a lot of developments in play but none of them are really that major,” John Normand, JPMorgan’s head of cross-asset fundamental strategy, told Bloomberg TV. “There are a lot of headlines that seem alarming at first blush and we dig a bit deeper, to me none of these are big derailers for the move up in risky markets this year.”

He was, of course, referring to the ongoing QE4 move in the Fed’s balance sheet, which continues to grow at a pace of about $100 billion per month.

As risk was bid, safety plays were out of favor, with gold retreating to $1,567 an ounce, after scaling a near seven-year peak overnight. At the same time, eurozone government bond yields edged up from around three-week lows. German bunds were little changed while U.K. gilts sold off; the pound gained versus the euro as the U.K. raised its debt-sales target for financial year 2019-2020, spurring bets the government is planning an expansionary new budget that could fuel inflation

The sense of calm also saw the yen lose much of its safe-haven gains, while the dollar advanced versus all G-10 peers; the euro declined even as the region’s retail sales picked up more than forecast in November; separate data showed euro-area inflation accelerated in December in line with the median economist forecast, while core inflation remained unchanged.

The Australian dollar led declines among G-10 currencies, dropping as much as 0.9% on geopolitics. Australia’s currency had weakened earlier after a decline in job advertisements and as the bush- fire crisis boosted the odds for a central bank interest-rate cut.

Curiously, overnight Bitcoin broke above $8,000 overnight and is up 13% since the U.S. drone attack in Iraq last week. Though it is not seen as a safe-haven asset given its wild swings, the surge has coincided with the equities sell off.

Looking at the day ahead now, the highlights in terms of data come in the US with the December ISM non-manufacturing likely to be of particular focus. We’ll also get the November trade balance, November factory, durable and capital goods orders in the US. This morning in Europe we got the preliminary December CPI report for the Euro Area and Italy along with November retail sales data for the Euro Area. Also as mentioned the UK Parliament returns from recess, with MPs due to debate the Brexit Withdrawal Agreement Bill.

Market Snapshot

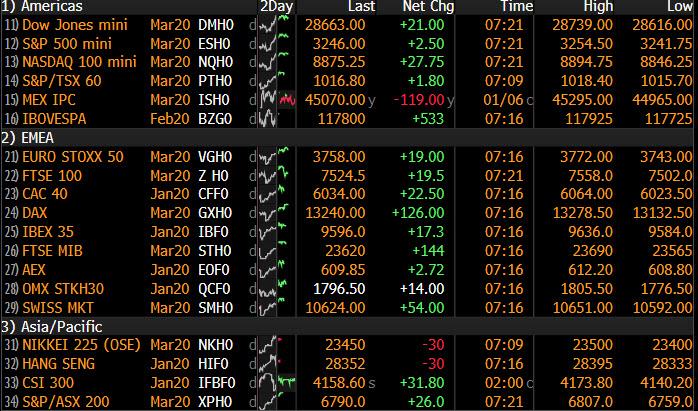

- S&P 500 futures up 0.2% to 3,250.25

- STOXX Europe 600 up 0.6% to 419.16

- MXAP up 0.9% to 171.33

- MXAPJ up 0.6% to 554.78

- Nikkei up 1.6% to 23,575.72

- Topix up 1.6% to 1,725.05

- Hang Seng Index up 0.3% to 28,322.06

- Shanghai Composite up 0.7% to 3,104.80

- Sensex up 0.4% to 40,830.27

- Australia S&P/ASX 200 up 1.4% to 6,826.44

- Kospi up 1% to 2,175.54

- German 10Y yield rose 1.1 bps to -0.276%

- Euro down 0.1% to $1.1183

- Brent Futures down 0.5% to $68.60/bbl

- Italian 10Y yield rose 1.4 bps to 1.191%

- Spanish 10Y yield rose 1.5 bps to 0.409%

- Brent Futures down 0.5% to $68.60/bbl

- Gold spot down 0.1% to $1,563.51

- U.S. Dollar Index up 0.03% to 96.70

Top Overnight News from Bloomberg

- Iran is assessing 13 scenarios to respond to the U.S. killing of Qassem Soleimani, the influential general in charge of foreign operations, and even the weakest of those options would be a “historic nightmare” for the U.S., Ali Shamkhani, the head of Iran’s national security council, was quoted as saying by Iran’s semi-official Fars news agency

- U.K. Chancellor of the Exchequer Sajid Javid promised to unleash “a decade of renewal” when he outlines his budget on March 11 as he seeks to ready the U.K. for its departure from the European Union

- Spain’s Socialist leader Pedro Sanchez looks set to secure the narrowest of victories in parliament on Tuesday to take power in Spain with the backing of the anti-austerity party Podemos.

- Brevan Howard Asset Management’s flagship hedge fund returned 8.4% last year, building on its 2018 gain and helping to pause a bleeding of assets

Asian equities posted gains across the board following a less pronounced but positive handover from Wall Street in which the major indices experienced a modest recovery from the prior session’s losses. ASX 200 (+1.4%) was propped up by its largest-weighed financials as yields recouped from recent downside. Nikkei 225 (+1.6%) retraced some of the prior session’s hefty losses whilst welcoming recent favourable currency moves. Elsewhere, Hang Seng (+0.4%) and Shanghai Comp (+0.7%) conformed to the overall risk appetite – and with the former supported by gains in large-cap financial stocks. China Vice Agricultural Minister said China will not increase annual grain import quotas to accommodate higher US farm purchases. This refutes rumours that China may raise or scrap its corn import quota following a phase one trade deal with the US

Top Asian News

- China Targets Internet Giants in Antitrust Law Overhaul

- China’s Next Crisis Brews in Taiwan’s Upcoming Election

- Disney Faces Pressure to Help Ease Hong Kong’s Housing Crisis

European bourses are firmer this morning, in a turn-around from yesterday’s dismal start to the week (Euro Stoxx 50 +0.5%). Notably, the Dax, which gave up the 13000 handle yesterday, has stayed well-clear of this mark to the downside; with the bourse having printed a cash high of 13266 and a future peak at 13260. Similarly, in contrast to yesterday, and indeed Friday, sectors are all firmly in positive territory with exception of energy names, where yesterday’s outperformers such as Shell (-0.8%) and BP (-0.7%) are under pressure; although, this is to the benefit of airlines such as Air France (+1.5%) and eastJet (+1.4%). Additionally, this downside in the aforementioned energy names is weighing on the FTSE 100 (+0.1%) this morning; with the bourse relatively flat at present. Other notable movers this morning include, Morrisons (+2.5%) after issuing their Christmas sales update and noting that PBT and exceptionals is likely to be within analyst forecasts for FY19/20. At the other end of the Stoxx spectrum are Standard Life Aberdeen and Man Group with both weighed on by broker moves.

Top European News

- Premier Oil to Buy North Sea Assets From BP for $625 Million

- Vestas to Invest in 5,000 New Vehicles in Massive E-Car Push

- U.K. Soccer Team Sunderland Kicks Off Sale After Fan Backlash

- Aston Martin Slumps After ‘Disappointing’ Year of Profit Decline

In FX, already feeling the adverse effects of natural disaster, anecdotal data overnight revealed a sharp decline in the number of Australian jobs advertised on the web and in newspapers to highlight the economic impact of the raging bushfires, with dovish RBA implications. Hence, the Aussie has weakened appreciably across the board, with Aud/Usd slipping through 0.6900 and the 200 DMA (0.6897), while Aud/Nzd has also breached a key chart level at 1.0367 (18 December 2019 low) as the Kiwi contains contagious losses against its US counterpart within 0.6642-80 parameters.

- USD – Aside from gleaning traction from the underperformance in Antipodean peers, the Greenback is consolidating off recent lows vs major rivals on a combination of technical and other factors awaiting further developments on the geopolitical front (namely Iran’s response to the US airstrike targeting and killing a top IRGC leader). The DXY has pared declines towards 96.500 and appears more settled in a 96.620-835 range ahead of the upcoming services ISM that could be pivotal for near term Fed policy given the disappointing manufacturing survey and expectations for a firmer headline than previous.

- CHF/EUR/CAD/JPY/GBP – As noted above, all weaker against the Buck with the Franc back below 0.9700 and not really inflated by Swiss CPI returning to positive territory in y/y terms, Euro fading ahead of 1.1200 and Loonie losing momentum alongside oil prices in advance of 1.2950 in the run up to Canadian trade data due alongside the US balance for direct comparison. Meanwhile, having met stiff resistance at 108.00 on several occasions of late the Yen is now deriving support from offers said to be capping the headline pair at 108.50, but the Pound has waned markedly after a stop driven rally in Cable on a break of 1.3180 (just above Monday’s peak) to 1.3200+ that pushed Eur/Gbp back under 0.8500 with more gusto and just under 0.8470 before the cross retraced some lost ground.

- SEK – Some respite for the Swedish Crown via a less contractionary services PMI, but Eur/Sek is still elevated above the 10.5000 level in contrast to Eur/Nok holding shy of 9.8500.

- EM – Although the Dollar has made advances elsewhere, Yuan strength off a marginally firmer PBoC midpoint fix has bucked the general trend, as Usd/Cnh eases back towards mid-December lows not far from 6.9200 and a series of key chart supports closer to 6.9000 amidst reports from the Chinese side alluding to the signing of Phase 1 in the not too distant future.

In commodities, the crude complex has dropped into negative territory, with WTI and Brent down by around USD 0.30/bbl at present and approximately USD 1.0/bbl at worst in overnight APAC trade. Newsflow from the Middle-East continues to emerge with the latest pertinent reports noting that Iran is, according to a Fars report, considering 13-scenarios as retaliation against the US. Additionally, a Senior Iranian Official has stated that Iran is prepared to come back to full compliance with the Nuclear Deal. Note, Iran has following the assassination of Soleimani made clear that they are to conduct nuclear related operations on their own accord, disregarding the Nuclear Deal; as such, these remarks potentially indicate a pivot in Iran’s stance against the US and Western powers. However, its worth highlighting that the conditions around their potential return to the deal are not known and previously Iran has indicated sanction relief is a pre-requisite for this type of action. Looking ahead, today sees the funeral of Soleimani and as such participants will now be more actively anticipating/awaiting a response from Iran as the initial mourning period comes to an end. Elsewhere, turning to metals, spot gold is back in positive territory after dipping overnight to a low of USD 1555/oz, prices are now comfortably back above the USD 1560/oz mark; but remain well off yesterday’s multi-year high at USD 1582/oz. Separately, iron ore prices are bolstered following on from China’s main steel making city of Tangshan lifted its level 2 smog alert which was implemented late last week.

US Event Calendar

- 8:30am: Trade Balance, est. $43.7b deficit, prior $47.2b deficit

- 10am: ISM Non-Manufacturing Index, est. 54.5, prior 53.9

- 10am: Factory Orders, est. -0.8%, prior 0.3%

- Durable Goods Orders, est. -2.0%, prior -2.0%

- Factory Orders Ex Trans, prior 0.2%

- Durables Ex Transportation, prior 0.0%

- Cap Goods Orders Nondef Ex Air, prior 0.1%

- Cap Goods Ship Nondef Ex Air, prior -0.3%

DB’s Jim Reid concludes the overnight wrap

I spent the evening last night taking down Xmas decorations before more bad luck could descend on my flu and bed ridden family. Normally my wife won’t let me anywhere near the decorations as when she last did, 11 months later she found them in such a mess the following Xmas that it took her as long to sort out/untangle as it did to put them up. I’ll let you know how she reacts on December 1st 2020 when the boxes come back down from the attic.

The first full day back for many in the market was busy spent digesting the fallout from the US/Iran tensions. In fairness there wasn’t much new to add from the weekend headlines so for now we’re still in a state of flux as to which way we go next. After the drone attacks on Saudi oil refineries in September there were expectations that the impact would linger for weeks or months, but in reality the market largely moved on within 24-48 hours. This does feel quite different though given the scale of the action and the war of words since. However it would be impressive if market professionals had a clear view on how this will all pan out. If you do though please get in touch and let me know. Throughout my career geo-political risk has always felt much worse for markets in the heat of the moment than it does in hindsight but it’s always possible that the next one will bring us into a different era.

Our oil analyst Michael Hsueh last night suggested that oil infrastructure and shipping is better protected now than it was last year and that the risks of retaliation are perhaps higher away from oil now. This could include cyber warfare. As such he doesn’t think the higher risk premium in oil will last for a prolonged period. See his note here for more.

The good news for now though is that markets got a lift from the lack of follow through as yesterday progressed and by the end of the session had actually staged a reasonable recovery from the lows. In fact the turnaround was so much so that by the close of trade yesterday, the S&P 500 was up +0.35%, recovering from futures being down -0.83% early in the European session. The steady rally puts the index back slightly higher for 2020 now. The NASDAQ also recovered to close +0.56%, and in Europe the STOXX 600 pared a drop of as much as -1.36% to close down ‘just’ -0.41%. Meanwhile oil faded from the highs with Brent crude now trading back below $70/bbl this morning at $68.14. It did touch a high of $70.74 yesterday having closed on Friday at $68.60 and at around $66 on NYE before the strike. For context the last time it closed above $70 was back in May so we haven’t managed that yet in this episode.

Looking at other assets, the move towards safe havens abated somewhat yesterday. The Japanese yen was actually the worst-performing G10 currency yesterday, having been the best-performing on Friday, while gold faded back to close up +0.87%, though this was still its highest level since April 2013. Over in fixed income, 10y Treasuries ended the session +2.1bps, in spite of the fall in yields earlier in the session, while the 2s10s curve saw a slight steepening of +0.3bps. In Europe, gilts underperformed thanks in part to stronger than expected PMI data from the UK (more on that below), ending +3.0bps, while 10yr bund yields ended the session unchanged.

The big event today is the services ISM in the US which will give us hints as to how the US economy closed last year.

Overnight Bloomberg has reported that the US Vice President Mike Pence will deliver an address on the Trump administration’s Iran policy next Monday. Elsewhere, the US denied media reports which circulated a letter suggesting that it had agreed to pull its forces from Iraq. Army General Mark Milley, chairman of the Joint Chiefs of Staff, said that the letter was a draft and should never have been sent. Elsewhere the Washington Post reported that senior Trump administration officials have begun drafting sanctions against Iraq with one of the officials saying that the plan was to wait “at least a little while” on the sanctions decision in order to see whether Iraqi officials followed through on their threat to push U.S. troops out of the country.

This morning in Asia markets are following Wall Street’s lead. The Nikkei (+1.46%), Hang Seng (+0.45%), Shanghai Comp (+0.26%) and Kospi (+0.92%) are all up alongside most indices in the region. As for Fx, currencies of oil importing Asian countries like South Korea (+0.599%) and India (+0.301%) are advancing this morning on cooling oil prices while the Japanese yen is down -0.10%. Elsewhere, futures on the S&P 500 are up +0.24% while in commodities spot gold prices are down -0.23%. As for overnight data, Japan’s December services PMI came in at 49.4 (vs. the 50.6 flash) while the composite PMI stood at 48.6 (vs. 49.8 last month).

Back here in the UK, MPs will be returning to Parliament today, where they will resume debate on the Withdrawal Agreement Bill that implements the Brexit deal into UK law. The House of Commons is scheduled to debate the bill over the next 3 days, but with the government having an 80-seat majority in the Commons following last month’s election, there aren’t expected to be any issues over its passage. Elsewhere, the Telegraph reported overnight that the UK government will deliver its budget on March 11. Chancellor Sajid Javid’s first budget is likely to be expansionary as during the election campaign he promised to loosen constraints on borrowing to the tune of up to £20 bn a year for capital spending.

Away from the geopolitical newsflow there were a number of data points to digest yesterday. On the remaining PMIs, the final December services reading for the Euro Area was revised up 0.4pts to 52.8 – a four month high – leaving the composite at 50.9 and therefore the highest since August when it hit 51.9. That composite reading is consistent with growth of around +0.1% qoq in Q4. At a country level we saw a decent upward revision to Germany’s services PMI (52.9 from 52.0) while Italy (51.1 vs. 50.9 expected) and Spain (54.9 vs. 53.9 expected) both beat. For completeness, here in the UK the services PMI rose 0.7pts to 50.0 (vs. 49.1 expected) which helped to hold the composite at 49.3, with sterling up around +0.6% against the US dollar yesterday following the better-than-expected performance. So, overall a modest positive in Europe albeit with the data clearly overshadowed yesterday by the Middle East tensions.

Over in the US the services PMI was also revised up, by 0.6pts to 52.8 which is the highest reading since July. It’s worth noting that the employment component was little revised but nevertheless has nearly fully recovered the plunge that occurred this summer. Finally on the data, German retail sales in November rose by +2.1% (vs. +1.0% expected), while the previous month’s numbers were revised to show a smaller contraction than previously thought.

Looking at the day ahead now, the highlights in terms of data come in the US this afternoon, with the December ISM non-manufacturing likely to be of particular focus. We’ll also get the November trade balance, November factory, durable and capital goods orders in the US. This morning in Europe we’re due to get the preliminary December CPI report for the Euro Area and Italy along with November retail sales data for the Euro Area. Also as mentioned the UK Parliament returns from recess, with MPs due to debate the Brexit Withdrawal Agreement Bill.

Tyler Durden

Tue, 01/07/2020 – 07:53

via ZeroHedge News https://ift.tt/2SZTHj6 Tyler Durden