On Tuesday night the Department of Justice filed its opposition to the appointment of a Special Master to sort through documents seized during the Aug 8 raid on former President Trump’s Mar-a-Lago residence.

Included in their 36-page filing was a photograph of documents seized from Trump’s Florida home, and an accusation that someone may have tried to remove or conceal classified documents prior to the raid, constituting potential obstructive conduct.

“TOP SECRET/SCI” blazed out on cover sheets for at least five sets of papers haphazardly laid out on the carpeting. Another cover sheet at the fore of the government photo said “SECRET/SCI” and “Contains sensitive compartmented information,” which refers to documents that include references to intelligence sources and methods.

The DOJ filing came in response to Trump’s request for an independent review of the materials seized from his home by a special master, which is often a retired judge who will segregate materials that may be covered by attorney-client privilege, or should otherwise he held back from the investigation.

As Jonathan Turley reports via Jonathanturley.org (emphasis ours):

The Department makes many of the same claims that it used to opposed the release of a redacted affidavit, claims shown to have been misleading and exaggerated after the magistrate ordered the release. Notably, this filing contained details that were likely redacted in the affidavit but just released on the public record.

In the most direct challenge to the former President’s public claims, the Justice Department claimed that he and his staff had failed to turn over classified material and that the Department had no choice but to search areas outside of the storage room. Indeed, it says that it found three classified documents in Trump’s desk without indicating the level of classification or subject matter.

It also said that the Trump staff barred the FBI from looking at documents in the storage room after turning over classified information to them.

“As the former President’s filing indicates, the FBI agents and DOJ attorney were permitted to visit the storage room. See D.E. 1 at 5-6. Critically, however, the former President’s counsel explicitly prohibited government personnel from opening or looking inside any of the boxes that remained in the storage room, giving no opportunity for the government to confirm that no documents with classification markings remained.”

The filing also adds new disclosures on past claims of declassification by Trump. It states that “[w]hen producing the Fifteen Boxes, the former President never asserted executive privilege over any of the documents nor claimed that any of the documents in the boxes containing classification markings had been declassified.” That was in January 2022. It then alleges that, in the June 3, 2022 meeting, “neither counsel nor the custodian asserted that the former President had declassified the documents or asserted any claim of executive privilege.” It is not clear if or when the Trump team made the declassification claim.

The filing also includes this notable allegation:

“The government also developed evidence that government records were likely concealed and removed from the Storage Room and that efforts were likely taken to obstruct the government’s investigation.”

The Justice Department told the court that it was vindicated in its suspicions and that

“the FBI, in a matter of hours, recovered twice as many documents with classification markings as the ‘diligent search’ that the former President’s counsel and other representatives had weeks to perform calls into serious question the representations made in the June 3 certification and casts doubt on the extent of cooperation in this matter.”

It is not clear from the filing if the FBI has evidence of intentional acts of concealment as opposed to negligence in keeping track of such material.

The main point of the filing was to address the court’s indication that it wanted a special master appointment. I have supported such an appointment, even at this late date. Indeed, I felt that this was one of the four failures of Attorney General Merrick Garland in not taking proactive steps to assure that public that this was not a pretextual raid to collect sensitive material for other investigative purposes. It would still have considerable value in the case.

The special master could divide these documents in classified material, unclassified but defense information, and unclassified material outside of the scope of the alleged crimes. The last category would then be returned. That accounting could also offer basic descriptive information on the material without revealing their precise content or titles. The special master could describe material as related to national defense or nuclear weapons (as was previously leaked government sources). The government has already leaked that there was nuclear weapons material being sought. Confirming such general details can be done without giving details on the specific information or even titles for the documents to protect national security. In national security cases, including cases where I have served as counsel, such indexes and summaries are common.

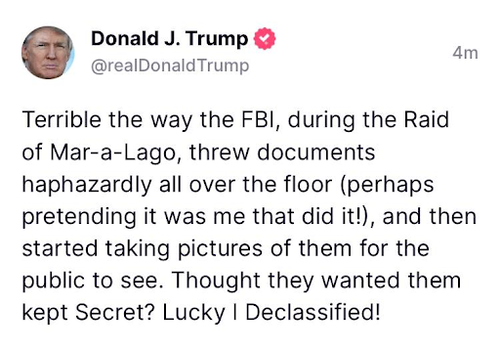

Notably, this filing includes the picture which is being widely distributed. It can, however, leave an obviously misleading impression.

The picture could be seen by many that secret documents were strewn over the floor when this appears the method used by the FBI to isolate classified documents. It also seems entirely superfluous in releasing this one picture. The picture is Attachment F and the textual reference on page 13 simply says

“Certain of the documents had colored cover sheets indicating their classification status. See, e.g., Attachment F (redacted FBI photograph of certain documents and classified cover sheets recovered from a container in the “45 office”).”

It is curious that the DOJ would release this particular picture which suggests classified material laying around on the floor. The point is to state a fact that hardly needs an optical confirmation: the possession of documents with classified cover sheets. Indeed, the top of roughly half of the documents are redacted in photo. The government could simply affirmatively state the fact of the covered pages and would not likely be challenged on that point without the inclusion of this one photo. For critics, the photo may appear another effort (with prior leaks) to help frame the public optics and discussion.

The arguments raised by the Justice Department are not just familiar but transparently weak. The government argues that Trump lacks standing because the records belong to the United States, not him. However, that is the point. The court is trying to determine who has a right to these documents. The Justice Department itself recognizes that it may have gathered some attorney-client privileged documents in this ridiculously broad search. It allowed the seizure of any box containing any document with any classification of any kind — and all boxes stored with that box. It also allowed the seizure of any writing from Trump’s presidency.

Moreover, the court itself has ample authority to appoint a special master to help sort through such material.

The Justice Department also makes the same type of arguments used to oppose the release of a single line of the affidavit in redacted form. It claims that both its investigation and national security would be harmed. That is even less compelling here. A special master would be reviewing documents in a secure facility and would presumably have a clearance. Many of us who have handled national security cases have been cleared for TS/SCI material.

How exactly would a special master review materially undermine national security as opposed to the same review conducted by the Justice Department’s own taint team? The special master is an extension of the court. This is simply a court review in camera of documents.

The use of such arguments after the release of the redacted affidavit only undermines the arguments further. The Justice Department insisted that the court should not release a single line of the affidavit and that any substantive disclosure would unleash a parade of horribles, from damaging national security to sacrificing witnesses.

For those of us who have litigated cases against the Justice Department, it was an all-too-familiar claim by a department notorious for over-classification and over-redaction arguments. For a week, media pundits mouthed the same exaggerated claims and challenged those of us who argued that it was clearly possible to release a redacted affidavit; liberals suddenly shuddered at the thought of doubting the Justice Department. Then the government produced a redacted version that cause no such harms while confirming important facts in the case.

Notably, some of the details in this filing on meetings before the August raid may have been part of the affidavit but redacted.

The Department also claims that it does not need to return personal material to the former president because the evidence of “commingling personal effects with documents bearing classification markings is relevant evidence of the statutory offenses under investigation.” That is again transparency weak. The government has recorded or documented such intermingling and make a record for any trial without refusing to return material that is neither classified nor otherwise subject to government confiscation or removal.

The Department also makes other incomplete or dubious arguments. For example, it asserts that no executive privilege claim can be made by a former president: “The former President cites no case—and the government is aware of none—in which executive privilege has been successfully invoked to prohibit the sharing of documents within the Executive Branch.” That is because this issue has not been fully litigated. It has been a long debate over the ability of former presidents to claim privilege. Indeed, under the Presidential Records Act, such assertions are honored over documents in its possession.

What is clear from this filing is that Merrick Garland will not change his refusal to seek modest steps to assure the public that this investigation is neither pretextual nor political. Instead, he is “all in” on these sweeping and untenable claims of the need for absolute control and secrecy. What is missing is real leadership to address the deep concerns of millions of Americans over the past record of the Department and its current investigation. Instead, Garland has required courts to force the release of a redacted affidavit and the possible appointment of a special master.

What is clear is that Garland’s “trust us” mantra has done little to assuage concerns. Indeed, that seems almost comical to many people, given the Crossfire Hurricane debacle and the fact that this investigation is being handled by the same section.

The court should reject the arguments against the appointment of a special master and allow for an independent review of these documents.

Here is the filing: doj-response-to-trump-special-master