Authored by Nick Corbishley via NakedCapitalism.com,

The ECB has already warned once about the potential impact a plummeting lira could have on Euro Area banks heavily exposed to Turkey’s economy.

Turkey is in the grip of another big wave of its multiyear currency crisis. The value of the lira against the dollar has plunged by almost 40% so far this year, making it the worst performing emerging market currency. The currency is currently trading at just over 13 units to the dollar, compared to 7.44 in January and 3.78 at the start of 2018. On just one day this month (Nov 23), the currency plunged almost 20% before recovering slightly. The main cause of the collapse was the Central Bank of the Republic of Turkey’s decision to reduce interest rates for the third time since September, despite a slumping lira and surging inflation.

Contagion Risks

Luxury watches have a reputation for holding value. eBay created a best-in-class platform to match bona fide buyers with a network of sellers. Whether you are looking for a statement piece or entering the watch investment game- eBay has you covered. Read more.

At the height of the last big wave of Turkey’s ongoing crisis, in August 2018, the European Central Bank issued a warning about the potential impact the plummeting lira could have on Euro Area banks heavily exposed to Turkey’s economy via large amounts in loans — much of them in euros — through banks they acquired in Turkey. The central bank was worried that Turkish borrowers might not be hedged against the lira’s weakness and would begin to default on foreign currency loans, which accounted for 40% of the Turkish banking sector’s assets.

In the end, the contagion risks were largely contained. Many Turkish banks ended up agreeing to restructure the debts of their corporate clients, particularly the large ones. At the same time, the Erdogan government used state-owned lenders to bail out millions of cash-strapped consumers by restructuring their consumer loans, many of them foreign denominated, and credit card debt.

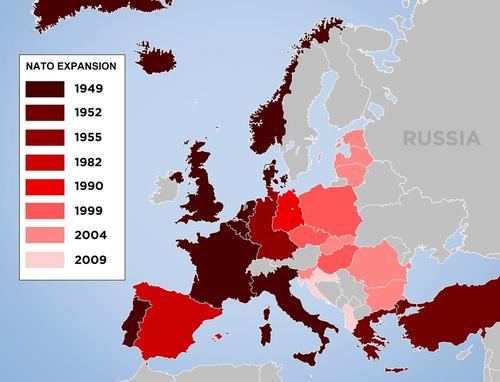

But concerns are once again on the rise about European banks’ exposure to Turkey. On Friday, as those concerns commingled with fears about the potential threat posed by the new omicron variant of Covid-19, Europe’s worst-affected stocks included the four banks most exposed to Turkey: Spain’s BBVA, whose shares fell 7.3% on the day, Italy’s Unicredit (-6.9%), France’s BNP Paribas (-5.9%) and the Dutch ING (-7.3%).

The collapsing lira is almost certain to fuel even higher inflation in Turkey. In October, consumer price inflation in the country was already at an eye-watering 20%. That’s still not as high as the 25% peak registered in 2018, but it is likely to go a lot higher as the lira weakens. As prices soar, further eroding the savings and incomes of many Turks, so too will the risk of social and political unrest. Another cause for concern is that a weaker lira will make it even harder for businesses already battered by the fallout of the virus crisis to repay their foreign-denominated debts.

The one silver lining for Turkey’s economy is that the crumbling lira has boosted exports while making imports prohibitively expensive for many people. Even before the currency’s latest rout, Turkey registered two straight months of current account surpluses in August and September — a rare feat for a country so heavily dependent on imports. Meanwhile, Erdogan, who maintains de facto control of Turkey’s central bank, continues to dig in his heels over interest rate policy, as the Guardian reports:

[…] Recep Tayyip Erdoğan’s declaration of an “economic war of independence” has pitched him against many in his own party and the country’s technocrats who fear an inflation rate running at 20% will create further bouts of social unrest.

“Some people who wanted to convey the opinion to the president that a different policy should be followed were not successful in this,” a senior official in the ruling AK party told Reuters, requesting anonymity.

Three central bank governors who stood against Erdoğan’s demand for lower interest rates have been sacked since mid-2019, leaving the way clear for the governor since March, Şahap Kavcıoğlu, to bring down the base rate in three separate cuts from 19% to 15%.

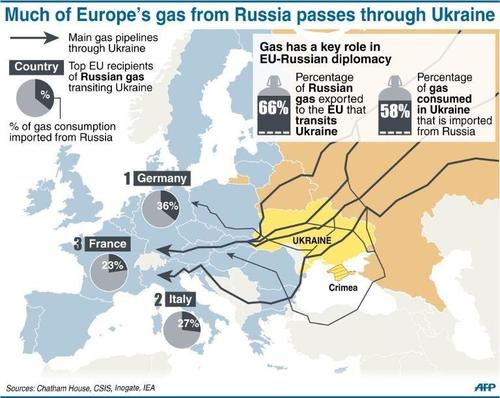

Reduced Exposure

Spanish banks have by far the highest loan exposure to Turkey, with just under $63 billion of loans outstanding, followed by France ($26 billion), Germany ($14 billion) and Italy ($6 billion), according to recent data from the Bank of International Settlements. The good news for the ECB is that some Eurozone banks with large-scale operations in Turkey have pared back their exposure to the country, or at least not added to it, since 2018.

Italian megabank Unicredit has sold down its stake in the commercial bank Yapi Kredi from 40% in 2018 to around 20% today. Under a strategy aimed at offloading non-core assets, the bank’s current business plan envisages achieving zero contribution from Yapi by the end of 2023. Nonetheless Yapi Kredi will still contribute around 5% of group earnings in 2021, according to estimates by Citi analysts.

French giant BNP Paribas operates various businesses in Turkey, from retail banking to leasing and insurance through a string of subsidiaries. But the country accounts for a low single-digit contribution to BNP profits, according to Jeffries. What’s more, BNP claims that most of its Turkish business is self-financed.

Another European bank with operations in Turkey is the Dutch group ING but its exposure is also limited. In 2020 it generated a total income of 420 million euros in the country, making it the Dutch bank’s third biggest market outside Europe after the United States and Australia. Assets in Turkey stood at around 7.3 billion euros in 2020, or less than 1% out of a total of 937 billion euros.

Bucking the Trend

There is one big exception to this trend: Spain’s second largest lender, BBVA. In 2020, Turkey was BBVA’s third largest market after Mexico and Spain, providing €563 million of net attributable profit, up 41% from 2019. That represents 14.3% of BBVA profits, excluding the corporate centre.

Until two weeks ago, BBVA owned just under 50% of Turkey’s second largest private bank, Garanti, for which it had paid €6.9 billion in incremental purchases beginning in 2010. Since then the Lira has done nothing but fall. Garanti’s market cap as of two weeks ago, converted into euros, was €3.7 billion (it is now €3.3 billion). BBVA’s 49.85% stake in it was worth €1.85 billion. In other words, BBVA had lost 73% of its investment.

But instead of cutting back its exposure to Turkey, BBVA has doubled it. Flush with cash after selling its U.S. subsidiary to PNC last year, BBVA announced two weeks ago — just days before Turkey’s central bank cut interest rates for the third time, triggering the lira’s worst daily collapse in 20 years — plans to buy the rest of Garanti for the price of TL12.20 per share. The move amounts to a massive gamble Turkey’s Erodgan-dominated economy and has found little favour among investors. Since the day of the purchase BBVA’s shares have fallen almost 20% while Garanti’s are now below the takeover price.

“It was our best investment option,” said BBVA’s CEO, Onur Genç, on in an investor call on Monday aimed at allaying shareholders’ concerns. The Spanish lender sees its purchase of Garanti as a long-term proposition that cements its position in a high-growth market it already knows well — and what’s more at a bargain price! Genç, himself of Turkish descent, said even the recent decline of the lira, which has decimated Garanti’s market value, was beneficial to BBVA since it meant that its offer price for Garanti, converted into euros, has fallen from €2.25 billion on the day BBVA announced its offer, to €1.8 billion today. At the same time, the amount of capital committed has fallen from €1.4 billion to €1.2 billion.

But while the collapsing lira may mean that BBVA is getting a cheaper and cheaper deal as each day goes by, it could still end up paying dearly. As a Reuters Breaking Views article cross-posted in El País points out, the crisis could hurt Garanti in two ways:

First, a weaker lira makes it harder for borrowers to service dollar-denominated debt, increasing the risk of defaults. Garanti has reduced its foreign currency exposure much faster than other banks, but at $11.6 billion (€ 10.3 billion), it is still almost a third of total loans. Second, the unorthodox monetary easing raises the prospect of a sharp rise in rates at some point in the future. That would reduce loan margins, as deposits instantly become more expensive while loans take longer to appreciate.

But BBVA’s CEO is for the moment nonplussed, or at least appears to be. “Since the beginning,” he said, “we have been aware of the risks and have controlled for them in multiple ways.” One prime example is the way BBVA has set up its global business to limit the spread of financial wildfires from Turkey or other emerging markets to the wider group, as a Bloomberg article recently pointed out (comment in parenthesis my own):

As a legacy from the Argentine debt crisis of the late 1990s, the bank uses a model of self-sufficient subsidiaries, which insulates other units if one of its businesses runs into trouble. That means that if Garanti were to start failing, it could be liquidated or restructured without affecting the rest of the group. In a worst case, BBVA would risk the value of its equity stake in Garanti — currently just under $4 billion.

In other words, BBVA would simply walk away from the smouldering wreckage as well as Turkey as a whole — at least in theory. The one thing the Bloomberg article doesn’t mention is that BBVA’s silo-based damage control system has never been properly road tested before.