Morgan Stanley: Here’s Why The Market Rally Is About To Take A Break

By Michael Wilson of Morgan Stanley

It’s Getting Hot

When the COVID lockdowns first hit, the primary risk facing companies centered on how to survive the sharpest economic downturn in 90 years. On reflection, what companies were able to accomplish over the past year with most of the labor force working from home is an economic miracle. In aggregate, the US economy surpassed its pre-COVID peak last quarter, just nine months after the trough of the recession. Profits returned to peak levels even faster, with many companies feeling no effects of the recession at all. In fact, essential businesses and technology enablers achieved an acceleration in pre-COVID sales trends, accompanied by record profitability as labor and other costs fell precipitously.

Now, with the economic recovery from COVID in full bloom, companies and investors are facing different questions:

- First, how will consumers spend their money? Will their purchases of the items they bought last year remain elevated or will we see a wallet share shift toward the experiences they were unable to enjoy? Perhaps there’s enough pent-up savings to support both? In our view, as the stimulus checks and supplemental unemployment benefits run out later this summer, consumers will be forced to make choices. That likely means a rotation toward services and away from goods, which have been over-consumed.

- Second, higher costs are returning as businesses deal with supply chain shortages. Most investors are aware of the spike in certain materials like lumber, copper and semiconductors. However, they also view such increases as temporary, or transitory, as the Fed calls them. They believe materials prices will eventually simmer down as supply adjusts, the normal pattern for commodity markets historically.

We’re not quite as confident in that view, but we do believe some commodity prices will subside where supply can adjust in a timely fashion.

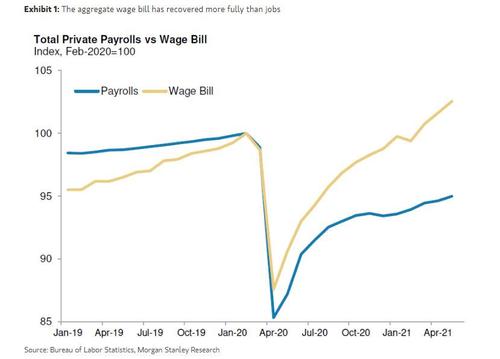

On the other hand, we think the risk is growing that rising labor costs are more structural. First, the pandemic lockdown has curtailed the labor supply in ways that may not be easily fixed. Many workers have moved on to new occupations, which means that labor shortages may be more persistent than normal. This is especially true of the hospitality, travel and leisure industries, where demand is now surging the most. Second, generous supplemental unemployment benefits and stimulus checks have given many the means to delay their return to the labor force or enroll in higher education or training to pursue a more attractive career. Third, thanks to the extraordinary rise in asset prices, including homes, some older workers are choosing to retire earlier than planned. All these factors suggest that there is less slack in the labor force than usual at this stage of the recovery. In fact, aggregate payrolls are already well above pre-COVID levels even though total payrolls are still well below (Exhibit 1). That suggests higher labor costs for businesses as we fully reopen and lower profitability.

A powerful political shift toward fostering social equality is also under way, increasing pressure on companies to pay higher wages. This trend began in 2015 with the push for an increase in the minimum wage. Since then, minimum wages in many states are up as much as 50% or more. At the federal level, ever greater increases have been proposed. Nevertheless, when adjusted for inflation, real minimum wages are still down almost 40% from their highs in the late 1960s. This suggests there’s a long way to go before policy-makers are satisfied.

Finally, globalization and the outsourcing of manufacturing and labor costs have been on a one-way track for the past 25 years. In addition to increasing political pressure to reverse course, the pandemic has exposed the outsourcing model as vulnerable when supply is less than fluid, leading many companies to rethink and reshore, which could mean higher costs.

The bottom line is that the US economy is booming, but this is now a known known and asset markets reflect it. What isn’t so clear anymore is at what price this growth will accrue. Higher costs mean lower profits, another reason why the overall equity market has been narrowing. It also supports our view that equity markets are likely to take a break this summer as things heat up.

Tyler Durden

Mon, 07/05/2021 – 16:47

via ZeroHedge News https://ift.tt/3ytFRqz Tyler Durden