Goldman Warns ‘Quant Quake’ Marks The End Of Momentum Rally, Not A Buying Opportunity

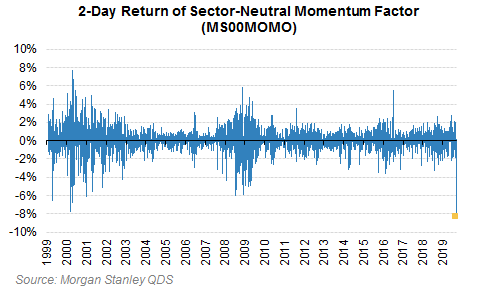

In the wake of the sharpest Momentum reversal in a decade, Goldman Sachs addresses some common investor questions on the equity market rotation and discuss what we expect going forward.

Q1: What just happened?

In the last two weeks, high momentum stocks have sharply underperformed what had been the equity market’s biggest laggards.

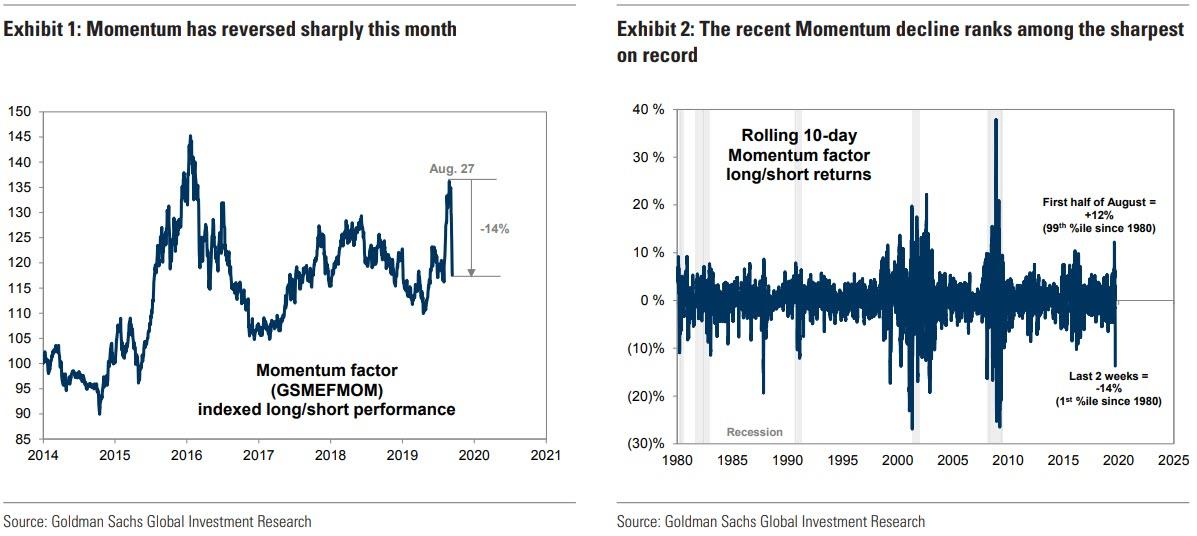

Our Momentum factor tracks the equal-weighted performance of the top 20% vs. bottom 20% of S&P 500 stocks ranked on trailing 12-month returns. The factor has declined by 14% since August 27, which marks the worst two-week return for Momentum since 2009 and ranks in the 1st percentile of historical returns since 1980.

Although the Momentum plunge has been sharp, it effectively only served to unwind the exceptionally strong Momentum rally in August. Momentum soared by 12% in the first half of August and 17% through August 27, a surge that in the last 40 years has only been matched in the late 1990s and late 2000s.

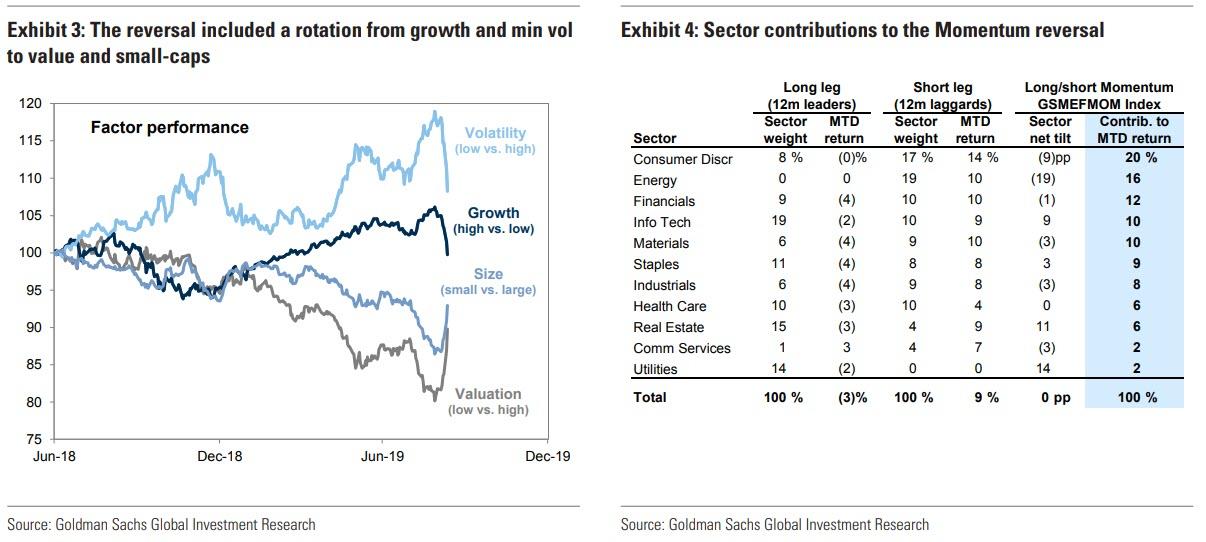

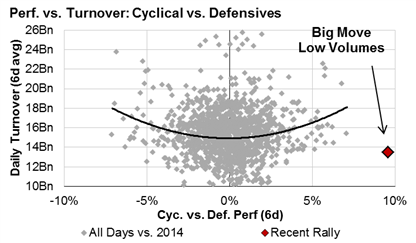

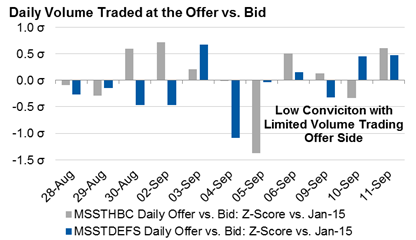

The reversal in Momentum captured sharp rotations in other equity factors and sectors that had become increasingly correlated with each other and Momentum through August. As Momentum declined, min vol and growth stocks also fell, while small-caps and value stocks outperformed. At the industry level, the Momentum reversal has reflected a rotation away from bond proxies like Utilities and secular growth stocks like Software & Services in favor of cyclicals like Consumer Durables that had lagged during most of the past 12 months. Unlike our other factors, our Momentum factor is not sector-neutral.

Q2: What caused the Momentum reversal?

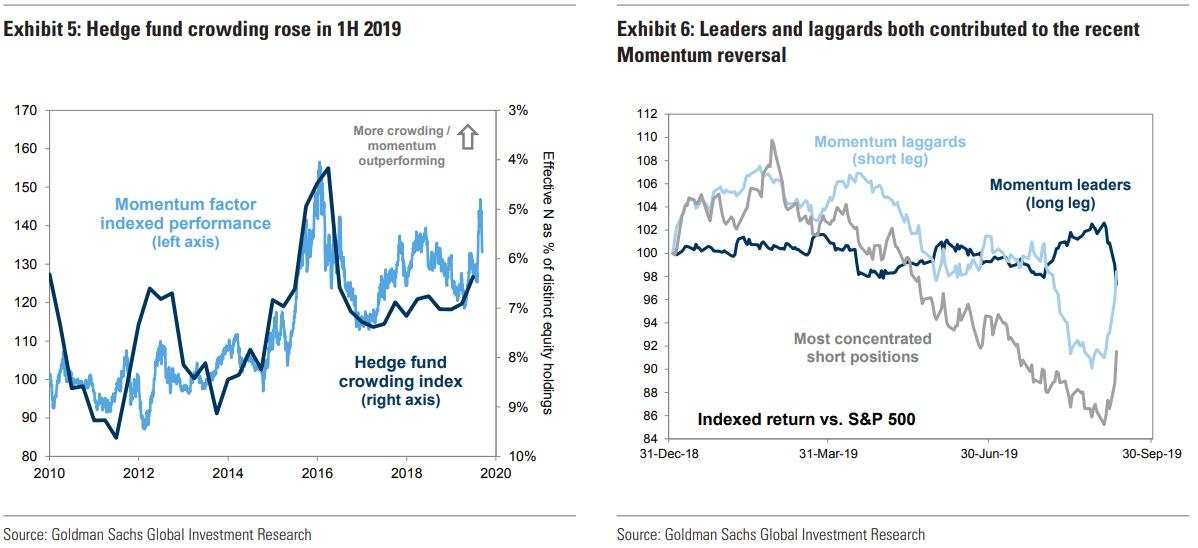

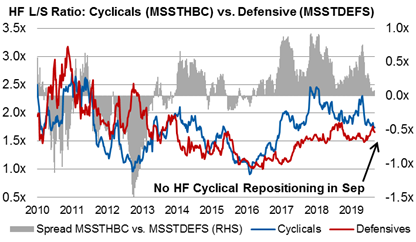

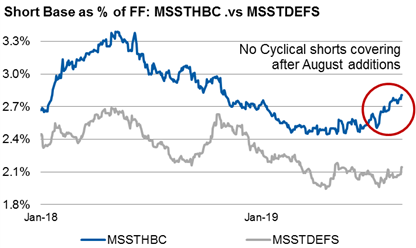

A rise in investor crowding set the stage for the violent market rotations of the last two weeks.

As we highlighted in our most recent Hedge Fund Trend Monitor, trends of rising portfolio concentration, falling position turnover, and increased crowding have accelerated in recent quarters and increased the risk of a positioning-driven unwind. The rise in crowding helped drive the outperformance of the most popular stocks, which in turn further increased both leverage and the weight of these positions in investor portfolios absent any active offsetting adjustment.

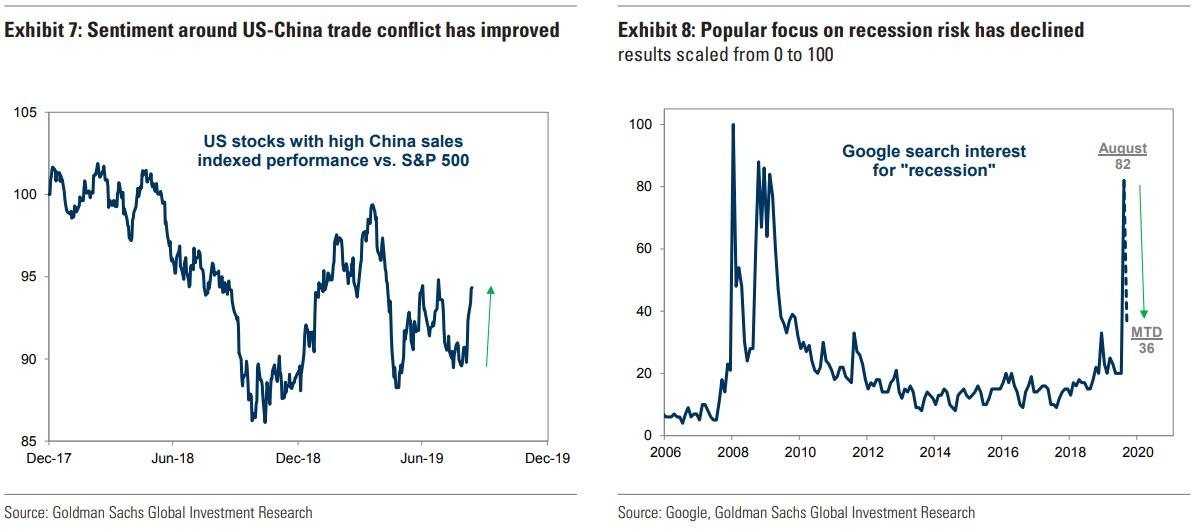

Perceived improvement in US-China trade negotiations and better-than-feared economic data helped ease investor concern about an impending recession, lifting bond yields and sparking the market rotation. At the same time as headlines indicated progress in trade negotiations, the ISM Non-Manufacturing index beat expectations and helped lift our economists’ MAP index of economic data surprises into positive territory. The August jobs report, while slightly missing consensus expectations, showed payroll growth in line with the trailing 3-month average and gave no indication that trade concerns were having a critical impact on corporate hiring activity. These catalysts released the potential energy created by investor crowding, moving 10-year US Treasury yields from 1.45% to 1.75% and driving the equity Momentum unwind.

Q3: What should we expect for Momentum going forward?

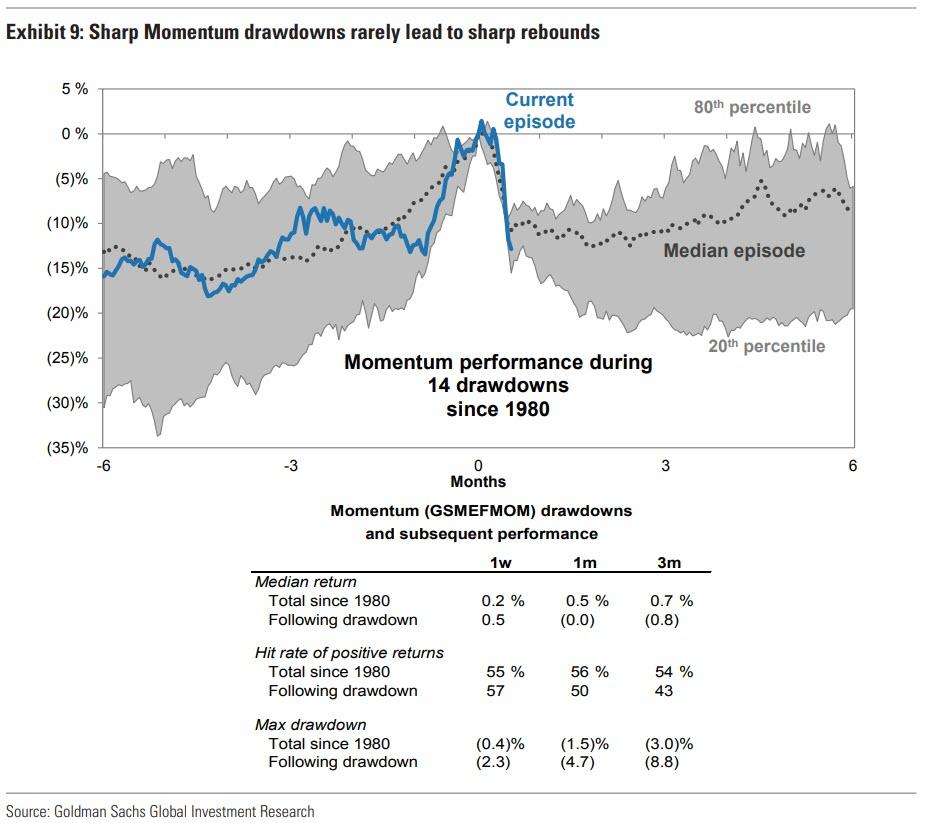

Sharp Momentum drawdowns similar to the one that has taken place in the last two weeks usually mark the end of the Momentum rallies rather than tactical buying opportunities.

The chart below shows Momentum performance during 14 other 1st or 2nd percentile two-week Momentum reversals since 1980. The 14% Momentum decline of the last two weeks has already reached the median historical episode’s trough, which typically occurred about six weeks after the Momentum peak. On average, Momentum has traded flat during the months following similar sharp drawdowns, although returns in the initial drawdown’s wake have generally been weaker than Momentum returns in other environments.

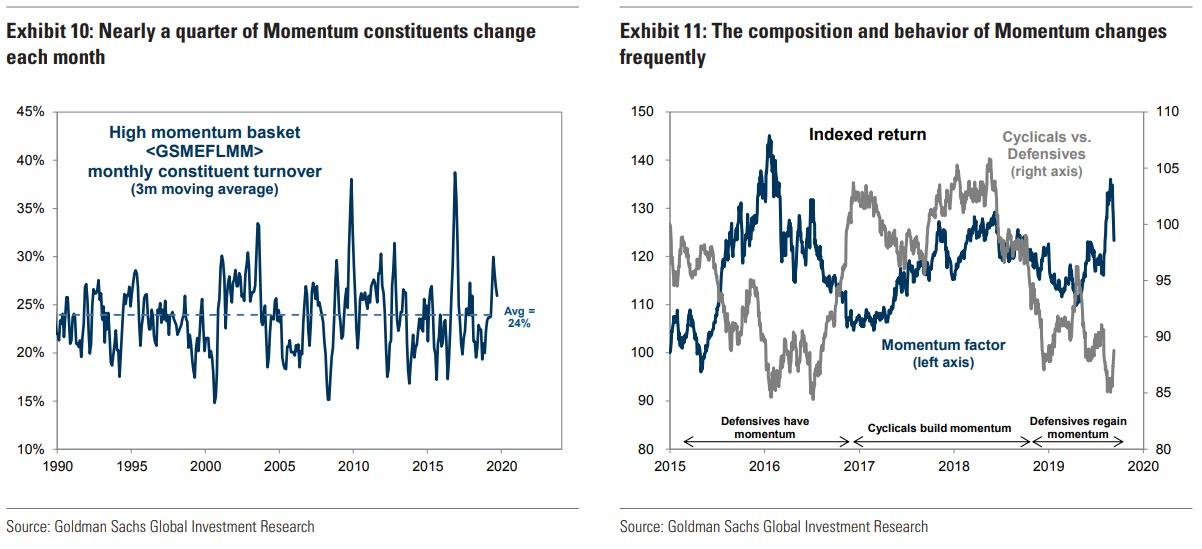

One reason Momentum rarely rebounds following sharp drawdowns is that the composition of Momentum frequently changes. On average, nearly a quarter of the constituents in our Momentum factor are replaced during each monthly rebalance. Because of the sharp moves during the last two weeks, many of the stocks that currently comprise our high Momentum basket are unlikely to rank as constituents in the next rebalance at the beginning of October.

From a macro perspective, Momentum typically performs best during extended periods of macroeconomic and market consistency. Long periods against a consistent macro backdrop allow investors to rotate portfolios toward the stocks best-suited for those environments and benefit from those positions as the macro trends continue. Most recently, the environment of slowing economic growth that has characterized the last 12 months has tilted Momentum toward defensive equities and away from cyclicals. Momentum and cyclicals exhibited a similarly strong negative correlation in the weak economic environment of 2015 and early 2016. In 2H 2016, however, growth expectations rebounded, unwinding the Momentum trade. By mid 2018, as tax reform helped lift US economic growth, the correlation between Momentum and cyclical equities had turned positive, only to reverse again as growth slowed at the end of the year. Looking forward, for Momentum to resume its outperformance, investors will need to either return quickly to the mindset of economic deceleration and recession risk, or wait until Momentum builds again in a form appropriate for an improved economic environment.

Q4: Does the Momentum reversal signal the start of a rotation from Growth to Value?

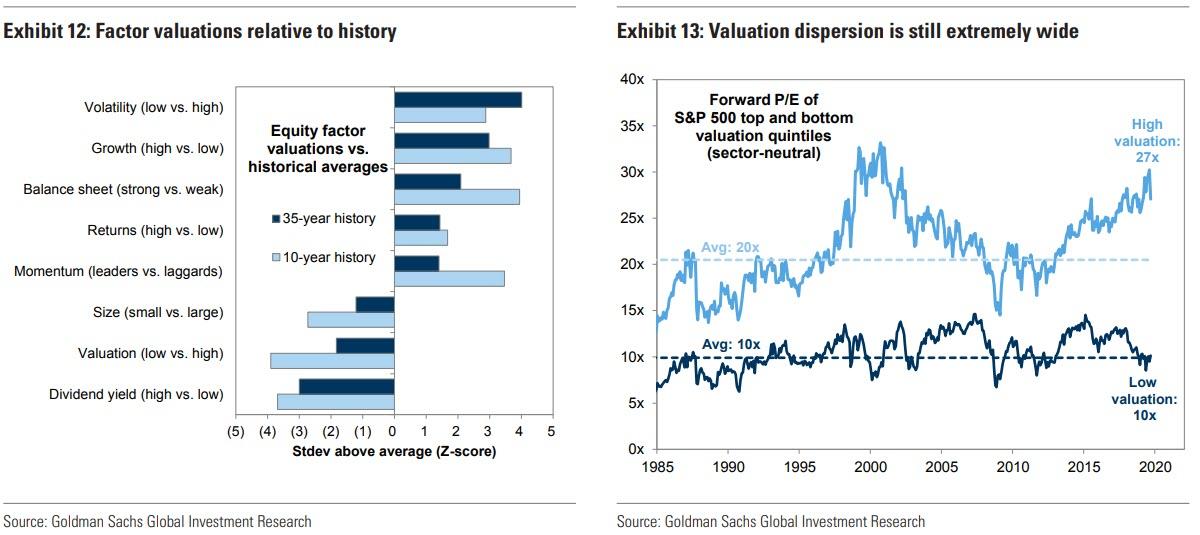

The sharp outperformance of Value over Growth in the last two weeks has generated renewed investor focus on the possibility that long-suffering Value stocks reverse their multi-year trend of underperformance.

Even including its 13% rally since late August, our long/short sector-neutral Value factor (GSMEFVAL) has declined by 7% YTD and by 20% in the last five years. As Value stocks have underperformed, the valuation gap between the most expensive and least expensive S&P 500 stocks has opened to the widest level since 2000.

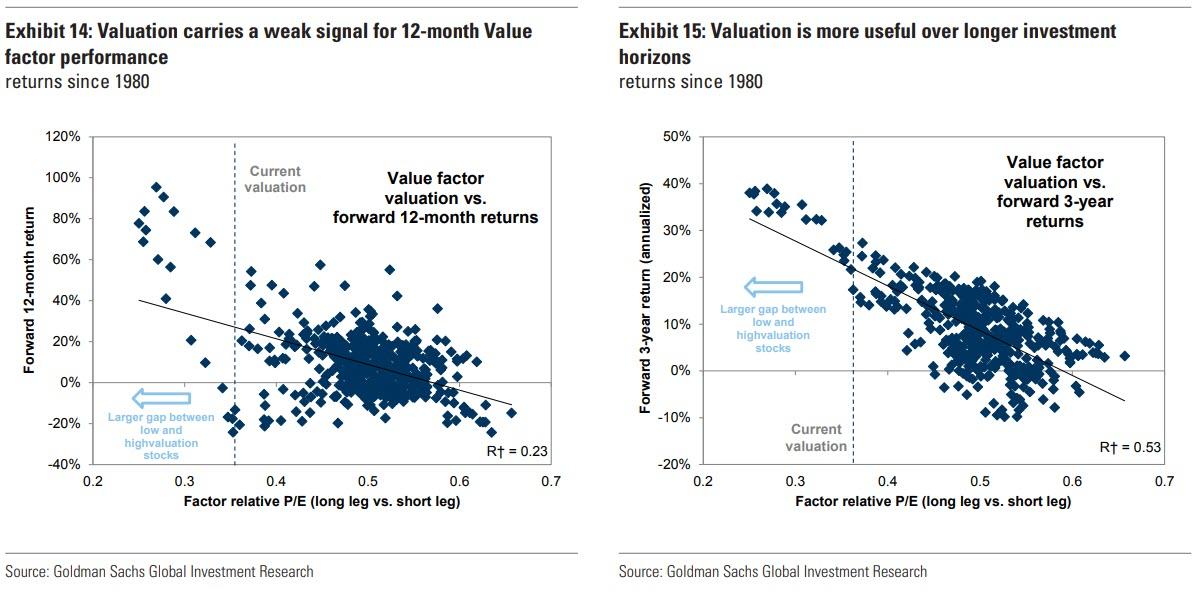

The dispersion of stock multiples has historically been a good predictor of the returns to be gained by Value investors, but has not been a useful signal for timing. At the start of 1999, for example, the top quintile of S&P 500 stocks traded with a P/E multiple of 30x, while the bottom quintile traded at just 12x. An investor buying the Value factor then would have watched it decline by 30% during the subsequent 15 months. If the investor had persisted with the strategy through the end of 2001, however, she would have realized a cumulative total return of 65% (18% annualized).

More than valuation dispersion, the path of economic growth will be the key determinant for Growth vs. Value performance in the near future. Historically, Value stocks have fared best in periods of very strong or very weak economic growth. In contrast, during periods of positive but modest growth, investors tend to favor the Growth stocks able to generate idiosyncratic growth in excess of the economy. These are often also periods in which investors favor the “Quality” stocks able to withstand a weak economic environment, even if those stocks carry a substantial valuation premium. For this reason, Value stocks typically underperform late in the economic cycle, as they have in recent months. Looking forward, even with valuation dispersion wide, investors will likely continue to favor Growth and Quality at the expense of Value unless the pace of economic growth changes materially, either rebounding sharply as it did in 2H 2016 or dipping finally into recession.

Tyler Durden

Thu, 09/12/2019 – 12:40

via ZeroHedge News https://ift.tt/34GgALM Tyler Durden

The latest escalations are particularly worrisome. Washington applied tariffs—which are

The latest escalations are particularly worrisome. Washington applied tariffs—which are