As COVID-19 Cases Spike Nationally, Black Lives Matter Plans More Rallies, Marches

Tyler Durden

Sun, 06/28/2020 – 18:00

Authored by Daniel Payne via JustTheNews.com,

Though coronavirus cases are surging in some parts of the United States, many Black Lives Matter activists are nonetheless planning sizable rallies in the near future, defying public health concerns in favor of continuing what has become a month-long streak of aggressive public activism.

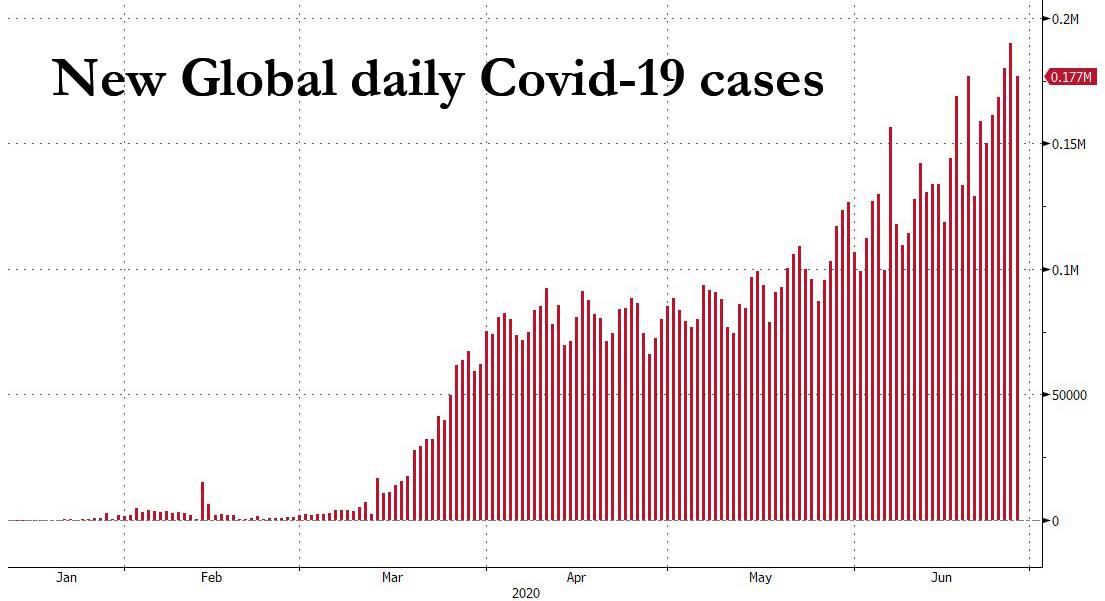

The surge in coronavirus cases in some parts of the country — especially Texas, Arizona and Florida — has brought with it renewed fears that any form of reopening states after months of lockdowns will bring a new wave of COVID-19 infections.

The governors of Texas and Florida imposed fresh restrictions on residents this week in response to rising cases in their states, while other governors such as Washington’s Jay Inslee mandated that all state residents must wear face masks while out in public.

In spite of those mounting concerns, multiple chapters of Black Lives Matter across the country are still planning rallies and marches, even as officials urge residents to refrain from gathering in large groups.

‘Community visioning, education, and mobilization’

One chapter, Black Lives Matter Michigan, is hosting a “protest & rally” at the Michigan State Capitol in Lansing on Monday. That event promises “community visioning, education, and mobilization to #DefendBlackLives.” Its Facebook page shows nearly 600 confirmed attendees and 2,800 “interested” in attending,

The event urges attendees to create signs with slogans on them such as “defund the police,” “invest the funds in the Black community,” and “declare racism a public health emergency in Michigan.”

In Minneapolis, meanwhile, a consortium of groups including the Chicago chapter of Black Lives Matter, has planned for a July 12 rally called the “National Mother’s March.” The group specifically invites “families (mothers, fathers, grandmothers, Aunts, Uncles, sisters, brothers spouses, significant others anyone) that have lost loved ones to police violence” to attend.

An “educational gathering” taking place that weekend will offer participants a host of workshops on subjects such as “the history and role of the police in US society;” “tools for organizing against police violence;” “DO’s and DON’T’s of organizing for families dealing with a more recent loss of a loved one;” and numerous other topics.

In Philadelphia on Sunday, a “Rally for Political Prisoners” will take place in the city’s Malcolm X Park. That event, which will be co-hosted by Black Lives Matter Philly and six other groups, has just over 200 confirmed attendees, though nearly 1,000 more are “interested” in going.

The rally will “center the lives and stories of our Political Prisoners in Pennsylvania and incarcerated people as we struggle to defund the police, dismantle the Fraternal Order Police and Abolish Policing,” the Facebook event states.

Citing the recent removal of former Philadelphia mayor and police commissioner Frank Rizzo, the description continues: “Now that the statue has been brought down, let’s bring home [Rizzo’s] victims.”

A spokeswoman for Black Lives Matter Philly said the group “ask[s] participant to wear masks at every action we plan.”

“We actively pass out masks, sanitizer, and wear gloves when we distribute items,” she said. “We’re very aware and cautious about risk with COVID-19.”

She added that one of the group’s supporters recently mailed the activists 500 masks to pass out to participants at rallies and marches.

On July 4, meanwhile, Black Lives Matter Boston will host an event called the “Say Her Name March & Rally.”

Participants will “gather to center and uplift the lives of ALL Black womxn in a march from Nubian Square to Boston Common, followed by a celebratory rally in the Common where we will share music, food, the arts.”

Nearly 300 participants are scheduled to go, while 2,000 have signaled an interest.

‘Avoid large gatherings’

The rallies, protests and marches that have rolled throughout the country over the past several weeks broke a months-long moratorium on large public gatherings throughout the United States. Sporting events, concerts, symposiums, conferences and other densely packed affairs were almost entirely cancelled from mid-March onwards, while restaurants and other popular gathering spots were all largely shuttered.

Federal, state and local politicians from the start of the outbreak aggressively promoted “social distancing” measures, urging and often mandating that citizens avoid each other, shelter in place and refrain from getting together outside of household family units.

Following the emergence of the protests after the police-involved death of Minneapolis resident George Floyd, however, political leaders rapidly shifted their rhetoric, coming out in tacit and sometimes outward support of the huge, densely crowded demonstrations that spread throughout the United States.

That apparent double standard was checked this week in a New York federal court, when a judge declared that Gov. Andrew Cuomo and New York City Mayor Bill de Blasio had unfairly discriminated against religious worshippers while giving preferential government sanction to protesters.

Though most authorities appear reluctant to criticize the large gatherings, Facebook in its event listings for the upcoming demonstrations still urges potential participants to stay away from them.

“It’s up to all of us to slow the spread of COVID-19,” a Facebook warning declares atop each event.

“Everyone, including young and healthy people, should avoid large gatherings during this time.”

via ZeroHedge News https://ift.tt/3gaaSqK Tyler Durden