Authored by Elijah Magnier, Middle East based chief international war correspondent for Al Rai Media

ZH note: War correspondent Elijah Magnier’s rare access to high level sources in Iran, Iraq and Lebanon, gives him unique capability to articulate Hezbollah’s strategic thinking and perspective, which he does so below from an on the ground perspective based on local sources.

The “Axis of the Resistance” has been informed about Hezbollah’s intention to respond to Israel imminently, confirmed sources within the decision-making leadership. The main offices of militant leadership and all gathering of forces have been abandoned or forbidden, and a state of full alert has been declared in preparation for a possible Israeli decision to go to war. In Iran, Syria and Palestine, the finger is on the trigger. Is the Middle East going to war? Actually, it all depends on how far and in which direction the Israel Prime Minister Benjamin Netanyahu wants to go — and the degree to which he will accept, or not, the hit back from Hezbollah.

This all snowballed when, from al-Ayen in the Bekaa Valley, Hezbollah Secretary General Sayyed Hassan Nasrallah launched his threat against Israel. He swore to down drones violating Lebanese sovereignty and threatened to kill Israelis. This is would be carried out in retaliation for the Israeli killing of two Hezbollah members in Syria, and for sending suicide drones to hit Hezbollah high-value objectives and capabilities in the suburbs of Beirut.

Netanyahu responded a few hours late by bombing a position of the Popular Front for the Liberation of Palestine – General Command (PFLP-GC) – in the same Bekaa Valley, to send a clear message to Sayyed Nasrallah: Hezbollah’s challenge is being acknowledged, and answered with another Israeli challenge. Now it is only a question of when, how, and at what cost the Hezbollah “bloody retaliation” will be, bloody because it is inevitable that Israeli soldiers will be killed.

Sayyed Nasrallah had no option but to respond to the Israeli violation of the Rule of Engagement (ROE) established since the 2006 third Israeli war on Lebanon. If he fails to hit Israel and accepts the ongoing international mediation and politico-financial temptations offered to the Lebanese government to persuade him to renounce his promised attack, he loses his credibility, which is substantial right now.

Moreover, Israel would then be encouraged to hit more targets in Lebanon as it is doing in Iraq and in Syria for some years now, against hundreds of objectives. If Hezbollah refrains from responding as promised, Netanyahu will “get away with it”: this boosts his chances in the forthcoming election.

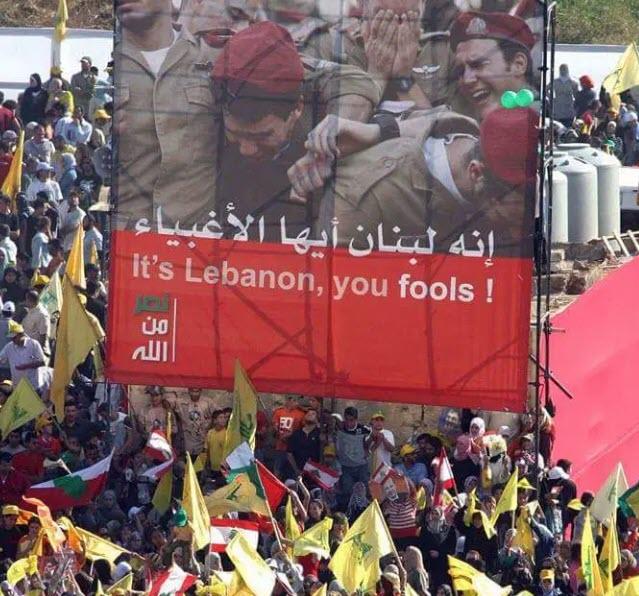

Sayyed Nasrallah committed himself before the whole world to hit back at Israel. All eyes in the Arab world – in particular among the Palestinians, the Syrians, the Iraqis, the Yemeni and his own Lebanese society that is embracing Hezbollah – are focused on what the target will be and when the attack will take place. In Israel, Sayyed Nasrallah has high credibility, and people believe him, as indeed most Israeli newspapers write today. Hezbollah is expected to halt Israel’s violation of the Rules of Engagement and give an example to follow for all those within the “Axis of the Resistance” and put a stop to the Israeli attacks on their sovereignty.

It will not be possible to stop all Israeli drones from flying over Lebanon and prevent these from collecting intelligence information. That is considered vital to Israel to update its bank of objectives and analyse any potential threat. Sayyed Nasrallah is aware of that and for that very reason he would indeed attempt to down Israeli drones.

Since the attack against Beirut, Israeli drones continue over flying Beirut: “Israel is doing everything to provoke a reaction from Hezbollah so that it can identify our anti-air missile capability”, said a source within the “Axis of the Resistance”.

Israel is also waiting to see if it is possible to continue targeting Hezbollah warehouses or send suicide drones to target-kill specific individuals, depending on the price it needs to pay in exchange for its killing of Hezbollah operatives. Netanyahu has positioned himself at the bottleneck, unable to move in or out. He pushed his arrogance to the limit in Lebanon, knowing that he would corner Sayyed Nasrallah if Hezbollah were not to hit back (due to the critical financial situation in Lebanon) and the desire to stay away from a devastating war. Now, the Israeli Prime Minister is asking Hezbollah to “calm down”. But it looks like it is too late to turn back the hands of the clock.

Because Iraq did not reply to the Israeli targeting of its warehouses (five destroyed so far) and the assassination of an Iraqi commander (killed by a drone on the Iraqi-Syrian border), Israel obviously concludes that the Iraqi stage is open to its military activities. Hezbollah is aware of the Israeli modus operandi so it cannot permit replication in Lebanon, even at the cost of going to war.

Actually, in Israel, many leaders are blaming Netanyahu for gossiping and bragging about Israel’s responsibility in attacks outside Israel’s borders. Israel generally prefers to be quiet about this practice, one used by Israel for decades but now exploited by Netanyahu for electoral purposes.

So, what is the “cost” Hezbollah is looking for? According to sources within the “Axis of the Resistance”, Hezbollah is looking for a target – to kill two or three Israelis or send a suicide drone against an Israeli military gathering or other more deadly and spectacular options. “Israel is only a few meters from the Lebanese borders. Killing Israeli soldiers is so simple when a Rule of Engagement is violated. Netanyahu will have to justify for his people what advantage he gained in breaking the cessation of hostility since 2006 despite repeated warnings of the consequences. He is either looking for war – in which case both belligerents have to be ready – or he will have caused unnecessary killing on both sides. He will have to pay the price for this,” said the source.

Obviously, Hezbollah is not looking to push Israeli too far outside its comfort zone, with an “acceptable” number of casualties: a hit in exchange for another hit. It will depend on Netanyahu to take it further into war if he wishes to, or to nurse his wounds. Although the Israeli Prime Minister holds the initiative and was respecting to the “rules of the game” as long as he honored the undeclared agreement, it is time now for him to understand that Lebanon, despite its small size, is not Yemen or Syria or Iraq.

Sayyed Nasrallah’s disposition to attack Israel was boosted by the Lebanese President Michel Aoun who described the Israeli aggression as “an act of war”. Prime Minister Saad Hariri considered the aggression “a threat to regional stability”. Hezbollah has enough domestic support to stand against Israel and retaliate even if the situation goes out of control. Sayyed Nasrallah is no longer constrained by the Lebanese officials who asked him months ago to take into consideration the tourist season, and to share their positive view of the highly tense situation in the Middle East. Indeed, the Iranian, Iraqi, Syrian, Palestinian and Lebanese fronts are all on the verge of explosion, depending on how Israel and the US are willing to be “guided.”

During the last Israeli elections, Hezbollah decided to keep at a distance. This time it seems the situation is different. There is an opportunity for Hezbollah to damage Netanyahu who is facing elections during the third week of September. In this case, Hezbollah’s reply to Israel must be before the 19th of September. If Netanyahu decides to go to war regardless of the outcome, he will certainly lose his possibility of re-election. Most probably, if he does not respond to Hezbollah, he will look weak but will come out of it with less damage.

This takes us to the date of the attack. First, and indeed above all, it depends on the opportunity and on identifying a selective target. That depends on the military decision and findings on the Lebanese-Israeli borders and most probably in the next 72 hours. Second, there are possibilities for allowing the 31stof August to go by, the date the “Amal” movement is planning a large gathering in Beirut to start celebrating the first day of Muharram. This is the first night that marks the beginning of Ashura, a solemn day of mourning for the martyrdom of Imam Hussein Bin Ali Bin Abi Taleb, Mohammad’s grandson, at Karbalaa, Iraq.

The first 10 days of Ashura bring most of the Shia in Lebanon and in particular Hezbollah supporters, to the utmost level of sacrifice. Netanyahu could not have chosen a worse timing for his violation of the Rules of Engagement.

Sayyed Nasrallah is not obliged to provide a date of attack to Israel. It is common for an organization to first exhaust a country’s resources by forcing it to mobilize its forces on all fronts and abroad to protect its embassies. Therefore, the exact date will be kept in the hands of Hezbollah to evaluate. It could be that allowing the Israeli soldiers to relax on the borders after several weeks of lack of action would create the best opportunity, but I doubt Hezbollah would wait that long. As we have said, Hezbollah as a matter of precaution has abandoned its offices and known gathering places: this is standard practice when war (an Israeli hit or attack) is expected. Netanyahu has really no alternative but to wait and decide if war is really going to be his next best option.

via ZeroHedge News https://ift.tt/2NJhzVz Tyler Durden