Heading into yesterday’s painful close to one of the ugliest months since March 2020, which saw a huge forced liquidation rebalance with more than $8 billion in Market on Close orders, we said that while we are seeing “forced selling dump into the close today” this would be followed by “forced Dec 1 buying frontrunning after the close.”

And just as expected, despite yesterday’s dramatic hawkish pivot by Powell, who said it was time to retire the word transitory in describing the inflation outlook (the same word the Fed used hundreds of times earlier in 2021 sparking relentless mockery from this website for being clueless as usual) while also saying the U.S. central bank would consider bringing forward plans for tapering its bond buying program at its next meeting in two weeks, the frontrunning of new monthly inflows is in full force with S&P futures rising over 1.2%, Nasdaq futures up 1.3%, and Dow futures up 0.9%, recovering almost all of Tuesday’s decline.

The seemingly ‘hawkish’ comments served as a double whammy for markets, which were already nervous about the spread of the Omicron coronavirus variant and its potential to hinder a global economic recovery.

“At this point, COVID does not appear to be the biggest long-term Street fear, although it could have the largest impact if the new (or next) variant turns out to be worse than expected,” Howard Silverblatt, senior index analyst for S&P and Dow Jones indices, said in a note. “That honor goes to inflation, which continues to be fed by supply shortages, labor costs, worker shortages, as well as consumers, who have not pulled back.”

However, new month fund flows proved too powerful to sustain yesterday’s month-end dump and with futures rising – and panic receding – safe havens were sold and the 10-year Treasury yield jumped almost 6bps, approaching 1.50%. The gap between yields on 5-year and 30-year Treasuries was around the narrowest since March last year. Crude oil and commodity-linked currencies rebounded. Gold remained just under $1,800 and bitcoin traded just over $57,000.

There was more good news on the covid front with a WHO official saying some of the early indications are that most Omicron cases are mild with no severe cases. Separately Merck gained 3.8% in premarket trade after a panel of advisers to the U.S. Food and Drug Administration narrowly voted to recommend the agency authorize the drugmaker’s antiviral pill to treat COVID-19. Travel and leisure stocks also rebounded, with cruiseliners Norwegian, Carnival, Royal Caribbean rising more than 2.5% each. Easing of covid fears also pushed airlines and travel stocks higher in premarket trading: Southwest +2.9%, Delta +2.5%, Spirit +2.3%, American +2.2%, United +1.9%, JetBlue +1.3%. Vaccine makers traded modestly lower in pre-market trading after soaring in recent days as Wall Street weighs the widening spread of the omicron variant. Merck & Co. bucked the trend after its Covid-19 pill narrowly gained a key recommendation from advisers to U.S. regulators. Moderna slips 2.1%, BioNTech dips 1.3% and Pfizer is down 0.2%.

Elsewhere, Occidental Petroleum led gains among the energy stocks, up 3.2% as oil prices climbed over 4% ahead of OPEC’s meeting. Shares of major Wall Street lenders also moved higher after steep falls on Tuesday. Here are some of the other biggest U.S. movers today:

- Salesforce (CRM US) drops 5.9% in premarket trading after results and guidance missed estimates, with analysts highlighting currency-related headwinds and plateauing growth at the MuleSoft integration software business.

- Hewlett Packard Enterprise (HPE US) falls 1.3% in premarket after the computer equipment maker’s quarterly results showed the impact of the global supply chain crunch. Analysts noted solid order trends.

- Merck (MRK US) shares rise 5.8% in premarket after the company’s Covid-19 pill narrowly wins backing from FDA advisers, which analysts say is a sign of progress despite lingering challenges.

- Chinese electric vehicle makers were higher in premarket, leading U.S. peers up, after Nio, Li and XPeng reported strong deliveries for November; Nio (NIO US) +4%, Li (LI US ) +6%, XPeng (XPEV US) +4.3%.

- Ardelyx (ARDX US) shares gain as much as 34% in premarket, extending the biotech’s bounce after announcing plans to launch its irritable bowel syndrome treatment Ibsrela in the second quarter.

- CTI BioPharma (CTIC US) shares sink 18% in premarket after the company said the FDA extended the review period for a new drug application for pacritinib.

- Allbirds (BIRD US) fell 7.5% postmarket after the low end of the shoe retailer’s 2021 revenue forecast missed the average analyst estimate.

- Zscaler (ZS US) posted “yet another impressive quarter,” according to BMO. Several analysts increased their price targets for the security software company. Shares rose 4.6% in postmarket.

- Ambarella (AMBA US) rose 14% in postmarket after forecasting revenue for the fourth quarter that beat the average analyst estimate.

- Emcore (EMKR US) fell 9% postmarket after the aerospace and communications supplier reported fiscal fourth-quarter Ebitda that missed the average analyst estimate.

- Box (BOX US) shares gained as much as 10% in postmarket trading after the cloud company raised its revenue forecast for the full year.

Meanwhile, the omicron variant continues to spread around the globe, though symptoms so far appear to be relatively mild. The Biden administration plans to tighten rules on travel to the U.S., and Japan said it would bar foreign residents returning from 10 southern African nations.

As Bloomberg notes, volatility is buffeting markets as investors scrutinize whether the pandemic recovery can weather diminishing monetary policy support and potential risks from the omicron virus variant. Global manufacturing activity stabilized last month, purchasing managers’ gauges showed Wednesday, and while central banks are scaling back ultra-loose settings, financial conditions remain favorable in key economies.

“The reality is hotter inflation coupled with a strong economic backdrop could end the Fed’s bond buying program as early as the first quarter of next year,” Charlie Ripley, senior investment strategist at Allianz Investment Management, said in emailed comments. “With potential changes in policy on the horizon, market participants should expect additional market volatility in this uncharted territory.”

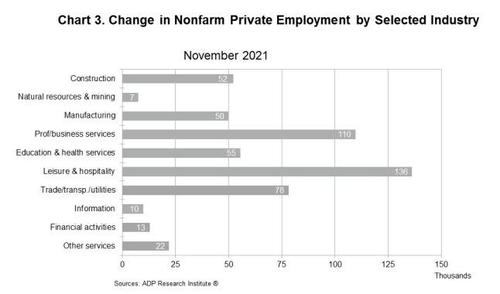

Looking ahead, Powell is back on the Hill for day 2, and is due to testify before a House Financial Services Committee hybrid hearing at 10 a.m. ET. On the economic data front, November readings on U.S. private payrolls and manufacturing activity will be closely watched later in the day to gauge the health of the American economy. Investors are also awaiting the Fed’s latest “Beige Book” due at 2:00 p.m. ET. On the economic data front, November readings on U.S. private payrolls and manufacturing activity will be closely watched later in the day to gauge the health of the American economy.

European equities soared more than 1.2%, with travel stocks and carmakers leading broad-based gain in the Stoxx Europe 600 index, all but wiping out Tuesday’s decline that capped only the third monthly loss for the benchmark this year. Travel, miners and autos are the strongest sectors. Here are some of the biggest European movers today:

- Proximus shares rise as much as 6.5% after the company said it’s started preliminary talks regarding a potential deal involving TeleSign, with a SPAC merger among options under consideration.

- Dr. Martens gains as much as 4.6% to the highest since Sept. 8 after being upgraded to overweight from equal- weight at Barclays, which says the stock’s de-rating is overdone.

- Husqvarna advances as much as 5.3% after the company upgraded financial targets ahead of its capital markets day, including raising the profit margin target to 13% from 10%.

- Wizz Air, Lufthansa and other travel shares were among the biggest gainers as the sector rebounded after Tuesday’s losses; at a conference Wizz Air’s CEO reiterated expansion plans.

- Wizz Air gains as much as 7.5%, Lufthansa as much as 6.8%

- Elis, Accor and other stocks in the French travel and hospitality sector also rise after the country’s government pledged to support an industry that’s starting to get hit by the latest Covid-19 wave.

- Pendragon climbs as much as 6.5% after the car dealer boosted its outlook after the company said a supply crunch in the new vehicle market wasn’t as bad as it had anticipated.

- UniCredit rises as much as 3.6%, outperforming the Stoxx 600 Banks Index, after Deutsche Bank added the stock to its “top picks” list alongside UBS, and Bank of Ireland, Erste, Lloyds and Societe Generale.

Earlier in the session, Asian stocks also soared, snapping a three-day losing streak, led by energy and technology shares, as traders assessed the potential impact from the omicron coronavirus variant and U.S. Federal Reserve Chair Jerome Powell’s hawkish pivot. The MSCI Asia Pacific Index rose as much as 1.3% Wednesday. South Korea led regional gains after reporting strong export figures, which bolsters growth prospects despite record domestic Covid-19 cases. Hong Kong stocks also bounced back after falling Tuesday to their lowest level since September 2020. Asia’s stock benchmark rebounded from a one-year low, though sentiment remained clouded by lingering concerns on the omicron strain and Fed’s potentially faster tapering pace. Powell earlier hinted that the U.S. central bank will accelerate its asset purchases at its meeting later this month.

“A faster taper in the U.S. is still dependent on omicron not causing a big setback to the outlook in the next few weeks,” said Shane Oliver, head of investment strategy and chief economist at AMP Capital, adding that he expects the Fed’s policy rate “will still be low through next year, which should still enable good global growth which will benefit Asia.” Chinese equities edged up after the latest economic data showed manufacturing activity remained at relatively weak levels in November, missing economists’ expectations. Earlier, Chinese Vice Premier Liu He said he’s fully confident in the nation’s economic growth in 2022

Japanese stocks rose, overcoming early volatility as traders parsed hawkish comments from Federal Reserve Chair Jerome Powell. Electronics and auto makers were the biggest boosts to the Topix, which closed 0.4% higher after swinging between a gain of 0.9% and loss of 0.7% in the morning session. Daikin and Fanuc were the largest contributors to a 0.4% rise in the Nikkei 225, which similarly fluctuated. The Topix had dropped 4.8% over the previous three sessions due to concerns over the omicron virus variant. The benchmark fell 3.6% in November, its worst month since July 2020. “The market’s tolerance to risk is quite low at the moment, with people responding in a big way to the smallest bit of negative news,” said Tomo Kinoshita, a global market strategist at Invesco Asset Management in Tokyo. “But the decline in Japanese equities was far worse than those of other developed markets, so today’s market may find a bit of calm.” U.S. shares tumbled Tuesday after Powell said officials should weigh removing pandemic support at a faster pace and retired the word “transitory” to describe stubbornly high inflation

In rates, bonds trade heavy, as yield curves bear-flatten. Treasuries extended declines with belly of the curve cheapening vs wings as traders continue to price in additional rate-hike premium over the next two years. Treasury yields were cheaper by up to 5bp across belly of the curve, cheapening 2s5s30s spread by ~5.5bp on the day; 10-year yields around 1.48%, cheaper by ~4bp, while gilts lag by additional 2bp in the sector. The short-end of the gilt curve markedly underperforms bunds and Treasuries with 2y yields rising ~11bps near 0.568%. Peripheral spreads widen with belly of the Italian curve lagging.

The flattening Treasury yield curve “doesn’t suggest imminent doom for the equity market in and of itself,” Liz Ann Sonders, chief investment strategist at Charles Schwab & Co., said on Bloomberg Television. “Alarm bells go off in terms of recession” when the curve gets closer to inverting, she said.

In FX, the Turkish lira had a wild session, offered in early London trade before fading. USD/TRY dropped sharply to lows of 12.4267 on reports of central bank FX intervention due to “unhealthy price formations” before, once again, fading TRY strength after comments from Erdogan. The rest of G-10 FX is choppy; commodity currencies retain Asia’s bid tone, havens are sold: the Bloomberg Dollar Spot Index inched lower, as the greenback traded mixed versus its Group-of-10 peers. The euro moved in a narrow range and Bund yields followed U.S. yields higher. The pound advanced as risk sentiment stabilized with focus still on news about the omicron variant. The U.K. 10-, 30-year curve flirted with inversion as gilts flattened, with money markets betting on 10bps of BOE tightening this month for the first time since Friday. The Australian and New Zealand dollars advanced as rising commodity prices fuel demand from exporters and leveraged funds. Better-than-expected growth data also aided the Aussie, with GDP expanding by 3.9% in the third quarter from a year earlier, beating the 3% estimated by economists. Austrian lawmakers extended a nationwide lockdown for a second 10-day period to suppress the latest wave of coronavirus infections before the Christmas holiday period. The yen declined by the most among the Group-of-10 currencies as Powell’s comments renewed focus on yield differentials. 10-year yields rose ahead of Thursday’s debt auction

In commodities, crude futures rally. WTI adds over 4% to trade on a $69-handle, Brent recovers near $72.40 after Goldman said overnight that oil had gotten extremely oversold. Spot gold fades a pop higher to trade near $1,785/oz. Base metals trade well with LME copper and nickel outperforming.

Looking at the day ahead, once again we’ll have Fed Chair Powell and Treasury Secretary Yellen appearing, this time before the House Financial Services Committee. In addition to that, the Fed will be releasing their Beige Book, and BoE Governor Bailey is also speaking. On the data front, the main release will be the manufacturing PMIs from around the world, but there’s also the ADP’s report of private payrolls for November in the US, the ISM manufacturing reading in the US as well for November, and German retail sales for October.

Market Snapshot

- S&P 500 futures up 1.2% to 4,620.75

- STOXX Europe 600 up 1.0% to 467.58

- MXAP up 0.9% to 191.52

- MXAPJ up 1.1% to 626.09

- Nikkei up 0.4% to 27,935.62

- Topix up 0.4% to 1,936.74

- Hang Seng Index up 0.8% to 23,658.92

- Shanghai Composite up 0.4% to 3,576.89

- Sensex up 1.0% to 57,656.51

- Australia S&P/ASX 200 down 0.3% to 7,235.85

- Kospi up 2.1% to 2,899.72

- Brent Futures up 4.2% to $72.15/bbl

- Gold spot up 0.2% to $1,778.93

- U.S. Dollar Index little changed at 95.98

- German 10Y yield little changed at -0.31%

- Euro down 0.1% to $1.1326

Top Overnight News from Bloomberg

- U.S. Secretary of State Antony Blinken will meet Russian Foreign Minister Sergei Lavrov Thursday, the first direct contact between officials of the two countries in weeks as tensions grow amid western fears Russia may be planning to invade Ukraine

- Oil rebounded from a sharp drop on speculation that recent deep losses were excessive and OPEC+ may on Thursday decide to pause hikes in production, with the abrupt reversal fanning already- elevated volatility

- The EU is set to recommend that member states review essential travel restrictions on a daily basis in the wake of the omicron variant, according to a draft EU document seen by Bloomberg

- China is planning to ban companies from going public on foreign stock markets through variable interest entities, according to people familiar with the matter, closing a loophole long used by the country’s technology industry to raise capital from overseas investors

- Manufacturing activity in Asia outside China stabilized last month amid easing lockdown and border restrictions, setting the sector on course to face a possible new challenge from the omicron variant of the coronavirus

- Germany urgently needs stricter measures to check a surge in Covid-19 infections and protect hospitals from a “particularly dangerous situation,” according to the head of the country’s DIVI intensive-care medicine lobby.

A more detailed breakdown of global markets courtesy of Newsquawk

Asian equity markets traded mostly positive as regional bourses atoned for the prior day’s losses that were triggered by Omicron concerns, but with some of the momentum tempered by recent comments from Fed Chair Powell and mixed data releases including the miss on Chinese Caixin Manufacturing PMI. ASX 200 (-0.3%) was led lower by underperformance in consumer stocks and with utilities also pressured as reports noted that Shell and Telstra’s entrance in the domestic electricity market is set to ignite fierce competition and force existing players to overhaul their operations, although the losses in the index were cushioned following the latest GDP data which showed a narrower than feared quarterly contraction in Australia’s economy. Nikkei 225 (+0.4%) was on the mend after yesterday’s sell-off with the index helped by favourable currency flows and following a jump in company profits for Q3, while the KOSPI (+2.1%) was also boosted by strong trade data. Hang Seng (+0.8%) and Shanghai Comp. (+0.4%) were somewhat varied as a tech resurgence in Hong Kong overcompensated for the continued weakness in casinos stocks amid ongoing SunCity woes which closed all VIP gaming rooms in Macau after its Chairman’s recent arrest, while the mood in the mainland was more reserved after a PBoC liquidity drain and disappointing Chinese Caixin Manufacturing PMI data which fell short of estimates and slipped back into contraction territory. Finally, 10yr JGBs were lower amid the gains in Japanese stocks and after the pullback in global fixed income peers in the aftermath of Fed Chair Powell’s hawkish comments, while a lack of BoJ purchases further contributed to the subdued demand for JGBs.

Top Asian News

- Asia Stocks Bounce Back from One-Year Low Despite Looming Risks

- Gold Swings on Omicron’s Widening Spread, Inflation Worries

- Shell Sees Hedge Funds Moving to LNG, Supporting Higher Prices

- Abe Warns China Invading Taiwan Would Be ‘Economic Suicide’

Bourses in Europe are firmer across the board (Euro Stoxx 50 +1.6%; Stoxx 600 +1.1%) as the positive APAC sentiment reverberated into European markets. US equity futures are also on the front foot with the cyclical RTY (+2.0%) outpacing its peers: ES (+1.2%), NQ (+1.5%), YM (+0.8%). COVID remains a central theme for the time being as the Omicron variant is observed for any effects of concern – which thus far have not been reported. Analysts at UBS expect market focus to shift away from the variant and more towards growth and earnings. The analysts expect Omicron to fuse into the ongoing Delta outbreak that economies have already been tackling. Under this scenario, the desk expects some of the more cyclical markets and sectors to outperform. The desk also flags two tails risks, including an evasive variant and central bank tightening – particularly after Fed chair Powell’s commentary yesterday. Meanwhile, BofA looks for an over-10% fall in European stocks next year. Sticking with macro updates, the OECD, in their latest economic outlook, cut US, China, Eurozone growth forecasts for 2021 and 2022, with Omicron cited as a factor. Back to trade, broad-based gains are seen across European cash markets. Sectors hold a clear cyclical bias which consists of Travel & Leisure, Basic Resources, Autos, Retail and Oil & Gas as the top performers – with the former bolstered by the seemingly low appetite for coordination on restrictions and measures at an EU level – Deutsche Lufthansa (+6%) and IAG (+5.1%) now reside at the top of the Stoxx 600. The other side of the spectrum sees the defensive sectors – with Healthcare, Household Goods, Food & Beverages as the straddlers. In terms of induvial movers, German-listed Adler Group (+22%) following a divestment, whilst Blue Prism (+1.7%) is firmer after SS&C raised its offer for the Co.

Top European News

- Wizz Says Travelers Are Booking at Shorter and Shorter Notice

- Turkey Central Bank Intervenes in FX Markets to Stabilize Lira

- Gold Swings on Omicron’s Widening Spread, Inflation Worries

- Former ABG Sundal Collier Partner Starts Advisory Firm

In FX, the Dollar remains mixed against majors, but well off highs prompted by Fed chair Powell ditching transitory from the list of adjectives used to describe inflation and flagging that a faster pace of tapering will be on the agenda at December’s FOMC. However, the index is keeping tabs on the 96.000 handle and has retrenched into a tighter 95.774-96.138 range, for the time being, as trade remains very choppy and volatility elevated awaiting clearer medical data and analysis on Omicron to gauge its impact compared to the Delta strain and earlier COVID-19 variants. In the interim, US macro fundamentals might have some bearing, but the bar is high before NFP on Friday unless ADP or ISM really deviate from consensus or outside the forecast range. Instead, Fed chair Powell part II may be more pivotal if he opts to manage hawkish market expectations, while the Beige Book prepared for next month’s policy meeting could also add some additional insight.

- NZD/AUD/CAD/GBP – Broad risk sentiment continues to swing from side to side, and currently back in favour of the high beta, commodity and cyclical types, so the Kiwi has bounced firmly from worst levels on Tuesday ahead of NZ terms of trade, the Aussie has pared a chunk of its declines with some assistance from a smaller than anticipated GDP contraction and the Loonie is licking wounds alongside WTI in advance of Canadian building permits and Markit’s manufacturing PMI. Similarly, Sterling has regained some poise irrespective of relatively dovish remarks from BoE’s Mann and a slender downward revision to the final UK manufacturing PMI. Nzd/Usd is firmly back above 0.6800, Aud/Usd close to 0.7150 again, Usd/Cad straddling 1.2750 and Cable hovering on the 1.3300 handle compared to circa 0.6772, 0.7063, 1.2837 and 1.3195 respectively at various fairly adjacent stages yesterday.

- JPY/EUR/CHF – All undermined by the aforementioned latest upturn in risk appetite or less angst about coronavirus contagion, albeit to varying degrees, as the Yen retreats to retest support sub-113.50, Euro treads water above 1.1300 and Franc straddles 0.9200 after firmer than forecast Swiss CPI data vs a dip in the manufacturing PMI.

In commodities, WTI and Brent front month futures are recovering following yesterday’s COVID and Powell-induced declines in the run-up to the OPEC meetings later today. The complex has also been underpinned by the reduced prospects of coordinated EU-wide restrictions, as per the abandonment of the COVID video conference between EU leaders. However, OPEC+ will take centre stage over the next couple of days, with a deluge of source reports likely as OPEC tests the waters. The case for OPEC+ to pause the planned monthly relaxation of output curbs by 400k BPD has been strengthening. There have been major supply and demand developments since the prior meeting. The recent emergence of the Omicron COVID variant and coordinated release of oil reserves have shifted the balance of expectations relative to earlier in the month (full Newsquawk preview available in the Research Suite). In terms of the schedule, the OPEC meeting is slated for 13:00GMT/08:00EST followed by the JTC meeting at 15:00GMT/10:00EST, whilst tomorrow sees the JMMC meeting at 12:00GMT/07:00EST; OPEC+ meeting at 13:00GMT/08:00EST. WTI Jan has reclaimed a USD 69/bbl handle (vs USD 66.20/bbl low) while Brent Feb hovers around USD 72.50/bbl (vs low USD 69.38/bbl) at the time of writing. Elsewhere, spot gold and silver trade with modest gains and largely in tandem with the Buck. Spot gold failed to sustain gains above the cluster of DMAs under USD 1,800/oz (100 DMA at USD 1,792/oz, 200 DMA at USD 1,791/oz, and 50 DMA at USD 1,790/oz) – trader should be aware of the potential for a technical Golden Cross (50 DMA > 200 DMA). Turning to base metals, copper is supported by the overall risk appetite, with the LME contract back above USD 9,500/t. Overnight, Chinese coking coal and coke futures rose over 5% apiece, with traders citing disrupted supply from Mongolia amid the COVID outbreak in the region.

US Event Calendar

- 7am: Nov. MBA Mortgage Applications, prior 1.8%

- 8:15am: Nov. ADP Employment Change, est. 525,000, prior 571,000

- 9:45am: Nov. Markit US Manufacturing PMI, est. 59.1, prior 59.1

- 10am: Oct. Construction Spending MoM, est. 0.4%, prior -0.5%

- 10am: Nov. ISM Manufacturing, est. 61.2, prior 60.8

- 2pm: U.S. Federal Reserve Releases Beige Book

- Nov. Wards Total Vehicle Sales, est. 13.4m, prior 13m

Central Banks

- 10am: Powell, Yellen Testify Before House Panel on CARES Act Relief

DB’s Jim Reid concludes the overnight wrap

If you’re under 10 and reading this there’s a spoiler alert today in this first para so please skip beyond and onto the second. Yes my heart broke a little last night as my little 6-year old Maisie said to me at bedtime that “Santa isn’t real is he Daddy?”. I lied (I think it’s a lie) and said yes he was. I made up an elaborate story about how when we renovated our 100 year old house we deliberately kept the chimney purely to let Santa come down it once a year. Otherwise why would we have kept it? She then asked what about her friend who lives in a flat? I tried to bluff my way through it but maybe my answer sounded a bit like my answers as to what will happen with Omicron. I’ll test both out on clients later to see which is more convincing.

Before we get to the latest on the virus, given it’s the start of the month, we’ll shortly be publishing our November performance review looking at how different assets fared over the month just gone and YTD. It arrived late on but Omicron was obviously the dominant story and led to some of the biggest swings of the year so far. It meant that oil (which is still the top performer on a YTD basis) was the worst performer in our monthly sample, with WTI and Brent seeing their worst monthly performances since the initial wave of market turmoil over Covid back in March 2020. And at the other end, sovereign bonds outperformed in November as Omicron’s emergence saw investors push back the likelihood of imminent rate hikes from central banks. So what was shaping up to be a good month for risk and a bad one for bonds flipped around in injury time. Watch out for the report soon from Henry.

Back to yesterday now, and frankly the main takeaway was that markets were desperate for any piece of news they could get their hands on about the Omicron variant, particularly given the lack of proper hard data at the moment. The morning started with a sharp selloff as we discussed at the top yesterday, as some of the more optimistic noises from Monday were outweighed by that FT interview, whereby Moderna’s chief executive had said that the existing vaccines wouldn’t be as effective against the new variant. Then we had some further negative news from Regeneron, who said that analysis and modelling of the Omicron mutations indicated that its antibody drug may not be as effective, but that they were doing further analysis to confirm this.

However, we later got some comments from a University of Oxford spokesperson, who said that there wasn’t any evidence so far that vaccinations wouldn’t provide high levels of protection against severe disease, which coincided with a shift in sentiment early in the European afternoon as equities begun to pare back their losses. The CEO of BioNTech and the Israeli health minister expressed similar sentiments, noting that vaccines were still likely to protect against severe disease even among those infected by Omicron, joining other officials encouraging people to get vaccinated or get booster shots. Another reassuring sign came in an update from the EU’s ECDC yesterday, who said that all of the 44 confirmed cases where information was available on severity “were either asymptomatic or had mild symptoms.” After the close, the FDA endorsed Merck’s antiviral Covid pill. While it’s not clear how the pill interacts with Omicron, the proliferation of more Covid treatments is still good news as we head into another winter.

The other big piece of news came from Fed Chair Powell’s testimony to the Senate Banking Committee, where the main headline was his tapering comment that “It is appropriate to consider wrapping up a few months sooner.” So that would indicate an acceleration in the pace, which would be consistent with the view from our US economists that we’ll see a doubling in the pace of reductions at the December meeting that’s only two weeks from today. The Fed Chair made a forceful case for a faster taper despite lingering Omicron uncertainties, noting inflation is likely to stay elevated, the labour market has improved without a commensurate increase in labour supply (those sidelined because of Covid are likely to stay there), spending has remained strong, and that tapering was a removal of accommodation (which the economy doesn’t need more of given the first three points). Powell took pains to stress the risk of higher inflation, going so far as to ‘retire’ the use of the term ‘transitory’ when describing the current inflation outlook. So team transitory have seemingly had the pitch taken away from them mid match.

The Chair left an exit clause that this outlook would be informed by incoming inflation, employment, and Omicron data before the December FOMC meeting. A faster taper ostensibly opens the door to earlier rate hikes and Powell’s comment led to a sharp move higher in shorter-dated Treasury yields, with the 2yr yield up +8.1bps on the day, having actually been more than -4bps lower when Powell began speaking. They were as low as 0.44% then and got as high as 0.57% before closing at 0.56%. 2yr yields have taken another leg higher overnight, increasing +2.5bps to 0.592%.

Long-end yields moved lower though and failed to back up the early day moves even after Powell, leading to a major flattening in the yield curve on the back of those remarks, with the 2s10s down -13.7bps to 87.3bps, which is its flattest level since early January. Overnight 10yr yields are back up +3bps but the curve is only a touch steeper.

My 2 cents on the yield curve are that the 2s10s continues to be my favourite US recession indicator. It’s worked over more cycles through history than any other. No recession since the early 1950s has occurred without the 2s10s inverting. But it takes on average 12-18 months from inversion to recession. The shortest was the covid recession at around 7 months which clearly doesn’t count but I think we were very late cycle in early 2020 and the probability of recession in the not too distant future was quite high but we will never know.The shortest outside of that was around 9 months. So with the curve still at c.+90bps we are moving in a more worrying direction but I would still say 2023-24 is the very earliest a recession is likely to occur (outside of a unexpected shock) and we’ll need a rapid flattening in 22 to encourage that. History also suggests markets tend to ignore the YC until it’s too late. So I wouldn’t base my market views in 22 on the yield curve and recession signal yet. However its something to look at as the Fed seemingly embarks on a tightening cycle in the months ahead.

Onto markets and those remarks from Powell (along with the additional earlier pessimism about Omicron) proved incredibly unhelpful for equities yesterday, with the S&P 500 (-1.90%) giving up the previous day’s gains to close at its lowest level in over a month. It’s hard to overstate how broad-based this decline was, as just 7 companies in the entire S&P moved higher yesterday, which is the lowest number of the entire year so far and the lowest since June 11th, 2020, when 1 company ended in the green. Over in Europe it was much the same story, although they were relatively less affected by Powell’s remarks, and the STOXX 600 (-0.92%) moved lower on the day as well.

Overnight in Asia, stocks are trading higher though with the KOSPI (+2.02%), Hang Seng (+1.40%), the Nikkei (+0.37%), Shanghai Composite (+0.11%) and CSI (+0.09%) all in the green. Australia’s Q3 GDP contracted (-1.9% qoq) less than -2.7% consensus while India’s Q3 GDP grew at a firm +8.4% year-on-year beating the +8.3% consensus. In China the Caixin Manufacturing PMI for November came in at 49.9 against a 50.6 consensus. Futures markets are indicating a positive start to markets in US & Europe with the S&P 500 (+0.73%) and DAX (+0.44%) trading higher again.

Back in Europe, there was a significant inflation story amidst the other headlines above, since Euro Area inflation rose to its highest level since the creation of the single currency, with the flash estimate for November up to +4.9% (vs. +4.5% expected). That exceeded every economist’s estimate on Bloomberg, and core inflation also surpassed expectations at +2.6% (vs. +2.3% expected), again surpassing the all-time high since the single currency began. That’s only going to add to the pressure on the ECB, and yesterday saw Germany’s incoming Chancellor Scholz say that “we have to do something” if inflation doesn’t ease.

European sovereign bonds rallied in spite of the inflation reading, with those on 10yr bunds (-3.1bps), OATs (-3.5bps) and BTPs (-0.9bps) all moving lower. Peripheral spreads widened once again though, and the gap between Italian and German 10yr yields closed at its highest level in just over a year. Meanwhile governments continued to move towards further action as the Omicron variant spreads, and Greece said that vaccinations would be mandatory for everyone over 60 soon, with those refusing having to pay a monthly €100 fine. Separately in Germany, incoming Chancellor Scholz said that there would be a parliamentary vote on the question of compulsory vaccinations, saying to the Bild newspaper in an interview that “My recommendation is that we don’t do this as a government, because it’s an issue of conscience”.

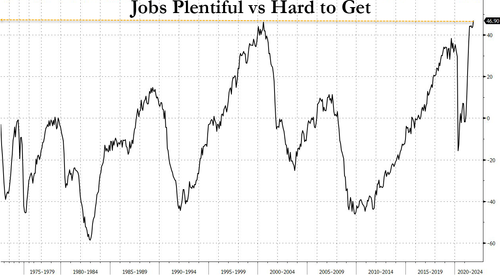

In terms of other data yesterday, German unemployment fell by -34k in November (vs. -25k expected). Separately, the November CPI readings from France at +3.4% (vs. +3.2% expected) and Italy at +4.0% (vs. +3.3% expected) surprised to the upside as well. In the US, however, the Conference Board’s consumer confidence measure in November fell to its lowest since February at 109.5 (vs. 110.9 expected), and the MNI Chicago PMI for November fell to 61.8 9vs. 67.0 expected).

To the day ahead now, and once again we’ll have Fed Chair Powell and Treasury Secretary Yellen appearing, this time before the House Financial Services Committee. In addition to that, the Fed will be releasing their Beige Book, and BoE Governor Bailey is also speaking. On the data front, the main release will be the manufacturing PMIs from around the world, but there’s also the ADP’s report of private payrolls for November in the US, the ISM manufacturing reading in the US as well for November, and German retail sales for October.