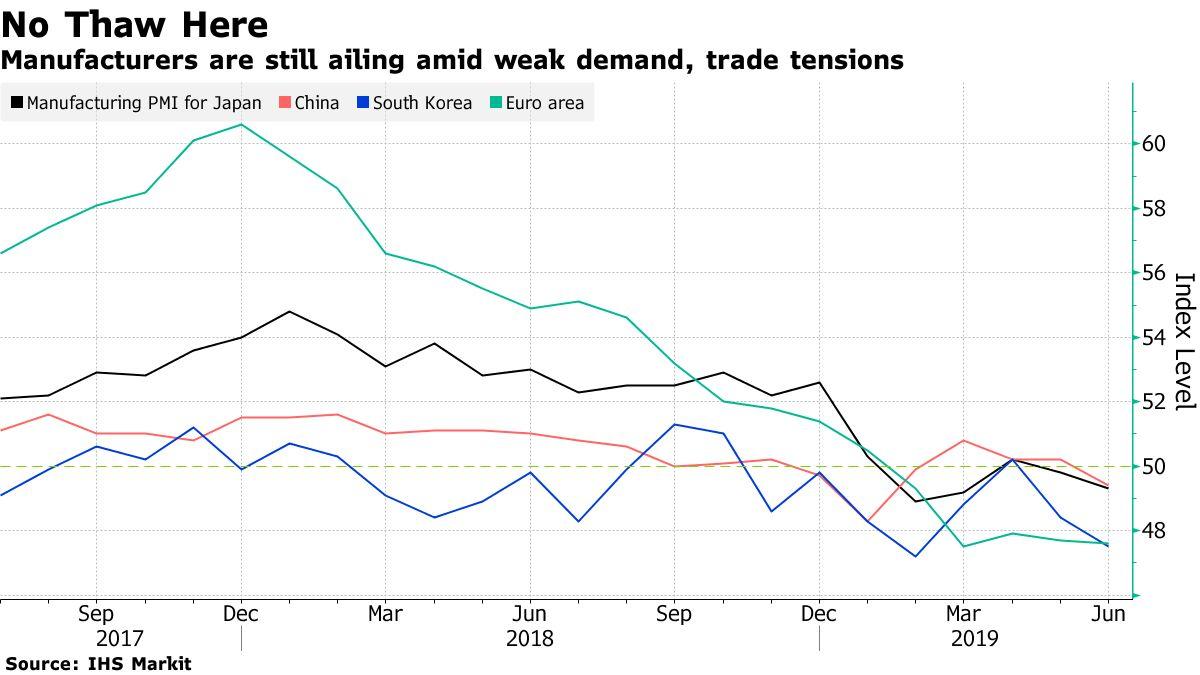

Overnight saw surveys confirm that factory activity collapsed in June across Asia and Europe. China’s manufacturers saw sales, exports and production fall, while Germany suffered from weaker foreign demand. Exports from South Korea plunged almost 14%, and Japan’s Tankan confidence index dropped to a three-year low.

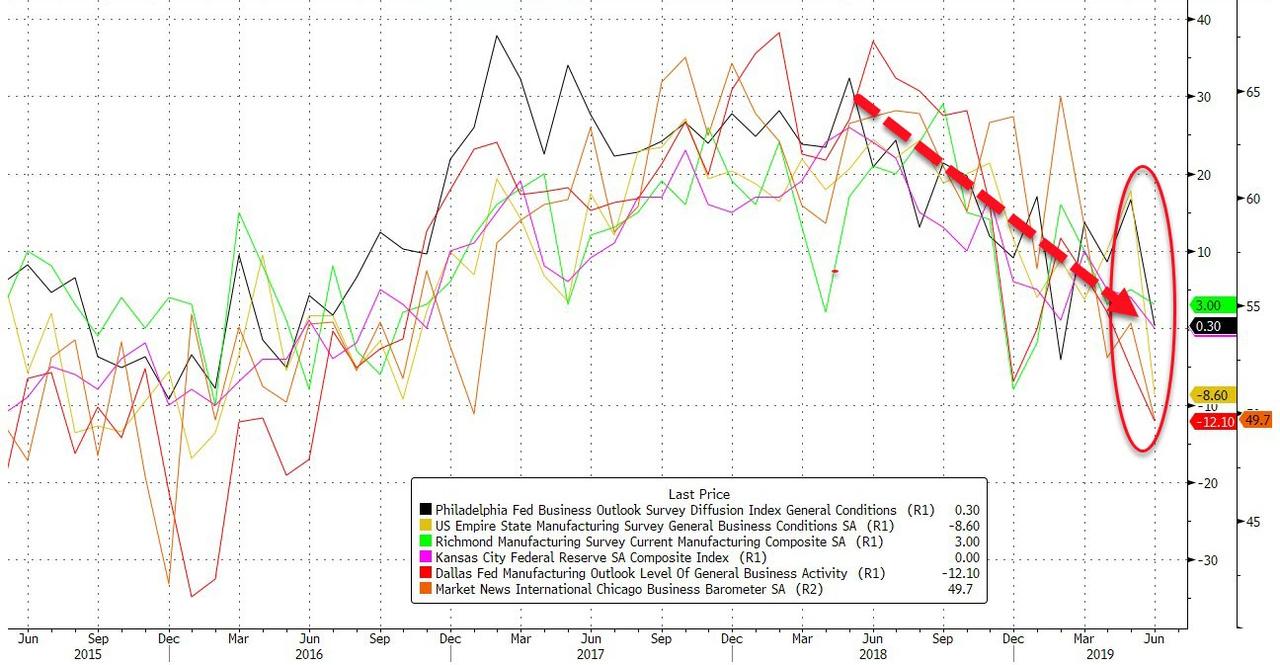

This comes on the heels of the total, broad-based collapse in US regional Fed manufacturing business surveys…

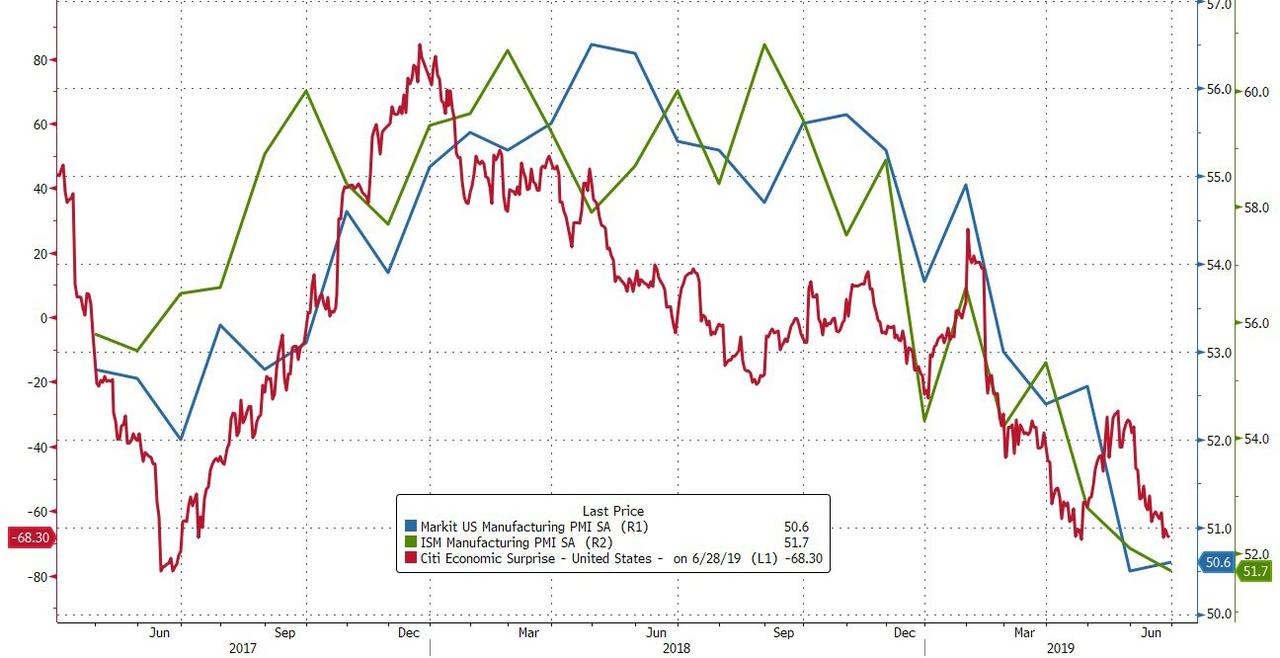

So, expectations were for a downshift in US Manufacturing ISM/PMI headline surveys (Goldman warned that a simple analysis based on the historical deviations between the ISM and our survey tracker suggests slightly more than a one in three chance of the ISM manufacturing index falling into contractionary territory).

But that’s not what happened!!

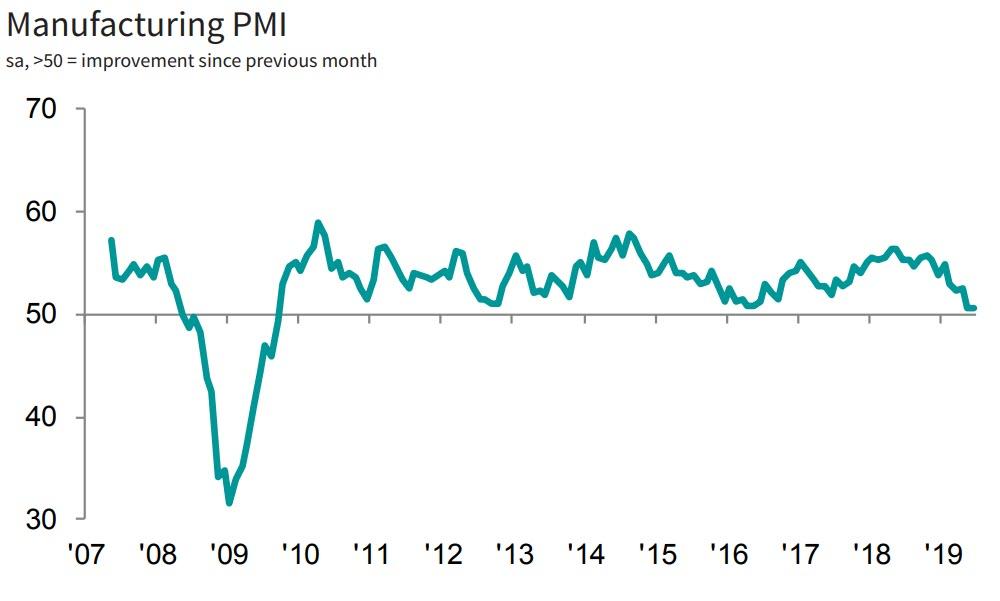

Markit US Manufacturing PMI beat expectations, rising from 50.1 to 50.6 in June (this was nonetheless the second-lowest figure since September 2009).

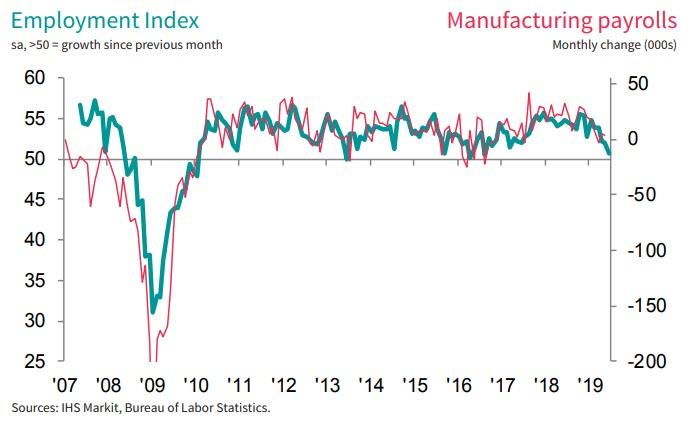

However, under the hood, not everything was awesome with employment expanding at its slowest rate since Aug 2016.

Chris Williamson, Chief Business Economist at IHS Markit said:

“US manufacturers reported business conditions to have remained the toughest for nearly a decade in June. The past two months have seen the lowest readings since the height of the global financial crisis in 2009.

“The survey provides accurate advance indicators of comparable official data, and paints a worrying picture of marked declines in both output and jobs. The June survey sub-index readings are consistent with manufacturing output contracting at a quarterly rate of 0.7% and factory payrolls falling by 18,000.

“A major development in recent months has been the deteriorating performance of larger companies, where the last two months have seen the lowest PMI readings for a decade. After inventories rose sharply earlier in the year, large companies have moved to destocking in May and June amid a sharp slowing in new order inflows.

“Although business optimism about the future lifted slightly higher, it remained close to survey lows to indicate persistent low morale. Worries centred on signs of slowing demand both at home and internationally, weaker sales, and geopolitical uncertainty.

“Tariffs meanwhile continued to push up prices, but weak demand often limited the ability of firms to pass higher prices onto customers, suggesting overall inflationary pressures have weakened compared to earlier in the year.”

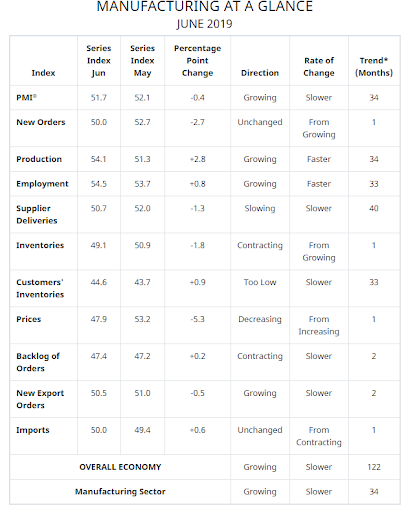

Additionally, ISM’s Manufacturing PMI beat expectations, printing 51.7 (better than the 51.0 expected) but still down from the 52.1 level in May – to the weakest since October 2016.

New orders fell to 50, from 52.7 – the lowest since Dec 2015 (and new export orders also slowed).

Respondents are unhappy:

“China tariffs and pending Mexico tariffs are wreaking havoc with supply chains and costs. The situation is crazy, driving a huge amount of work [and] costs, as well as potential supply disruptions.” (Computer & Electronic Products)

“Demand for the remainder of 2019 has softened significantly, due to issues in the aerospace industry. The 2020 outlook is looking stronger. Overall, state and local economies remain strong. Recruiting for open positions still requires time to find the right candidates.” (Transportation Equipment)

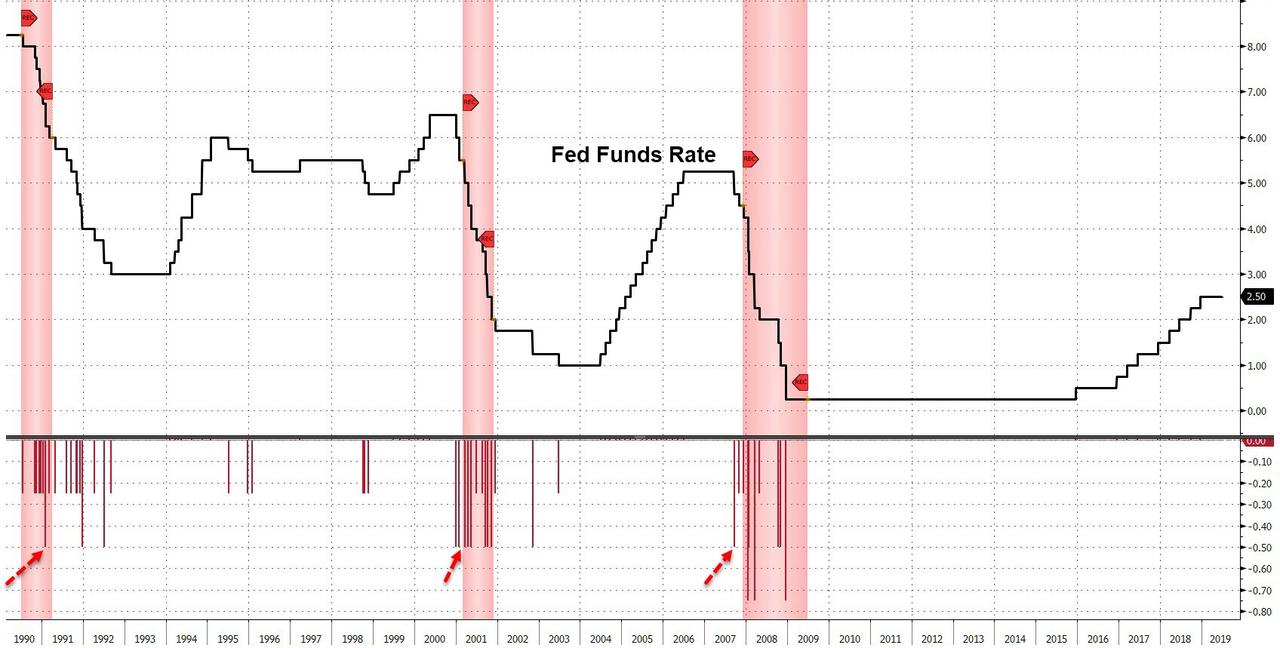

Is this “bad” enough to help The Fed?

via ZeroHedge News https://ift.tt/2Jcb0ac Tyler Durden