Uber Surges After Announcing Another 3,000 Job Cuts, Bringing Total Layoffs To A Quarter Of Its Workforce

Tyler Durden

Mon, 05/18/2020 – 11:27

Last week, Wall Street was shocked following a report that Uber was seeking to acquire its biggest competitor in the food delivery space, Grubhub, in hopes of creating a food-delivery giant. The news was good enough to send the stock price surging however as it suggested Uber saw a light at the end of the coronavirus pandemic tunnel. Maybe not, because moments ago, the Journal reported that Uber was cutting another several thousand jobs, and closing 45 offices as part of its re-evaluation of “big bets in areas ranging from freight to self-driving technology as Chief Executive Dara Khosrowshahi attempts to steer the ride-hailing giant through the coronavirus pandemic.”

According to the report, the CEO announced the plans in an email to staff Monday, less than two weeks after the company said it would eliminate about 3,700 jobs and planned to save more than $1 billion in fixed costs. Monday’s decision to close 45 offices and lay off some additional 3,000 people means Uber – whose core rides business was down 80% year-over-year in April – is shedding roughly a quarter of its workforce in under a month. Drivers aren’t classified as employees, so they aren’t included.

Stay-at-home orders have ravaged Uber’s core ride-hailing business, which accounted for three-quarters of the company’s revenue before the pandemic struck.

Employees in the U.S. will be the hardest hit by the cuts. Uber is closing one of its offices in downtown San Francisco, which had more than 500 employees. It is also considering moving its Asia headquarters from Singapore to a different market.

As part of the new changes, Uber will also scale back on noncore businesses, with the company winding down its product incubator and artificial-intelligence lab, and exploring “strategic alternatives” for Uber Works, which pairs prospective employers with gig workers. The company is also re-evaluating cash-burning businesses such as freight and autonomous driving. Uber has spent hundreds of millions of dollars to advance self-driving research in recent years.

Employees in the U.S. will be the hardest hit by the cuts. Uber is closing one of its offices in downtown San Francisco, which had more than 500 employees. It is also considering moving its Asia headquarters from Singapore to a different market.

Does that mean the “recovery” is put on hold? Here’s what Khosrowshahi said in his note to employees:

“We’re seeing some signs of a recovery, but it comes off of a deep hole, with limited visibility as to its speed and shape.”

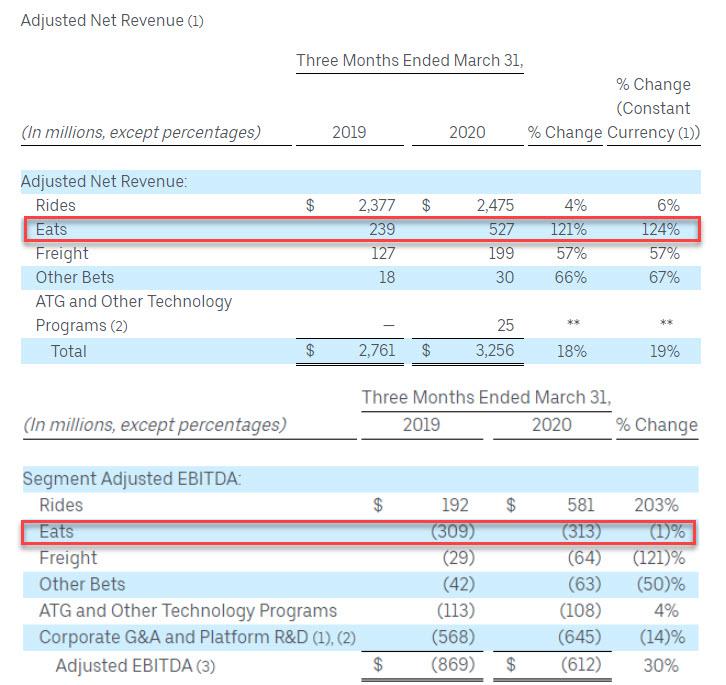

And while the company’s food-delivery arm, Uber Eats, has been a bright spot during the crisis, but “the business today doesn’t come close to covering our expenses”, something we pointed out two weeks ago when Uber reported earnings and showed that depsite a surge in Uber Eats, the EBITDA actually declined.

In an attempt to deflect investor attention from woes in its core business, Uber recently entered talks to buy rival Grubhub, a deal that would help stem losses from the cost-intensive business of building out delivery operations and give it an edge in competing with industry leader DoorDash. Khosrowshahi didn’t reference the potential deal in his memo.

As the journal notes, the pandemic hit “when Uber was pivoting from growth at all costs to a profitable future” and the company was trimming costs even before the outbreak, in an effort to propel Uber toward a path to profitability by the end of the year. He recently pushed that timeline to next year.

“I will not make any claims with absolute certainty regarding our future,” Mr. Khosrowshahi wrote in his note. “I will tell you, however, that we are making really, really hard choices now, so that we can say our goodbyes, have as much clarity as we can, move forward, and start to build again with confidence.”

And since nothing makes sense any more, Uber’s admission that it continues to be surprised by the severity of the coronavirus slowdown was enough to spike its stock to session highs, sending it up as much as 10% on the session.

via ZeroHedge News https://ift.tt/3g2zoKP Tyler Durden