2 Letters; $20 Billion Lost

Submitted by Adventures in Capitalism

Over the past few months, we’ve learned a lot about the psyche of the typical Ponzi Sector investor.

You see, Ponzi sector investors will ignore most red flags, even at a company like WeWork, with more red flags than a Soviet May Day parade;

-

Super-voting stock – Zuck did that and it worked out in the end

-

Accelerating losses – Look at all that revenue growth

-

Zero possibility of profits – Hasn’t mattered for years

-

Convoluted insider dealings on property leases – Property GPs always double dip somehow

-

Sold the pronoun “WE” to the company – That man is a crook!!

Look, the average bagholder is braindead. However, it doesn’t matter how “woke” you pretend to be while promoting your stock scam, you cannot do something as egregious as sell 2 letters to a company you control 30% of. That is just blatant theft.

Ever since this transaction was disclosed, I’ve seen people attack the absurdity of it all. In fact, I saw so much coverage that I felt that I’d let this one pass—what else did I have to add? Then they failed to find buyers for the IPO. The valuation started a few months ago at $65b, then $50b, then $40b (…still no one?), $30b (…uhh guys, think of the kegerators?), $25b (does anyone care at roughly half of what SoftBank paid?), now $20b is looking like a long-shot.

It’s like one of those charity date-auctions in college where no one wants the fat chick. The price keeps dropping and everyone is looking at each other, seeing who’ll step up. “At least it’s for a good cause, right?” Well, the WeWork IPO does nothing other than prop up a Masayoshi Scheme (which is just a sophisticated Ponzi Scheme). Letting WeWork fail would actually be the “good cause.” It would stop innocent retail investors from getting hosed—while the scam artists take the beating for a change.

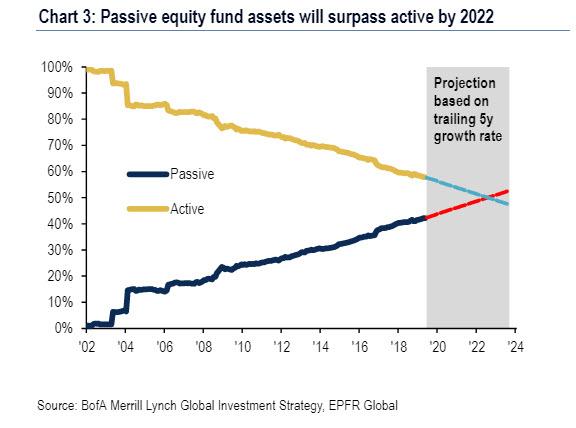

I’m not going to opine on the continued busting of the Ponzi Sector bubble, as I’ve done enough of that already and hopefully made my point (look at charts of TSLA, UBER, LYFT, etc. if you don’t know what I’m talking about). Instead, I want to talk about corporate governance. In today’s world where shares are increasingly owned through ETF mandate, investors often forget that behind the ticker symbol is an actual business and the guy in charge is king—particularly at a company like WeWork with super-voting stock. This king has incredible power over a pool of someone else’s money. There is literally no one to stop him from misbehaving and hardly anyone even watching closely. Abusing a key funding partner like SoftBank, really is something “special,” even in today’s era of corporate excess. Fortunately, CEOs leave paper trails which speak volumes as to how a particular CEO will treat minority shareholders going forward.

Let’s pivot to the smaller companies that I focus on. Corporate governance is everything to me. At a small growing company, your cost of capital or even access to capital (at any price), determines your ability to succeed. We all accept that a CEO needs to earn a salary so he can pay his mortgage and buy groceries for his family. Anything beyond a certain threshold seems egregious—particularly when the same CEO is tossing his hat around asking investors to buy shares so that the business can grow. You have no idea how many times I’ve avoided an attractive investment over excessive executive compensation. Why does a CEO need to earn 20% of EBITDA? This isn’t a hedge fund. That EBITDA has a multiple on it. The higher the valuation, the lower the cost of capital going forward. If a CEO with a pile of equity doesn’t understand this—I want nothing to do with that company.

Don’t CEOs need to profit too? Sure. Give them stock options. If you give stock options to a rapidly growing company, at worst, it’s a deferred capital raise when those options get exercised. More importantly, it retains cash inside of the company instead of giving it away as salary. Besides, the CEO is only making money on his options if I’m making money on my shares. I can accept a bit of dilution—especially if the cash salary component is on the lower side.

Of course, there’s a level of option compensation that is also egregious. Board members will agree to damn near anything for the CEO of a company that’s succeeding. It’s up to the CEO to recognize where the grey line is, then take 2 giant steps backwards and be shareholder friendly. It’s all about cost of capital. Over the past few years, where plenty of dubious companies have been able to raise capital, people seem to have forgotten this rule. Suddenly, a non-sensical $5.9 million payment (less than 2 days of losses at WeWork) has cut at least $20 billion off the company’s valuation. It may even prove fatal if they cannot list. Previously, WeWork was a loss-making real estate company masquerading as a tech business—now it’s simply WeFraud to everyone I know. Those were 2 expensive letters.

Watch your CEOs. Read the proxy statements. See who earns what. You’d be surprised at the dispersion of compensation levels, even at similarly sized companies. If cash compensation is egregious—run!! All businesses have a certain level of related party dealings—look closely at them—do they make sense? Does the company get a fair deal? Look for anything beyond the norm—look for transactions designed to take advantage of the company. The markets are rife with abuse. There’s a reason that owner-operator businesses tend to out-perform those with hired gun CEOs. Then there’s the exception to the rule; Adam Neumann owns roughly 30% of WeWork. Why is he destroying their cost of capital?

Tyler Durden

Mon, 09/09/2019 – 12:10

via ZeroHedge News https://ift.tt/34ulj3n Tyler Durden