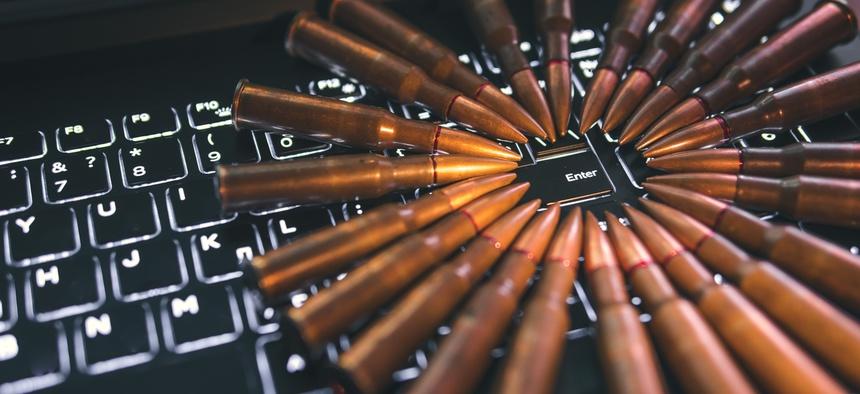

In what will be seen as another escalation of tensions in the Persian Gulf, Iran’s Revolutionary Guards seized a foreign oil tanker in the Persian Gulf on July 31, adding to rising concerns about the safety of shipping in a region crucial to oil exports.

The vessel – the third foreign ship seized by Iran in the Gulf since July 14 in response to a UK seizure of Iran’s own ship – is suspected of smuggling a large volume of fuel, the Guards said on their Sepah News portal according to Bloomberg. They did not, however, give any details about the flag or nationality of the ship or its operator.

The ship’s seizure took place last Wednesday, Sepah News, the Revolutionary Guard’s official news service, reported, a day after United Arab Emirates officials traveled to Iran to discuss maritime border cooperation and the flow of shipping traffic, including illegal movements.

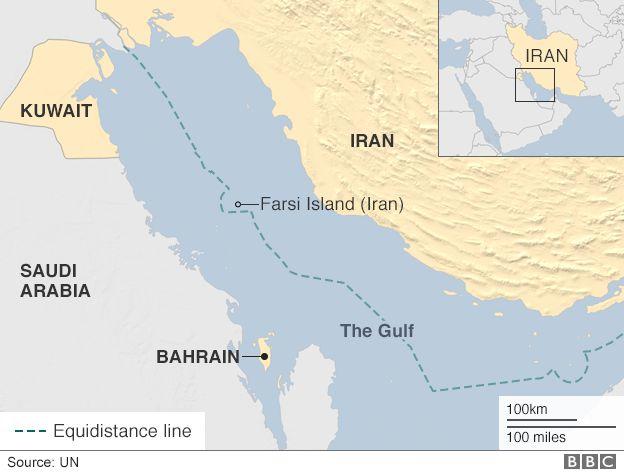

The ship was carrying 700,000 liters (4,403 barrels) of smuggled fuel when it was seized near Farsi Island in the western part of the Gulf, off Iran’s southwestern coast, Sepah News reported. The island is located about 400 miles (640 kilometers) from the Strait of Hormuz, the volatile center of Iran’s standoff with the West in recent weeks. Iran’s state-run Press TV reported that the seized ship is an Iraqi tanker that was delivering the fuel to some Arab countries in the Persian Gulf.

Iranian state news agency IRNA reported that a video of the moment the vessel was seized showed it was Iraqi, although as the WSJ notes, maritime confrontations between Iran and Iraq are considered rare. The Iraqi ship’s seizure would follow July’s visit to Tehran by Prime Minister Adel Abdul-Mahdi, who has sought to ease tensions between the U.S. and Iran, both close allies of Iraq.

Gen. Ramezan Zirahi, a navy forces commander in the Guard, was quoted by Iran’s Fars News Agency as saying the fuel had been transferred to the vessel from another ship, and was bound for Arab countries in the region when it was impounded. The seven detained crew members – who were arrested – were foreign, he said, without naming their nationality or that of the vessel. The ship was taken to Bushehr port on Iran’s southwest coast, and its cargo was confiscated and handed over to the National Oil Distribution Company of Iran.

The announcement of the ship’s capture coincides with a joint meeting between the Iranian and Qatari coast guards in Tehran aimed at improving and developing maritime cooperation between the Gulf neighbors, state-run Islamic Republic News Agency reported earlier Sunday. That gathering follows a rare meeting between the coast guards of Iran and the U.A.E. last week.

* * *

The impounding of the ship will escalate the tensions that have flared in the region’s waters as Iran resists U.S. sanctions that are crippling its all-important oil exports and retaliates after one of its ships was seized July 4 near Gibraltar. Iran grabbed a British tanker, the Stena Impero, in Hormuz two weeks later and continues to hold it. Iran also detained a small Emirati-based vessel, the Riah, earlier in July and accused it of smuggling fuel. Nine of the 12 Indian crew members have since been released, but the vessel remains impounded. Ship-tracking experts noted the size of the cargo on the vessel seized on Wednesday was even smaller. Petroleum products sold domestically in Iran are heavily subsidized, so it is potentially lucrative to divert them to foreign markets, where they can be sold for a higher price.

The passage at the mouth of the Persian Gulf accounts for about a third of the world’s seaborne oil flows. To reduce the risks of navigating the waterway, the Royal Navy has started to escort British ships, and a plan for a European naval mission is taking shape.

Meanwhile, the U.S. has blamed Iran for attacks on oil tankers in the region in recent months, a charge Tehran has denied.

The crisis in the Gulf has caused oil prices and shipping premiums to rise and prompted some vessel owners to avoid the region. Last week, Bloomberg reported that British oil giant BP, which had to shelter one of its tankers in the Persian Gulf this month in fear it could be targeted by Iranian forces, was avoiding sending ships to the region after tensions flared between Tehran and London.

BP is “certainly not sending British ships and crews” through the Strait of Hormuz, the only way for tankers to reach the world’s biggest oil-exporting region, Chief Executive Officer Robert Dudley said in a Bloomberg TV interview.

Earlier this month, a BP tanker had to abandon a plan to load Iraqi crude and instead took shelter near Saudi Arabia because the company feared the ship could be targeted in a tit-for-tat response for British Royal Marines seizing a vessel transporting Iranian crude in the Mediterranean, a person familiar with the matter said at the time.

At the same time, the U.S. has boosted military deployments in the Persian Gulf and Strait of Hormuz and is trying to pull together an international maritime force to patrol the region. The British also plan to create a separate European maritime security force.

Ironically, it remains unclear if allies in the North Atlantic Treaty Organization will cooperate: as the WSJ notes, the U.K., Germany and France are at odds with the Trump administration over its decision to pull out of the 2015 Iranian nuclear deal to which they are co-signatories, and are working to keep the deal alive and to ease tensions with Tehran.

For its part, Iran says it is trying to maintain maritime security in the region. But its officials also have repeatedly warned they would block the Strait of Hormuz—through which a third of the world’s seaborne oil is transported—in response to crippling U.S. sanctions. Iran has accused the Europeans of not providing adequate relief from American pressure.

via ZeroHedge News https://ift.tt/31lT4S3 Tyler Durden