The roaring stock rally of the past six days week took a breather on Tuesday, with futures dipping from a record high of 3,913 as investors sifted through earnings and weighed the impact of soaring inflation expectations which saw 10Y Breakeven rates hit 7 year highs amid signs the Biden administration is committed to passing a sizable aid bill..

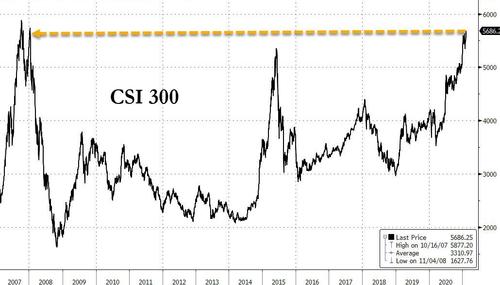

The MSCI All-Country World Index edged up 0.1% to its own record high, although early moves in Europe’s top indexes suggested further gains may be tougher to find, with Britain’s FTSE 100 flat on the day even as a record high close for Wall Street overnight gave Asian stocks the confidence to push on further, with MSCI’s broadest index of Asia-Pacific shares outside Japan up 0.3%, led by Chinese blue chips, up 2.2%.

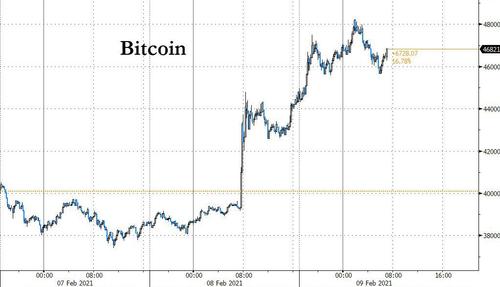

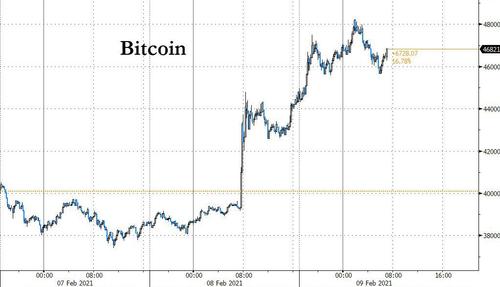

European equities turned red after a choppy start even as bitcoin powered on, rising above $48,000 overnight following widespread speculation that more companies will follow Tesla in purchasing the cryptocurrency outright. Oil reversed its recent rally while the dollar slide accelerated. Futures for the S&P 500 were modestly in the red, suggesting a quiet start to the U.S. trading day.

“Reflation on the back of U.S. fiscal stimulus and positive vaccine news remains the major theme for markets,” strategists at National Australia Bank wrote.

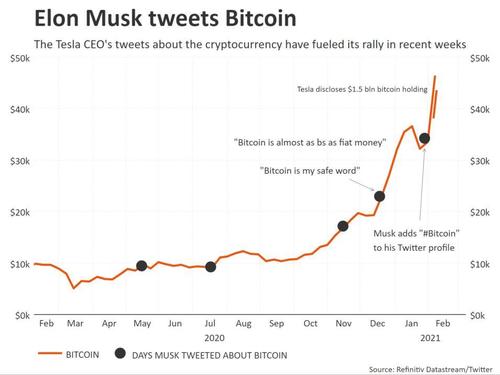

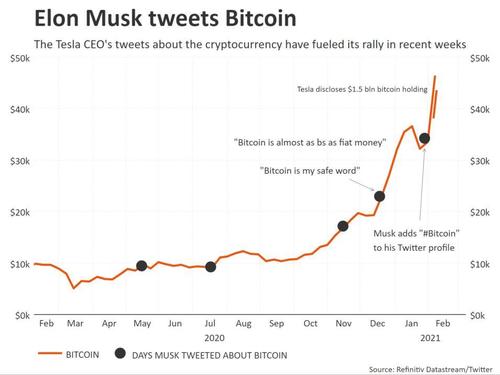

While Emini futures drifted around the 3,900 gamma “call wall”, Bitcoin’s surge continued as it rapidly approached the $50,000 mark on Tuesday as the afterglow of Elon Musk-led Tesla’s investment in the cryptocurrency had investors reckoning it may become a mainstream asset class for both corporations and money managers. The price of one bitcoin climbed to a peak of $48,216 – almost enough to buy one of the best-selling Tesla vehicles, Tesla Model Y SUV. Rival cryptocurrency ethereum struck a record high of $1,784.85 on Tuesday. Bitcoin exploded 20% higher on Monday after Tesla announced it had a $1.5 billion investment and that it would eventually take the cryptocurrency as payment for its cars. That was its largest daily rise in more than three years.

Musk foresees accepting the currency as a payment for Tesla cars and analysts reckon this is a larger shift as companies and big investment houses follow small traders into the asset.

“Bitcoin is definitely capturing investors’ attention — I get more and more questions about it,” said Marija Vertimane, senior strategist at State Street Global Markets. “From a practical point of view, using bitcoin to buy anything – Tesla cars – would be still extremely difficult given its excessive volatility.”

“Right now, it still seems like a bit of a leisurely pursuit, to acquire bitcoin. But I think by the end of the year, with the current rate of institutional flow inbound, it will become clear that this is a once-in-a-lifetime landgrab,” said Jehan Chu, founder and managing partner at Kenetic, which invests in blockchain-related companies.

Going back to equities, the euphoria was far more muted: Europe was broadly, if modestly, in the red with the Eurostoxx 50 down 0.3% and the Stoxx 600 index down 0.4% despite positive results from French oil giant Total SE and online grocer Ocado Group Plc. Utilities, media and construction names are a drag on indexes; oil & gas is the sole sector in positive territory. Natixis SA shares were suspended after French financial group BPCE SA was said to be in advanced discussions about a potential offer to buy out minority shareholders of the investment bank. Here are some of the biggest European movers today:

- Total shares rise as much as 2.8% after the French oil major’s fourth-quarter results beat estimates, bucking the trend of disappointing updates from the sector and lifting the energy sub-index. Analysts highlighted its defensive attractions and said the results look “good.”

- Demant shares jump as much as 14%, the most since Oct. 2008, after the Danish hearing-aid maker’s 2020 profit and its 2021 guidance topped expectations. Peers Sonova and GN Store Nord both rose too.

- Bellway shares rise as much as 4%, touching the highest since March 11, after the U.K. housebuilder’s first-half update pointed to consensus upgrades and showed a reassuring trading performance.

- Randstad shares rise as much as 4.3%, hitting the highest since March 22, with RBC saying the Dutch staffing company had an “excellent” quarter and that it should continue to recover.

- Electrocomponents shares gain as much as 5.1% to a record high after JPMorgan upgraded the electronics distributor to overweight on optimism about it maintaining market share gains and growing faster through M&A.

Earlier in the session, Asian stocks posted modest gains, with the benchmark gauge rising for a third day as it looked set for another record high. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.3%, led by Chinese blue chips, up 2.2%. In Japan, SoftBank Group shares rose 3.4% after reporting record profit in its Vision Fund. The stock was the biggest boost to Japan’s Topix Index for a second straight day and is closing on a record high. Telecommunications providers were the largest boost to the Topix, which extended its gain after climbing Monday to its highest level since 1991. The Nikkei 225 added to Monday’s 2.1% surge, powered by a jump in SoftBank after it reported a record profit in its Vision Fund. The Topix itself climbed 0.1%, extending gains from Monday when it reached its highest level since 1991. Blockchain and cryptocurrency stocks jumped after Bitcoin reached a fresh peak in the wake of Tesla’s announcement that it made a $1.5 billion investment in the digital currency. Meanwhile, Indonesia’s Jakarta Composite slumped 0.4% even after the central bank governor said it’s weighing whether to slash interest rates further because inflation was falling “too low.”

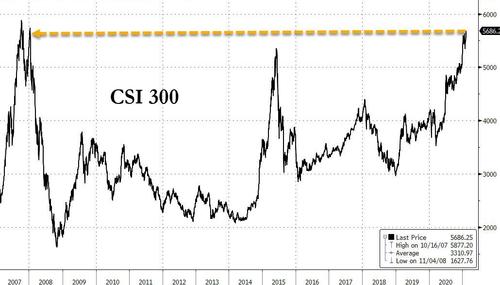

China’s CSI 300 Index extended gains in afternoon trade to surpass January’s peak and reach its highest level in 13 years, led higher by materials and technology stocks. The benchmark index closed 2.19% higher with Iflytek, Han’s Laser Technology and Zoomlion Heavy Industry among biggest gainers.

Stretched valuations are giving investors pause as they cheer advancing vaccination efforts, rising stimulus prospects and a slowdown in coronavirus infections across the globe. With inflation expectations near the highest since 2013, questions have also begun to be raised about when the so-called reflation trade in bonds could start to threaten equities. On Monday, Goldman pulled forward its forecast for a first rate hike from late 2024 to early 2024 after raising its GDP forecasts for 2022 and 2023, which put the US economy on the verge of redlining and inflation set to be red hot.

“We are getting to the point where we have to start worrying about the risk of how do we pull back on that stimulus, will it cause the economy to overheat, are these valuations becoming too expensive,” Saira Malik, Nuveen head of global equities, said on Bloomberg TV. “That is something we are going to be grappling with as the year goes on.”

In addition to growing worries about higher bond yields, concern remains over the pace of vaccination, the efficacy of the vaccines against new strains of the COVID-19 virus and the damage being done to economies, including the impact on the dollar of a planned $1.9 trillion stimulus package.

That suite of negativity helped weigh further on the dollar. Against a basket of other currencies, the dollar weakened broadly against its Group-of-10 peers, with haven currencies leading gains. At the same time, the euro extended gains in early European hours, rising above $1.21, while Italian bonds rallied to send the country’s borrowing costs to a record low. The euro volatility skew has undergone a sharp repricing once again in the front-end, which shows cash positioning drives the market as the dollar remains in a bearish trend. The yen advanced beyond 105 per dollar and was set for its biggest daily gain since November amid the decline in Treasury yields. The pound rose to its highest in nearly three years, helped by broad dollar weakness amid cautious optimism about a recovery in equities. The Australian and New Zealand dollars climbed for a third day as rising commodity prices brightened the outlook for the nations’ exports; Brent crude rose an eight consecutive day, the longest streak in almost a year, and gold climbed for a third day.

As noted above, Bitcoin hit a fresh record above $48,000 on Tuesday after Tesla Inc.’s announcement of a $1.5 billion investment in the largest cryptocurrency.

In rates, Treasuries were higher led by long-end of the curve after dip-buying during Asia session sent yields to session lows, after hitting 1.20% yesterday. U.S. bonds outperformed bunds and gilts with additional support from S&P 500 futures easing from record high levels. Yields were richer by ~2bp across long-end of the curve, flattening 5s30s by 1.5bp and 2s10s by 1.9bp; 10s around 1.15%, outperforming bunds and gilts more than 1bp. Today the Treasury refunding starts with 3-year note sale; 10- and 30-year are later this week. The difference between the US 5 and 30 year yield curve and its German equivalent reached its widest since 2011, mainly reflecting expectations for a stronger inflation pickup in America.

In commodities, In keeping with the risk-on sentiment, oil earlier hit 13-month highs, helped by rising optimism about a return in fuel demand, with Brent crude up 0.8% before giving up gains.

“There is a sense that the glut of oil supply is disappearing more rapidly than anybody thought possible,” said Phil Flynn, senior analyst at Price Futures Group in Chicago. “There seems to be a paradigm shift in the market.”

Jim Bullard, St Louis Fed President, is today’s designated Fed speaker before we move on tomorrow’s CPI data and Jay Powell speech at the Economic Club of New York. Yesterday, Kansas Fed President Esther George was very much on-message and helped smooth the bond market, setting the scene for the risk recovery.

Finally before the day ahead a quick few lines on ECB President Lagarde’s comments after the European close. She again pledged to continue offering the bloc monetary support as lockdowns in the region continue on longer than what many originally anticipated. She called on countries to follow on as well saying that “ it remains crucial that monetary and fiscal policy continue to work hand in hand. Fiscal policy – both at the national and at the European level – remains crucial to bolster the recovery.”

To the day ahead now we and will get data on both the German December trade balance and current account balance along with Italian December industrial production. From the US, there will be the January NFIB small business optimism survey and December JOLTS job openings. From central banks, ECB Chief Economist Philip Lane will be speaking. Some of the largest companies reporting today include Cisco Systems, Dupont de Nemours, Twitter and Fiserv.

Market Snapshot

- S&P 500 futures down 0.1% at 3,905.00

- MXAP up 0.4% to 215.62

- MXAPJ up 0.3% to 722.26

- Nikkei up 0.4% to 29,505.93

- Topix little changed at 1,925.54

- Hang Seng Index up 0.5% to 29,476.19

- Shanghai Composite up 2.0% to 3,603.49

- Sensex down 0.2% to 51,250.64

- Australia S&P/ASX 200 down 0.9% to 6,821.23

- Kospi down 0.2% to 3,084.67

- Brent Futures up 0.6% to $60.93/bbl

- Gold spot up 0.9% to $1,847.35

- U.S. Dollar Index down 0.41% to 90.57

- German 10Y yield fell 1.6 bps to -0.452%

- Euro up 0.5% to $1.2107

- Brent Futures up 0.6% to $60.92/bbl

Top Overnight News from Bloomberg

- Scientists on a World Health Organization-sponsored mission to shed light on the spread of the SARS-CoV-2 virus in Wuhan will brief journalists later on Tuesday. China pushed back a target to inoculate 50 million people by almost two months

- Investors predict that an additional 15% of their FX trading will be conducted via algorithms over the next two years, JPMorgan said

- China’s central bank instilled calm in the country’s money market by downplaying the significance of its recent liquidity withdrawals in a quarterly report, which said the PBOC won’t make “sharp turns” with its monetary policy

- Richmond Fed President Tom Barkin said in an interview with the Financial Times that he expects “short-term price volatility” but he saw deflationary as well as inflationary risks in the future

- House Democrats are proposing to limit the next round of Covid-19 relief payments to households earning less than $200,000, after criticism that President Joe Biden’s $1.9 trillion stimulus package would benefit the rich

- England’s third lockdown hit non-essential retailers harder than the previous one in November, with the new variant of the coronavirus hampering spending and confidence last month, according to the British Retail Consortium

- The PBOC has downplayed the significance of its recent liquidity operation that caused wild money- market rate gyrations, saying its policy stance remains neutral and unchanged

- Reserve Bank of New Zealand said Tuesday it will reinstate mortgage lending restrictions on March 1 and tighten them further for investors from May 1

- Japanese wages fell in December for a ninth straight month, declining the most since June 2015, as employers remained fearful of the profit outlook amid a global resurgence of the coronavirus

A quick look at global markets courtesy of Newsquawk:

Asian equity markets were mostly positive after the stimulus-driven momentum on Wall St. which lifted all major US indices to fresh unprecedented levels and the S&P 500 to above 3900 for the first time ever, but with gains capped as focus in the region shifted to the deluge of earnings releases. ASX 200 (-0.9%) underperformed with the index dragged by defensives and cautiousness in the largest-weighted financials sector after the RBNZ announced to reinstate LVR restrictions from March 1st to curb risks to financial stability from high-risk mortgage lending. There were also varied corporate updates including Macquarie Group which was boosted despite forecasting its FY21 results to be slightly lower Y/Y as it also noted its market-facing businesses’ combined Q3 net profit contribution was significantly higher Y/Y and with Suncorp lifted by an increase in H1 cash earnings, although Challenger slumped after it reported weaker H1 net. Nikkei 225 (+0.4%) was kept afloat amid supportive measures whereby the government announced to spend JPY 1.4tln in emergency reserves for pandemic-related measures and as earnings also provided a tailwind including SoftBank which posted blockbuster results and was helped by record profit in its Vision Fund. However, most of the advances in Tokyo were eventually faded on currency flows and with wage growth at its largest contraction since December 2009. Hang Seng (+0.5%) and Shanghai Comp. (+2.0%) were initially tentative heading closer to the Lunar New Year holiday closures and after the PBoC reiterated its prudent approach, although support was seen in the blue-chip oil names after further gains in the underlying commodity, while Geely Auto outperformed after its sales rose 40% Y/Y to 156.3k units in January. Finally, 10yr JGBs were steady as prices found a platform around the 151.50 level and with the BoJ also present in the market today for more than JPY 1.2tln of JGBs heavily concentrated in 1yr-10yr maturities.

Top Asian News

- Hong Kong Exchange Names JPMorgan’s Aguzin New CEO

- China Solar Supplier Plans Huge Plant to Meet Soaring Demand

- Asian Stocks Gain for Third Day as SoftBank Nears Record High

- Clubhouse Users in China Say Service Appears to Be Blocked

European stocks take a breather from the recent rally and see a mild downside bias in early trade (Euro Stoxx 50 -0.3%) following a relatively mixed APAC session, as the stimulus-driven momentum seen on Wall Street gradually fizzled out. US equity futures also see shallow losses with the ES, NQ, YM and RTY lower by some 0.1-0.2% as participants await the next catalyst for further conviction. Sectors in Europe are mostly lower with no clear risk bias but with some defensives seeing less pronounced losses, although Energy outpaces as crude prices remain near pre-COVID levels. Delving deeper into the sectors Food & Beverage and Healthcare reside near the top of the table, just below Oil & Gas, whilst the other side of the spectrum sees Construction, Tech and Banks – with the latter potentially a function of yields pulling back. Spain’s IBEX (-0.9%) resides as the underperformer amid losses in its heavyweight banking sector coupled with some earnings-hit stock – with Solaris (-9%) the laggard in the Spanish benchmark. Elsewhere, France’s CAC (+0.1%) is cushioned by gains in Total (+1.6%) post-earnings, whereby the Co. beat on adj. net expectations and noted that the group maintains its priorities for cash flow allocations and the implementation of the Co’s transformation strategy, support dividends and maintain a strong balance sheet. Other earnings-related movers include Micro Focus (+3.19%), TUI (-0.5%), ASM (+0.9%) and Randstad (+2.5%).

Top European News

- France’s BPCE Said in Advanced Talks on Natixis Buyout

- TDR-Backed Modulaire Group Weighing Initial Public Offering

- EssilorLuxottica’s EU Offer Kick-Starts GrandVision Review

- Equiniti Soars About 50% After Report of Takeover Approach

In FX, the Dollar has fallen further from best levels, and almost across the board on a mixture of fundamental and technical factors, including more retracement and reconvergence in yield spreads that had been favouring US Treasuries, even loftier record peaks on Wall Street and further progress towards fiscal relief. Meanwhile, crude and fellow commodities are also applying greater downside pressure on the Greenback and G10 counterparts have either scaled or are testing key chart and sentimental levels. Hence, the DXY is now struggling to stay above 90.500 between 90.963-502 parameters compared to Monday’s 91.288 high.

- JPY/EUR/CHF – It’s a close call, but in terms of magnitude and sheer speed of movement, the Yen’s resurgence from 105.77 at one stage last Friday to circa 104.54 (and counting) so far today is perhaps most eye-catching, especially when set against the Nikkei’s ongoing rally and close just above 29.5k. However, from a chart perspective alone, the 2nd successive close below the 200 DMA (now 105.54) was bearish for Usd/Jpy and the loss of 105.00+ status would have tripped stops set by short term longs and intraday jobbers looking for a rebound. Similarly, the Euro has managed to sustain momentum through 1.2050 and 1.2100 to surpass the 21 DMA just beyond the round number to expose 1.2150 and the 50 DMA around 1.2156, while the Franc has rebounded from sub-0.9000 to 0.8950+.

- AUD/NZD/GBP – The next best majors, as the Aussie takes a firmer grip of the 0.7700 handle in wake of a rather mixed NAB business survey showing an improvement in sentiment, but deterioration in conditions, while the Kiwi is hovering just under 0.7250 following a rise in NZ inflation expectations and the RBNZ preannouncing that LVR restrictions will be reimposed with effect from March 1. Elsewhere, the Pound has finally pierced 1.3750 and a near double top formed either side of month end to post a fresh y-t-d pinnacle a fraction shy of 1.3790 and a technical hurdle protecting 1.3800.

- CAD/NOK/SEK – Oil’s extended rally to top Usd 58.50/brl and Usd 61/brl in WTI and Brent respectively continues to underpin the Loonie and Norwegian Krona, but a downturn in broad risk sentiment has prevented the former from scaling 1.2700 vs the Buck and latter from holding above 10.2500 vs the Euro. Nevertheless, the Nok is doing better than the Swedish Crown that remains capped beneath 10.1000 against the single currency on the eve of the Riksbank.

- EM/PM/CRYPTO – Broad gains vs the Usd, bar the Try that is still facing heavy offers into 7.0000, with Gold inching closer to Usd 1850/oz and the 200 DMA, Bitcoin tops Usd 48.2k for another new ATH.

In commodities, WTI and Brent futures trade off best levels but remain elevated on the reflationary prospect emanating from the US stimulus bill, which comes against a supportive backdrop of vaccine hopes and OPEC+ supply tweaks – with Saudi’s extra output cuts exacerbating the tightening in the oil market. The oil complex has also been tracking the broader market sentiment amid the slowing in pace of COVID infections alongside calls from monetary and fiscal figures not to taper stimulus too soon. Desks also note that refinery margins are pointing towards a recovery in fuel demand – with jet fuel demand also supported by measures mulled by officials to ensure cross-country travel can occur safely. That being said, downside risks include the prolongation of lockdown measures due to staggered vaccine rollouts or the emergence of a more potent variant – this sentiment was also reflected in the outlook by oil giant Total. Furthermore from a supply standpoints, the high oil prices could prove tempting for producers to unwind or at least call for the tapering of COVID-related output cuts. Meanwhile, US active oil rigs have seen a consistent rise since the latter part of November – with the number seen rising on the back of attractive prices. WTI resides just north of USD 58/bbl (vs. high 58.59/bbl) whilst Brent itself back on a USD 60-handle after briefly topping USD 61/bbl to a high of around USD 61.23/bbl. Elsewhere, precious metals benefit from the softer Dollar with spot gold inching closer back towards 1850/oz with its 200DMA seen around USD 1855/oz followed by its 50DMA at USD 1859/oz. Spot silver meanwhile extends its gains above USD 27.50 (vs. low 27.23/oz). Finally, base metals are firmer amid the softer Buck and reflationary backdrop, with LME copper meandering around the USD 8,100/t mark.

US Event Calendar

- 6am: Jan. Small Business Optimism, est. 97.0, prior 95.9

- 10am: Dec. JOLTs Job Openings, est. 6,400, prior 6,527

DB’s Jim Reid concludes the overnight wrap

After a weekend of pathetic attempts to snow here in Surrey, yesterday a more meaningful attempt was made and I’ve woken up to a few more centimetres this morning. One of the things that has kept me going in lockdown 3 is that over the last 5 weeks of tedium, I suspect the golf course would have been closed a lot more than it was open given a bad month of rain, snow and cold weather. I was telling my kids last night that when I was about 4 I used to believe that every garden in the world had exactly the same amount of snow regardless of its size. So I thought a small garden saw a huge depth of snow. When I told this to my kids they looked at me as if I was the most stupid person in the world.

The reflation trade helped markets hit new pandemic highs yesterday with recent market storms a distant memory as the prospect of a substantial US fiscal stimulus package and slowing Covid-19 infection rates caused risk assets to continue their February rally. The renewed optimism was particularly strong in commodity markets, where Brent crude rose +2.06% to $60.56/bbl – closing over $60/bbl for the first time since January 2020. This led energy stocks to lead equity indices on both sides of the Atlantic, with the S&P 500 energy industry rallying +4.17% and the STOXX 600 Energy sector gaining +1.21%. Banks similarly rallied even as bond yields took a break from their recent rise, with US banks adding +1.78% as their European counterparts rose +0.86%. Overall the S&P 500 rose +0.74%, to gain for a sixth straight session and reach another record high. Meanwhile, US small cap stocks outperformed significantly as the Russell 2000 rose +2.53% to a fresh all-time high of its own and is now up +130% from its pandemic lows, compared to the S&P’s 74.5% rally from its low.

While not really a commodity (yet) and not necessarily a risk asset, Bitcoin rose +15.8% and to a new all-time high ($44,692) with Tesla (+1.31%) just shy of theirs after we learnt yesterday that Tesla had acquired $1.5bn Bitcoin in January. Bitcoin is up another 4% this morning. In last month’s survey (link here) we asked whether you thought Bitcoin and Tesla were more likely to double or halve over the next 12 months. Doubling was seen by 25% and 18% for Bitcoin and Tesla respectively with 56% and 62% thinking they halve.

Perhaps with Elon Musk’s space ventures he will try to make Bitcoin the currency of the universe going forward. Why stop at global domination? Anyway, whatever you think of Bitcoin (and Tesla’s) valuations this announcement gives the crypto currency further institutional credibility in the near-term. Marion Laboure on my team wrote a great piece last week on the future of digital and crypto currencies. She is firmly of the view that both are going increasingly mainstream. See her report here.

Overnight, most Asian markets have continued to climb up with the Hang Seng (+0.63%), Shanghai Comp (+1.30%) and Kospi (+0.48%) all posting gains. Japanese markets are a bit more mixed with the Nikkei (+0.13%) up after erasing early losses while the Topix is down -0.27%. Futures on the S&P 500 are trading broadly flat as we type while the US dollar index is down -0.22%. Yields on 10y USTs are down -1.2bps overnight to 1.159%. In terms of overnight data releases, Japan’s December real cash earnings came in at -1.9% yoy (vs. -3.4% yoy expected) while the previous month’s reading was revised to -0.7% yoy from -1.1% yoy.

Back to yesterday and in Europe, the STOXX 600 gained +0.30% on the same reflation and pro-cyclical forces driving other markets. Meanwhile the FTSEMIB rallied a further +1.48% as Mario Draghi has won the backing of the main Italian political parties and is now expected to announce cabinet picks shortly as he tries form a new government. The risk on mentality did not see a significant weakening in sovereign debt though as yields and curves were mostly unchanged by the end of their sessions. Just prior to the start of trading in the US, 30yr Treasury bonds traded at 2.0% before falling back to 1.95% by the end of the day, while the 10yr yield was as high as 1.198% before finishing the day just a bit higher (+0.7bps) at 1.171%. In Europe, 10yr German bund yields were up +0.3bps to -0.45% while 10yr Gilt yields fell back -0.7bps to 0.48%.

On the topic of fiscal stimulus, Congressional Democrats in the US will start committee votes on elements of the Biden Administration’s Covid-19 relief bill later today. After the equity market closed yesterday, Senate Minority leader McConnell noted that “Democrats have decided to go at virus relief alone” in a sign that budget reconciliation is indeed the path forward and the Democrats will be able to pass the bill with a simple majority. Keeping an eye on what measures stay in the administration’s plan as it makes its way through the various House committees will be key in understanding where exactly the stimulus bill will affect the economy. See DB’s Matt Luzzetti (here) and Peter Hooper’s pieces ( here ) for more on how the economy would be impacted by various levels of stimulus and also on how the plan could be optimised to get political acceptance while still stimulating the economy.

Elsewhere, in terms of the worrying AstraZeneca weekend news, the U.K. Deputy Chief Medical Officer suggested yesterday that the South African strain shows no evidence of becoming the dominant strain in the U.K. over the coming months, and said it doesn’t appear to have a transmissible advantage over the current dominant domestic strain which is the so-called “Kent strain”. At the moment there have “only” been 147 SA cases in total in the U.K. and no new ones for two days which is important as lots of surge (mass) testing has been done in areas where it has been found. If it eventually does take over the hope is that adapted booster jabs will then be ready (likely by the autumn) that can be adapted to deal with mutations. It is also hoped that vaccines will help reduce dramatically severe illness and hospitalisations. Even though I’m a vaccine and global economy bull for this year I still think that these mutations will complicate the reopening plans a bit more than I was expecting at the end of last year or at least be associated with a higher level of restrictions when reopening than would be the case with vaccines perfectly protecting against all the mutations. International travel is probably going to be the biggest problem in 2021.

On the coronavirus more broadly, German Health minister Spahn expressed the need to keep the country’s restrictions in place for the time being as new infections are likely to remain above the government’s target in coming days. While in France, a government official said yesterday that the UK variant probably makes up about 20% of French cases currently and that the country may not move on to vaccinating the less vulnerable until May. In the US, it was announced that indoor dining would reopen as soon as Friday in order to take advantage of the Valentine Day holiday weekend, though capacity will remain limited to 25%. The new head of the CDC suggested requiring Covid-19 tests before all domestic flights in order to reduce transmission, and the new Transportation Secretary Buttigieg said any final decision on the policy would “guided by data, by science, by medicine, and by the input of the people who are actually going to have to carry this out.”

Finally before the day ahead a quick few lines on ECB President Lagarde’s comments after the European close. She again pledged to continue offering the bloc monetary support as lockdowns in the region continue on longer than what many originally anticipated. She called on countries to follow on as well saying that “ it remains crucial that monetary and fiscal policy continue to work hand in hand. Fiscal policy – both at the national and at the European level – remains crucial to bolster the recovery.”

To the day ahead now we and will get data on both the German December trade balance and current account balance along with Italian December industrial production. From the US, there will be the January NFIB small business optimism survey and December JOLTS job openings. From central banks, ECB Chief Economist Philip Lane will be speaking. Some of the largest companies reporting today include Cisco Systems, Dupont de Nemours, Twitter and Fiserv.