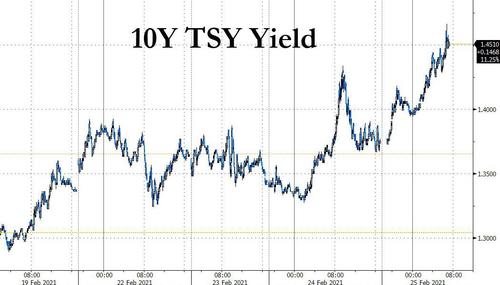

It’s not just the surge in meme stocks that is a case of deja vu all over again: the big action this morning is in another closely watched asset – the 10Y – where yields have soared by almost 10bps, rising from 1.38% to a one-year high of 1.46%, rising just 4bps shy of the closely watched 1.50% level which Nomura predicts will spark an equity selloff.

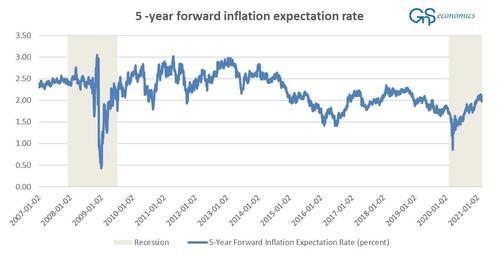

“Inflationary signals, including a surge in commodity prices, are higher than we have seen in years,” said Geir Lode, head of global equities at the international business of Federated Hermes. “The prospect of a sooner-than-expected economic recovery has led to a surge in the U.S. 10-year yield.”

And amid fears that the stock rout will only get worse, Nasdaq futures fell 1% on Thursday, sliding for seven out of the last eight sessions, as investors rotated out of technology-related stocks…

… and into small cap and reflationary shares that will benefit from an economic rebound later in the year. The Russell 2000 index rallied and S&P500 eminis were modestly in the red. At 715 am ET, Dow e-minis were up 5 points, or 0.01%, S&P 500 e-minis were down 12.35 points, or 0.3%, and Nasdaq 100 e-minis were down 123.5 points, or 1%.

Banks such as Citigroup, Goldman Sachs, JPMorgan, Morgan Stanley, Wells Fargo and Bank of America Corp were up between 0.6% and 1.2%, tracking a rise in U.S. 10-year Treasury yields. Oil producer Apache Corp gained 1.3% after it reported a smaller-than-expected fourth-quarter loss and raised its spending forecast. Tesla fell as much as 2.7% in premarket trading Thursday after the company told workers it will temporarily halt some production at its car assembly plant in California.

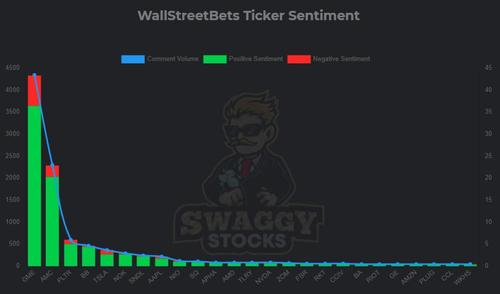

Meanwhile, traders were kept busy after a renewed retail frenzy re-ignited the likes of GameStop, bets on $70 a barrel oil and a decade high in copper prices drove a commodity currency rally and bond yields were still rising too. In a fresh sign of a renewed retail-driven frenzy in equity markets, GameStop shares quadrupled, rising as high as $200 overnight.

The new frenzy puzzled analysts, who had ruled out another short squeeze of the stock which had battered some hedge funds, and fueled more hype after some Twitter users pointed out a cryptic tweet of an ice-cream cone photo from activist investor Ryan Cohen – a major shareholder in GameStop and a board member.

Reddit discussion threads were buzzing again about GameStop on Thursday, with members exhorting others to pile into the stock as the rally gathers steam. “Bought lots more #GME today, let’s keep fighting !!,” wrote one Reddit user Fundssqueezzer, while another user Responsible_Fun6255 said, “Rise of the planet of the ape: GME edition”.

Other “stonks” favored by WallStreetBets retail traders also leapt again, although explanations for the moves were tenuous. Headphone maker Koss Corp surged 57%, while cannabis company Sundial Growers rose 10%; AMC rose 29%, Express was up 42%, and Koss soared 75%. In Europe, Nokia shares are up 6.2%; the stock was also a Reddit favorite last month

The risky trading strategies employed by some traders on Reddit have drawn the ire of investing legends such as Charlie Munger, long time business partner of Warren Buffett. “It’s really stupid to have a culture which encourages as much gambling in stocks by people who have the mindset of racetrack bettors,” said Munger on Wednesday.

Of course, everyone ignored the warning and GameStop’s U.S.-listed shares soared nearly 104% on Wednesday. The volatility in GME, AMC Entertainment and other stocks led to outages on Reddit and periodic trading halts by the New York Stock Exchange. Robinhood said in a tweet that the NYSE action would impact all brokerages, but that it had not paused trading on the shares.

“It’s a pretty risky play to try and buy now … what we might (see) at the open of the cash market is some people trying to get in,” said Oriano Lizza, premium sales trader at CMC Markets in Singapore, which does not offer pre- or post-market trade.

In any case, back to global markets where European stocks erased an earlier gain even as most European equities hold in the green. Eurostoxx 50 traded 0.2% higher having gapped up on the open. DAX fades an initial 0.5% gain to trade flat. FTSE 100 and IBEX outperform. Oil & gas, banks and miners are the best performers. Here are some of the biggest European movers today:

- Nokia shares jump as much as 8.2%, the biggest gainer in the Stoxx Telecom Index, amid fresh interest in meme stocks. Nokia surged 26% last month as the stock became a Reddit trader favorite.

- Telefonica shares gain as much as 5.7%, the best performer in Spain’s benchmark IBEX 35 index, after results, with Berenberg saying the telecom firm’s 4Q financials were strong.

- DS Smith surges as much as 14%, the most since 2011, after Bloomberg reported Wednesday night that rival Mondi is exploring a potential takeover.

- Vestas shares jumps as much as 6.2% after UBS analysts said the outlook for wind-turbine makers is continuing to gain momentum and upgraded the stock to buy.

- Standard Chartered falls as much as 5.5% in London as the Asia-focused lender’s financial markets unit and progress on cost cutting disappoint at quarterly results.

- Bayer shares drop as much as 4.5% after what Redburn describes as “messy” 4Q earnings and cautious 2021 dividend expectations, as well as management comments that co. may withdraw from various Roundup settlement agreements if certain eligibility and participation rates are not satisfied.

Earlier in the session, Asian stocks rebounded from their biggest drop in almost three months, bolstered by a rally in technology names. Samsung Electronics, SK Hynix and Taiwan Semiconductor Manufacturing boosted the MSCI Asia Pacific Index after U.S. President Joe Biden said he plans to address shortfalls in chip output that have idled production at some auto plants. SK Hynix hit a 20-year high. Tencent and SoftBank were the other big contributors to the Asian benchmark’s rise. South Korea’s equity benchmark surged 3.5% to lead gains in Asia. Key gauges in Singapore, Malaysia and Taiwan rallied at least 1.5% each. Markets in the Philippines were shut for a local holiday. Stocks in New Zealand bucked the regional trend, with the S&P/NZX 50 index sliding 1.2%. The nation’s government said it will require the central bank to take account of rampant house prices when it sets interest rates, a change that may restrict its ability to run loose monetary policy.

“There are two clear stories now” said CMC Markets senior analyst Michael Hewson. “You have the concerns about rising yields and they are continuing to move higher today, and then you have got an economic recovery story, which is helping lift the more moderately-valued parts of the market.”

Yields on U.S. Treasury bonds have soared recently (and with CTAs the most short in two years, they are likely to rise even more), pressuring technology-related companies as the United States accelerates its coronavirus vaccination program and plans further fiscal spending. Commodities also extended gains, with investors piling into metals that can ride faster growth trends. Copper, as previewed last week, moved closer to a record high set a decade ago and aluminum touched a two-year high.

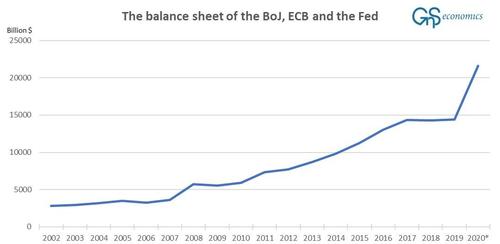

Yields have blown up despite two days of reassuring remarks by Fed Chairman Jerome Powell who offered reassurance that policy would continue to be supportive and look beyond a temporary pick-up in inflation, especially from a low base. That’s given the bond market enough reason to keep driving yields higher. Powell said on Wednesday that U.S. rates could remain low for years, while ECB board member Isabel Schnabel was out early on Thursday saying it would fight any big increases in inflation-adjusted market rates.

“A too-abrupt increase in real interest rates on the back of improving global growth prospects could jeopardise the economic recovery,” she said. “Therefore, we are monitoring financial market developments closely.”

Despite growing central bank jawboning, bond markets are still not playing ball and are threatening to steamroll over what little credibility central bankers have. Ten-year German Bund yields climbed 3 basis points in early trading. U.S. 10-year Treasury yields blew to one-year highs of 1.46% and on course for the biggest monthly rise since Donald Trump’s 2016 U.S. election victory jolted markets.

In the FX markets, the dollar slumped in early trading to three-year lows as the Fed’s stance, ongoing progress with COVID vaccination programmes and commodity market uplift boosted riskier currencies. However, it has since rebounded back to unchanged. The Australian and Canadian dollars both hit three-year highs of $0.7978 and C$1.2503 per U.S. dollar respectively. The euro touched a one-month high of $1.2183. The safe-haven yen and Swiss franc both weakened.

“It is pretty clear that there is a pretty strong concentration in the commodity currencies,” said Saxo Bank’s John Hardy. “Even with emerging markets you are seeing it to a degree,” he added, pointing to how big energy importers like Turkey’s lira had faded.

In commodities, crude oil climbed to 13-month highs after U.S. government data on Wednesday showed a drop in crude output as a deep freeze in Texas disrupted production last week. Copper prices steadied near $9,500 a tonne in London. It’s now at its highest level in almost a decade and could log its biggest monthly gains in 15 years this month.

Looking at the day ahead, data releases from the US include the second estimate of Q4 GDP, weekly initial jobless claims and the preliminary January durable goods orders reading. From central banks, we’ll hear from the Fed’s Quarles, Bostic, Bullard and Williams, and the ECB’s De Guindos, Lane and Hernandez de Cos. Earnings releases include Salesforce, American Tower, Moderna and HP, and this afternoon EU leaders will be gathering via videoconference for a European Council meeting. Highlights on the earnings agenda include Salesforce, HP, Etsy and Monster Beverage, all expected after markets close

Market Snapshot

- S&P 500 futures down 0.1% to 3,917.50

- Euro up 0.4% to $1.2213

- Brent Futures up 0.5% to $67.35/bbl

- MXAP up 1.4% to 215.29

- MXAPJ up 1.5% to 723.82

- Nikkei up 1.7% to 30,168.27

- Topix up 1.2% to 1,926.23

- Hang Seng Index up 1.2% to 30,074.17

- Shanghai Composite up 0.6% to 3,585.05

- Sensex up 0.5% to 51,043.83

- Australia S&P/ASX 200 up 0.8% to 6,834.03

- Kospi up 3.5% to 3,099.69

- Brent Futures up 0.5% to $67.35/bbl

- Gold spot down 0.8% to $1,790.99

- U.S. Dollar Index down 0.40% to 89.82

Top Overnight News from Bloomberg

- Economic confidence in the euro area improved in February, as consumers and businesses grew more optimistic that vaccine rollouts will spark a recovery this year

- The European Central Bank is keeping a close eye on the euro area’s financing conditions and will use bond purchases to counter any unwarranted tightening, according to chief economist Philip Lane

- New Zealand’s government will require the central bank to take account of rampant house prices when it sets interest rates, a change that may restrict its ability to run loose monetary policy.

- Federal Reserve Chair Jerome Powell emphasized his view that the economy has a long way to go in the recovery and signs of prices rising won’t necessarily lead to persistently high inflation

- Pfizer Inc. and BioNTech SE’s Covid-19 vaccine was overwhelmingly effective against the virus in a study that followed nearly 1.2 million people in Israel, results that public-health experts said show that immunizations could end the pandemic

- Australia’s central bank found itself overwhelmed by the global reflation trade after it dived back into markets and discovered its biggest bond purchases in 11 months did little to hold down yields

- New Zealand’s government will require the central bank to take account of rampant house prices when it sets interest rates, a change that may restrict its ability to run loose monetary policy

- The Bank of Japan’s policy review will likely center on flexible stock-fund buying, bond yield movements and the potency of negative rates

- Oil held gains after closing at the highest level in more than a year as a slump in U.S. crude production following the cold blast and shrinking European stockpiles tightened the market further

A quick look at global markets courtesy of Newsquawk

European stocks trade mostly firmer (Euro Stoxx 50 +0.1%) with price action somewhat contained in early hours as the region picked up a similarly mixed APAC lead heading into month-end. US equity futures also see a mixed session early-doors, but have waned off best levels seen overnight with the growth-led NQ (-0.6%) once again the laggard in European hours whilst the value-driven RTY (+0.6%) remains propped. The lukewarm tone in the equities markets comes as Fed officials downplayed the sustainability of the expected rise in inflation, whilst yields continue to remain elevated – with French 10yr yield turning positive for the first time since mid-2020. On the topic of rising yields, it’s worth recapping the sectorial correlation relative to a high-yield environment. The top beneficiaries from rising yields (by order) includes Banks, Cyclicals, Value, Insurance, Autos, Basic Resources. The top hit sectors meanwhile (by order) goes as such: Food & Beverage, Defensives, Growth, Healthcare, Real Estate. Meanwhile Technology and Retail see little correlation with rising rates in the context of weekly relative returns, as suggested by Goldman Sachs. This higher-yield playbook is currently portrayed within European sectors, with Banks, Oil & Gas, Basic Resources and Auto’s residing as the winners, whilst Healthcare, Food & Beverage and Chemicals reside on the other end of the spectrum. In terms of individual movers, heavyweight Bayer (-3.5%) pressures the DAX (-0.1%) lower following dismal earnings whereby revenue and Adj. EBIT deteriorated Y/Y whilst a large number of segments reported sales contractions. Other earnings-related movers include Axa (+3%), Telefonica (+2%), AB Foods (+1%), AB InBev (-5%) and Standard Chartered (-5%). Looking at M&A, FTSE-listed DS Smith (+7%) is lifted on reports Mondi (-0.7%) is reportedly considering a bid for DS Smith and has been speaking with advisors on the matter. Finally, heading into the US session, it’s worth mentioning the Reddit darling stocks – GME (+50% pre-mkt) and AMC (+16% pre-mkt) – are seeing another bout of upside after a late-door buying frenzy heading into the close.

Top European News

- Europe’s Recovery Choices Will Leave It a Year Behind the U.S.

- Merkel Is Leaving, But the EU Has a New Heavyweight in Draghi

- Sunak Gives Himself Room to Raise Corporation Tax in U.K. Budget

- How U.K. and Israel Raced to Global Lead in Covid Vaccination

Asia-Pac stocks rebounded from yesterday’s selldown after the region took impetus from the strong performance on Wall St where sentiment was underpinned by dovish Fed rhetoric and with gains led by energy and financials after oil prices and yields edged higher. ASX 200 (+0.8%) was positive in which energy stocks spearheaded the advances across the commodity-related sectors and with participants occupied by a heavy stream of earnings results including Qantas which surged despite posting a H1 net loss, as it also announced it was on track to deliver billions of cost savings over the next 3 years and is working on the assumption for international travel to resume in October. Nikkei 225 (+1.6%) coat-tailed on favourable currency flows and reclaimed the 30k status, while KOSPI (+2.1%) outperformed post-BoK meeting in which the central bank maintained its 7-day repo rate at 0.50% as expected and suggested the economy is to recover gradually led by solid growth in exports. Hang Seng (+2.1%) and Shanghai Comp. (+1.2%) were also positive in light of the global optimism and with MOFCOM planning to reinforce policy support for foreign trade, although tensions continued to linger after a US Navy warship transited through the Taiwan Strait and with USTR nominee Tai suggesting the US needs a plan for holding China accountable and to compete with its state-run economy. Finally, 10yr JGBs were lower amid gains in stocks which saw prices slip beneath the 151.00 level and as JGB yields extended to multi-year highs with 30yr and 40yr yields reaching the highest since December 2018 and January 2019, respectively, while the presence of the BoJ in the market for nearly JPY 1.3tln of JGBs with up to 10yr maturities failed to support prices.

Top Asian News

- Hong Kong’s Biggest Builder Sun Hung Kai Posts Higher Profit

- Hong Kong’s Richest Property Tycoon Said to Plan U.S. SPAC

- Armenian Premier Warns of Coup as Army Tells Him to Quit

- Aussie Dollar Breaches 80 U.S. Cents to Reach Three-Year High

In FX, the Euro marginally pipped the Aussie to the post in round number terms, but it was much more even between the single currency and both Antipodean Dollars when it came to percentage gains vs the Greenback before the former accelerated beyond 1.2225. All 3 are gleaning leverage from yield differentials, while Eur/Usd is also benefiting from supportive month end rebalancing flows and what looks like a more concerted technical correction in Eur/Gbp after the midweek bounce from just under 0.8550. Hence, the headline pair has breached recent highs ahead of 1.2200 on the way to circa 1.2235 and applied further pressure on the DXY that is losing touch with 90.000 between 90.144-89.720 parameters following Wednesday’s false break through the 50 DMA. Meanwhile, Aud/Usd has peered over 0.8000 where big barriers reside with impetus from an unexpected rise in Q4 Capex that reversed the prior quarter’s fall precisely, and Nzd/Usd is hovering around 0.7450 having spiked above 0.7460 in wake of NZ Finance Minister Robertson formally announcing changes to the RBNZ’s remit to include house prices. Note, modest declines in NBNZ business sentiment and the activity outlook were largely shrugged off, but looming trade data will likely draw more attention.

- GBP/CAD – Notwithstanding the aforementioned retracement against the Euro, Sterling has taken advantage of general Dollar weakness to reclaim 1.4150+ status, and the Loonie has notched another milestone with the aid of strong oil prices with Usd/Cad down through 1.2500.

- CHF/JPY- The Franc and Yen are still lagging due to less attractive costs of carry even though JGBs were flogged overnight in catch-up trade as widely anticipated, as the former languishes below 0.9050 and latter under 106.00 ahead of Tokyo CPI, Japanese ip and retail sales.

- SCANDI/EM – The Sek is back on a more even keel vs the Nok and Eur amidst bullish rebalancing requirements given an above average standard deviation for the end of February, while Swedish sentiment indices for the current month were firmer across the board. Elsewhere, most EM currencies are reeling on the high yield eroding risk appetite and threatening capital flight scenario.

In commodities, WTI and Brent front-month futures are firmer on the session and hovering around best levels during early European trade. The complex overnight benefited from a mostly upbeat APAC session, whilst sources yesterday highlighted a rift building among OPEC+ members ahead of the meeting next week. One source suggested prices are “definitely high” and more oil is needed to cool the markets – adding that a 500k BPD increase looks to be a good option. Conversely, another source suggested no more relaxations until June given the risk of new variants and setbacks in the battle against COVID. Saudi will have to avoid a rift widening as the Kingdom itself is currently poised to reintroduced the 1mln BPD of oil which was taken offline as a goodwill gesture in January. ING previously suggested “It is unlikely that the group would bring a little over 2.2mln BPD of supply back onto the market, aware that the market would baulk at such a decision”, but the bank highlights that there is room for some sort of easing, contingent on how much output volume Saudi decides to bring back from its own additional cuts. Barclays meanwhile, forecasts 2021 Brent at USD 62/bbl & WTI at USD 58/bbl reflecting their projection of OPEC+ to increase aggregate supply by 1.5mln BPD over Q2 and for Saudi Arabia to reverse the unilateral cut in April. Furthermore, as production in Texas is coming back online – a subsequent reflection in the price of WTI may be noticed as ING states it expects to see further crude oil builds in the weeks ahead. WTI resides mid USD 63/bbl (vs high USD 63.79/bbl) and Brent mid USD 67/bbl (vs high USD 67.70/bbl). Notable tail-risks on the table surrounds month-end factors which may offer volatility, several Fed officials speaking through the session alongside US data which includes Initial Jobless Claims and Q4 PCE prices. Elsewhere, precious metals are mixed on the session, with spot gold trading below the USD 1800/oz handle amid headwinds from rising yields and spot silver nursed earlier losses. As a side note for silver, Reddit retail traders have been driving GME prices higher again so it may be something to just keep an eye on for any potential targeting of silver. Turning to base metals, LME copper has gains of around 0.5% and trades above USD 9,500/t, continuing the narrative as a recovery metal surrounding the reflationary backdrop. More on base metals. Looking further ahead, some suggest aluminium supply in China could be affected by China’s journey to net-zero CO2 emissions by 2060. China Inner Mongolia has seen a series of environmental changes which would inhibit further capacity growth as the region accounts for 9.0% of total Chinese aluminium supply.

US Event Calendar

- 8:30am: 4Q GDP Annualized QoQ, est. 4.2%, prior 4.0%

- 8:30am: Feb. Initial Jobless Claims, est. 825,000, prior 861,000; Continuing Claims, est. 4.46m, prior 4.49m;

- 8:30am: Jan. Durable Goods Orders, est. 1.1%, prior 0.5%

- 8:30am: Jan. Cap Goods Ship Nondef Ex Air, est. 0.6%, prior 0.7%; Cap Goods Orders Nondef Ex Air, est. 0.8%, prior 0.7%

- 8:30am: 4Q PCE Core QoQ, est. 1.4%, prior 1.4%; 4Q Personal Consumption, est. 2.5%, prior 2.5%

- 8:30am: 4Q GDP Price Index, est. 2.0%, prior 2.0%

- 9:45am: Feb. Bloomberg Consumer Comfort, prior 45.8

- 10am: Jan. Pending Home Sales YoY, prior 22.8%; Pending Home Sales (MoM), est. 0%, prior -0.3%

- 11am: Feb. Kansas City Fed Manf. Activity, est. 15, prior 17

DB’s Jim Reid concludes the overnight wrap

Risk appetite showed signs of returning to global markets over the last 24 hours as Fed Chair Powell stuck to his reassuring tone and continued to signal that the central bank would keep policy accommodative for some time to come. The remarks led to a sharp turnaround across a number of different asset classes, with the S&P 500 moving from an intraday low of -0.56% shortly after the open to end the session +1.14% higher, which was the strongest daily performance for the index in over 3 weeks. Perhaps the most headline-grabbing comment from Powell was thatit could take more than 3 years before the Fed reached its inflation goal of 2%, helping to reiterate the message that the Fed are in absolutely no rush to pare back on stimulus any time soon, and he reaffirmed his message that the labour market was very far from the Fed’s goal, saying that there was still “a long way to go” before the US got to maximum employment. We should find out more on the Fed’s current thinking on inflation in the next 3 weeks when they release their new Summary of Economic Projections at the March FOMC meeting.

Looking at the moves in more depth, risk assets had their best day for some time thanks to Powell, though it was energy stocks that saw the largest gains thanks to another sizeable rise in oil prices. In fact, both Brent crude (+2.55%) and WTI (+2.51%) climbed to their highest levels in over a year yesterday, at $67.04/bbl and $63.22/bbl respectively, as the combination of tighter supplies and recovering economic demand proved supportive, and they’re holding those levels this morning. Otherwise though, it was cyclical industries that led the advance, with autos (+5.60%), banks (+2.49%) and capital goods (+2.26%) being among the strongest performers in the S&P. Tech stocks recovered their losses too, with the NASDAQ up +0.99%, while over in Europe the STOXX 600 gained +0.46%. The reflation/reopen trade was in full force in Europe as well with the travel & leisure (+1.87%), energy (+1.71%) and basic resources (+1.46%) again leading the charge here.

Even as Powell struck a dovish tone, sovereign bonds continued to lose ground on both sides of the Atlantic, and yields on 10yr Treasuries rose +3.4bps to 1.376%, their highest closing level in a year, and have moved up a further +2.0bps this morning. As with equities though, that was some distance from its intraday high, at which point yields had climbed all the way to 1.434%. The moves were evident across the curve, with 30yr Treasury yields rising +5.2bps yesterday to their own 1-year high, which helped the 5s30s curve reach its steepest level in over 6 years. For Europe it was a similar story, with yields paring back their intraday highs as Powell spoke, though they still closed at levels not seen in months, with yields on 10yr bunds (+1.2bps), OATs (1.4bps) and BTPs (+4.2bps) all moving higher. The moves in turn have proved supportive for bank stocks, with the STOXX Banks index in Europe up a further +1.36% yesterday at its highest level since the pandemic began.

Overnight in Asia, markets have taken Wall Street’s lead with the Nikkei (+1.57%), Hang Seng (+2.15%), Shanghai Comp (+1.07%) and ASX (+0.93%) all rising. Futures on the S&P 500 are also trading +0.25% higher and sovereign bond yields have continued to climb in Asia, with Japan’s 30yr yield (+1.9bps) at its highest level since December 2018, and 10yr yields on Australian (+10.3bps) and New Zealand (+18.4bps) debt seeing sharp moves higher. For New Zealand, the moves have been prompted by a decision to change the RBNZ’s remit to support more sustainable house prices and improve affordability for first time buyers, which has led to expectations that the central bank could tighten more quickly than previously expected. On top of this, the Bank of Korea left their main interest rate unchanged at 0.5% as expected, though they raised their CPI forecast for 2021 by three-tenths to +1.3%.

Staying on central banks, a number of other Fed speakers gave remarks yesterday, though the overall tone didn’t add much to what we already knew. Vice Chair Clarida gave a speech on the economic outlook and monetary policy, where he made the point others have about “the true unemployment rate” being closer to 10% when you factor in declines in the labour force and misclassification. However, he remains “bullish on the economic rebound in the US” and sees inflation reaching around 2% by end of 2021. Separately Governor Brainard noted that transitory inflation was “not the kind of inflation that monetary policy would react to”.

Here in the UK, multiple newspapers have reported that the government are potentially planning for a rise in corporation tax at next week’s budget on Wednesday, with the FT saying that Chancellor Sunak would announce “a sharp rise” in the tax from its current 19%, and that the similar proposed increase in the US from 21% to 28% would offer some cover in terms of competitiveness. Other proposals reported have been a six-month extension to the uplift in Universal Credit mentioned in the Telegraph, as well as a Times report that the holiday on stamp duty (the home purchase tax) would be extended until the end of June. For those wanting more info, our UK economists released their preview of the budget yesterday (link here).

Turning to the pandemic, we got some very positive news yesterday as a large-scale study of almost 1.2m people in Israel showed that 2 doses of the Pfizer/BioNTech vaccine prevented 94% of infections. On top of this, staff at the FDA in the US wrote that the Johnson & Johnson vaccine was safe and effective, which comes ahead of an FDA committee meeting tomorrow where they’ll be discussing whether to give it an emergency use authorization. Unlike the other vaccines authorised in the US (Pfizer/BioNTech and Moderna), the Johnson & Johnson vaccine only requires a single dose, and the company have said that they’ll initially be able to provide 4m shots. Elsewhere, Ghana received the first delivery from the Covax vaccine-sharing initiative, which is seeking to support vaccine distribution in lower-income countries, with 600,000 doses of the AstraZeneca vaccine. When it comes to global restrictions there was a divergent picture however, with France announcing that Dunkirk would go into lockdown over the weekend, while in Switzerland, it was confirmed that shops, museums and outdoor sports and leisure facilities would be open from Monday. Meanwhile Moderna announced plans to study various approaches to vaccine boosters to protect against the variant strains, at the same time as they’re taking steps to ramp up production in the next year. The company has already completed manufacturing and sending doses to researchers for a clinical study around the South African strain.

As we mentioned in yesterday’s edition, it’s now been over a year since the first big pandemic-related selloff for markets as the virus started to hit Western nations. In Jim’s chart of the day yesterday (link here) ), we showed the performance of a number of global assets since this point, and also include the low point over the last 12 months. Commodities have been among the strongest performers, with copper leading the way as it hit its highest level in nearly a decade yesterday, whilst gold, silver and oil have also seen major gains. European equities have been the worst hit however, falling behind other regions as a number of indices still haven’t recovered to their pre-Covid levels.

In terms of yesterday’s data releases, the final German GDP reading for Q4 was revised up to show +0.3% growth quarter-on-quarter (vs. +0.1% initial estimate). Looking at the breakdown, private consumption saw the biggest hit (-3.3% qoq), though the savings rate rose again to 17.7%, which supports the argument from our German economists (link here) that pent-up demand will support the economy in the summer half and potentially add to emerging inflationary pressures. With the more positive end to last year, they’re maintaining their 4% GDP forecast for 2021. The other main data release were the new home sales figures from the US, which rose to a stronger-than-expected annualised rate of 923k in January (vs. 856k expected).

To the day ahead now, and data releases from the US include the second estimate of Q4 GDP, weekly initial jobless claims and the preliminary January durable goods orders reading. Over in Europe, there’s also the final Euro Area consumer confidence reading for February, and the January M3 money supply figure. From central banks, we’ll hear from the Fed’s Quarles, Bostic, Bullard and Williams, and the ECB’s De Guindos, Lane and Hernandez de Cos. Earnings releases include Salesforce, American Tower, Moderna and HP, and this afternoon EU leaders will be gathering via videoconference for a European Council meeting.