If America is going to be a force for peace in the world, it needs to stop invading other countries for their benefit and it also needs to stop cultivating nasty regimes for its benefit. But ironically, the very politicos who are anti-war often become pro-dictator. Unfortunately, Democratic presidential contender Tulsi Gabbard, the congresswoman from Hawaii, is no different.

Gabbard, an Iraq war veteran, has made opposition to war her signature issue. During the second round of the Democratic debates, she was the only candidate who promised to “end wasteful regime change wars” and “take the trillions of dollars that we’ve been wasting on these wars and…redirect those resources into serving the needs of our people right here at home.” But that doesn’t make her a peacenik; it makes her an America Firster, like President Donald Trump. Indeed, although she went out of her way to condemn Trump as a “warmonger,” there isn’t much daylight between her position and his—which is no doubt why the former White House aide Stephen Bannon, the notorious architect of Trump’s America First campaign, interviewed her for a position in the administration.

Gabbard purports to be a dove when it comes to wars of regime change. But like Trump, she is a self-avowed hawk on Islamic terrorism. She repeatedly slammed President Barack Obama for shying away from referring to Al Qaeda and ISIS as “Islamic terrorists.”

But the more striking similarity between her and Trump is that she too has no qualms about courting dictators if they advance her cause, no matter the consequences for others. Gabbard was the first U.S. official in 2017 to meet with Syrian President Bashar al-Assad after he used chemical weapons against his own people; she aimed to enlist him in America’s struggle against ISIS. Two years before that, she stood next to Egyptian dictator Abdel Fattah el-Sisi after he’d orchestrated the worst mass killings in modern history of Arab Spring protesters.

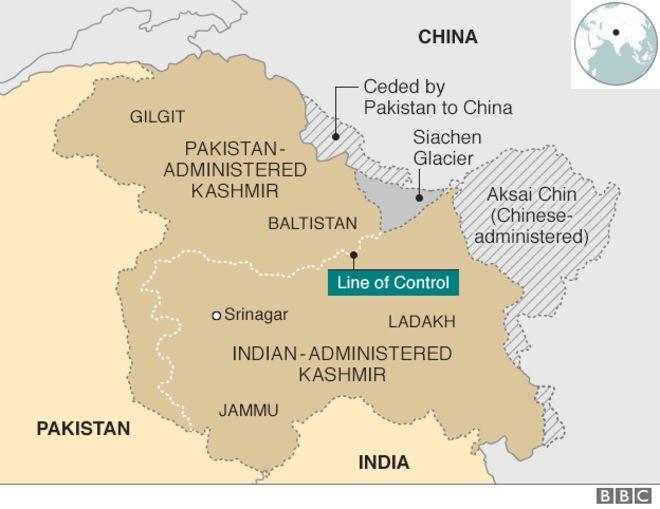

But perhaps her most disturbing transgression was her outreach to Indian Prime Minister Narendra Modi. Modi’s militant brand of Hindu nationalism is fundamentally transforming a liberal country into an illiberal one where violent attacks on the minority Muslim population have become a daily occurrence—not because Indian Muslims are terrorists or radical extremists, but simply because they consume beef or refuse to chant the names of Hindu gods. Yet Gabbard, who, like me, was raised in the Hindu faith, has become close to Modi, presenting him with her personal copy of the Bhagavad Gita (a Hindu holy book) when she visited him in 2014, 12 years after one of the worst massacres of Muslims was committed by thugs from his own party in the state of Gujarat, where he was chief minister at that time.

All of this has fueled suspicion that Gabbard’s foreign policy is driven by Islamophobia. There may be some truth to that, given that she supported the SAFE Act, which would have subjected Syrian and Iraqi Muslim refugees fleeing ISIS to extreme vetting, even before Trump got elected and implemented it. At the same time, she pushed a resolution to make it easier for Christians and Yazidis who were ISIS victims to come to the United States.

But even if she isn’t motivated by anti-Muslim animus, the fact is that a foreign policy that elevates America’s narrow national interest above any broader concerns will inevitably lead to unsavory realpolitik alliances, regardless of whether it is pro- or anti-war. If “The Blob”—as the bipartisan interventionist foreign policy establishment is sarcastically called—has a tendency to exaggerate the threat posed to the international order by regimes that don’t play by America’s rules in order to justify overthrowing them, Gabbard-style anti-interventionist nationalists have a tendency to downplay the threat that odious regimes who play ball with America pose for their own people in order to enlist them.

It is not a coincidence that Gabbard has questioned whether Assad actually deployed chemical weapons against innocent Syrians at all. Or that she has praised Sisi for his “great courage and leadership.” Or that she refused to support a House resolution that offered the 2002 anti-Muslim pogrom—which occurred on Modi’s watch—as an example of India’s persecution of its religious minorities, insisting that “there was a lot of misinformation surrounding that event.”

Turning a blind eye to such atrocities removes an important external check on these regimes. But that’s not all it does. It undermines the domestic forces trying to hold them accountable. It turns these rulers into international players, rather than pariahs, handing them stature that allows them to argue to their people that they can’t be so bad if the world is willing to do business with them. In India’s case, this is particularly unfortunate given that the country is at a critical juncture and desperately trying to hang on to its commitment to religious tolerance, pluralism, and free speech in the face of the Modi administration’s constant assaults. Yet if India goes the route of its more illiberal neighbors in Pakistan and China, the result won’t be world peace but greater conflict from which America will hardly be immune.

Ultimately, there is no such thing as non-interventionism. Failure to condemn nasty regimes is also a kind of interventionism. And when it stems from narrow self-interest without any regard to broader consequences, it is both morally problematic and dangerous.

A version of this column appeared in The Week.

from Latest – Reason.com https://ift.tt/2ZIyjj7

via IFTTT