Rabo: Powell Can’t Wait To See “Actual Inflation” To Hike… But What Do We Have Right Now

By Michael Every of Rabobank

Inflection/Infection Point

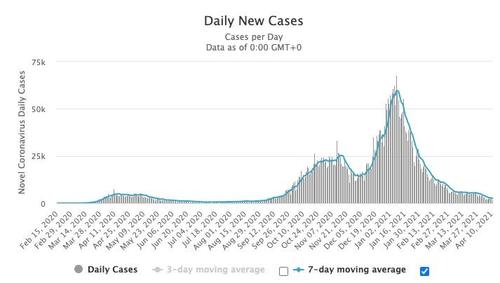

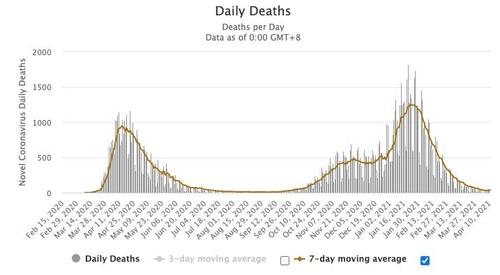

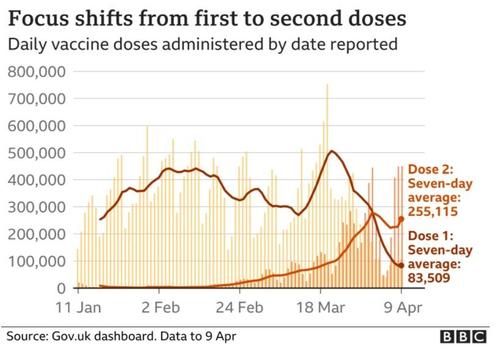

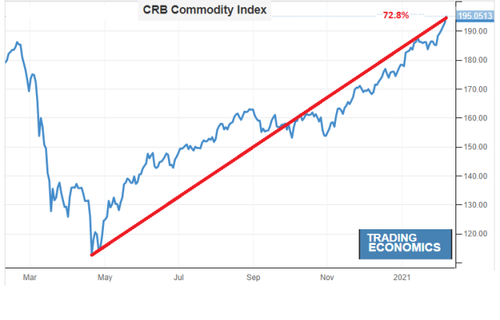

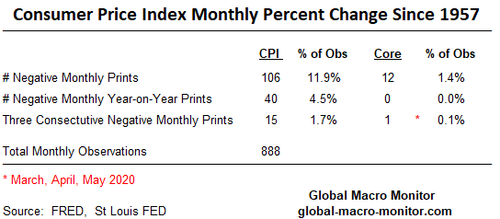

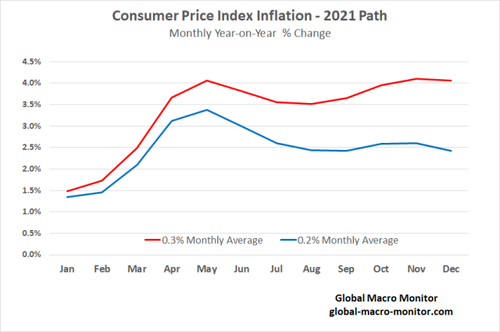

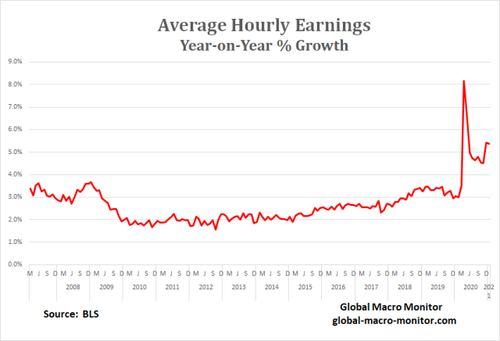

If you are still in the camp that all that really matters is what central banks say, then note “the US is now at an inflection point”. So says Fed Chair Powell on CBS TV. While positive, this does seem to lean in a more hawkish direction: could his credibility be “Gone in 60 Minutes”, after repeated messaging that rates are on hold for years to come? Or is this a special kind of inflection point which still necessitates the lowest rates and most QE ever? It seems so, as Powell added: “We can wait to see actual inflation before we raise interest rates.” What do we have right now, chopped liver?! Yet the primary concern for the Fed is not inflation, but infection. If Covid gets worse again, then the Fed needs to be there: but what if infection doesn’t?

Infection point is what markets will see as: France goes into another lock-down for schools; by contrast, the UK finally begins to open up; Australia and New Zealand launch a trans-Tasman travel bubble; Thailand, with a mass break-out of the UK variant, is nonetheless allowing the whole country to travel for a week for its new year; India is seeing huge vaccination success – and also huge daily Covid case numbers; a Chinese official admits their Covid vaccine isn’t very effective –as the Malaysian press reports several Chinese tourists in Sarawak tested positive for Covid despite having been vaccinated twice in China; and the EU is admitting that even if it buys Russia’s Sputnik vaccine, it will take months to get production numbers up to where they need to be, so no quick fix. This all seems to leans towards a market bias for the US and UK.

Yet one infection inflection point should terrify us: the island of St. Vincent is seeing a massive volcanic eruption – and yet only those with proof of vaccination, just 10% of the population, are being evacuated. And there you were worrying about the idea of needing to show papers or have a facial scan to sit in a pub garden in the UK.

Many other potentially-volcanic inflection points are evident. In China, Alibaba has been hit with a record USD2.8bn anti-monopoly fine, which follows Beijing forcing an elite business school backed by Jack Ma to halt enrolments. China analysts are trying very hard not to see the writing on the wall as large as that from a key scene in ‘The Life of Brian’: “Foreign capital they go the house?” Some things need even larger fonts, however.

The excited tech coverage of China’s launch of its digital CNY last week failed to notice one key detail: according to the Wall Street Journal, “The money itself is programmable. Beijing has tested expiration dates to encourage users to spend it quickly, for times when the economy needs a jump start.” A point long made here is that a sovereign digital currency would not only mean all economic anonymity being removed; and capital flight, short of trading money for goods and shipping them offshore; and that interest rates could be set as negative as needed given no ability to hoard cash; but, crucially, that digital money could be switched off to force you to spend it on what the state wants – or ‘on’, to circumvent the banking system entirely. Would you, as a market player or a CFO, want to hold a digital currency that can disappear from your bank balance as needed?

The White House is catching on to the Great Power and Great Currency game here, Bloomberg reporting: “Biden Team Eyes Potential Threat From China’s Digital Yuan Plans”. For now the US remains concerned about the risk of sanctions evasion (as if that doesn’t already happen): yet the US is also considering a digital Dollar. All the criticisms of DNCY would apply to DUSD too.

Perhaps the more important question is if you will get a choice or not: this is going to be a political, not an economic decision. In May 2017, former Fed Chair Bernanke echoed my earlier warnings (e.g., 2015’s ‘FX Wars’ and 2016’s ‘Thin Ice’) and gave a speech flagging the next downturn would see fiscal and monetary policy cooperation: here we are four years later and that long-untouchable policy is suddenly normal. The same Kalecki/Polanyi logic that predicted Bernanke’s prediction says digital currency is likely to happen at some point too, because fiscal and monetary policy together still isn’t enough in a globalized world unless everyone is doing it – and not everyone can or will.

True, a digital inflection point could still just mean a cashless DUSD and DCNY battling it out for global economic favor. However, at any point they could be used in a truly radical manner. Indeed, digital currencies allow us to more easily replicate the 1930’s splitting of the global gold standard into bifurcated rival currency blocs: how about holding DCNY that can only be spent in China, or a DUSD that works the same way? (Some would say we already have that if you include US financial assets.)

Of course, this isn’t just political but geopolitical. After all, our global financial architecture sits on geopolitical plates. Day to day these don’t move, and markets don’t know how to price for them if they do: yet that doesn’t mean we aren’t moving closer to such an epic move:

-

US Secretary of State Blinken has warned China against encroaching on Taiwan – and also blamed it for helping the initial spread of Covid-19. That’s as the bill mandating deeper US-Taiwan ties works its way through Congress. The US is also sending more warships to the South China Sea, and the Philippines seems to be moving closer to the US once again given what it claims is further Chinese encroachment on its maritime territory. The very fat tail risks here are self-evident: more so given neither side can back down without a serious loss of relative power (which would flow through to FX markets);

-

Blinken has warned Russia any offensive against Ukraine would have “consequences”. It’s not clear what these would be, but military does not appear high on the list. Yet markets thinking this is “’A Small Country Far Away about Which We Know Little” fail to see the tail risks against the broader backdrop;

-

Iran’s Nantaz nuclear reactor was subject to Israeli sabotage (“nuclear terrorism”) according to Tehran, which follows an attack on an Israeli ship by Iran, and one on an Iranian ship by Israel. The Middle East is simmering on an axis involving key sea lanes for global energy; and

-

John Kerry is due in Beijing this week to try to get Chinese cooperation on all matters green. It may well suit Beijing to play nice here in an attempt to leverage that promise against other US actions. Let’s see if the climate crisis provides a genuine geopolitical inflection point or not.

Tyler Durden

Mon, 04/12/2021 – 09:56

via ZeroHedge News https://ift.tt/3tfCf9u Tyler Durden