Authored by Richard Breslow via Bloomberg,

When I sat down to write this morning, S&P 500 futures were up nearly one-half of 1%, having spent the start of today comfortably in the green. A headline hit that Google is going to shift Pixel smartphone production to Vietnam from China and the market was sent promptly back to flat on the day. And, while it is still very early going to be sure, and recent intraday volatility makes it a mug’s game to predict what the day will bring, that’s about all that was worth. The market immediately attempted to bounce. It’s tempting to make a comment about the disconnect between markets and the real world. But that’s not possible when one shifts focus to the bond screens.

In many ways, the world has taken leave of its senses.

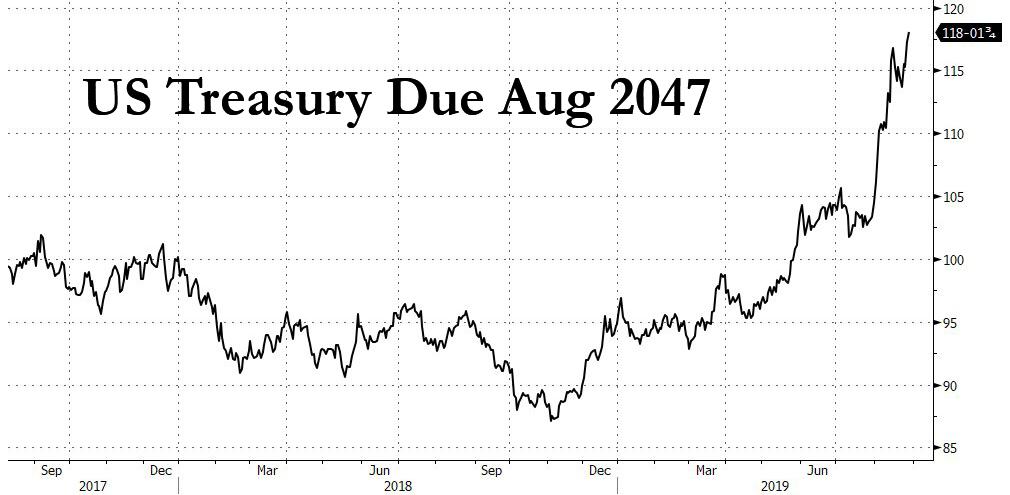

Global fixed-income yields reflect that quite convincingly. Germany auctioned 10-year bunds this morning at negative 70 basis points. Which is close to, but not quite at, year-to-date lows. But, as I said, the day is young and the market has stayed bid. At the last auction — a mere month ago — it raised eyebrows that investors and liability managers were willing to accept negative 41 basis points. Bring on the ECB.

Of course, since then, the German economic numbers have been hugely disappointing. And just this morning the German Institute for Economic Research (it sounds more impressive if you just say DIW) forecast that the economy will shrink by 0.2% in the third quarter. And that is what recessions are made of. As they pointed out in their report, manufacturing is so weak that it is dragging the service sector down with it.

And still the German government refuses to properly loosen the fiscal purse strings. The number of respected commentators who are wondering why, or screaming bloody murder, keeps growing. The chancellor, inexplicably, seems willing to keep a wait-and-see approach. Bundesbank President Jens Weidmann has reverted to type, saying this past weekend that the government and the ECB shouldn’t “act for action’s sake.” Huh.

But why wouldn’t you think those yields are attractive when Italian two-year paper passed negative 15 basis points earlier this morning?

Former New York Fed President Bill Dudley, unsurprisingly, got the lion’s share of the headlines yesterday with his column saying the central bank shouldn’t encourage President Trump’s trade war. It immediately provoked rebuttals. The market didn’t alter its pricing on it. But I’ve been amazed how many people said to me that they have thought the same thing. Forget about it. What seems like muscular politics on paper would most likely have some very unfortunate unintended consequences. And with everything else going on, the world simply can’t afford a U.S. recession. Nor is it clear how we would get out of one.

Slash rates and do more QE?

Good luck with that.

Driving Treasury yields into negative territory is a prescription for economic and political disaster far worse than “waiting it out.” Forcing pension plans into an even more aggressive feeding frenzy for whatever yield they can get could lead to some mighty cold winters for retirees. Heat doesn’t trickle down. The only thing that is likely to work is the passage of time. And when it comes to lowering rates, patience is not something the central bank will be very good at.

It’s maddening that the makers of monetary policy now realize that they need to reconsider the assumptions built into their models. No one is feeling particularly over-confident anymore. On the other hand, they have no choice but to do so. And the sooner the better.

I have a lunch today and my host will ask me how the markets are doing. If I can tell him stocks and bonds are up, he will smile and assume all is right with the world. That’s a big reason how we got here.

via ZeroHedge News https://ift.tt/2ZCvOh3 Tyler Durden