Just one day after stocks tumbled on concerns of an imminent economic recession when the US Manufacturing ISM tumbled below 50 for the first time in 3 years, all fears appeared to evaporate this morning as U.S. stock-index futures surged, erasing almost all of yesterday’s losses, boosted by hopes of a return to calm in Hong Kong combined with political developments in Italy and the U.K. S&P futures surged as much as 1% after news that Hong Kong’s chief executive plans to formally withdraw the extradition bill that had sparked widespread protests.

Stocks got a further boost out of the latest development in Italy, where the FTSE MIB Index was the best performer among local European markets, up 1.7%, after Giuseppe Conte cleared the last hurdle to become prime minister, when he got backing from supporters of the Five Star Movement in an online vote. Finally, the no-deal Brexit storm appears to be passing as lawmakers in the U.K. supported moves to block Prime Minister Boris Johnson from taking the nation out of the European Union without a deal.

As a result, global stocks rose 0.4%, as Europe rallied 1.1% and after a positive session in Asia following a report showing that growth in China’s service sector accelerated despite broader economic headwinds.

Asian equity markets eventually traded mostly higher as the headwinds from Wall Street, where the S&P 500 and DJIA snapped a 3-day win streak due to ongoing trade uncertainty and weak ISM Manufacturing, was eventually counterbalanced as data from the region provided some encouragement.

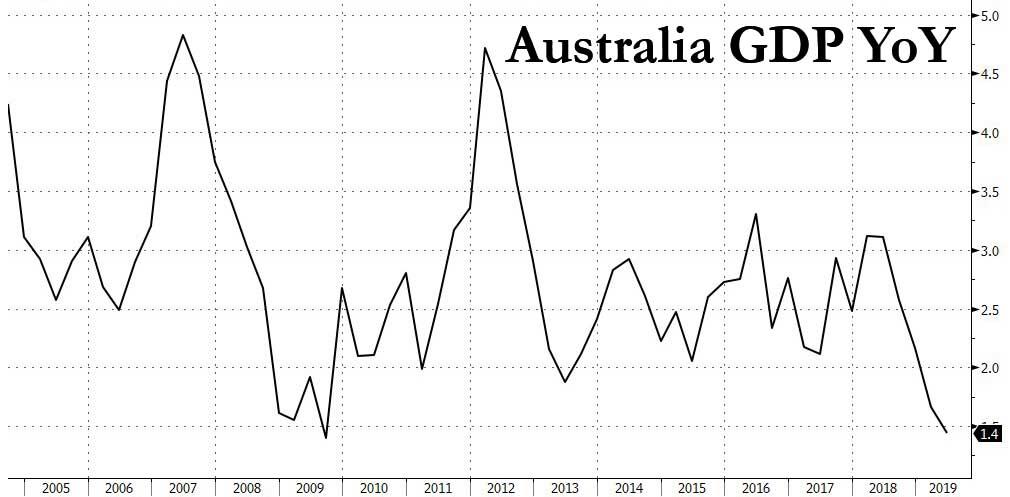

ASX 200 (-0.3%) and Nikkei 225 (+0.1%) were mixed with broad weakness seen across Australia’s sectors as participants digested GDP figures which showed growth slowed to its weakest since the GFC as expected and with a cut at next month’s RBA meeting seen as a coin flip.

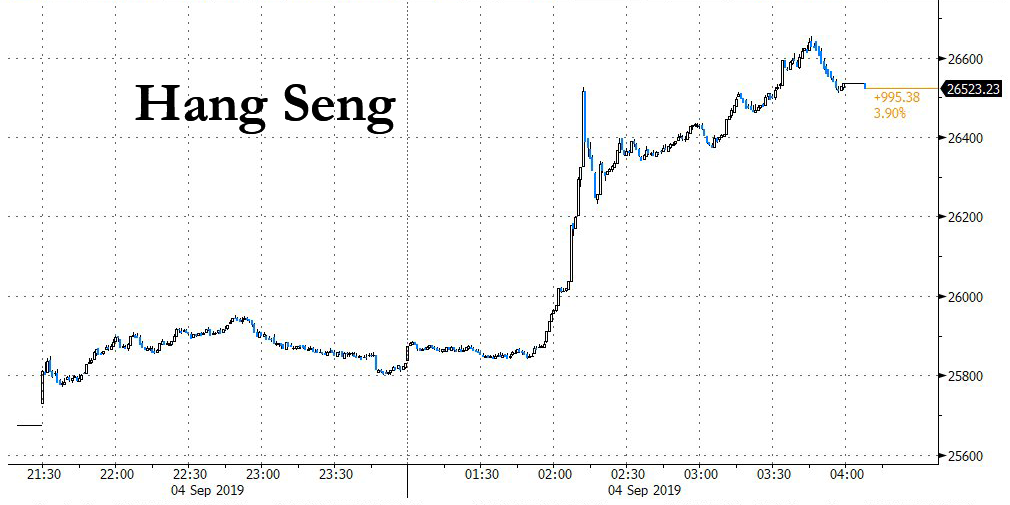

In terms of sectors, the top-weighted financial industry was among the laggards, although gold miners bucked the trend on recent strength in the precious metal. The Japanese benchmark was indecisive but pared opening losses as it found mild support from favourable currency moves, while Hang Seng (+3.9%) and Shanghai Comp. (+0.9%) were positive after Chinese Caixin Services PMI topped estimates to print a 3-month high with Hong Kong the outperformer after HK CEO Carrie Lam unexpectedly withdrew legislation that would’ve allowed extraditions to China.

The MSCI Hong Kong Index surged 5.4%, its biggest gain since October 2011. Real estate firms led the gains, with Wharf Real Estate Investment Co., New World Development Co. and Sun Hung Kai Properties Ltd. all up more than 9%. The Hong Kong dollar strengthened as much as 0.08%. The Hang Seng Index closed 3.9% higher.

However, gains in the mainland were restricted amid a continued PBoC liquidity drain and ongoing trade uncertainty after President Trump reiterated China will get a tougher deal if he wins the 2020 elections and was said to be angered by China’s tariff retaliation that he wanted to double the tariffs but resorted to a 5% hike after consultations. The Shanghai Composite Index added 0.9%, supported by large financial firms. Finally, 10yr JGBs were lacklustre amid the indecision in Japan and a lack of BoJ presence in the market, which saw prices retrace some of the recent gains.

Major European bourses are also higher across the board, with the Stoxx 50 +0.8%, and all industry groups in the Stoxx Europe 600 index advanced, almost erasing the gauge’s August decline as risk appetite was initially spurred by the news that Hong Kong Chief Executive Carrie Lam will formally withdraw the extradition bill, which is responsible for the ongoing protests in the region. UK’s FTSE 100 (+0.3%) marginally lags its peers amid unfavorable Sterling action to exporters after the UK Parliament approved a motion to seize control of Parliamentary time in an attempt to block a no-deal Brexit, sending . Meanwhile, Italy’s FTSE MIB (+1.5%) is led by constructive developments in Italian politics, after the 5SM’s online vote of grassroot members showed a backing for the formation of a 5SM/PD coalition, thus eliminating the risk of political limbo. Luxury-goods makers that depend on Hong Kong sales including Richemont and Swatch climbed along with stocks in Italy, where a new political coalition took shape that may be more conciliatory toward the European Union.

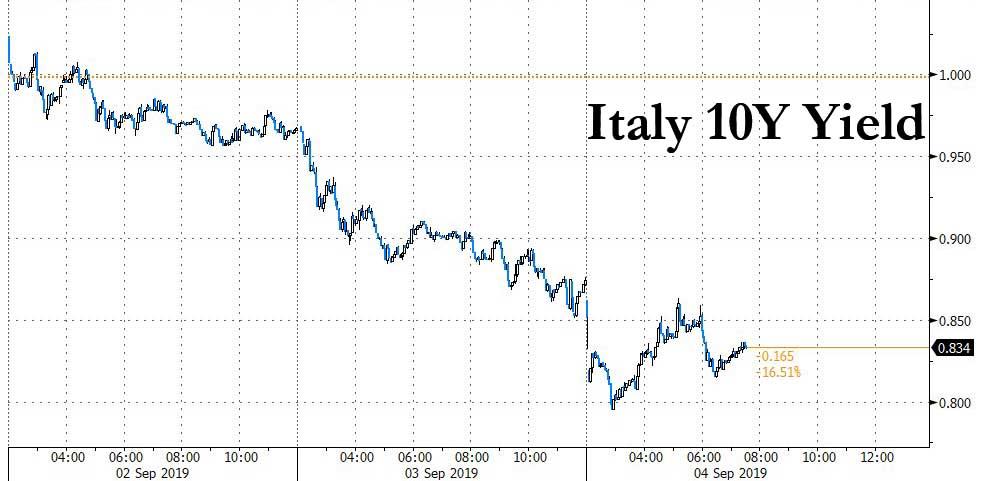

Italian bonds rose after members of the “anti-establishment” 5-Star Movement backed a proposed coalition with the establishment, center-left Democratic Party on Tuesday, opening the way for a new government to take office in the coming days. As a result 10-year Italian government bond yields hit 0.803%, a new record low, while Italian banks, another proxy for political risk in the country, rallied 2%.

“The next hurdle for the government will be the confidence vote in Parliament. But at the moment risks appear limited,” said Giuseppe Sersale, fund manager at Anthilia Capital.

Yields on the safe-haven 10-year German Bund rose to 0.676% after falling to a fresh record low on Tuesday, while the yield on the 10-year U.S. Treasury rose to 1.489% after hitting its lowest since July 2016 in the previous session in light of the weak ISM U.S. factories reading.

Political concerns and expectations of further easing measures by central banks have been squeezing bond yields globally but the return of risk appetite on Wednesday on the back of political developments in Europe and upbeat economic data from China triggered a rebound.

In FX, China’s yuan rose the most in a week as the dollar slid on weak data and the central bank set its daily fix at a level stronger than market watchers expected for an 11th day. The People’s Bank of China set the yuan’s daily reference rate at 7.0878 per dollar, stronger than the average forecast of 7.1023 by 20 traders and analysts surveyed by Bloomberg. The yuan rose as much as 0.2% against the greenback, which fell after a disappointing U.S. manufacturing report reignited concern about global economic growth. The yuan will continue to trade between 7.1 and 7.2 as long as trade tensions between China and the U.S. don’t escalate further, according to Gao Qi, a currency strategist at Scotiabank in Singapore.

The Bloomberg Dollar Spot Index slipped for a second day, while the pound rises for a second day amid broad dollar weakness after Prime Minister Boris Johnson moved to trigger a snap general election to resolve the Brexit standoff. British lawmakers defeated Boris Johnson on Tuesday in a bid to prevent him taking Britain out of the European Union without a divorce agreement, prompting the prime minister to announce that he would immediately push for a snap election. On Wednesday they will seek to pass a law forcing Johnson to ask the European Union to delay Brexit until Jan. 31 unless he has an exit deal approved by parliament beforehand. Traders were also awaiting a speech by Bank of England Governor Mark Carney and the August inflation report.

In commodities, oil prices recovered some ground, helped by the positive China data and having touched their lowest in close to a month during the previous session on fears over the weakening global economy. Brent crude was up 22 cents at $58.48 a barrel, while WTI futures gained 31 cents at $54.25 at barrel.

On today’s calendar, trade balance, mortgage applications are due. Scheduled earnings include Palo Alto Networks, Slack.

Market Snapshot

- S&P 500 futures up 0.9% to 2,932.25

- STOXX Europe 600 up 1.1% to 383.83

- MXAP up 0.9% to 153.57

- MXAPJ up 1.6% to 497.54

- Nikkei up 0.1% to 20,649.14

- Topix down 0.3% to 1,506.81

- Hang Seng Index up 3.9% to 26,523.23

- Shanghai Composite up 0.9% to 2,957.41

- Sensex up 0.4% to 36,718.48

- Australia S&P/ASX 200 down 0.3% to 6,553.01

- Kospi up 1.2% to 1,988.53

- German 10Y yield rose 2.4 bps to -0.682%

- Euro up 0.2% to $1.0991

- Brent Futures up 0.5% to $58.56/bbl

- Italian 10Y yield fell 9.1 bps to 0.535%

- Spanish 10Y yield rose 1.7 bps to 0.126%

- Brent Futures up 0.5% to $58.56/bbl

- Gold spot down 0.6% to $1,537.47

- U.S. Dollar Index down 0.2% to 98.82

Top Overnight News from Bloomberg

- U.K. Prime Minister Johnson began moves to trigger a snap election after suffering a defeat for his Brexit strategy. Members of the House of Commons voted 328 to 301 to take a first step toward forcing the prime minister to delay Brexit by three months

- Economic situation with U.S. manufacturing contracting amounts to a “global shock” that warrants an aggressive step by the Fed at its meeting in two weeks, St. Louis Fed President James Bullard says

- Boston Fed President Eric Rosengren said the U.S. economy remains “relatively strong” despite clearly heightened risks, leaving him unconvinced the central bank needs to cut interest rates this month

- ECB policy maker Francois Villeroy de Galhau signaled skepticism over the need for renewed asset purchases while leaving open the question of whether he’d still back a stimulus package that includes them.

- President Donald Trump sought to prod China into doing a trade deal before the U.S. presidential election in November 2020, or face even more difficult negotiations during his potential second term

- French Finance Minster Bruno Le Mairemet with U.S. authorities in Washington as part of a plan to offer Iran a $15 billion economic lifeline and rescue the Iran nuclear accord

- Economists are downgrading their forecasts for economic growth in China to below a level seen as necessary for the Communist Party to meet its own goals in time for its centenary in 2021

- China softened toward Hong Kong’s protesters, saying peaceful demonstrations were allowed under the law, even as it ruled out a fundamental demand for direct democracy

Asian equity markets eventually traded mostly higher as the headwinds from Wall St, where the S&P 500 and DJIA snapped a 3-day win streak due to ongoing trade uncertainty and weak ISM Manufacturing, was eventually counterbalanced as data from the region provided some encouragement. ASX 200 (-0.3%) and Nikkei 225 (+0.1%) were mixed with broad weakness seen across Australia’s sectors as participants digested GDP figures which showed growth slowed to its weakest since the GFC as expected and with a cut at next month’s RBA meeting seen as a coin flip. In terms of sectors, the top-weighted financial industry was among the laggards, although gold miners bucked the trend on recent strength in the precious metal. The Japanese benchmark was indecisive but pared opening losses as it found mild support from favourable currency moves, while Hang Seng (+3.9%) and Shanghai Comp. (+0.9%) were positive after Chinese Caixin Services PMI topped estimates to print a 3-month high with Hong Kong the outperformer after HK Chief Exeutive Carrie Lam withdrew the controversial Extradition Bill. However, gains in the mainland were restricted amid a continued PBoC liquidity drain and ongoing trade uncertainty after President Trump reiterated China will get a tougher deal if he wins the 2020 elections and was said to be angered by China’s tariff retaliation that he wanted to double the tariffs but resorted to a 5% hike after consultations. Finally, 10yr JGBs were lacklustre amid the indecision in Japan and a lack of BoJ presence in the market, which saw prices retrace some of the recent gains.

Top Asian News

- Traders Fixate on Trump’s Twitter Everywhere, Except in China

- China Foreign Ministry Doesn’t Comment on H.K. Bill Withdrawal

- Anil Ambani’s Reliance Naval Facing Cash Crunch Amid Debt Revamp

- Miners Offer Some Tactical Opportunities in Late Cycle, DB Says

Major European bourses are higher across the board [Eurostoxx 50 +0.8%] as risk appetite was initially spurred amid source reports (later confirmed) that Hong Kong Chief Executive Carrie Lam is to formally withdraw the extradition bill today, which is responsible for the ongoing protests in the region. UK’s FTSE 100 (+0.3%) marginally lags its peers amid unfavourable Sterling action to exporters after the UK Parliament approved a motion to seize control of Parliamentary time in an attempt to block a no-deal Brexit. Meanwhile, Italy’s FTSE MIB (+1.5%) is led by constructive developments in Italian politics, after the 5SM’s online vote of grassroot members showed a backing for the formation of a 5SM/PD coalition, thus eliminating the risk of political limbo. Sectors are in a sea of green with substantial outperformance in consumer discretionary names as luxury stocks soar on optimistic Hong Kong news. Kering (+3.7%), Richemont (+3.5%), Swatch (+3.2%) all reside near the top of the Stoxx 600. In terms of individual movers, Thales (+6.4%) shares spiked higher at the open after posting an improvement in earnings, meanwhile Mediaset (+2.1%) shareholders approved the merger of its Italian and Spanish units to compete with the likes of Netflix. On the flip side, Barratt Developments (-1.4%) shares fell post-earnings, whilst Deutsche Telekom (-0.1%) is subdued amid reports that Illinois has joined the lawsuit aimed at blocked a merger between T-Mobile (of which Deutsche Telekom owns 63% of) and Sprint.

Top European News

- Germany Cabinet Aims to Reduce Glyphosate Usage in Coming Years

- U.K. on Course for Recession as Services Growth Stagnates

- U.K.’s Super-Rich Prepare to Flee From Corbyn Rule, Not Brexit

- European Car-Parts Makers Rise as JPMorgan Sees Year-End Rally

In FX, the Pound remains at the top of the G10 ranks after MPs voted in favour of a no Brexit deal blocking motion last night, with Cable breaching technical resistance in the form of the 21 DMA at 1.2144 and Eur/Gbp extending its reversal through 0.9100 and pivoting 0.9050. However, Sterling lost some momentum after the UK services PMI completed a set of misses vs consensus and IHS/Markit conjects that the slowdown in the sector combined with more pronounced contraction in manufacturing and construction indicates that GDP is likely to slip 0.1% q/q in Q3. If confirmed this would mean a technical recession and Cable is waning just ahead of 1.2200 having eclipsed Monday’s 1.2175 high and Fib resistance around the same level, or 1.2176 to be precise.

- AUD/NZD/EUR/SEK – The next best majors and all benefiting from further Greenback weakness post yesterday’s sub-50 US manufacturing ISM (DXY down to 98.571) on top of a broad upturn in risk sentiment on the aforementioned positive Brexit developments, Italy’s 5-Star approving its tie-up with the PD party and Hong Kong’s CE Lam withdrawing the extradition bill. Aud/Usd just pulled up shy of the 0.6800 mark with the added impetus of China’s Caixin services/composite PMIs surpassing expectations and not too ruffled by Aussie GDP data confirming forecasts for a slowdown in growth to GFC levels. Nzd/Usd continues to lag around 0.6350 as the Aud/Nzd cross holds above 1.0650, but Eur/Usd is back on the 1.1000 handle following a run of firmer than expected Eurozone services PMIs and ahead of more ECB speakers. Nevertheless, the Swedish Krona is outperforming on the back of an even stronger services PMI print and not perturbed by Nordea revising its Riksbank rate outlook from unchanged through 2020 to a 25 bp ease in December this year on the eve of this month’s policy meeting, with Eur/Sek straddling 10.7500.

- CAD/CHF – Also firmer vs the Greenback, but a bit more contained as the Loonie faces resistance around 1.3300 in the run up to Canadian trade data and the BoC, while the Franc is ever wary that too much appreciation will not be tolerated and is fading into 0.9840 with Eur/Chf meandering between 1.0825-60.

- JPY – Safe-haven unwinding has undermined the Yen, to an extent, as Usd/Jpy rebounds from sub-106.00 yet again, but hefty option expiries layered from 106.30-40, through 106.50-60 to 106.75-85 (5.5 bn in total) could keep the headline pair in check from a high circa 106.30 so far.

- EM – Broad gains vs the Greenback, with the Rand and Lira still leading the way, but perhaps some respite in store for the Ars in wake of an upgrade from Fitch to CC from RD for Argentina late on Tuesday.

In commodities, WTI and Brent futures are higher in early EU trade as risk sentiment was bolstered by the aforementioned developments in Hong Kong with the former back above the 54/bbl level and the latter hovering around 58.50/bbl. News-flow for the complex has been light, although UBS downgraded its global growth forecasts to 2.5% from 3.2% annualised, which coincided with downside in prices at the time. Elsewhere, with Hurricane Dorian drifting away from the Gulf of Mexico, eyes turned to Tropical Storm Fernand (formerly known as cyclone Seven) which is located around 130km SE of La Pesca, Mexico. NHC stated that the tropical storm is moving slowly Westward, and once inland, rapid weakening is expected before the storm dissipates on Thursday. As a reminder, API crude inventories will be released today due to Monday’s US Labour Day holiday. Turning to metals, gold has thus far failed to benefit from a weaker Buck as the current risk appetite spurred some outflow in safe-haven assets. The risk-on sentiment has also driven gains in copper prices as the red metal reclaimed 2.5/lb to the upside following three consecutive days of losses.

US Event Calendar

- 7am: MBA Mortgage Applications, prior -6.2%

- 8:30am: Trade Balance, est. $53.4b deficit, prior $55.2b deficit

- 2pm: U.S. Federal Reserve Releases Beige Book

- Wards Total Vehicle Sales, est. 16.8m, prior 16.8m

DB’s Jim Reid concludes the overnight wrap

So today in the UK we have another Battle Royale in store between two warring factions with neither side prepared to compromise, back down, give way or show any signs of desire to engage with the opposition. Indeed, it could come down to the toss of a coin as to who wins. Yes, in Manchester the oldest international rivalry in sport recommences with the 4th test in a 5 test Ashes series between England and Australia. For those uninitiated in the charms of Cricket, the last game was the equivalent of your favourite football team scoring 5 times in injury time to win the game 5-4. Fortunately, England were that team and my shouts of jubilation could be heard in Australia.

It was Ashes to Ashes in terms of the manufacturing sector yesterday as the US industrial sector effectively joined the majority of the rest the world in contraction. If that wasn’t enough to keep an eye on, we also saw negative trade remarks from Mr Trump, rumoured ECB stimulus headlines, and more Brexit turmoil. So welcome to September and a microcosm of what the rest of the year could look like. Those factors combined meant it wasn’t the best of first days of the month for US equities after the holiday with the S&P 500 down -0.69% and DOW and NASDAQ down -1.08% and -1.11% respectively. Elsewhere US HY credit spreads were +7.7bps wider, with HY energy spreads leading the move (+12.5bps) as oil dropped -2.09%.

Treasuries rallied with 10y yields hitting 1.441% at one stage before closing at 1.473%, albeit still -2.4bps on the day. Remember that the all-time low is 1.358%. The curve edged back into positive territory (+0.6bps) though as 2y yields dropped -4.0bps. The front-end rally was driven by heightened expectations for Fed easing, as the market now prices 64bps of cuts before year-end and another 59bps in 2020. That is 5bps and 7bps of more cuts than before the poor data. For the meeting later this month, the market fully prices in a 25bps cut, plus a 20% chance of larger 50bps cut. St. Louis Fed President Bullard argued last night in favour of a 50bps cut,though he is known as the most dovish member of the committee. Perhaps more interestingly, Boston Fed President Rosengren, who dissented against the July cut, opened the door to a rate cut later this year if the data deteriorates further.

That weak US data that we referred to at the top was the August ISM manufacturing reading which dropped 2.1pts to 49.1 (vs. 51.3 expected). That’s the first sub-50 reading since August 2016 and the weakest since January 2016. The details weren’t much more pleasing on the eye with employment (47.4 from 51.7) and new orders (47.2 from 50.8) also slumping. In fact the latter is the weakest since June 2012 although even more eye catching was the new export orders component hitting 43.3 and the lowest since the depths of the financial crisis.

So pretty ugly data and the damage in markets really came after the data. Prior to that President Trump tweeted that the US “is doing very well in our negotiations in China” and that “while I am sure they would love to be dealing with a new administration…think what happens to China when I win. Deal would get much tougher”. In a separate tweet he also said that “the EU & all treat us very unfairly on trade also” and that “will change”.

This morning in Asia markets are largely trading higher with the Hang Seng (+1.18%), Shanghai Comp (+0.22%) and Kospi (+0.15%) all making advances. The Nikkei is trading down (-0.06%) but is rallying back towards flat for the day. Elsewhere, futures on the S&P 500 are up +0.34% this morning. As for overnight data releases, China’s August Caixin services PMI came in at 52.1 (vs. 51.7 expected) while the composite read was at 51.6 (vs. 50.9 last month). Japan’s final August services PMI came in one tenth lower than initial read at 53.3 while the composite PMI was two tenths above initial read at 51.9. In other overnight news, the BoJ board member Goushi Kataoka, a known dove, said that the central bank shouldn’t wait for changes in data to back up the case for more stimulus while adding that the deepening of the BOJ’s negative short-term rate is his preferred option.

Onto Brexit, and the government was defeated last night by 328 to 301, quite a wide margin, and now have to cede control of today’s parliamentary business where a similar majority are now highly likely to vote to request an extension to Brexit and put anti no-deal legislation in place. It is assumed that they will pass such legislation very quickly but in these unprecedented times there is some speculation of various forms of filibustering in the Lords so take nothing for granted. Ahead of the vote, PM Johnson also lost his majority yesterday as Phillip Lee defected to the Lib Dems. Meanwhile, after yesterday’s defeat in the House of Commons, PM Johnson retaliated by asking his officials to expel the 21 Conservative rebels, including former Chancellor Philip Hammond, who defied him and voted against the bill.

Immediately after the vote, PM Johnson said that if the motion to extend Brexit passes, he would move to call a new election. The main opposition leaders, including Jeremy Corbyn and Ian Blackford, said that they would entertain the possibility of an election as long as the legislation preventing no-deal is passed first. So that vote will be the first and principle focus today. If Mr Johnson wants an election on October 14th, I think (and I reserve the right to be wrong so please don’t hold me to it) that it needs to be legislated by Monday at the latest. So if correct it may be in his interest to allow the anti no-deal legislation through and then move quickly to call for an election.

There are a number of mechanisms to call an early election but all of them are complicated at the moment. The first, which was used in the 2017 vote, is that 2/3rds of MPs vote in favour of one, which would be difficult to achieve if a sizeable minority of MPs see the election as a vehicle for a no-deal exit so that is unlikely to work until said legislation is passed. The second is that a vote of no confidence is passed in the government by a simple majority in the House of Commons, and no alternative government can be formed that commands the confidence of MPs within 14 days. Could Mr Johnson express a vote of no-confidence in himself and could the opposition reject this assertion? Such an outcome is highly unlikely but it would fit in well with the ongoing narrative of strange and unprecedented occurrences.

The final way it could be done would be by a simple majority of both Houses of Parliament passing an amendment to the Fixed-Term Parliaments Act or another piece of legislation that simply writes into law that the Act does not apply for the next election. Lawyers will be busy in Westminster today but the central case is that anti no deal legislation gets passed and then an election gets agreed for October 14th. It’s very fluid though.

With fears of a no-deal exit rising, sterling fell to $1.196 yesterday morning, its lowest level since October 2016 before recovering to trade a touch higher at $1.208 and is trading up +0.18% this morning at 1.2104.Ten-year gilt yields also fell to a record low of 0.34% at one point yesterday before closing down -0.9bps at 0.41%.

While the situation remains incredibly fluid, it’s worth noting that yesterday DB’s Oli Harvey published an update (link here ) on the situation in which he emphasises that should a general election be confirmed for October, he would turn neutral on sterling, having been very negative over the last six months. Oli sees a pre-31 October election as the least worst of all scenarios this week, reducing the prospect of a no deal Brexit. This is because of the three central outcomes he identifies, two – either a large Conservative majority or a remain coalition government – are more likely than not to lead to an orderly Brexit or no Brexit at all. The other outcome, that of a narrow Conservative majority/Brexit coalition is what Oli describes as the worst outcome for a deal, since the government will be vulnerable to MPs who favour leaving without a deal.

In other news, with the next policy meeting round the corner, right on cue we had the usual ECB sources story from the MNI yesterday. The story essentially endorsed consensus expectations for a broad based package from the ECB and while it didn’t contain anything new in terms of the components of package, it did have several sources saying there will be QE2. Later in the day Reuters reported that policymakers are leaning towards a rate cut, tiering and reinforced guidance. The headline suggested that committees are preparing a package but the exact quantum is still up in the air. Finally, we also had public remarks from the governors of the national central banks in France and Estonia. France’s Villeroy, a centrist on the committee, gave balanced comments, saying that inflation is still too low but declining to endorse the need for new QE. Estonia’s Muller sent a similar message, saying “I don’t think we have a strong case for reactivating QE now.” The earlier ECB related headlines caused a small bounce in the euro and for bond yields although it was fairly short lived. In the end the euro ended flat while 10y Bunds were -0.4bps lower at -0.706%. In equities the STOXX 600 ended down -0.23%. It’s worth noting that (relatively) new ECB Chief Economist Lane is due to speak today so that will be worth keeping an eye out for.

Staying with Europe, Bloomberg has reported overnight that Five Star supporters voted by 79.3% yesterday in favor of Conte’s attempt to form an alliance between Five Star and the center-left Democratic Party. This paves the way for Prime Minister-designate Giuseppe Conte to form Italy’s next government. Conte is now due to bring a list of ministers and a government program today to President Sergio Mattarella. A new administration could likely be sworn in later this week, with a first confidence vote in the lower house by the weekend and in the Senate early next week.

As for other US data yesterday, the August Markit manufacturing PMI was revised up 0.4 points to 50.3. That took the index out of contractionary territory, but it remained the lowest reading of the cycle. Construction spending came in at 0.1% mom for July, less than the 0.3% expected, though June’s figure was revised up a touch. Overall, today’s data sent the Atlanta Fed’s Q3 GDP estimate down to 1.7%, its lowest reading yet.

Finally the only data worth flagging in Europe yesterday was the July PPI print which came in-line at +0.2% mom while the construction PMI in the UK printed at a lowly 45.0 for August and well below expectations for 46.5. Luckily we’ve got Brexit to overshadow the data for now.

Looking at the day ahead now, the focus this morning will be on the remaining August services and composite PMIs in Europe while the only other release of note is July retail sales for the Euro Area. In the US this afternoon we’ll get the July trade balance and August vehicle sales data. Meanwhile, it’s a very busy day for central bank speak. This morning we’re due to hear from the ECB’s Lane in London while in the afternoon and into the evening we’ve got the BoE’s Carney, ECB’s Mersch and Guindos and the Fed’s Williams, Kaplan, Bowman, Bullard, Kashkari and Evans all speaking at various events. The BoC policy decision is also due today.

via ZeroHedge News https://ift.tt/2ZKXPDr Tyler Durden