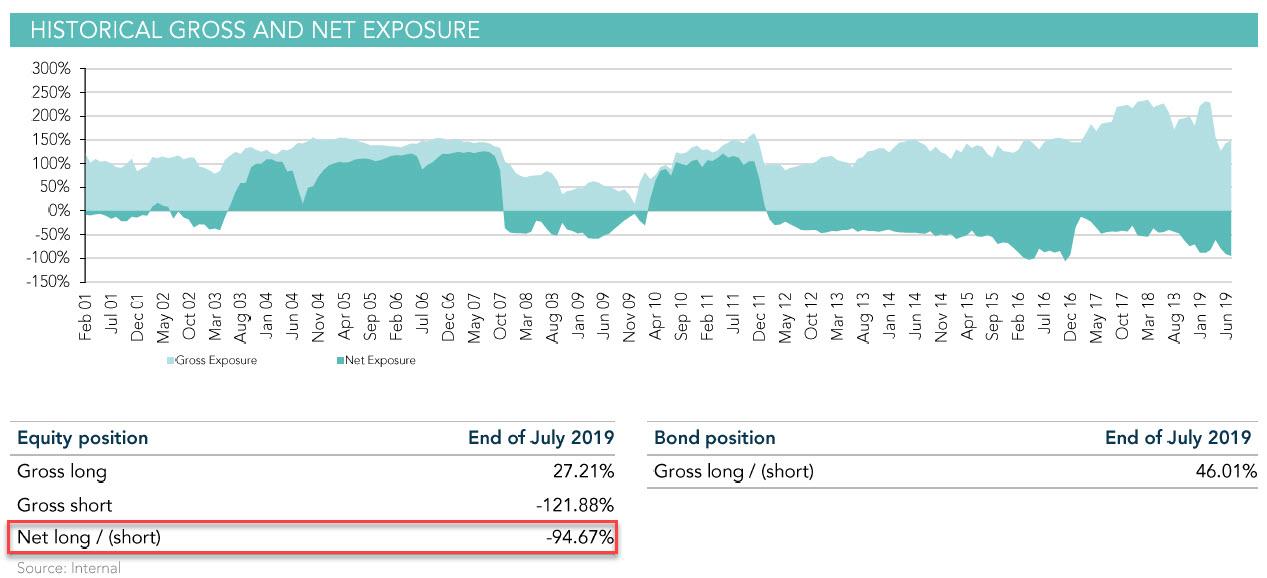

While Horseman Global, better known as the world’s most bearish hedge fund for its unprecedented -95% net equity position…

… managed to narrowly avert a disappointing performance in 2018 thanks to a remarkable +13.5% return in the month of December which brought the fund’s full year return to 7.5%, Russell Clark’s investment vehicle has had far less luck in 2019, a in the year in which the fund went “all out” bearish, demonstrating why one shouldn’t fight the central banks in the short-term, even if the world’s money printers will ultimately lose the war.

The reason: after two consecutive -5% months in June and July, the fund has fully wiped out any goodwill from its amazing 17.1% return in May, and its YTD performance is now down a whopping 22%. Putting that number in context, Horseman’s two worst years, 2009 and 2016, both recorded a decling of -24%. Horseman is almost there… and there are still 5 more months left in the year.

There are two notable highlights here: the first is that after sticking with Clark for years, the fund’s LPs appear to be bailing, and net assets for the fund are down to $263MM, from $488MM a year ago and $654MM in August 2017; the second is that Horseman’s monthly volatility appears to be increasing with every month’s performance in 2019, except March, representing a swing of more than 5% in either direction.

Why is this? Is Clark growing increasingly desperate (and leveraged) and swinging for the fences in hopes of a return home run?

Here is the explanation from the horse’s, or rather bear’s mouth:

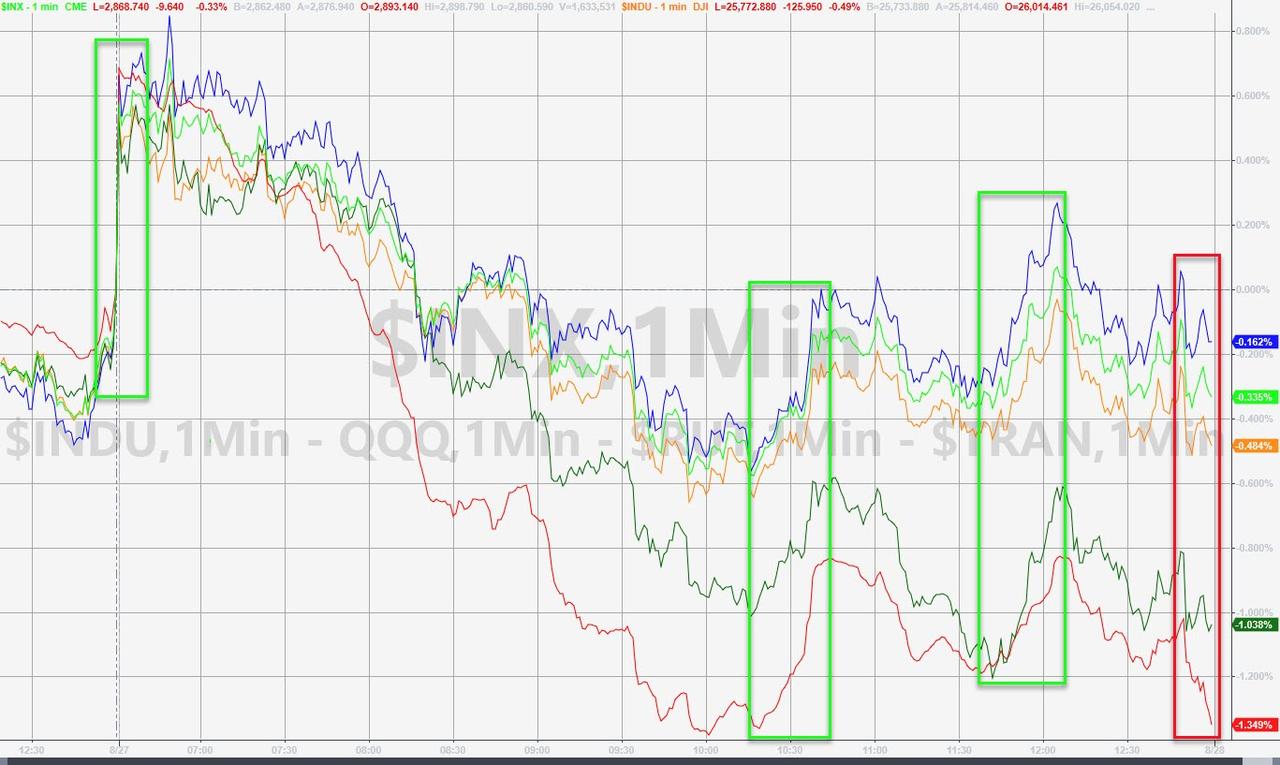

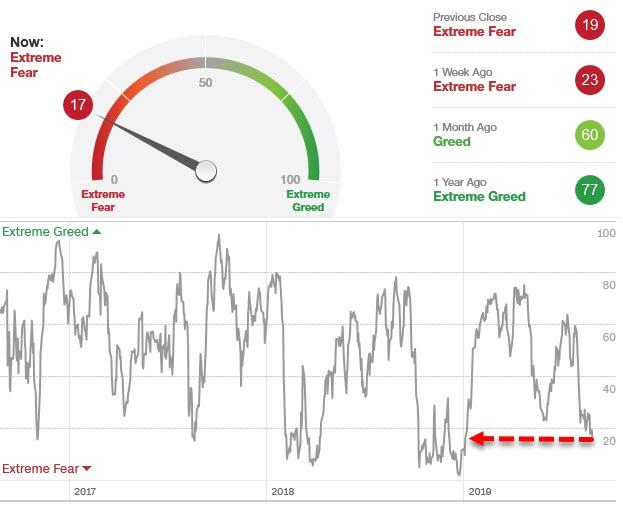

Why is the fund so volatile? Mainly because it’s obvious to me that growth is slowing globally, and risks are all to the downside. But what is obvious to me, is also obvious to policy makers and other investors. We are seemingly in a never ending cycle of markets beginning to price in a slowdown, and then pricing in stimulus and policy response. And so, after a successful May for the fund, we have two down months, and now what is shaping up as a successful August.

He’s right of course: the moment markets swoon, they surge on the expectation that “politically independent” central banks will rescue them, a trend that hasn’t failed to disappoint the BTFDers so far. So why does Clark assume that this time will be different? He explains:

If I believed that this was all we had to look forward to (endless volatility) then I would probably not even bother to run the fund, let alone have most of my money invested. But, obviously, I do run the fund and I do have most of my money committed to it. So what am I seeing? Well, we continue to see weakness in semiconductor pricing, leading to weakness or stagnation in major Asian semiconductor stock prices, and we continue to short this area.

Alas, his semis short, which was behind the fund’s remarkable return in May, has since cost the fund more than 10% in downside. And yet, Horseman refuses to throw in the galium-oxide towel, for one simple reason: he has seen this pattern before and it did not end happily for the bulls:

[W]e are seeing that Chinese steel production has reached new record levels of output, even as cash margins fall to zero. This is exactly what preceded the weakness in Chinese equities in 2015/6. We are already seeing many steel and commodity linked share prices fall significantly. Perhaps most ominously is that listed Chinese property companies and bank shares are also weakening. Historically, these are signs of a weakening economy, and typically one that needs to devalue.

It’s not just China that is keeping Clark bearish: pretty much everything else is too, but especially recent developments in the shale patch:

While semiconductors and China alone would be enough for me to be pretty bearish, we are now starting to see profit warnings and significant share price falls in US shale Permian producers. One leading company, Concho Resources, warned of much higher costs at its Dominator project. This was due to wells being drilled too close together. The implication being that drilling efficiencies have largely been tapped out in shale drilling. While this may seem a company specific issue, many other leading Permian drillers have seen similar share prices falls. It is also leading to a problem for many private equity shale producers that have bought land seeking to sell to listed drillers. Implied (from share prices) land prices for the Permian are far below the price paid recently. Riverstone Energy, a listed, energy focused private equity player, has seen its share price fall 42% in recent months. The implication is that drilling in the US will slow, and that the discount on US oil (WTI) versus Brent will narrow. This is already beginning to happen. The gap between 9 month forward Brent and WTI has fallen from 10 USD in November to nearly 4 USD today. This will have a very negative effect on US refiners and the petrochemical industry. Slowing shale production will also have a negative effect on general activity in the US.

Putting it all together, “semiconductors, China and US shale all looking problematic, would be probably enough for me to extremely bearish”, an already extremely bearish Clark admits. However, he adds, he is also “starting to see evidence that the Japanese are losing faith in the US dollar.”

The head of the GPIF — the largest pension fund in the world – has started to discuss hedging their dollar exposure. This is leading to JPY/USD basis spreads to widen. This means that the Japanese are worrying about the dollar falling versus the Yen (even with negative rates in Japan) and would therefore need a higher premium to buy US debt. Such a change in Japanese attitudes to dollar debt has occurred 1998, 2008, and 2014 – all periods of financial distress.

So where is the fund on the last day of July?

I have three huge industries that look problematic —semiconductors, Chinese steel/property and US shale. I then combine that with the Japanese tightening funding, and huge Korean autocallable issuance, all my favourite lead indicators such as the Nikkei and Kospi trading bearishly, and the Chinese Yuan devaluing.

So, at least in theory, it should all be ok. Only it isn’t, as the recent hammering the fund’s P&L received. Even so, as Clark concludes, “I am more confused by why people are not more bearish.”

The reason, of course, is simple: central banks – which have now gone all in to defend stocks – have no choice but to double, triple and quadruple down in avoiding a market drop, as the circular collapse in the economy and stocks that would ensue should the Fed fail to arrest such a plunge, would put even the financial crisis to shame.

via ZeroHedge News https://ift.tt/3465xLy Tyler Durden