The National Debt Is Now More Than Ten Times Annual Tax Receipts

Authored by Ryan McMaken via The Mises Institute,

Politicians from Alexandria Ocasio-Cortez to Dick Cheney are united in their agreement that deficits don’t matter. Of course, that’s exactly what a politician would say. Politicians score points by spending other people’s money, so naturally, they don’t want to hear anything about how prudence suggests it might be a good idea to not spend that extra 800 billion dollars they don’t have.

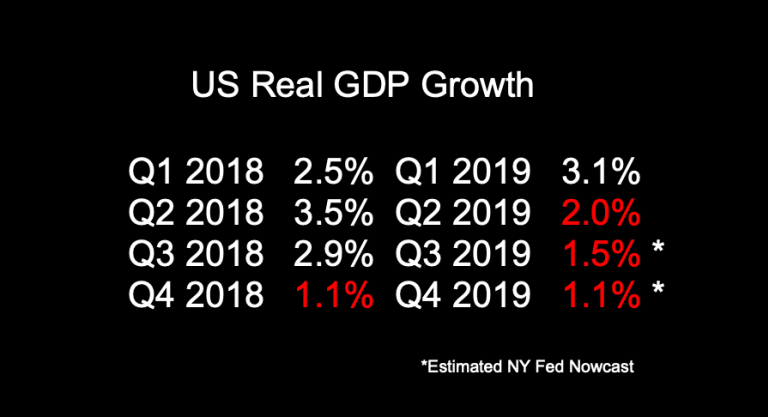

But there is apparently little concern in Washington, DC as the annual deficit — for a single year, mind you — approaches one trillion dollars for the first time since the hit-the-panic-button days of the Great Recession. Except that now huge deficits are coming during “good” economic times.

Moreover, as the Congressional Budget Office has forecast, the debt load is expected to rise to 125 percent of GDP over the 20 years. That’s higher than the US debt-to-GDP ratio during World War II.

This, of course, assumes no major geopolitical or economic disruptions, which would make things far worse.

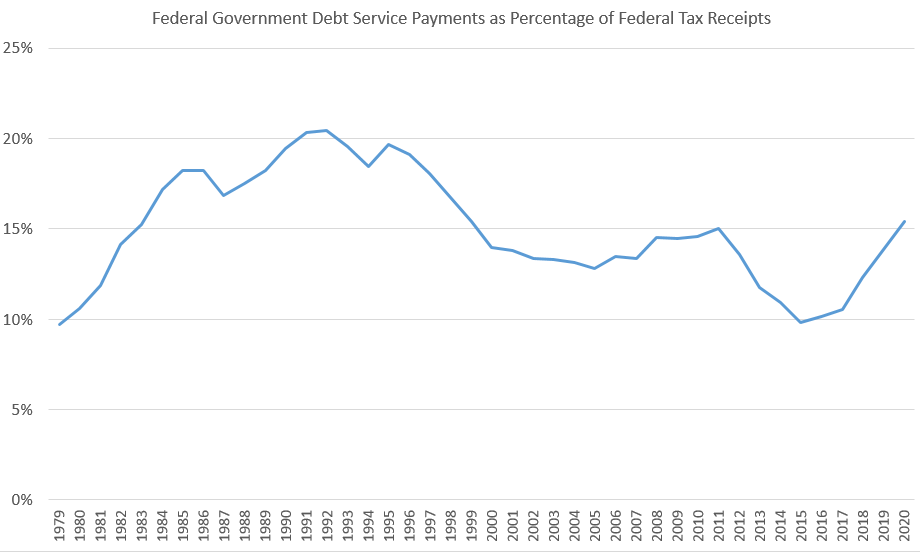

For those who believe huge debts are no big deal, however, there’s still no need to worry. After all, they say, actual debt payments are still only a minor issue. In fact, they’re still lower than where they were during the early 1990s.

Consider the first graph, for example. If we take the federal government’s interest payments, and calculate them as a percentage of federal tax revenue, we find 12 percent of what the feds take in has to paid out as interest. Back during the early nineties, on the other hand, the feds were paying more than twenty percent of their tax revenue toward debt service.

Source Office of Management and Budget and US Bureau of Economic Analysis.

Of course, that’s not all due to debt load. A lot of it depends on the interest rate. Back in late 1990, for example, the target federal funds rate was over 7 percent. The 10-year note rate was around seven percent also — compared to around two percent today. Not surprisingly, the feds were paying more on the debt they owed than under current conditions with a note rate of two percent.

But, the CBO estimates the 10-year note rate to double between now and 2020. I’m skeptical it will rise that fast from its current low levels, but when it does go up, so will the amount of money the federal government has to devote to servicing the debt. And that means cuts to things like defense, social security, and medicare.

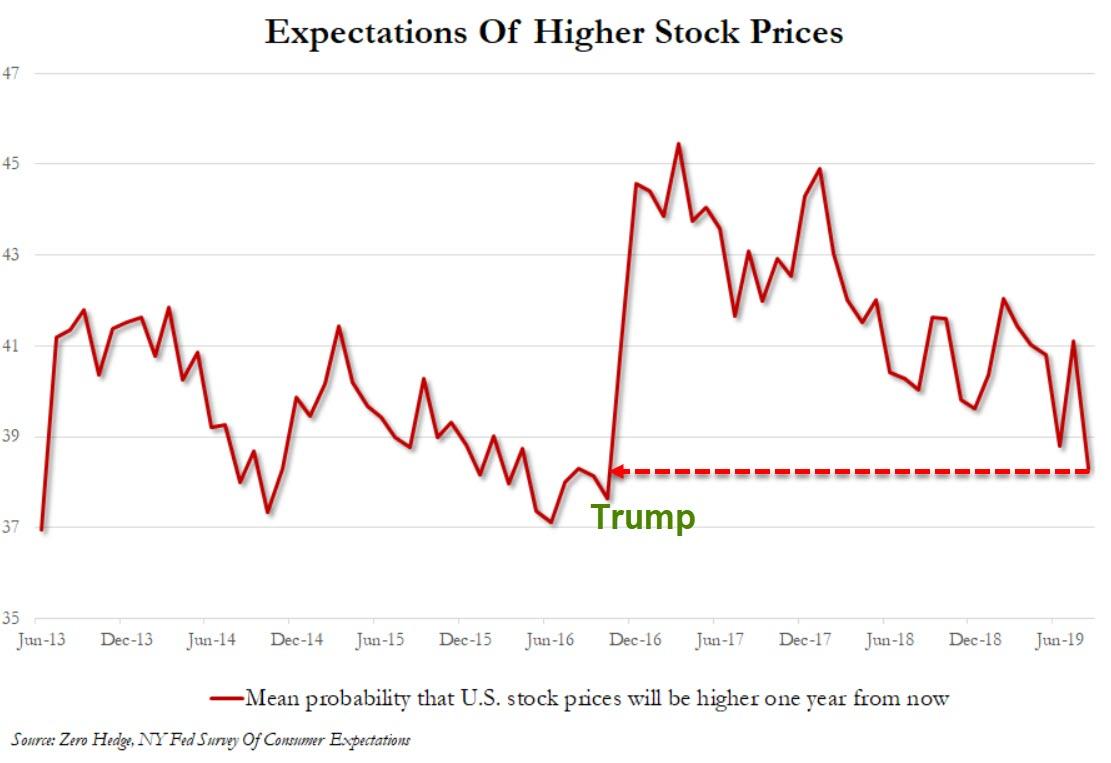

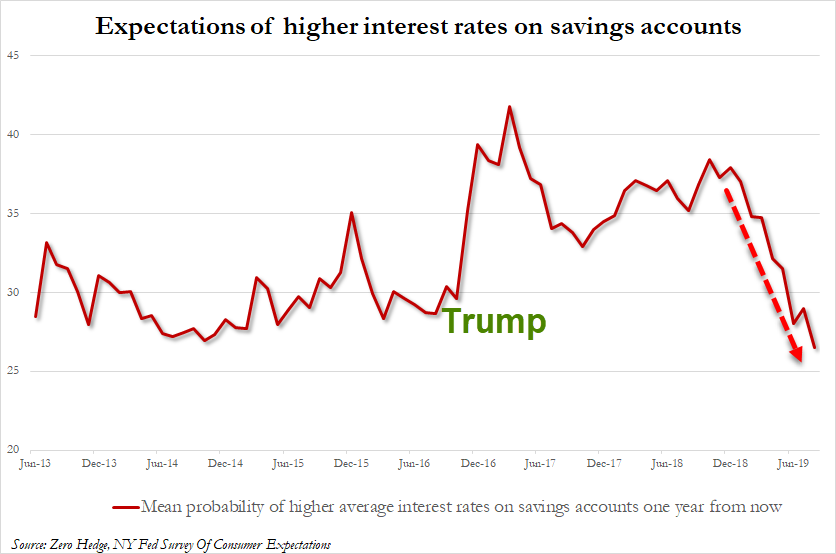

Moreover, as the debt gets bigger and bigger, the need to keep the interest rate low via central bank “quantitative easing” will become more important, meaning middle class savers will take more of a hit to savings accounts and pension plans.

But perhaps the most striking aspect of the growing debt is the fact there really is no end in sight, and the US has no chance of ever paying off the debt.

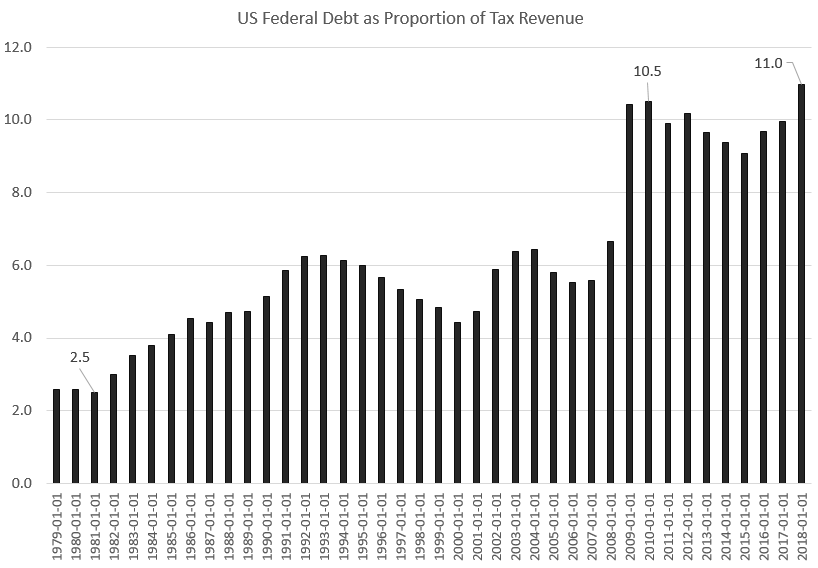

We can see this when we compare the total size of the debt with government revenue.

Comparing Debt to Tax Revenue

Part of the reason people have a hard time comprehending the sheer size of the debt is because it is often compared to total GDP size. For example, it’s easy to find online that the US debt-to-GDP ratio right now is around 105 percent. But what does that mean? One problem we encounter here is the fact when it comes to personal debt, people don’t think of making debt payments as a percentage of their household “GDP.” That wouldn’t make much sense since the ability to pay off debt usually depends on income.

So what is the national debt as a percentage of the federal governments income? Income, in this case is the federal government’s tax revenue. And it turns out by this measure, we’re in uncharted waters.

In fact, the national debt is now eleven times annual federal revenue. And as far as I can tell, that’s the highest it’s ever been. (In 1945, the national debt was $251 billion, and tax receipts were $45 billion, meaning the national debt was 5.6 times tax revenue that year.)

Specifically, in 2018, the national debt ($21.4 trillion) was 10.9 times the size of annual tax receipts ($1.9 trillion). That’s even higher than what it was during the dark days of the “stimulus” following the great recession. In 1981, on the other hand, the total debt load was only two-and-a-half times annual tax receipts.

From the perspective of household management, this is easier to comprehend. For example, if a household has an income-to-debt ratio like the federal government, that would mean an annual income of $100,000 and a debt load of a million dollars.

Now, at ultra low interest rates, if payments are interest-only, and non-debt-related daily expenses are fairly low, one could certainly manage this. But there are risks here. Interest rates could go up. Other expenses could rise. And in the end, the great-grandchildren are still paying off the debt for vacations and fancy their ancestors bought decades earlier. Even worse, if interest rates go up significantly, one’s great grandchildren have a lower standard of living because they have to devote more and more of their possible savings and consumption to unproductive debt service.

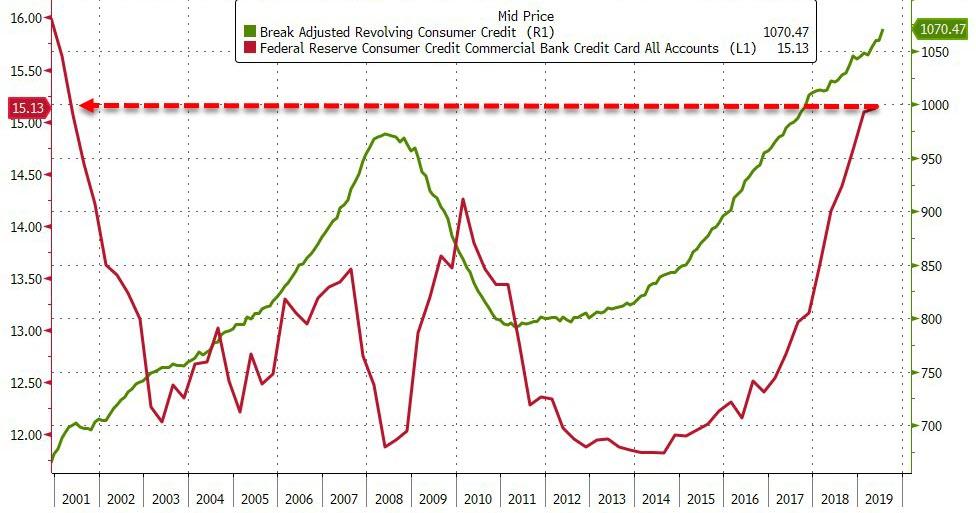

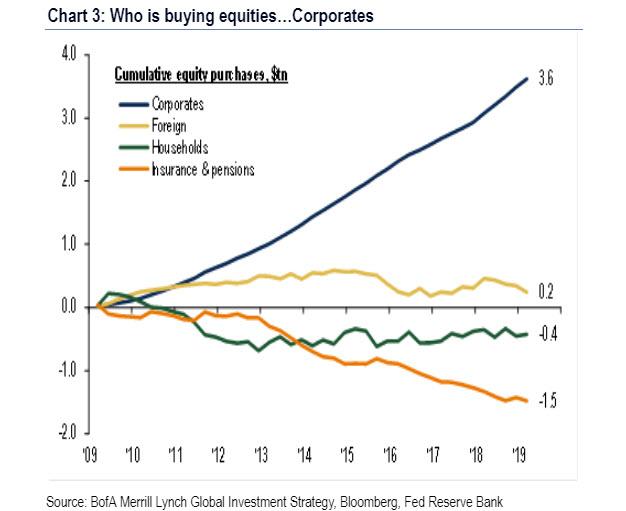

None, of this, however, is likely to convince those who think debt doesn’t matter. Some may still cling to the idea that the government can just print more money and purchase bonds to drive down interest and make payments.There are at least two problems that emerge here. The constant forcing down of interest rates is a problem for those who rely on pension funds and other investments that need relatively lower-risk yield to grow. Meanwhile, households that are on fixed incomes will be harmed by growing inflation, if it takes the form of consumer price inflation. If, on the other hand, the money-supply growth leads to asset -price inflation (which is what we have now) then this will make housing more unaffordable, while locking out lower-income and lower-net-worth people from a variety of assets, such as homes.

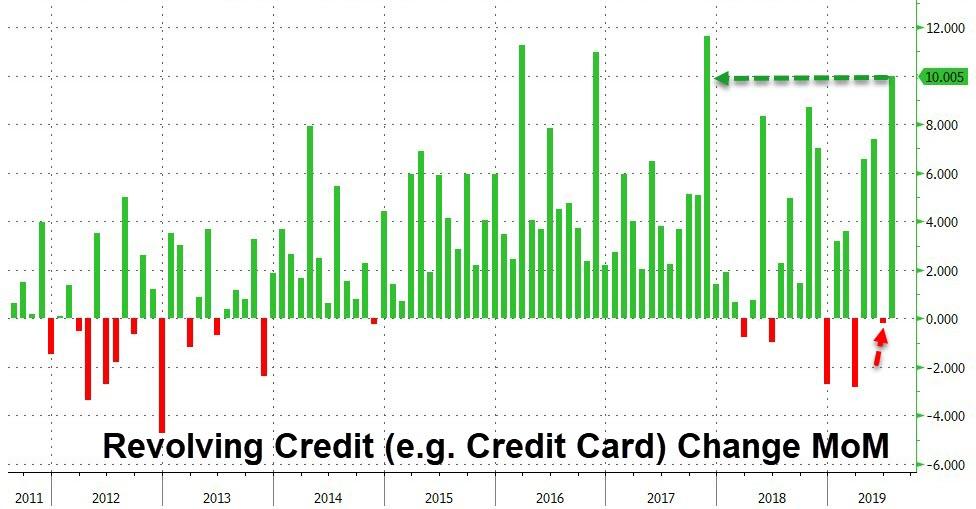

Now, none of this is an apocalyptic scenario, but it is a scenario in which people with low and moderate incomes must pay more, and are able to save less and invest less. It’s a scenario of a standard of living that in decline. It’s a scenario in which much of the population faces more roadblocks to wealth accumulation and must devote increasing levels of income and resources to paying off the debts of past generations. Government amenities such as welfare payments and transportation facilities must also shrink as more tax revenue must be spent on debt service. And, of course, the tax burden on ordinary people certainly won’t be going down.

Tyler Durden

Mon, 09/09/2019 – 15:50

via ZeroHedge News https://ift.tt/2I0laLo Tyler Durden