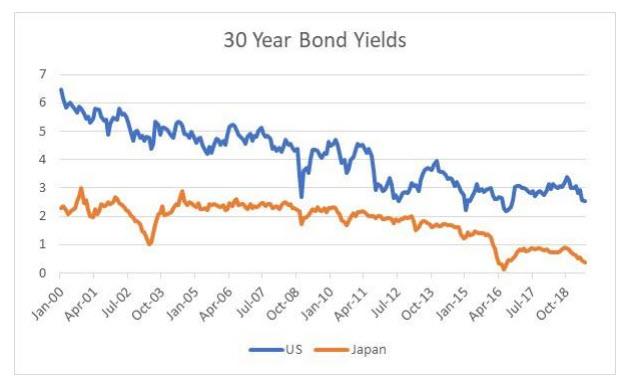

For the first time in 41 days, the US Treasury yield has un-inverted…

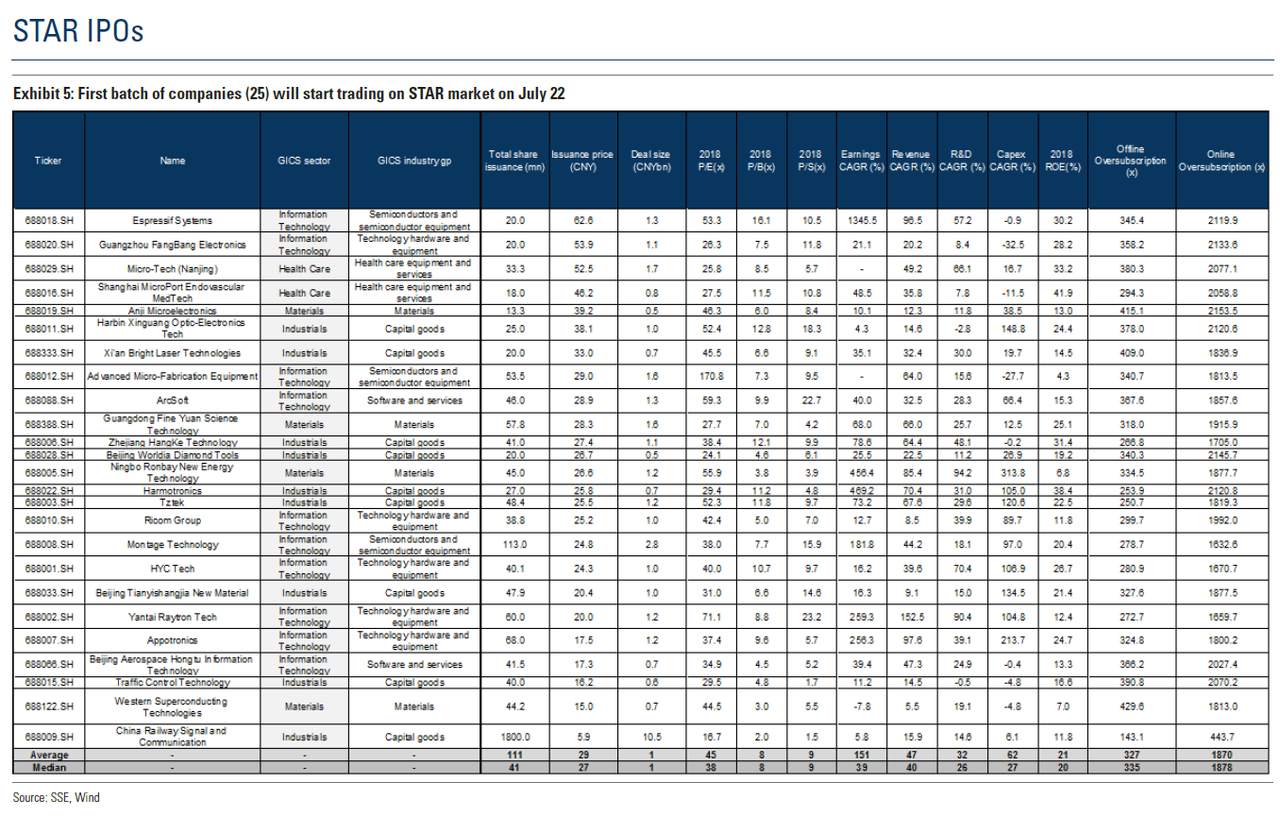

Chinese stocks managed gains overnight (even as STAR IPOs tumbled on their second day)…

European Stocks soared on the day with Germany leading the way…

US equities spiked on China trade headlines…

The buying program that hit when the China trade headlines printed, was the highest since July 10th’s open (after Powell’s prepared remarks prompted a panic-bid)…

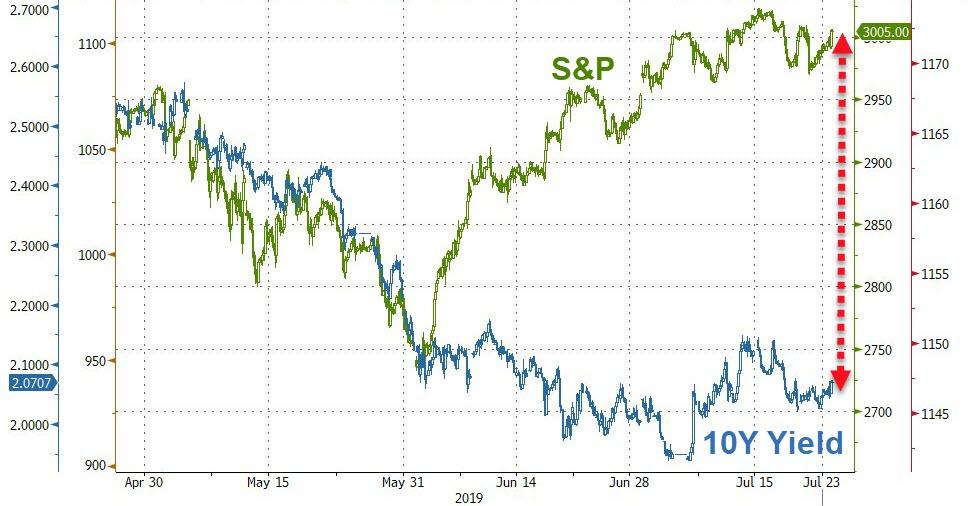

S&P spiked back above the 3,000 level…

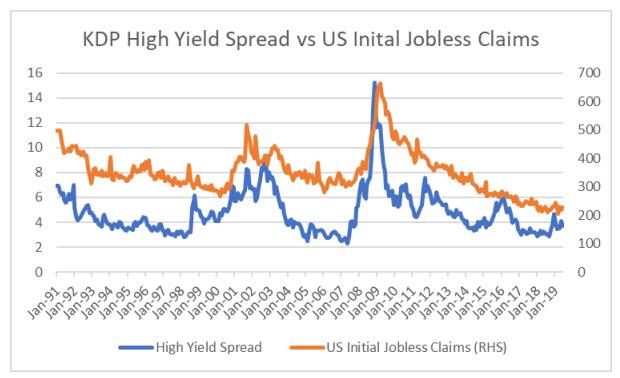

While tech stocks are at record highs, tech credit risk is anything but…

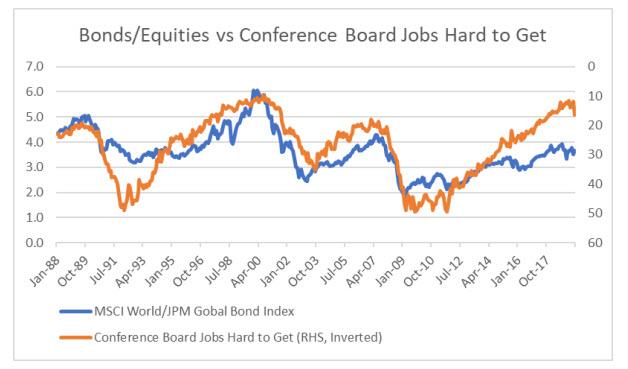

Bonds and stocks remain in their own worlds…

Treasury yields rose modestly on the day with the long-end underperforming…

10Y yields plunged on the dismal Richmond Fed data, but sellers re-emerged quickly…

The yield curve (3m10Y) spiked almost 5bps today, surging back above 0 for the first time in 41 days…

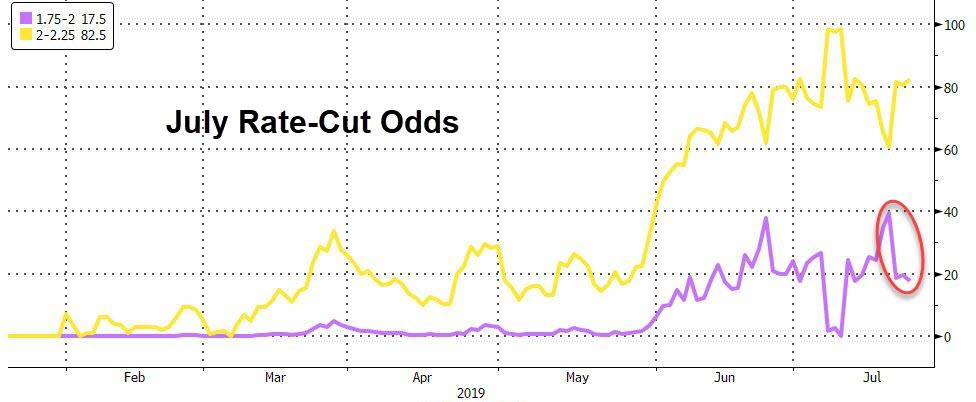

The odds of a 50bps rate cut next week slipped to 17.5%…

The debt ceiling ‘kink’ in the Bill curve has been erased…

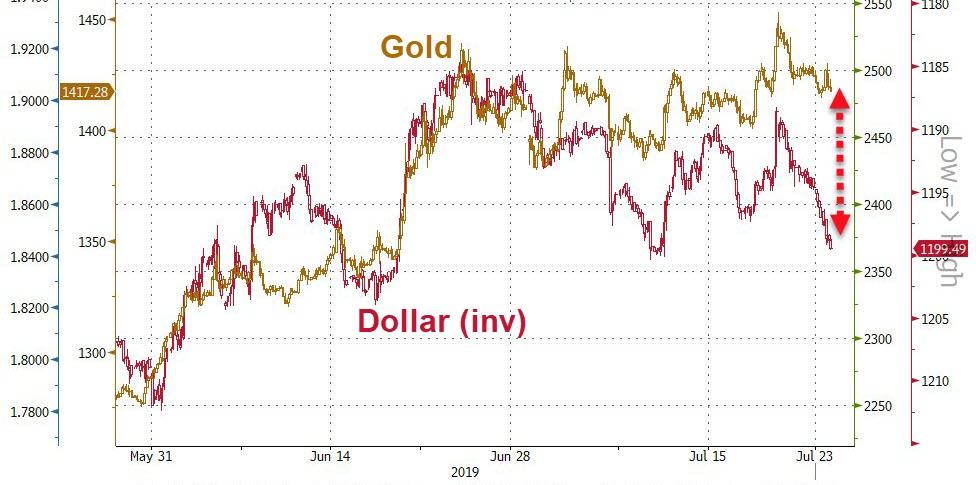

The Dollar rose for the 3rd day in a row – bouncing back from Fed’s Williams lows – this is the biggest 3-day jump in the dollar in over 4 months…

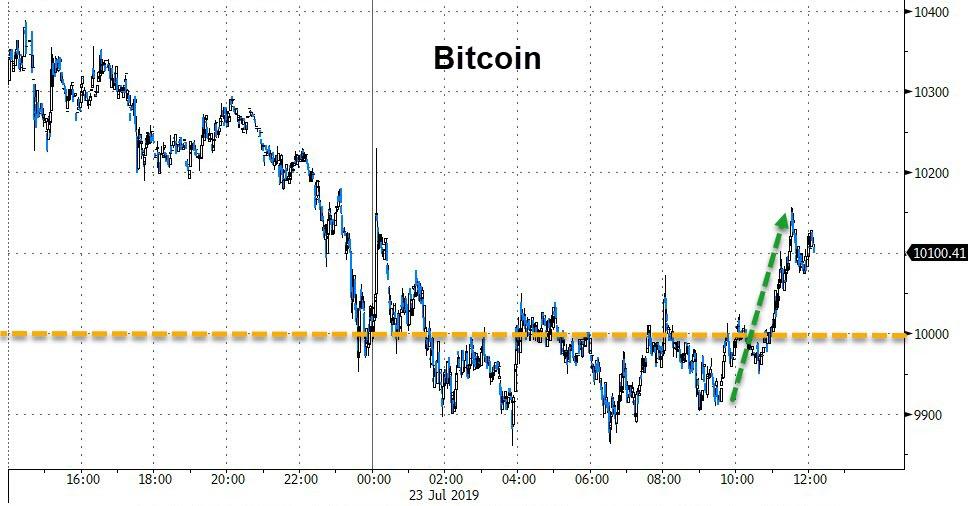

Cryptos were mixed today but only Bitcoin Cash is green on the week…

But Bitcoin rebounded back above $10,000…

Gold and Copper slipped on the day as the dollar rallied but Silver and Oil prices rallied further…

Gold is holding up despite the dollar strength…

Silver outperformed Gold for the seventh day in a row…

Oil prices spiked back up to $57 ahead of tonight’s API inventory data…

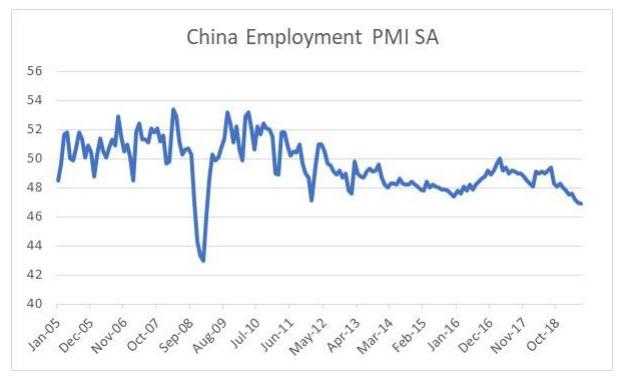

Finally, soft data collapsed to post-Trump lows (Richmond Fed plunged) as hope disappears…

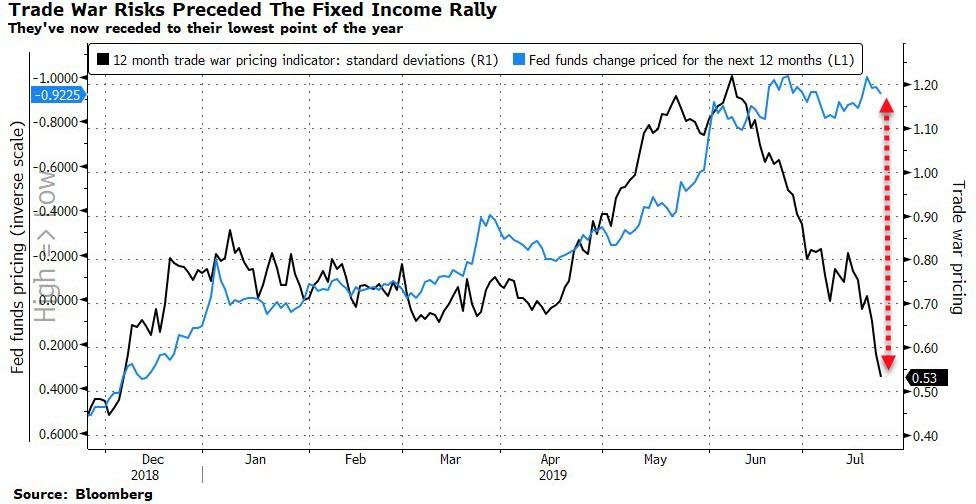

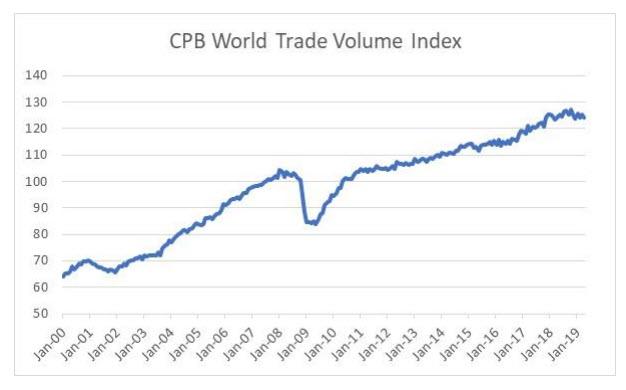

And trade-deal complacency is running high once again…

And perhaps even more notably, as Bloomberg’s Cameron Crise quantifies, as trade-war risk is priced out of markets (black line) so expectations for the need for a Fed rate cut should be reducing… but aren’t…

via ZeroHedge News https://ift.tt/2Ybe5g7 Tyler Durden