US index futures were little changed and global stocks treaded water on Wednesday as Treasury yields resumed their upward march ahead of Joe Biden’s Pittsburgh event where he will announce a $2.25 trillion dollar plan – one which the administration says will be the most sweeping since investments in the 1960s space program and 1950s interstate-highway system – to rebuild America’s infrastructure, with traders weighing the inflation and tax impact of the stimulus.

At 07:30 a.m. ET, Dow E-minis were down 27 points, or 0.06%, and S&P 500 E-minis were up 3.5 points, or 0.09%.

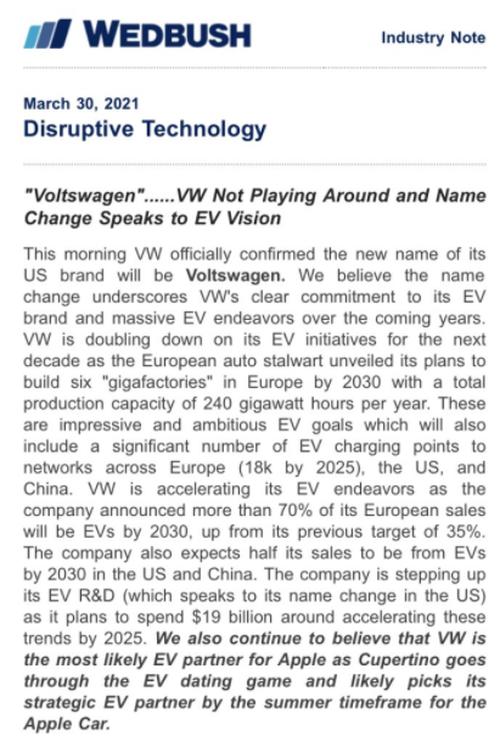

Nasdaq 100 E-minis were up 75 points, or 0.56%, as Apple Inc rose 1.6% after UBS upgraded the stock to Buy on stable long-term demand for iPhones with better authorized service providers.

MSCI’s All Country World Index traded 0.1% lower. Europe’s STOXX 600 index was up 0.2%, on course for its second straight month of gains. Britain’s FTSE 100 was down 0.1% as shares in online food delivery firm Deliveroo slumped as much as 30% on their first day of trading.

Britain’s GDP rose more than expected, 1.3%, in the final quarter of last year, but still shrank the most in more than three centuries in 2020 as a whole.

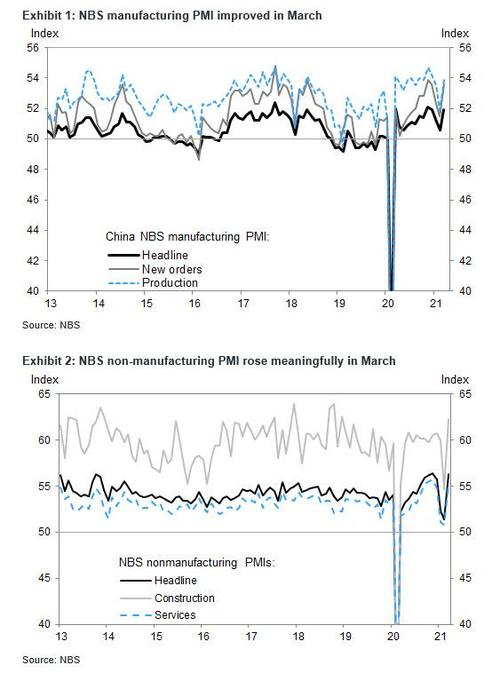

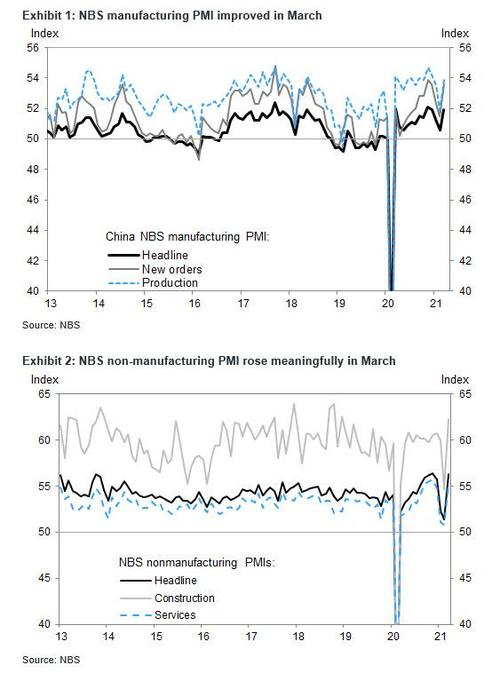

MSCI’s broadest index of Asia-Pacific shares outside of Japan fell 0.3%, its first monthly loss in five months. Sentiment in Asia remained downbeat despite data showing China’s factory activity expanded faster than expected in March. Chinese services surged, too.

Asian tech shares dragged the index lower as borrowing costs climbed, with Taiwan Semiconductor Manufacturing Co. falling 1.7%. The chipmaker’s chairman said Tuesday that global efforts to develop national self-sufficiency in chip production are “economically unrealistic” and U.S.-China trade tensions have contributed to chip shortage. Shares of Hong Kong’s stock exchange closed down 1.3% after a Reuters report said China is considering setting up a stock exchange to attract overseas-listed firms. Meanwhile, China’s CSI 300 Index fell 0.9%. The gauge ended March with its worst monthly loss in a year as investors assess lofty valuations and a tighter liquidity environment. Overall, the MSCI Asia Pacific Index fell 0.7%, trimming the benchmark’s gain so far this year to less than 2%, set for its fourth straight quarterly advance. The gauge is poised for the longest stretch of quarterly gains since 2017.

While global banks are facing as much as $10 billion in losses after U.S. investment firm Archegos Capital Management defaulted on margin calls, putting investors on edge about who else might be exposed, the panic over what shoe will fall next subsided after no more big blocks were sold overnight. Meanwhile investors, rattled by the meltdown of Archegos are turning their attention to growth and inflation as volatility spurred by the forced sales subsides. While Europe’s struggle with inoculations and the resurgence of the coronavirus have tempered growth expectations, the U.S. vaccine rollout is surpassing targets. The focus on surging bond yields remains, making equity valuations look lofty, particularly for major tech companies that have borne the brunt of the sell-off.

“The plans as announced have a long and tortuous journey to make it through Congress and thus the end result is likely to be nine months or more away and may well look very different indeed once it has been through that political wranglings on the Hill,” said James Athey, investment director at Aberdeen Standard Investments. “If investors are weighing the risks appropriately, there shouldn’t be much impact on markets in the short term.”

“Even if President Biden’s infrastructure plans come with a considerable sting in the tail, the economic reflation and reopening story should limit any pullback in interest rates,” ING Groep NV strategists including Antoine Bouvetand Padhraic Garvey wrote in a note. “The rise in rates is about more than fiscal stimulus.”

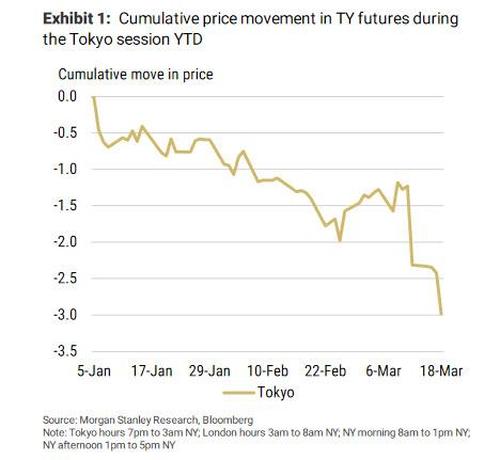

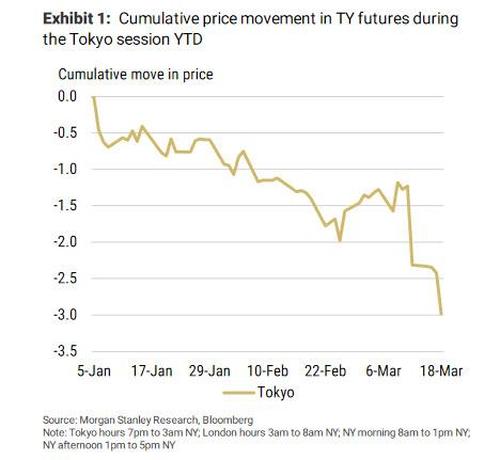

In rates, Treasuries slid again in Asian hours, dragged down by losses in Aussie bonds following a tepid debt sale and solid Australian building-permit data before later rallying into the month-end close. As a reminder, we previously noted that Japan has been the big seller of Treasurys in 2021.

The 10Y Treasury rose as high as 1.746% from Tuesday’s 1.708% and were last at 1.723%. Euro zone bonds calmed, but Germany’s 10-year yield was set for its biggest quarterly jump since the fourth quarter of 2019. USTs were kept under pressure by weakness in Aussie bonds, with USD/JPY rising as much as 0.6%. Quarter-end flows are expected to be supportive for debt markets, with Bank of America seeing $41b of inflows into Treasuries.Treasury futures volumes are around average. There are no sign of the considerable month-end real-money demand seen in the long-end on Tuesday, according to one trader

Bonds were sold ahead of renewed reflation jitters unleashed by Biden’s multi-trillion infrastructure package which will target traditional projects like roads and bridges alongside investments in the electric vehicle market; its size and scale of the proposal as well as the question of how it would be paid for is likely to set the stage for the next partisan clash in Congress.

In FX, the dollar dropped, still heading for its best quarter in a year. The Bloomberg Dollar Spot Index erased an earlier gain shortly after the London open amid quarter-end position rebalancing flows, and was mirrored by an advance in most other Group-of-10 currencies led by the pound and Norwegian krone; the euro rose to a fresh day high in morning hours, even as ECB President Christine Lagarde said her institution won’t shy away from using all its tools if investors try to push bond yields higher. The yen slid to a new one-year low against the greenback amid rising Treasury yields, before paring the move; the Bank of Japan plans to slow its bond purchases in all maturities in April, according to a statement Wednesday.

In commodities, Brent crude rose 0.5% to $64.47 a barrel. U.S. crude added 0.6% to $64.53 barrel. Gold prices slipped to 1,684.40 an ounce.

To the day ahead now, and the main highlight will be President Biden’s aforementioned infrastructure speech. Over in the US, there’ll be the ADP’s report of private payrolls for March, the MNI Chicago PMI for March and February’s pending home sales, while Canada will be releasing January’s GDP. Finally from central banks, the ECB’s Villeroy will be speaking.

Market Snapshot

- S&P 500 futures little changed at 3,944.00

- STOXX Europe 600 little changed at 430.44

- MXAP down 0.7% to 203.56

- MXAPJ down 0.4% to 678.02

- Nikkei down 0.9% to 29,178.80

- Topix down 1.2% to 1,954.00

- Hang Seng Index down 0.7% to 28,378.35

- Shanghai Composite down 0.4% to 3,441.91

- Sensex down 1.0% to 49,660.06

- Australia S&P/ASX 200 up 0.8% to 6,790.67

- Kospi down 0.3% to 3,061.42

- Brent Futures up 0.3% to $64.33/bbl

- Gold spot down 0.1% to $1,684.09

- U.S. Dollar Index down 0.16% to 93.15

- Euro up 0.2% to $1.1742

- Brent Futures up 0.3% to $64.33/bbl

Top Overnight News from Bloomberg

- Usage of the Treasury’s overnight reverse repurchase facility surged to $104.7 billion on Tuesday, the most since last April, according to data from the New York Fed. It pays an overnight rate of 0% — well above the minus 0.05% available at Tuesday’s close in the general collateral market — helping to temporarily reduce the quantity of reserve balances in the banking system

- Britons saved 16% of their disposable income in the fourth quarter, adding to a cash pile that could power a consumer boom as coronavirus restrictions are lifted

- German joblessness declined in March, signaling economic resilience even as thousands of businesses remain affected by recently-extended pandemic restrictions

- Chancellor Angela Merkel said Germany will halt the use of AstraZeneca Plc’s Covid-19 vaccine for people younger than 60 starting Wednesday after a handful of new cases of severe blood clots emerged

- A panel of OPEC+ technical experts agreed to revise down oil-demand estimates for 2021, signaling a more negative view of the market just days before the group decides on production policy

A quick look at global markets courtesy of Newsquawk

Asian equity markets traded cautiously during the quarter- and fiscal year-end with sentiment not helped by the uninspiring lead from the US where participants were tentative ahead of President Biden’s speech later today where he is to unveil USD 2.25tln of infrastructure spending and is also expected to comment on increasing the corporate tax rate to 28%. ASX 200 (+0.8%) outperformed helped by strength in financials after the RBNZ partially relaxed dividend restrictions to allow a pay-out of up to 50% of earnings and with nearly all industries in the green aside from gold miners after the precious metal recently slipped beneath the USD 1700/oz, while Nikkei 225 (-0.9%) failed to benefit from favourable currency flows with the index subdued on the last day of the financial year following weak Industrial Production data and with Mitsubishi UFJ warning of a USD 300mln loss related to the Archegos fallout. Hang Seng (-0.7%) and Shanghai Comp. (-0.4%) were subdued despite better-than-expected Chinese Manufacturing and Non-Manufacturing PMI data as a deluge of earnings releases also took plenty of the focus, while US-China tensions continued to linger in which the US State Department’s annual human rights report cited China for “crimes against humanity” and FCC Commissioner Carr called for the US to take further steps to remove Huawei and ZTE equipment from US networks. Finally, 10yr JGBs were softer following the indecisive performance in USTs and with mild upside in yields, although downside was cushioned amid the BoJ’s presence in the market for a total of JPY 510bln of JGBs in the belly to super-long end.

Top Asian News

- Hong Kong Limits Public Information as China Exerts Control

- China Fintech Firm Falls 16% in Worst Hong Kong Debut Since 2018

- China Mulls New Bourse for Overseas-Listed Firms, Reuters Says

- Chinese Fresh Food Chain Qiandama Said to Weigh Hong Kong IPO

European equities (Eurostoxx 50 -0.1%) and US futures (e-mini S&P flat) trade with little in the way of firm direction as markets await US President Biden’s infrastructure speech at 21:20BST/16:20EDT. US President Biden is set to unveil USD 2.25trln of infrastructure spending in the first part of the bill today, with USD 650bln said to have been earmarked for roads and bridges, USD 300bln for housing, USD 400bln for clear energy credits and USD 400bln for the elderly. Furthermore, other reports note that Biden’s plan is to include spending over 8 years and that he will not call for a wealth tax to pay for spending proposal but is expected to comment on increasing the corporate tax rate to 28%. From a sectoral standpoint, performance is relatively mixed in Europe with not much in the way of breadth. Telecom names outperform, whilst some of the more cyclically-exposed sectors such as Banks, Basic Resources and Oil & Gas lag. Credit Suisse continue to act as a drag on banking names as speculation lingers around the extent of its losses related to the Archegos blow-up. Elsewhere, the Deliveroo IPO has commenced on a weak footing with the stock enduring losses of circa 25%; Just Eat (-1.4%) have posted modest losses in sympathy. Finally, H&M (-2.4%) trade lower on the session after posting a loss for Q1 and amid recent criticism from the Chinese government after the Co. raised concerns over forced labour in the Xinjiang region.

Top European News

- H&M Tries to Smooth Over Chinese Social-Media Backlash

- Credit Suisse Outlook Cut to Negative by S&P as Bonds Tumble

- Lagarde Says Investors Can Test ECB Resolve as Much as They Want

- Equity Positioning Is Now Less of a Tailwind, Barclays Says

In FX, although the Euro enjoys a greater share of the Dollar index, the sharp ascent of Usd/Jpy and sheer magnitude of the rally has been instrumental if not quite responsible for its breach of 93.000. To recap, the Yen put up a pretty staunch defence of 109.00 and 109.50 before caving in at the end of last week when US Treasury yields set off on their most recent ramp higher and it appeared that most Japanese hedgers had completed their buying for month, quarter and fiscal year end. Subsequently, the rate of decay and Usd/Jpy upside have accelerated amidst reports of demand from importers and M&A related buying in the headline pair, not to mention residual rebalancing for the March/April, Q1/Q2 and FY turn plus weaker than forecast Japanese IP data. However, 111.00 seems to be a line in the sand and the DXY also ran out of steam just ahead of 93.500 at 93.439, albeit with resistance also coming via Eur/Usd that narrowly held above 1.1700. The index is currently just above 93.000 and a 93.092 low awaiting ADP as a proxy for NFP and the Chicago PMI that might be a reliable guide for the ISM also on Friday, and both due before pending home sales and President Biden unveiling his Economic Vision for the Future.

- EUR/AUD/NZD/GBP/CAD – All benefiting from the Greenback’s fade, as the Euro eyes 1.1750 amidst fairly familiar rhetoric from ECB President Lagarde and decent option expiry interest at the strike (1.2 bn) that extends up through 1.1775 (1 bn) to 1.1800 (1.2 bn). Meanwhile, the Aussie has also gleaned encouragement from a bumper rise in building approvals that beat consensus more than 4-fold, plus stronger than expected Chinese PMIs, services in particular, to retain grasp of 0.7600. Conversely, 0.7000 is still proving elusive for the Kiwi and a deterioration in NBNZ business sentiment alongside a decline in the activity outlook will hardly have helped. Elsewhere, the Pound is hovering below 1.3800 having bounced off a marginally firmer low 1.3700 base, but staging another attempt to fill bids into 0.8500 vs the Euro, but could be scuppered by option expiries between 0.8525-15 (1.1 bn) and even undermined by those at 0.8540-50 (1.3 bn) if the round number emerges unscathed again.

- SCANDI/EM – The Norwegian Crown is getting tantalisingly close to breaking the 10.0000 barrier vs the Euro in wake of the Norges Bank raising its daily foreign currency sale quota to Nok 1.8 bn from tomorrow vs Nok 1.7 bn in March, but the Swedish Krona is still lagging even though the NIER has upgraded is 2021 GDP and inflation projections quite markedly from those made in December. In contrast, the aforementioned encouraging official PMIs are helping the Cnh pare some recent losses and the Try has drawn some comfort from a rise in Turkish consumer confidence irrespective of the prospect that it comes before a fall on the back of latest investor qualms over CBRT independence.

In commodities, WTI and Brent front month futures opened the session on a firmer footing, following on from Asia’s positive lead, but have since reversed course and now sit in negative territory. The initial price rise followed suit from mounting expectations that OPEC+ will maintain current output cuts into May. That said, bearish macro impulses are likely to be the driver for any such action. Note, the OPEC+ JTC panel raised concern over growing COVID infection rates, new lockdown measures and travel restrictions. As such, the panel stated the uncertainties could hinder oil demand recovery, especially fuel transport, and it sees prevailing volatility as a sign of fragile market conditions. Accordingly, OPEC+ revised its 2021 global oil demand growth forecast down by 300,000 BPD to 5.6mln BPD. The May WTI contract trades low/mid USD 60.00/bbl (vs high USD 61.17/bbl) whilst its Brent counterpart trades just shy of USD 64.00/bbl (vs high USD 64.79/bbl). Spot gold is flat on the session whilst spot silver is seeing mild upside amid the softer Dollar. Moreover, for the quarter, due to the surge in US treasury yields and the stronger DXY spot gold is set for its worst quarter since 2016. At the time of writing, spot gold trades at USD 1,685/oz (vs high USD 1,688/oz) and silver trades just shy of USD 24.10/oz (vs low USD 23.79/oz). Onto base metals, LME copper is firmer on the session, but it is set for its first monthly fall in a year, due to aforementioned DXY strength and rising yields. Lastly, Dalian iron ore has seen a fall in price alongside Chinese environmental policies reducing demand.

US Event Calendar

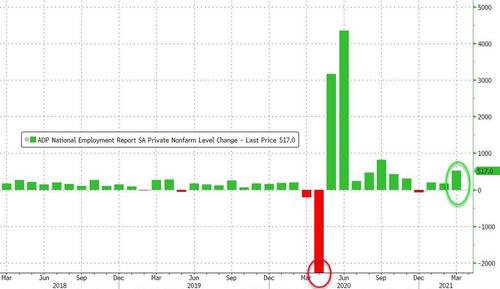

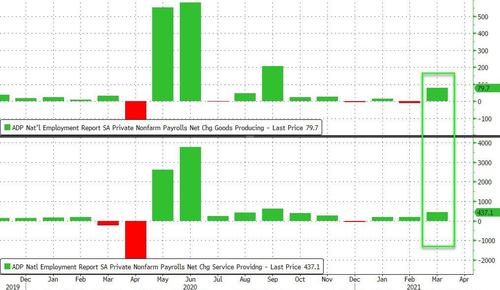

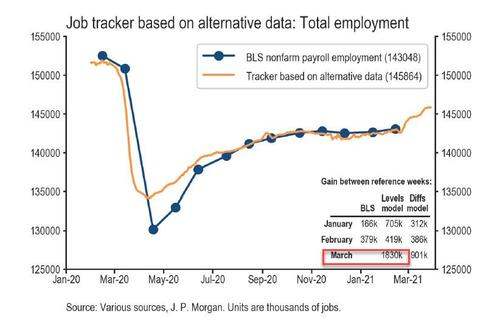

- 8:15am: March ADP Employment Change, est. 550,000, prior 117,000

- 9:45am: March MNI Chicago PMI, est. 61.0, prior 59.5

- 10am: Feb. Pending Home Sales YoY, est. 6.5%, prior 8.2%; Pending Home Sales (MoM), est. -3.0%, prior -2.8%

DB’s Jim Reid concludes the overnight wrap

As we arrive at the last day of Q1, the quarter seems to be ending very much how it began, with Treasury yields rising to fresh highs as investors await the announcement of further spending proposals in President Biden’s infrastructure package. Indeed at time of writing, the rise in 10yr Treasury yields in Q1 so far had reached a massive +82.7bps, which puts them just shy of the 21st century’s other quarterly records back in Q4 2016 (+85.0bps) when President Trump won the presidential election, and Q2 2009 (+87.0bps) as the global economy was climbing out of the financial crisis. Should today’s speech spark a further climb in yields, that could then leave this as the biggest quarterly rise going all the way back to Q1 1994 (+94.4bps).

We’ll have to wait a few more hours to get the final scorecard, and by the end of the session yesterday, yields on 10yr Treasuries had actually fallen back -0.5bps to 1.703%, though they’ve risen another +3.7bps this morning. This was down from their midday high of 1.77%, which is their highest level since January last year, aided by the prospect of further stimulus as well as continued progress on the vaccine rollout. Real yields (+1.6bps) lost out to inflation expectations (-1.8bps) falling back, while the dollar index strengthened +0.38% to its highest level since Election Day last November.

In terms of what to expect today, Biden will be unveiling his plans in a speech later in Pittsburgh, which are part of his agenda to “Build Back Better” from the pandemic. We’re yet to get the full details, but the Washington Post reported yesterday that it would be worth around $2.25tn, with the focus on physical infrastructure, housing, clean energy and manufacturing, among others. Currently there is $650 billion earmarked for bridges, highways and ports, while additional $300 billion for housing and manufacturing separately. That comes ahead of another address scheduled for next month, in which he’ll be looking at other areas of investment such as healthcare and education. The combined cost of the two parts could reach $4 trillion. White House Press Secretary Jen Psaki has indicated that the government will seek to reverse much of the 2017 tax cuts, particularly those on corporations, and that clean energy jobs and expanding broadband access would be among the focuses. One part of the 2017 tax changes that has been particularly contentious has been that a few House Democrats are saying they will only approve tax increases if the $10,000 cap on state and local deductions is repealed. This is an important issue for Democrats from high cost of living areas such as California, New Jersey and New York and could become a sticking point for the Biden administration which can only afford to lose three Democrats in the House of Representatives and no Senators on any legislation, given their 219-211 margin in the House, and the 50-50 margin in the Senate.

This morning Asian markets are following Wall Street’s lead with the Nikkei (-0.75%), Hang Seng (-0.31%) and Shanghai Comp (-0.61%) all losing ground, though the Kospi (+0.10%) is the exception to this pattern. Japanese banks are continuing to underperform however after Mitsubishi UFJ Financial said that it is also impacted by Archegos (more below), and the TOPIX Banks index is down -2.71% this morning. The weakness in Asian equity gauges comes in spite of China posting strong PMI releases for March, with the manufacturing reading at 51.9 (vs. 50.6 last month and 51.2 expected) while non-manufacturing reading climbed to 56.3 (vs. 51.4 last month and 52.0 expected), the highest level since November 2020. Meanwhile, amidst the chatter on inflation it’s worth noting that the sub index for input prices rose to 69.4 (vs. 66.7 last month) as did output prices to 59.8 (vs, 58.5 last month). Outside of Asia, and futures on the S&P 500 (+0.02%) are trading broadly flat overnight and European futures are pointing to a weaker open as they catch up with yesterday’s move in the US. In FX, the Japanese Yen is down -0.45% against the US Dollar to 110.86, which is the Yen’s weakest level in over a year.

Looking back at yesterday’s moves again, equity markets had a pretty divergent performance on either side of the Atlantic, with the S&P 500 falling a further -0.32%, whereas Europe’s STOXX 600 rose +0.71% to a post-pandemic high and the German Dax (+1.29%) breached the 15,000 mark for the first time. The sectoral patterns were more similar however, with higher yields helping banks reverse their losses from the previous day following the Archegos fallout, as the S&P 500 Banks (+1.80%) and Europe’s STOXX Banks index (+2.86%) both recorded solid gains. Energy stocks underperformed however against the backdrop of lower oil prices, with Brent Crude (-1.49%) and WTI (-1.85%) moving lower, while tech stocks outperformed the S&P slightly. The NADSAQ’s move of -0.11% broke a streak of 5 successive sessions underperforming the S&P 500.

Though equities diverged, rates followed a similar pattern in the US and Europe, with European sovereign bonds losing ground across the continent. Yields on 10yr bunds (+3.2bps), OATs (+2.8bps) and gilts (+3.7bps) all moved higher, supported by further rises in inflation expectations ahead of today’s flash CPI reading for the Euro Area. In Germany, 10yr breakevens rose +1.2bps to 1.31%, while their Italian counterparts were up +2.0bps to 1.30%, putting both at their highest level since 2018. And 5y5y forward inflation swaps for the Euro Area advanced +1.6bps to 1.54%, their highest level since the start of 2019.

In terms of that fallout from the Archegos block trades, the worst-affected banks continued to struggle in trading yesterday, with Credit Suisse (-3.07%) and Nomura (-0.66%) adding to their Monday losses, with S&P Global Ratings downgrading Credit Suisse’s outlook on all group entities to negative from stable. Furthermore, Mitsubishi UFJ Financial (-1.94%) warned that they could face a loss of around $300mn “in relation to a US client”, which Bloomberg later reported was linked to Archegos according to a person familiar with the matter. That said, some of the tech companies that had sold off significantly on Friday staged something of a recovery, with Discovery (+5.86%) and ViacomCBS (+4.05%) recording solid gains, though in both cases their share price remains well beneath its levels a couple of weeks back.

Turning to the pandemic, there was a further setback for the AstraZeneca vaccine, as Chancellor Merkel announced that the country will suspend the vaccine for use in those under 60. This comes as the Paul Ehrlich Institute said it had now registered 31 cases of a rare blood clot in the brain after people received the vaccine. This was followed by news that Merkel and French President Macron have discussed using Russia’s Sputnik Covid-19 vaccine with Russian officials. However, Sputnik V has not yet been approved by the European Medicines Agency. There was some more positive news out of the UK however, as the ONS’ latest antibody study estimated that over half of the population in England had tested positive for antibodies in the week ending 14 March, implying that either they’ve been vaccinated or have had Covid in the past themselves. And over in Ireland, travel restrictions will be eased from April 12, with people allowed to travel within their county or a 20km radius of their home. Furthermore, two households will be able to meet outside for social purposes. In the US, deaths from the latest spike are expected to bottom in the next few weeks and then any ensuing rise on the back of the current surge of cases could give insight into the efficacy of inoculating much of the older, more vulnerable, part of the population. And finally, a new cluster of 6 confirmed cases and 3 asymptomatic cases was reported in China, in the southwestern province of Yunnan, the first cluster in over a month.

Looking at yesterday’s data, the preliminary German inflation reading for March came in at +2.0% as expected, which was the highest rate in nearly 2 years. We also got the European Commission’s economic sentiment indicator for the Euro Area, which rose to a post-pandemic high of 101.0 in March (vs 96.0 expected). On the other side of the Atlantic meanwhile, the US Conference Board’s consumer confidence index for March rose to 109.7 (vs. 96.9 expected), which was its highest level for a year.

To the day ahead now, and the main highlight will be President Biden’s aforementioned infrastructure speech. On top of that, there’ll be the flash CPI reading for the Euro Area in March, as well as the figures for France and Italy, while the UK will be releasing their final estimate of Q4’s GDP. Over in the US, there’ll be the ADP’s report of private payrolls for March, the MNI Chicago PMI for March and February’s pending home sales, while Canada will be releasing January’s GDP. Finally from central banks, the ECB’s Villeroy will be speaking.