When It Comes To Economic Suffering, Some Parts Of The US Are Feeling It Far More Than Others

Tyler Durden

Mon, 07/27/2020 – 17:04

Authored by Michael Snyder via TheMostImportantNews.com,

2020 has been a very tough year for the U.S. as a whole, but some portions of the country have been hit much harder than others. For example, if you live in a rural area that hasn’t seen any civil unrest and that hasn’t been hit very hard by the COVID-19 pandemic, the way that you are living your life now may seem nearly unchanged from the way you were living your life in 2019.

But if you live in an urban area that has experienced endless protests and rioting and that has seen COVID-19 sweep through local neighborhoods like wildfire, your life in 2020 may look radically different from the way it looked in 2019.

Unfortunately, conditions in our largest cities are not likely to improve dramatically any time soon.

But many people that live in rural communities are feeling pretty good about things right now. Even though more than 52 million Americans have filed new claims for unemployment benefits over the last 18 weeks, the official unemployment rate in many rural counties is still in the single digits.

I know that may be difficult to believe, but that is what the numbers tell us.

Sadly, in many of our largest cities it is a completely different story. New York City was one of the early epicenters of the COVID-19 pandemic in the United States, and many of us will never forget watching video footage of the looting that took place in the heart of Manhattan earlier this year. As a result of all of this chaos, the unemployment rate in the state as a whole is nearly twice the national average…

New York’s unemployment rate rose to 20.4% last month, according to state-level data issued Friday by the Bureau of Labor Statistics that detailed figures for some large metro areas. That’s up from 18.3% in May and 15% in April.

We see a very similar story when we look at the city of Los Angeles.

Thanks to COVID-19 and endless civil unrest, the official unemployment rate in the city is hovering near 20 percent…

Los Angeles, the second-largest U.S. city, has seen a similar level of joblessness.

Its unemployment rate recovered slightly in June but remains startlingly high — at 19.5%, versus 20.6% in May, according to data published Friday by California’s Employment Development Department.

Unfortunately, it appears that the COVID-19 pandemic and the violence in our major cities are both going to be with us for the foreseeable future.

Some people think that the civil unrest will disappear if Joe Biden wins in November, but I do not believe that is the case. Nearly all of the major cities where the violence is happening are controlled by radical Democrats, and those radical Democrats have been completely unable to control the riots. To the protesters, Republicans and Democrats are both two sides of the same coin and are both responsible for the injustices in our society, and they are not going to give up on their goals just because a moderate Democrat like Joe Biden wins the election.

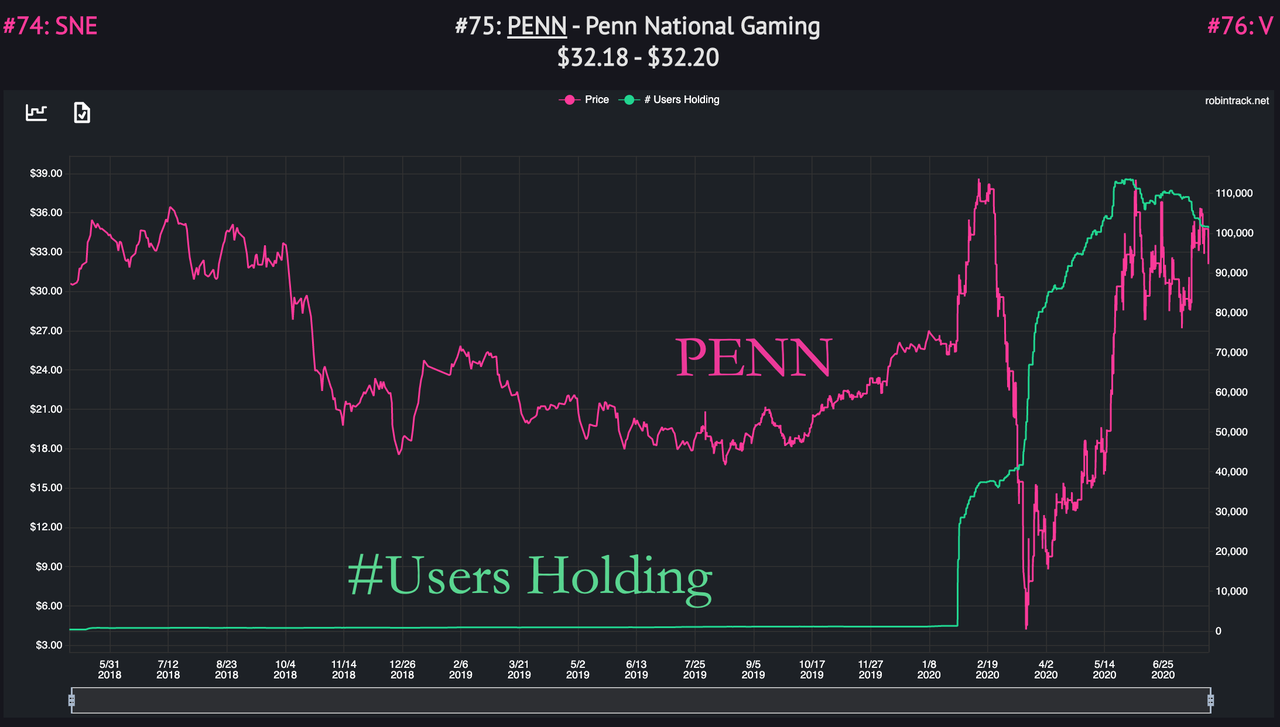

At this point, millions upon millions of Americans are sticking closer to home these days because of COVID-19 and all the unrest, and this has been particularly devastating for the leisure and hospitality industries…

The unemployment rate in the leisure and hospitality industries, including restaurants, soared from 5.7% in February to 39.3% in April, and in June was still at an unprecedented 28.9%. By comparison, the overall unemployment rate is 11.1%, and no other industry comes close to restaurants’ level.

The restaurant industry employed nearly 9.2 million people in June, almost 3 million more than in April but still 25% below where it was in February. Anecdotally, though, restaurant workers—even those who’ve spent decades in the industry—say they’re looking to get out. The line of work that had been stable, geographically flexible, reliable and largely safe for generations is no more, they say.

As I discussed the other day, we have already lost thousands upon thousands of small and independent restaurants, and this “restaurant apocalypse” is only going to get worse with each passing month.

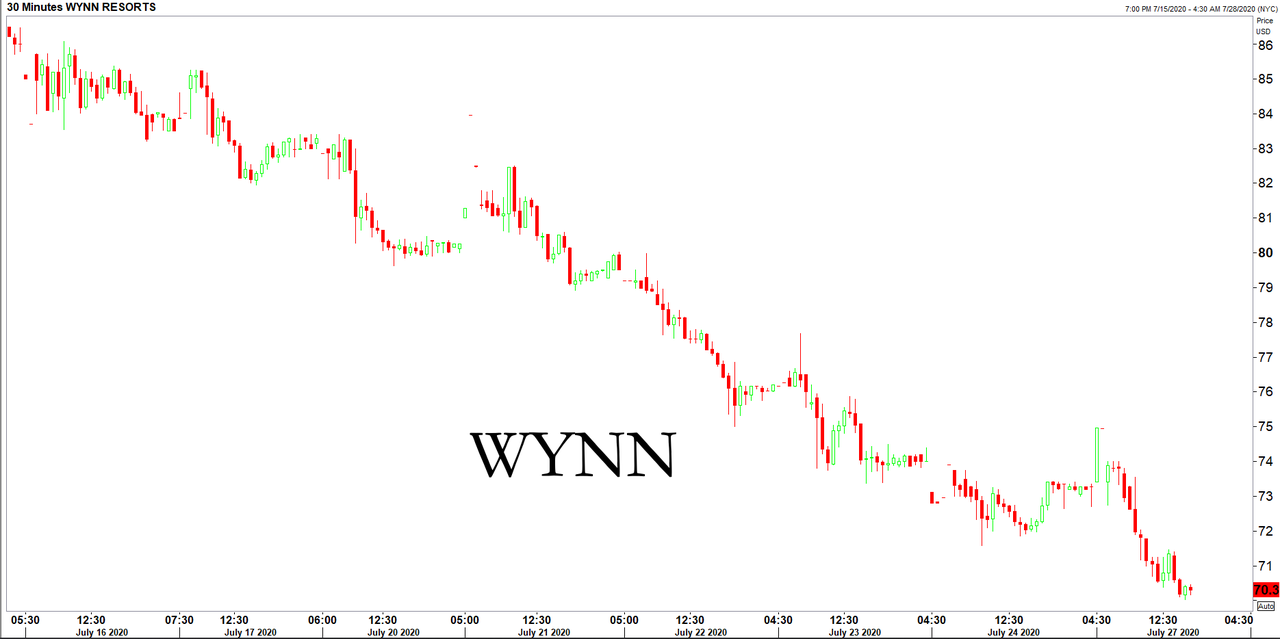

Moving forward, some cities may never be the same again. In Las Vegas, the official unemployment rate recently hit 29 percent, and everyone agrees that tourism will never recover until the pandemic ends.

If this pandemic stretches on for several years, many of those unemployed workers will be forced to abandon the city entirely in order to find work elsewhere.

Sadly, competition for the few good jobs that are available will become increasingly fierce, and this will result in millions of Americans falling out of the middle class.

And we are starting to see some numbers that indicate that this process is already moving along very quickly. According to the U.S. Census Bureau, “24 million Americans say they have little to no chance of being able to pay next month’s rent”.

Just think about that.

We never saw anything like this during the last recession, and the Census Bureau says that things are particular dire for Black and Hispanic renters…

This month, nearly 28% of Black renters say they haven’t paid last month’s rent, and about 46% say they have slight or no confidence they’ll be able to pay next month’s rent, according to figures from the Census Bureau’s Household Pulse Survey. Hispanic renters face similar economic strain: 22% say they missed last month’s rent and 46% fear they won’t make rent next month.

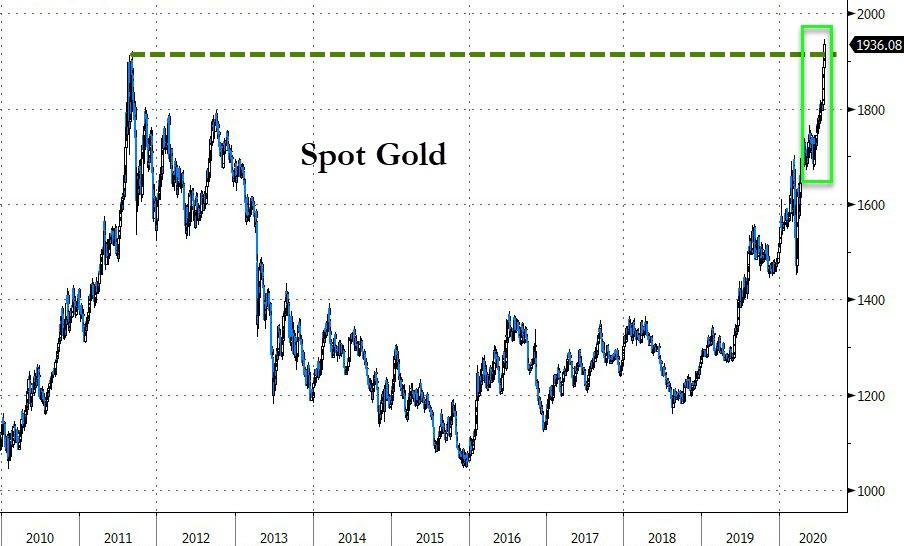

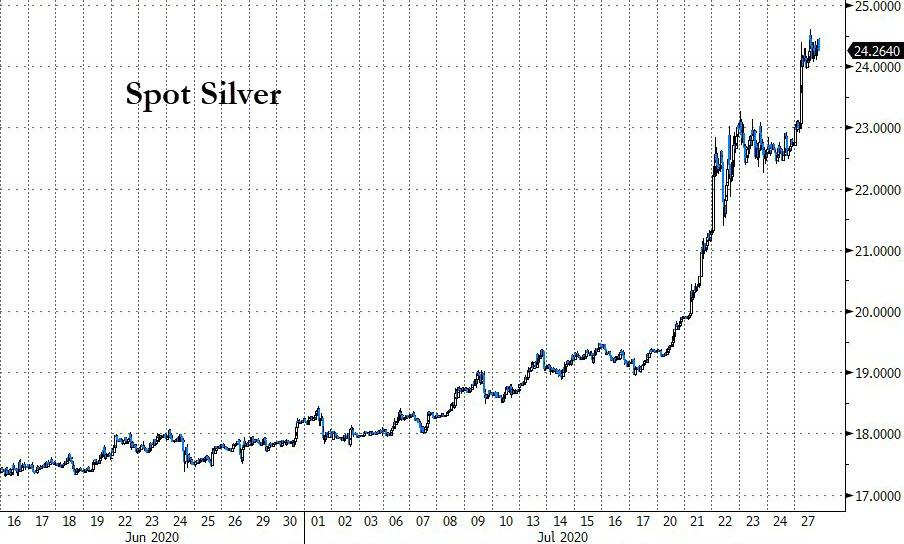

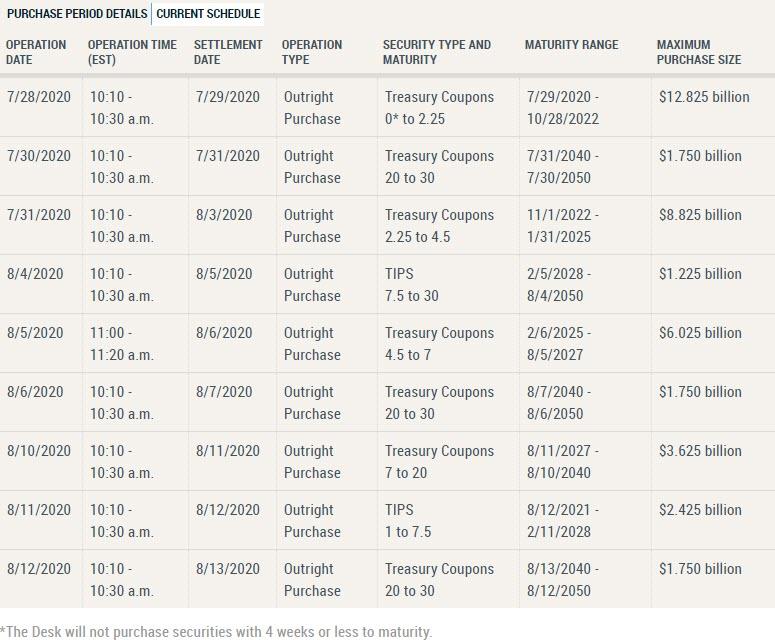

Those numbers are simply eye-popping. As people increasingly get behind on their bills, the cries for more direct government assistance will become deafening, and it appears that Republicans and Democrats in Congress both want to pass yet another stimulus bill.

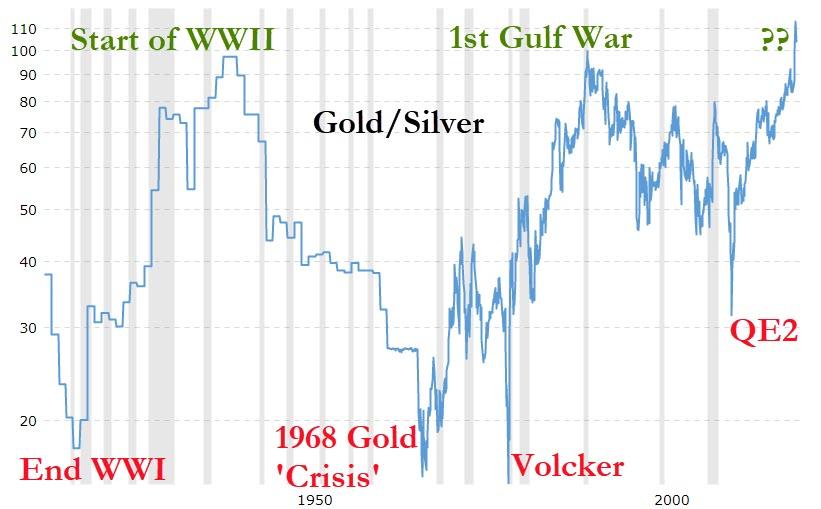

Of course that will mean borrowing and spending more gigantic piles of money that we do not currently have, but at this point most Americans do not seem to care that we are literally completely destroying our financial future.

For such a long time, I warned that the next economic downturn would be worse than the last recession, and that has turned out to be precisely correct.

And what we are experiencing right now will pale in comparison to what is eventually coming.

But for most people, the only thing that seems to matter is what is happening here and now.

And at this moment we are seeing tremendous economic suffering in major cities all over the nation, and in an election year very few of our politicians want to be the “bad guy” that says that we can’t hand out “free money” to everyone.

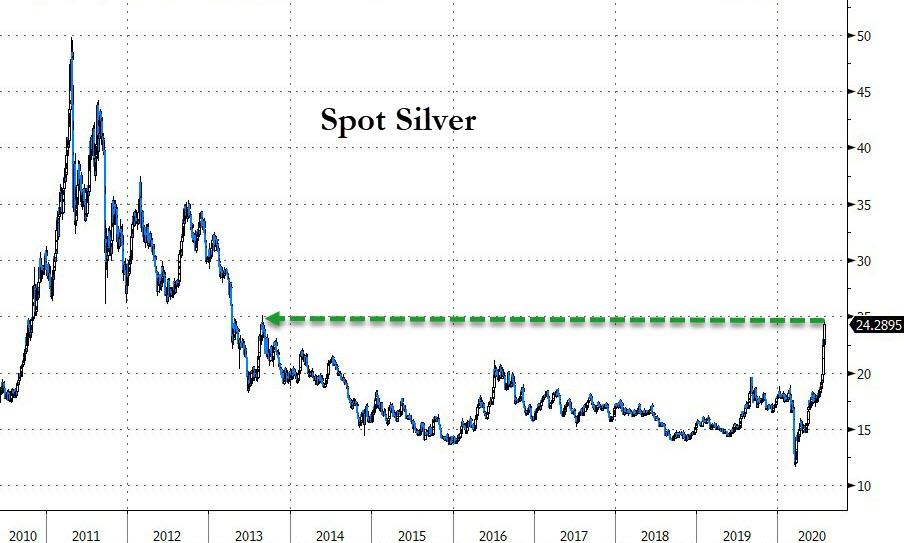

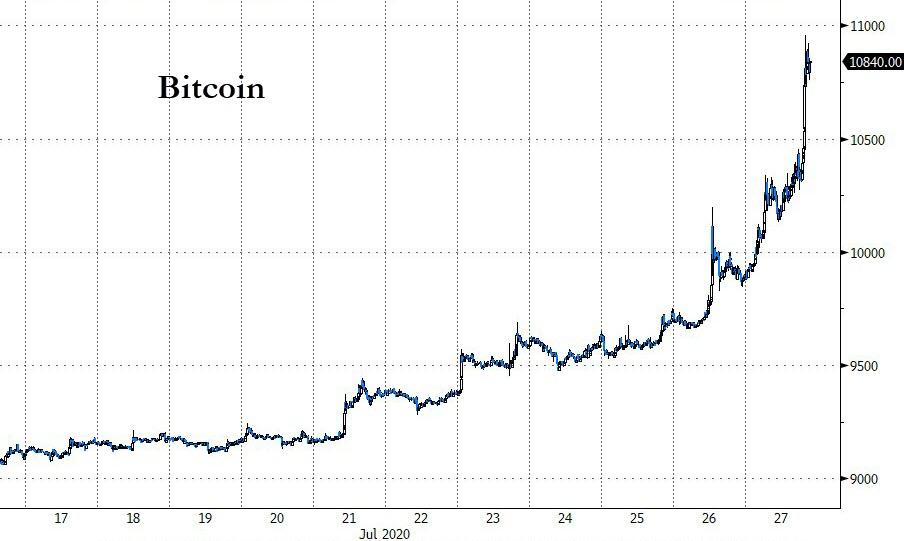

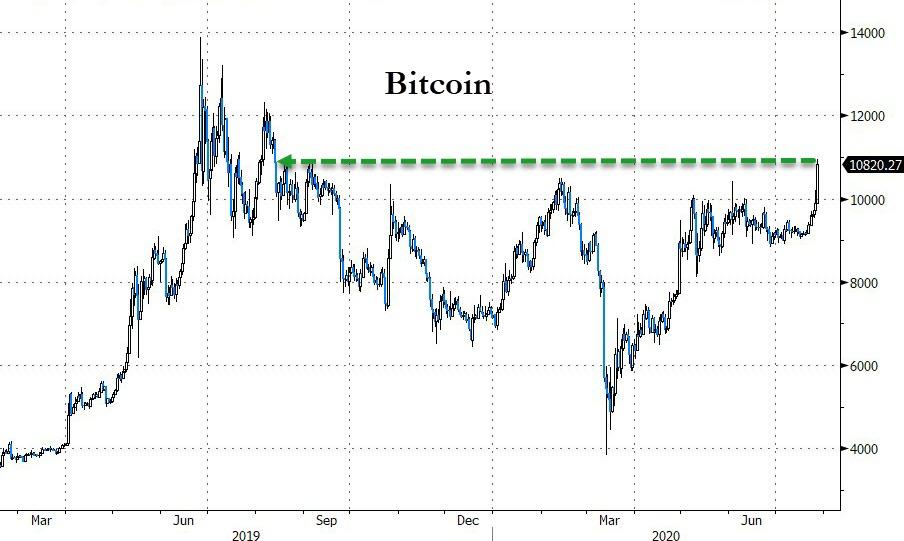

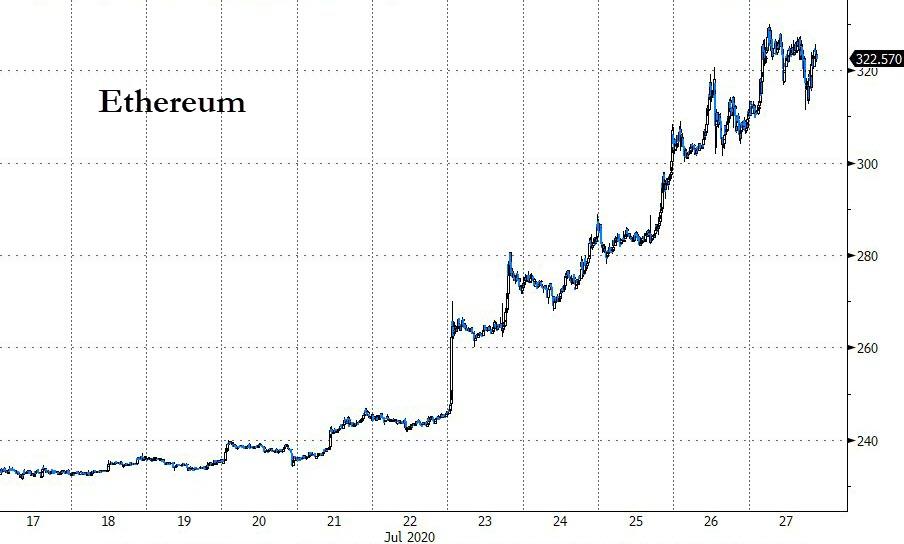

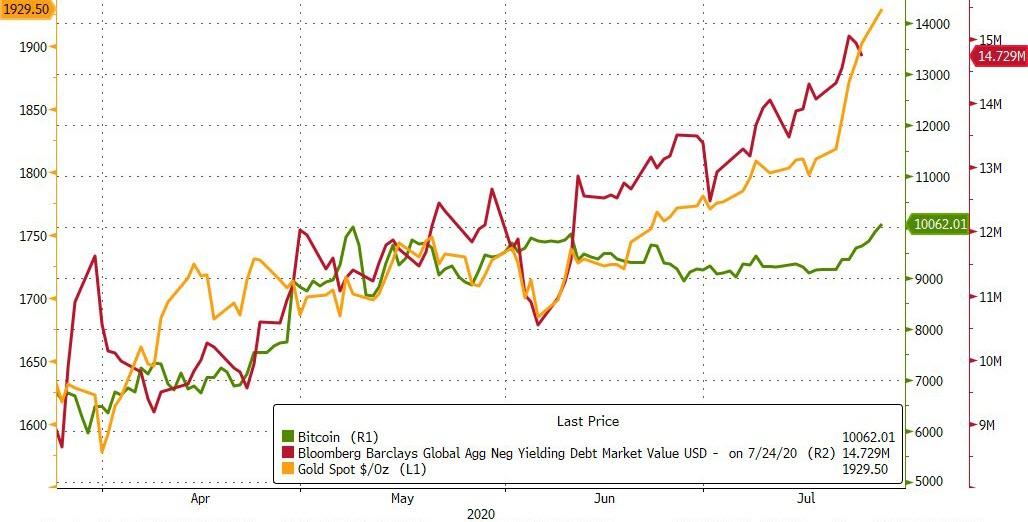

So our currency will continue to be rapidly devalued, our debt levels will continue to explode, and we shall get to see where this relentless march toward socialism takes us.

via ZeroHedge News https://ift.tt/2CUd1IP Tyler Durden