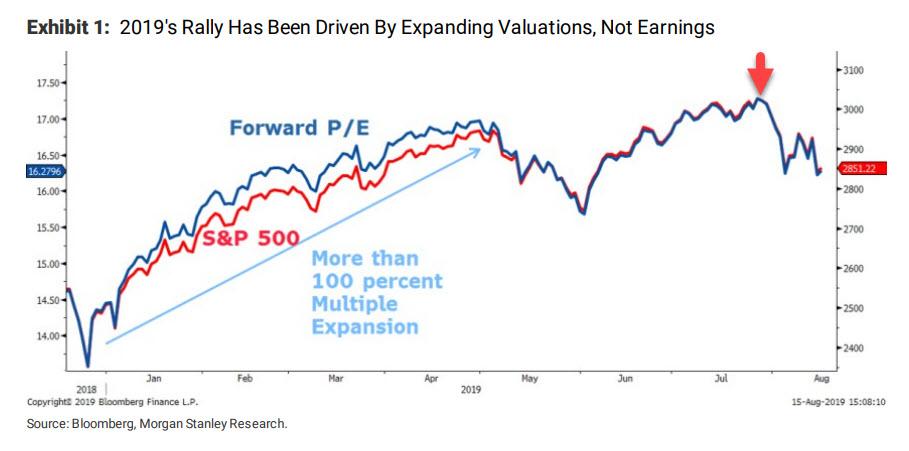

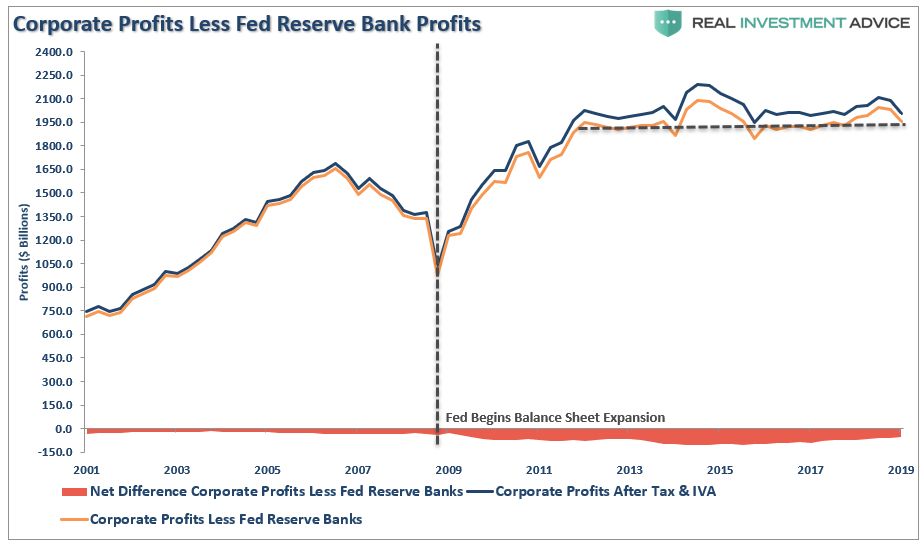

At the end of June we reported a startling finding by Goldman Sachs: while the S&P 500 rose 7% from its trough on June 3 through the end of the month, valuation expansion accounted for 90% of the rally in response to the Fed’s becoming “impatient” and signaling an easing cycle has begun.

What about for the full 2019? The answer comes today courtesy of Morgan Stanley’s bearish equity strategist, Michael Wilson who writes that since 2019 has been a game of deteriorating fundamentals versus a pivoting Fed and hope for a resolution to the US-China trade uncertainties, a whopping 94% of the year to date performance in the S&P 500 has been driven by rising valuations while the other 6 percent is due to rising forward 12 month EPS. Wilson, always the bearer of even worse news, then adds that based on his own EPS forecasts – which are far below those of consensus – “well over 100 percent of the move in the S&P 500 has come from rising valuations.”

This means that any stock market upside in 2019 is entirely due to the Fed’s dovish pivot coming at a time of declining earnings, and makes Trump’s bizarre feud with the Fed even more perplexing: had it not been for Powell, Trump would be nursing the first bear market in a decade right now.

…..The Fed Rate, over a fairly short period of time, should be reduced by at least 100 basis points, with perhaps some quantitative easing as well. If that happened, our Economy would be even better, and the World Economy would be greatly and quickly enhanced-good for everyone!

— Donald J. Trump (@realDonaldTrump) August 19, 2019

Of course, this being a Morgan Stanley report, there is a punchline, and it’s hardly bullish. In this case, it is that as Wilson writes, “the Fed meeting on July 31st was a sell the news event because it had been so telegraphed, and priced. The fact that the Fed arguably disappointed with only a 25bps cut means they are now behind the curve; until they get in front of it, multiples are unlikely to expand again.”

In short, according to Wilson, “the Fed put expired on July 31st.”

Further elaborating his thoughts, Wilson writes that trade escalation has not been the only thing keeping the market from new highs since August 1st. While he notes that “there seems to be a significant percentage of investors who believe the equity markets would/could have kept making new highs had trade tensions not been re-escalated on August 1st” he disagrees “as we saw bonds rally and stocks sold off immediately after the Fed decision and the rally in the morning of August 1st, before the President’s tweet that announced new tariffs, was being led by defensive sectors and rates were still falling.”

These are bearish, not bullish, internals that were on display even before the tweet on August 1st.

But wait, there’s more.

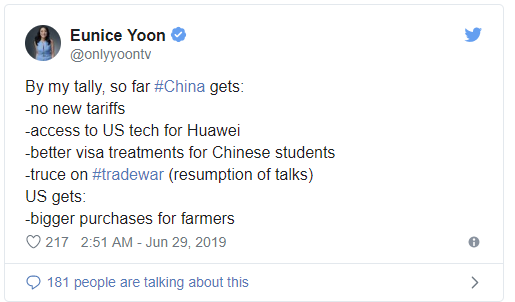

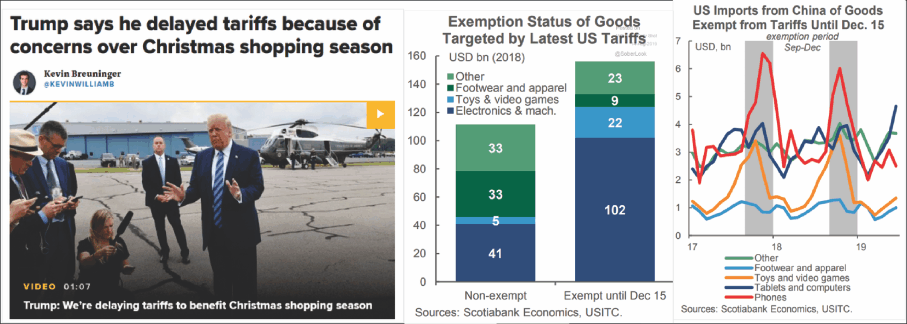

In his ongoing attempts to read the market’s tea leaves (and find misery and pain), Wilson says that it is “probably more insightful to discuss how markets traded after the administration attempted to de-escalate the trade situation.”

On Tuesday last week, it was announced that half of the tariffs to be imposed on September 1st would be delayed until December. Unsurprisingly, equity markets rallied sharply that day but on fairly light volume and what appeared to be more short covering rather than new committed buyers. Sure enough, the very next day the market gave up all of the previous day’s gains with the major US averages down 3 percent.

This, Morgan Stanley correctly points out, was the first time markets have not responded positively in a sustained manner to what amounted to a de-escalation of the trade situation. And in conjunction with the end of the Fed put, Wilson believes it “effectively means the Trade put has also expired.”

So with both of these two puts now allegedly expired, Morgan Stanley thinks investors are now left to face the risks that have been glossed over all year because stocks were rising–namely falling earnings estimates and disappointing economic data. In short, “we think many have been misinterpreting the signals from the market to be a bullish signal for growth when in fact the market has been signaling since April that growth was likely to disappoint.”

The bank’s chief US equity strategist also warns that using the S&P 500 as a barometer for the health of the economy and broad corporate profits growth is inappropriate when global growth is slowing so rapidly and small business profits are seeing even greater pressure.

Specifically, as he notes, “the S&P 500 is the most defensive, highest quality and liquid stock market in the world so if it is outperforming so strongly, it is likely a bad sign for future growth.” Meanwhile, the dramatic underperformance of the small cap Russell 2000 and cyclical sectors all year was a clear indication that things were not improving, nor were they likely to this year.

Which brings us to the real punchline from MS – which as expected was especially gloomy – namely that with the Fed and Trade puts now expired, Wilson warns that “it’s pretty clear that others will now have to acknowledge that the likelihood of a second half recovery has diminished significantly.”

And to confirm that, the bearish strategist writes that perhaps there is no better example of the beginning of this acknowledgement than what Eastman Chemical’s (EMN) CEO had to say after the company reported disappointing earnings late last month:

“Everyone in April and through the beginning of May thought that the economy was going to get better in the back half of the year, trade war was going to sort of settle, certainly not escalate. Now we’re just in a very different world where I don’t think that’s true…There’s not a lot of signs of economic recovery coming in the second half.”

Always happy to take a victory lap on a downtick (just as Marko Kolanovic will only publish reports when the S&P is green), Wilson mocking notes that he “would take exception to the phrase that everyone was thinking this way in April” but overall agrees that this captures the shift in mood between April and July by many companies, especially those levered to economic growth.

Wilson concludes that, without going through an exhaustive list, he has “heard similar commentary from the likes of Cisco (CSCO), Caterpillar (CAT), Macy’s (M) and Advanced Auto Parts (AAP) just in the past week representing a fairly wide range of end markets and customers.” Of course there have been positive earnings reports too, including Walmart (WMT) which put up strong numbers last week and did not note any slowdown. However, Walmart is a discounter and does better in economic slowdowns relative to other retailers.

via ZeroHedge News https://ift.tt/2NfnBNu Tyler Durden