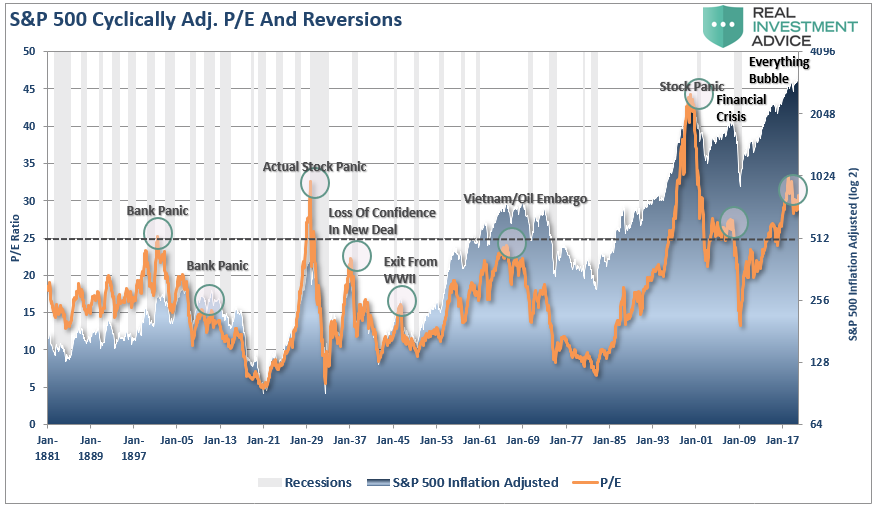

The latest NBC/Wall Street Journal poll spends a lot of time sussing out American voters’ views on President Donald Trump’s impeachment and the 2020 election. But something else is tucked in there too: new numbers on the national mood when it comes to capitalism and socialism.

Fifty-two percent of those polled said they viewed capitalism positively, while just 19 percent said the same about socialism. In an almost mirror flip, 18 percent had a negative view of capitalism, while 53 percent viewed socialism negatively.

The poll of 1,000 registered voters was conducted last week (and has a 3.1 percentage point margin of error).

“Democratic primary voters have a net-positive impression of socialism (40 percent positive, 23 percent negative), and Dem voters ages 18-34 view it even more favorably (51 percent to 14 percent),” reports NBC. “But key general-election groups like independents…suburban voters and swing-state voters have a much more negative impression of socialism.”

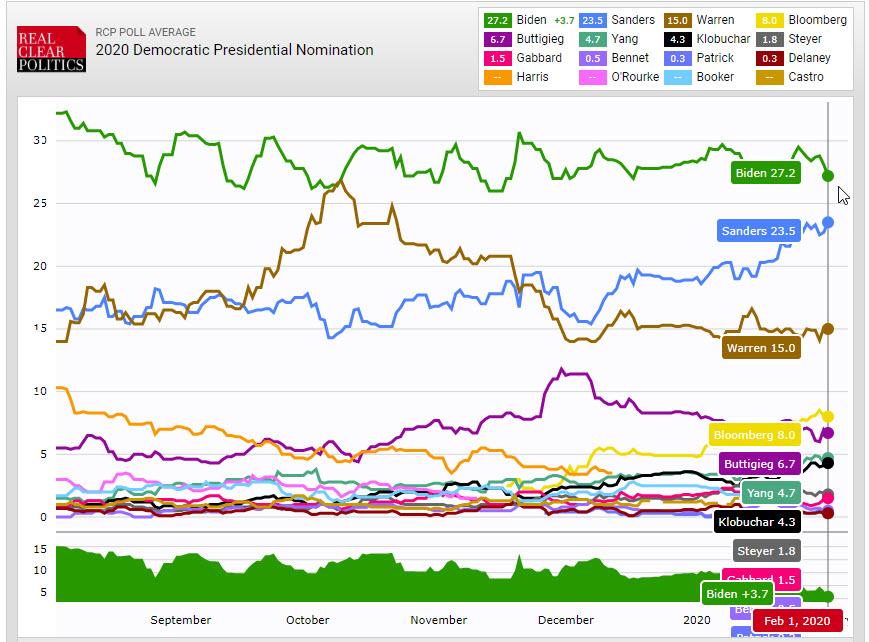

The first votes for the Democratic presidential nominee are being cast in Iowa today.

FREE MINDS

A false positive drug test prompted the authorities to take an Alabama mom’s newborn, just four hours after she gave birth. The hospital “declined to comment on why [Rebecca Hernandez] was drug tested in the first place,” says NBC. But “in many parts of the state, hospitals test mothers without their consent, and tests are often done on a case-by-case basis” that winds up biased against poor women.

A 2015 investigation from ProPublica found that Alabama’s rules—aimed at stopping drug use by pregnant women and new mothers—are some of the most strict in the country.

Hernandez has since been reunited with her new son, but the experience was a “nightmare,” she told WAFF last week.

Her doctor, Yashica Robinson, said the false positive probably came from Hernandez eating a poppy seed muffin the day before she went into labor. Robinson criticized same-day drugs tests that trigger the takeaway of newborn children and said hospitals should wait on lab-confirmed results, which in this case cleared Hernandez.

FREE MARKETS

Warren’s tax returns show gas-well royalties. The Wall Street Journal observes:

On her first day as President, Elizabeth Warren says she will “ban fracking—everywhere,” while putting a “total moratorium” on leases offshore and on federal lands. Ms. Warren has signed a pledge to refuse campaign contributions over $200 from the oil-and-gas industry. She’s a past sponsor of a Senate bill called the Keep It in the Ground Act.

So it’s worth noting that, for years, she and her husband reported modest income from natural-gas royalties in her native state of Oklahoma….Ms. Warren’s campaign has posted 11 years of her tax returns, which show gas income from at least 2008. That year she filed jointly with her husband, Bruce Mann, who had $872 in royalties from gas wells in Oklahoma. There are smaller amounts—a few hundred dollars—reported over the next several tax returns, before the yearly earnings stop….

“Elizabeth and Bruce sold or transferred these mineral interests to her children several years ago,” a Warren campaign spokesman said. “Her children still own them. They generated a few hundred dollars a year.” How long did Ms. Warren and Mr. Mann receive these royalties? Were the amounts larger in the past? The campaign declined to say. For context, gas wells become less productive over time.

“If you ask us, there’s nothing wrong here,” the Journal‘s editorial board adds. But “it belies the purism of her presidential rhetoric. She speaks as if oil inevitably stains everything it touches.”

QUICK HITS

- “A recent national poll by Data for Progress found an outright majority of all voters support decriminalizing sex work,” reports the organization. “Additionally, two-thirds of voters age 18–44 support decriminalization.”

- The best Super Bowl ad:

Two Super Bowls ago I was sitting in a prison cell.

Today I am a free woman and my story was featured in a Super Bowl Ad.

I will spend the rest of my life fighting for the wrongly and unjustly convicted!

God Bless America! pic.twitter.com/CGSyk54O37

— Alice Marie Johnson (@AliceMarieFree) February 3, 2020

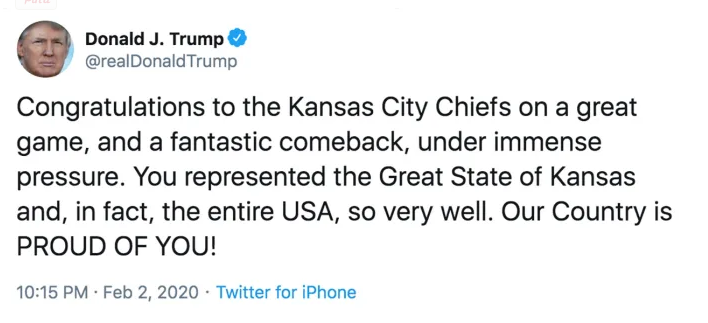

- Speaking of the Super Bowl: Can you spot what’s wrong with this tweet?

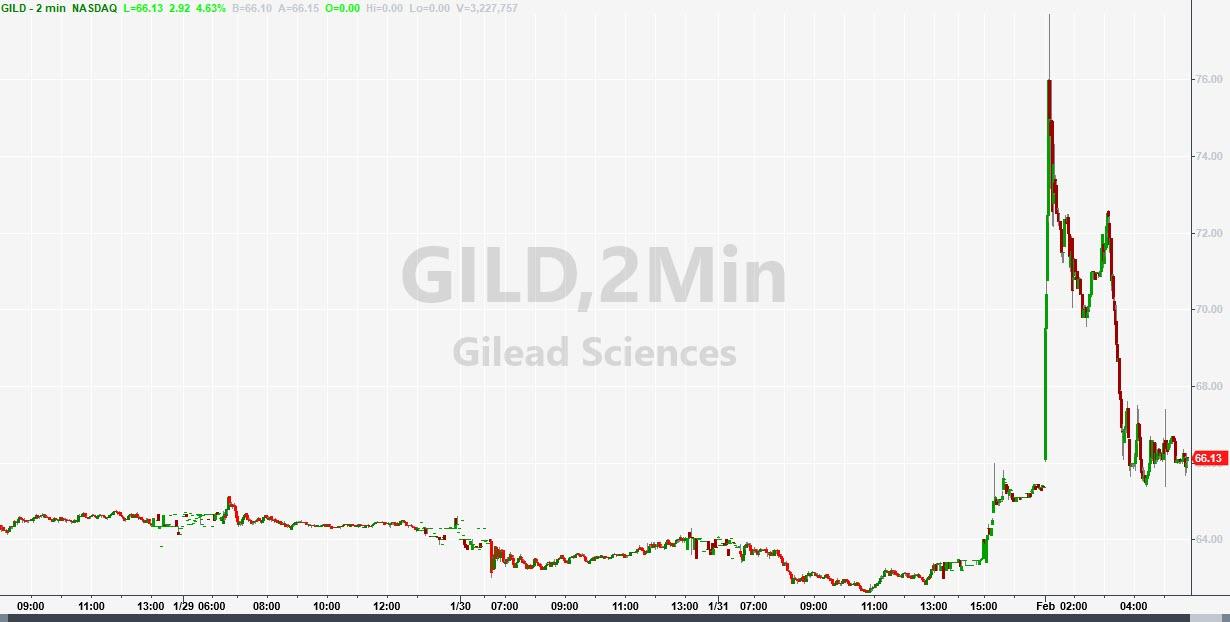

- Coronavirus is causing the Chinese stock market to crater.

- Protecting and serving:

hello garbage nationhttps://t.co/LztzXOqPms pic.twitter.com/NZidbx5Gnm

— Tim Cushing (@TimCushing) February 2, 2020

- A proposed judiciary ethics rule would “tighten existing guidance that lets [federal] judges belong to…but not take leadership roles” in the conservative Federalist Society and the liberal American Constitution Society. Supreme Court Justice Clarence Thomas has called this an attempt “to silence the Federalist Society.”

- The Atlantic hyperventilates over children’s TV.

from Latest – Reason.com https://ift.tt/37VHoJ9

via IFTTT