Recipe from Kristina Johnson (Former Chef), who indeed is a former chef and a superb cook.(We’ve been friends for 30 years, and I have eaten her cooking often, always with great delight.)

from Latest – Reason.com https://ift.tt/35H5XJA

via IFTTT

another site

Recipe from Kristina Johnson (Former Chef), who indeed is a former chef and a superb cook.(We’ve been friends for 30 years, and I have eaten her cooking often, always with great delight.)

from Latest – Reason.com https://ift.tt/35H5XJA

via IFTTT

On Wednesday, the Supreme Court heard oral argument in Barr v. American Association of Political Consultants Inc. Around the 59:40 mark, there was an audible toilet flush in the background. The C-SPAN clip went viral:

LISTEN: Toilet flush during U.S. Supreme Court oral argument (h/t @nicninh) pic.twitter.com/He3QGMzvJI

— Jeremy Art (@cspanJeremy) May 6, 2020

The Supreme Court posted the audio the same day, which is now on Oyez. I’ve cropped out the relevant segment.

I hear subtle differences, but I may have listened to these clips far too many times, Zapruder style.

Here is the full text:

“And what the FCC has said is that when the subject matter of the call ranges to such topics then the call is transformed.”

From the C-SPAN recording:

From the SCOTUS recording there are several breaks in the audio, and when Martinez says “topics,” his voice gets echoey. Am I hearing things?

from Latest – Reason.com https://ift.tt/2zpZB5y

via IFTTT

A just-enacted San Antonio City Council resolution provides, in relevant part (emphasis added):

WHEREAS, COVID-19 is a public health issue, not a racial, religious or ethnic one, and the deliberate use of terms such as “Chinese virus” or “Kung Fu virus” to describe COVID-19 only encourages hate crimes and incidents against Asians and further spreads misinformation at a time when communities should be working together to get through this crisis; and

WHEREAS, the Jewish community has been targeted with blame, hate, antisemitic tropes and conspiracy theories about their creating, spreading and profiting from COVID-19; and

WHEREAS, to target and stigmatize specific communities for the COVID-19 outbreak and world- wide spread creates an inexcusable risk to all community members; and

WHEREAS, it is critical that the City of San Antonio take leadership and stand in solidarity with its Asian and Jewish communities to send a message that discriminatory and hate-motivated behavior or violence will not be tolerated; and

WHEREAS, all persons are encouraged to report any such antisemitic, discriminatory or racist incidents to the proper authorities for investigation; and

WHEREAS, the City of San Antonio wishes to affirm its commitment to the well-being and safety of its Asian and Jewish community members and ensure they know they are not alone and that the City of San Antonio is committed to ending the spread of all forms of hate and bigotry;

SECTION 1. The City of San Antonio denounces antisemitism, anti-Asian bigotry, and all hateful speech, violent action and the spread of misinformation related to COVID-19 that casts blame, promotes racism or discrimination or harms the City of San Antonio Asian and Pacific Islander, Jewish, immigrant or other communities.

SECTION 2. The City of San Antonio joins cities, counties and states across the country in affirming its commitment to the safety and well-being of all community members, including the Asian and Jewish communities, and in combatting hate crimes targeting Asians, Jews and Pacific Islanders.

SECTION 3. The City of San Antonio will continue its efforts to protect residents and targets and victims of hate, and to prosecute and curb hate acts related to COVID-19 in partnership with nonprofit organizations, the Bexar County District Attorney’s Office, the San Antonio Police Department and other law enforcement partners….

This seems not just to encourage “report[ing]” violence “to the proper authorities” for “investigation,” but also reporting other “hate-motivated behavior”—”all forms of hate and bigotry”—including “deliberate use of terms such as ‘Chinese virus'” and “stigmatiz[ing] specific communities.”

I don’t use the phrase “Chinese virus” because it’s being used as an attempt at political spin, and I prefer my disease names to be more objective and less political. (“Kung Fu virus” strikes me as just silly; “Kung Flu” is at least a pun, though again one that’s chiefly used as political spin.)

But “Chinese virus” or the less precise “Chinese flu” seem to me to be quite legitimate political spin—trying to blame China (the political entity) for its role in the spread of the virus—and of course fully protected speech. “Sinophobia” in the sense of fear of Chinese people is irrational, but “Sinophobia” in the sense of fear or dislike of the People’s Republic of China is quite sound, though, like all fear or dislike, needs to be treated sensibly.

Blame placed on Jews or Asian-Americans or others for the epidemic is nonsense. Blame placed on China for various of its actions is not nonsense (see, e.g., this), though of course there is a great deal of uncertainty about exactly how much fault China bears here.

And while of course criminal attacks on Asians (or my own group, Jews, or any other group) are bad, that a tiny fraction of the public might react badly as a result of the label “China virus” doesn’t strike me as a reason to avoid the speech. Compare, for instance, Wisconsin v. Mitchell (1993), the Supreme Court’s leading “hate crimes” case, which upheld Todd Mitchell’s enhanced sentence based on Mitchell’s having chosen his target based on the target’s race:

On the evening of October 7, 1989, a group of young black men and boys, including Mitchell, gathered at an apartment complex in Kenosha, Wisconsin. Several members of the group discussed a scene from the motion picture “Mississippi Burning,” in which a white man beat a young black boy who was praying.

The group moved outside and Mitchell asked them: “‘Do you all feel hyped up to move on some white people?'” Shortly thereafter, a young white boy approached the group on the opposite side of the street where they were standing. As the boy walked by, Mitchell said: “‘You all want to fuck somebody up? There goes a white boy; go get him.'” Mitchell counted to three and pointed in the boy’s direction. The group ran toward the boy, beat him severely, and stole his tennis shoes. The boy was rendered unconscious and remained in a coma for four days.

The blame was rightly placed on Mitchell, not on “Mississippi Burning”; likewise for talk of the “Chinese virus,” or for harsh criticisms of police officers that lead a tiny fraction of the public to react by attacking police officers (or violently resisting them during police stops).

Here’s the full resolution (minus some procedural details at the end):

WHEREAS, since the outbreak of the COVID-19 virus, more than 3,222,107 cases and more than 228,756 deaths have been confirmed worldwide as of April 30, 2020, according to the Johns Hopkins University Coronavirus Resource Center, and according to the Centers for Disease Control and Prevention, 1,005,147 cases and 57,505 deaths have been reported in the United States as of April 30, 2020; and

WHEREAS, COVID-19 will not be stopped by political boundaries and was not created or caused by any race, nationality or ethnicity, and the World Health Organization has cautioned against using geographic descriptors that can fuel ethnic and racial discrimination; and

WHEREAS, COVID-19 has infected people from all racial, national and ethnic backgrounds; and

WHEREAS, the City of San Antonio is fully committed to the safety, security, and equal treatment of its residents as it confronts the COVID-19 pandemic; and

WHEREAS, each individual has the ability to promote inclusiveness, celebrate diversity, support all fellow community members, prevent the spread of misinformation, and reject hate and bias in all forms; and

WHEREAS, hate crimes, discrimination and aggression against Asians and Jews are on the rise throughout the country as these groups are being blamed for the COVID-19 outbreak and spread; and

WHEREAS, as our history has shown, times of great fear, uncertainty and unrest can lead to the demonization, blaming, and scapegoating of groups as the “other;” and

WHEREAS, extremists are taking advantage of COVID-19 to spread their hateful ideologies, including antisemitism, racism, Islamophobia, and Sinophobia; and

WHEREAS, amid the growing spread of COVID-19, there are surging reports of bias-motivated incidents targeting members of the Asian and Pacific Islander community in the U.S.; and

WHEREAS, COVID-19 is a public health issue, not a racial, religious or ethnic one, and the deliberate use of terms such as “Chinese virus” or “Kung Fu virus” to describe COVID-19 only encourages hate crimes and incidents against Asians and further spreads misinformation at a time when communities should be working together to get through this crisis; and

WHEREAS, the Jewish community has been targeted with blame, hate, antisemitic tropes and conspiracy theories about their creating, spreading and profiting from COVID-19; and

WHEREAS, to target and stigmatize specific communities for the COVID-19 outbreak and world- wide spread creates an inexcusable risk to all community members; and

WHEREAS, it is critical that the City of San Antonio take leadership and stand in solidarity with its Asian and Jewish communities to send a message that discriminatory and hate-motivated behavior or violence will not be tolerated; and

WHEREAS, all persons are encouraged to report any such antisemitic, discriminatory or racist incidents to the proper authorities for investigation; and

WHEREAS, the City of San Antonio wishes to affirm its commitment to the well-being and safety of its Asian and Jewish community members and ensure they know they are not alone and that the City of San Antonio is committed to ending the spread of all forms of hate and bigotry; NOW THEREFORE,

BE IT RESOLVED BY THE CITY COUNCIL OF THE CITY OF SAN ANTONIO:

SECTION 1. The City of San Antonio denounces antisemitism, anti-Asian bigotry, and all hateful speech, violent action and the spread of misinformation related to COVID-19 that casts blame, promotes racism or discrimination or harms the City of San Antonio Asian and Pacific Islander, Jewish, immigrant or other communities.

SECTION 2. The City of San Antonio joins cities, counties and states across the country in affirming its commitment to the safety and well-being of all community members, including the Asian and Jewish communities, and in combatting hate crimes targeting Asians, Jews and Pacific Islanders.

SECTION 3. The City of San Antonio will continue its efforts to protect residents and targets and victims of hate, and to prosecute and curb hate acts related to COVID-19 in partnership with nonprofit organizations, the Bexar County District Attorney’s Office, the San Antonio Police Department and other law enforcement partners.

SECTION 4. The City of San Antonio pledges to support the inalienable rights of all people in our community, who should be treated with respect and must remain safe during this pandemic. We call upon all our residents to treat each other with respect.

SECTION 5. The City of San Antonio urges residents to join us in calling attention to these harms and denouncing hate to help keep us all safe during this unprecedented pandemic and beyond….

from Latest – Reason.com https://ift.tt/2LbyMo9

via IFTTT

Is Trump Kicking The Saudis To The Curb The Beginning Of Something Not Terrible?

Authored by Tom Luongo via Gold, Goats, ‘Guns blog,

More than anything else in Saudi Arabia, that thing you smell is fear. Everything is coming unglued for the royal family there all at once. If we all weren’t so distracted by the Coronapocalypse these things would all be front page news.

In the past week there have been three major stories concerning Saudi Arabia, none of the bullish.

First, there was the news that UAE-backed forces in Yemen broke with the Saudis-led coalition there to declare the Southern Transitional Council the new administrators over southern Yemen which includes the capital and major port at Aden.

This led to major clashes over the next week between forces which less than two weeks ago were supposedly on the same side.

In addition, Saudi mercenaries were routed in Northern Yemen. The UAE pulled its troops out of Yemen ending its fight with the Houthis after the attack on the Ab Qaiq oil processing facility last summer.

Finally, the Saudis accepted a UN-brokered ceasefire with the Houthis. This is a two-week provisional ceasefire, but considering how badly their mercs and pet head-chopping animals have been faring this should be considered a mercy gesture by the Houthis.

The war against Yemen has reached its terminal stage and it only took the impending financial collapse of the entire world to get it done.

Next up we have two news items from Thursday which underscore just how irrelevant the Wahabist government in Riyadh has become.

1. They accepted the reality that they can’t win an oil price war with the Russians by raising the tender prices for Saudi Aramco grades across the board. They had no choice since China told them they liked more expensive Russian oil better.

Buying from the Salman family is like buying from Donald Trump and under the current set of geopolitical imperatives China’s leaderships would be colossal fools to do so just to save a few dollars.

2. But the big news is that President Trump is removing the Patriot Missile systems he put in last year. From Zerohedge:

The Wall Street Journal reports that The U.S. is removing Patriot anti-missile systems from Saudi Arabia and is considering reductions to other military capabilities – marking the end, for now, of a large-scale military buildup to counter Iran, according to U.S. officials.

Trump’s been vocal about how vulnerable the regime in Riyadh is without his support. But the bigger reason for this, I think, has nothing to do with punishing Crown Prince Mohammed bin Salman for starting an oil price war which created a mess in U.S. oil markets.

This is about Trump realizing that oil should no longer be central to foreign policy objectives. In a world of $20-25 per barrel oil, why are we basing our entire foreign policy, which costs trillions we now truly cannot afford, on controlling the physical commodity markets which we are more than capable of producing?

Energy Dominance was the strategy of this administration, but that was predicated on the U.S. becoming the supplier of the marginal barrel of oil. That is clearly not the case with the May contract settling for $-40.

Trump will never apologize for making a mistake. He will just change course and end one policy and begin the next. Telling the Saudis he’s pulling the Patriots is a clear sign that policy is changing.

There’s no profit or purpose for continuing the operation in Yemen. That war of attrition is over.

This is also about the beginning of Trump’s re-election campaign in the wake of this historic economic collapse. It becomes a down payment to his anti-war, anti-imperial voting block which he has thoroughly alienated with his disastrous critical decisions culminating in the assassination of Iranian General Qassem Soleimani.

He has to do something to get these people (like me) back on his side. Now with the New Great Depression he has an excellent milieu for pulling back the empire… but he actually has to do it. So, is he?

Look at where we are today. Trump previously removed our support for the war in Yemen. He did not escalate in March after Kataib Hezbollah sent a second round of missiles into a U.S. base in Iraq, when he was being lobbied hard by the State Dept. and the Pentagon to do so.

Iran was able to deliver a major cargo of oil to Syria which previously had been under sincere U.S. embargo which lead to the seizure of the Iranian oil tanker last summer. Trump, apparently, berates his National Security staff daily to get us out of Afghanistan.

Sure, we’re still trying to pull strings in Iraq to install a government that will allow our troops to stay, but this policy has all the earmarks of State Dept. and Pentagon policy which Trump could pull the plug on if it looks grim.

Iraq is a mess of our devising, fighting China, Russia and Iran there will only make things worse for everyone. No matter what happens there now, the tired cry by Secretary of State Mike Pompeo about evil Iran will fall on very deaf ears when Americans are truly suffering at home.

I still think Trump has the political instincts to realize this in an election year during a depression and a country bitterly divided on nearly every issue.

So, in the end, the collapse in oil prices after Crown Prince Mohammed bin Salman threw a hissy fit back in March probably didn’t help U.S./Saudi relations any but given what’s happened and what’s on the horizon I don’t think it would have mattered.

Trump can blame MbS all he wants but we’d likely end up right here anyway.

Because his real enemies are not in the Kremlin or in Tehran. Trump’s real enemies are in his own White House, on Capitol Hill and across the various think tanks, NGOs and gentlemen’s clubs around the world that want him gone from power and a much poorer, desperate world than the one we had before the fear of COVID-19.

And in the grand scheme of the emerging post-COVID world is our support of the vicious Saudis all that important when we are swimming in oil we can’t find room to store?

So, MbS, like Trump and like nearly everyone else is looking closer to home to solve their problems rather than getting caught up in silly power games supporting outdated theories about who controls what part of the world.

With oil this low the petrodollar simply isn’t that important anymore and neither is the survival of what we currently know as Saudi Arabia.

* * *

Join My Patreon if you want help navigating the shifts in geopolitics. Install the Brave Browser if you are tired of feeding the Google Beast.

Tyler Durden

Fri, 05/08/2020 – 18:05

via ZeroHedge News https://ift.tt/2LgjhuY Tyler Durden

High Yield Issuance Window Slams Shut As United Pulls 11%-Yielding Bond

Just minutes after CNBC was discussing how fantastic the Fed put on High-Yield Bonds has been in setting a floor under the capital structure and enabling the biggest surge in stocks off the COVID-19 contagion lows (despite The Fed not having yet set one foot in the corporate bond space), an awkward headline hit that may prove to be monumental by Monday morning.

After early discussions in the low 9%-yield range, United Airlines was reportedly forced to increase the juice to 11% late this afternoon in order to encourage takers for its $2.25 billion bond offering.

Bloomberg reported that the changes come after the three and five-year bonds had only received about $1.5 billion of orders as of Thursday morning, the people added.

But then it got worse, as potential buyers continued to push for investor-friendly changes.

Bloomberg points out that the notes were secured on a first priority basis by a pool of 360 aircraft owned by United, leaving some investors concerned that these are not valuable enough to balance out the risk of investing in an airline whose business has been hit as governments across the globe have halted travel to help stem the spread of Covid-19.

The aircraft are close to retirement with a weighted average age of 19 years, CreditSights analyst Roger King wrote in a note published Wednesday. That means many of the planes will not be flying when the five-year bond matures, he wrote.

Despite investors’ apparent eagerness to buy any and junk debt issue this week – because they know there’s the greater fool in The Eccles Building coming in right behind them – United Airlines tonight abandoned its bond offering according to its latest filing.

UAL shares are down over 3% after hours on the news.

But perhaps more notably, this may force UAL to issue more stock and more systemically, force investors front-running The Fed to reassess the level of the strike price to assign to Powell’s Put.

Equity traders better start paying attention to what the CDS market is saying…

Did the HY issuance window just go full Keyser Soze…

Tyler Durden

Fri, 05/08/2020 – 17:55

via ZeroHedge News https://ift.tt/3bfTe1G Tyler Durden

As Markets Crashed, The Swiss National Bank Went On A FAAMG Buying Spree

It used to be a running joke among traders that when markets crash, central banks step in – either directly or in the case of the Fed indirectly via Citadel – and buy stocks to prop up the market and short up confidence. That joke is now the truth.

Now that the Fed is openly buying corporate bonds and fallen angels, what was once absurd humor has become sad reality. And while we wait for the Fed to admit it too will be buying stocks soon – we just need that pesky next crash before Powell commits – other central banks have no such qualms.

Take the SNB.

We previously reported that the hedge fund that is not only publicly traded but also moonlights as the Swiss central bank, which allows it to print money and effectively purchase any security it wishes with a zero cost basis suffered its biggest loss in history, reporting a loss of $32.7 billion on its massive equity portfolio. Yes, the SNB along with the BOJ, is unique in that it does not pretend to not buy stocks, and does so quite openly.

So openly, in fact, that in the past 5 years, the value of its US equity holdings increased more than threefold, from $26.7 billion in Dec 2014 to $97.5 billion in Dec 2019.

What about in the first quarter of 2020 when after hitting an all time high, stocks crashed in March?

As one can see in the chart above, the total value of SNB stock holdings barely budged from Q4 2019 to Q1 2020 despite the 30% crash in the market in March.

How is that possible? Simple: after the SNB kept its total holdings relatively flat for the past year, conserving its dry powder for just the right occasion, said occasion materialized in March, and the Swiss National Bank went on a buying spree as markets crashed, adding roughly 22% (on average) to its top positions.

Also according to the SNB’s latest 13F, as of March 31, the central bank owned $4.5 billion in Microsoft shares, $4.4 billion in Apple, $3.2 billion in Amazon, $2.7 billion in Google and $1.6 billion in Facebook, also known as the FAAMG stocks which as everyone knows by now, have become the market leaders, accounting for over 20% of the S&P’s market cap.

And the punchline: the SNB added approximately 22% to its holdings of each of the FAAMGs in Q1 as follows:

So for all those wondering who was going crazy bidding up all the megatech names, which are now up more than 10% YTD while the rest of the market is down 13%…

… even as even Warren Buffett sat on the sidelines waiting for the other shoe to drop, now you know and all you need to replicate the SNB’s performance and buy FAAMGs without a care in the world, is your own (legal) printing press to print digital money out of ones and zero and buy anything and everything in the name of preventing the system from collapsing.

Source: SNB

Tyler Durden

Fri, 05/08/2020 – 17:45

via ZeroHedge News https://ift.tt/3clExvq Tyler Durden

“It’s Like Pre-Crime” – California County Launches Snatch-And-Grab COVID Spy Program

Authored by Simon Black via SovereignMan.com,

Are you ready for this week’s absurdity? Here’s our Friday roll-up of the most ridiculous stories from around the world that are threats to your liberty, your finances, and your prosperity… and on occasion, poetic justice.

19 residents of Ventura County, California have died so far from Covid. That’s 0.002% of the population.

Most places would consider this a rounding error. But in Ventura County, it’s 19 too many.

So the county government has now launched a ‘contact tracing’ initiative to hire 50 investigators, and perhaps more later, to track down people who might have Covid, “immediately isolate them,” and then “find every one of their contacts” to isolate those people as well.

They also state that, if someone has Covid and is living in a home with other family members, “we’re not going to be able to keep the person in that home. . .”

This is a mass surveillance apparatus that effectively amounts to a snatch-and-grab. You get a knock at the door and are forcibly removed from your home and taken away from your family because some county bureaucrat traced you to someone who might have the virus.

It’s like “pre-crime”, but even more ridiculous… I mean, look at the words they’re using – it’s up to the government now to decide who gets to stay in their own private property with their families.

Click here to watch it yourself.

* * *

Kshama Sawant is a member of the City Council of Seattle, and a proud Socialist.

She recently took to Twitter to criticize Amazon, one of the most popular whipping boys of the Bolsheviks:

“The super-rich are out of touch with the reality they inflict on the majority of humanity. They will ruthlessly extract the price of this pandemic recession from workers, unless we fight back. #TaxAmazon.”

When a Twitter follower under the handle @KarlMarxJunior suggested, “How about #NationalizeAmazon?” Sawant responded:

“Yes, corporations like Amazon need to be taken into democratic public ownership, to be run by workers for social good. We will need militant mass movements, strike actions at workplaces, to begin to fight to win this. Because it will be a political strike against billionaires.”

Click here to see the Twitter thread.

* * *

Recently we told you how police departments in many cities across the Land of the Free were adopting new policies to NOT arrest people for petty or victimless crimes.

The idea was to keep jails from being overcrowded petri-dishes which would spread Covid-19.

And some Texas cities were among those easing up.

But not Laredo, Texas.

Officers received an anonymous tip that two women were committing a heinous crime: doing nails and eyelashes from their homes.

In an undercover sting operation, police officers caught the two women attempting to market and sell their services.

Police charged the women for a violation of the lockdown order, and held them in jail on $500 bond each.

This is the new criminality in 2020: women painting nails in their own homes.

Cities with strained budgets are wondering how they are going to get through the economic devastation caused by the lockdowns. Revenue is drying up.

And THIS is how cities use their scarce resources– to stake-out and arrest women for giving pedicures.

Click here to read the full story.

* * *

The “crisis budget” plan of the mayor of Nashville is to cut spending, and raise taxes.

Now that the hard times have hit, governments will take more, and give you less.

Nashville was overspending and racking up debt in the best of times. And now that the economy is locked down, the city expects to miss out on $470 million of tax revenue over the next year or so.

For homeowners, that means a property tax increase of about $625 per year on a $250,000 house.

“In the end, hard, hard decisions have to be made,” the Mayor said. “Everybody is sacrificing in this budget.”

But it’s hard to see where the city is making sacrifices.

The new budget doesn’t lay-off any city employees, and in fact increases spending from last year by $115 million.

Click here to read the full story.

* * *

And to continue learning how to ensure you thrive no matter what happens next in the world, I encourage you to download our free Perfect Plan B Guide.

Tyler Durden

Fri, 05/08/2020 – 17:25

via ZeroHedge News https://ift.tt/2SQ1fE6 Tyler Durden

A just-enacted San Antonio City Council resolution provides, in relevant part (emphasis added):

WHEREAS, COVID-19 is a public health issue, not a racial, religious or ethnic one, and the deliberate use of terms such as “Chinese virus” or “Kung Fu virus” to describe COVID-19 only encourages hate crimes and incidents against Asians and further spreads misinformation at a time when communities should be working together to get through this crisis; and

WHEREAS, the Jewish community has been targeted with blame, hate, antisemitic tropes and conspiracy theories about their creating, spreading and profiting from COVID-19; and

WHEREAS, to target and stigmatize specific communities for the COVID-19 outbreak and world- wide spread creates an inexcusable risk to all community members; and

WHEREAS, it is critical that the City of San Antonio take leadership and stand in solidarity with its Asian and Jewish communities to send a message that discriminatory and hate-motivated behavior or violence will not be tolerated; and

WHEREAS, all persons are encouraged to report any such antisemitic, discriminatory or racist incidents to the proper authorities for investigation; and

WHEREAS, the City of San Antonio wishes to affirm its commitment to the well-being and safety of its Asian and Jewish community members and ensure they know they are not alone and that the City of San Antonio is committed to ending the spread of all forms of hate and bigotry;

SECTION 1. The City of San Antonio denounces antisemitism, anti-Asian bigotry, and all hateful speech, violent action and the spread of misinformation related to COVID-19 that casts blame, promotes racism or discrimination or harms the City of San Antonio Asian and Pacific Islander, Jewish, immigrant or other communities.

SECTION 2. The City of San Antonio joins cities, counties and states across the country in affirming its commitment to the safety and well-being of all community members, including the Asian and Jewish communities, and in combatting hate crimes targeting Asians, Jews and Pacific Islanders.

SECTION 3. The City of San Antonio will continue its efforts to protect residents and targets and victims of hate, and to prosecute and curb hate acts related to COVID-19 in partnership with nonprofit organizations, the Bexar County District Attorney’s Office, the San Antonio Police Department and other law enforcement partners….

This seems not just to encourage “report[ing]” violence “to the proper authorities” for “investigation,” but also reporting other “hate-motivated behavior”—”all forms of hate and bigotry”—including “deliberate use of terms such as ‘Chinese virus'” and “stigmatiz[ing] specific communities.”

I don’t use the phrase “Chinese virus” because it’s being used as an attempt at political spin, and I prefer my disease names to be more objective and less political. (“Kung Fu virus” strikes me as just silly; “Kung Flu” is at least a pun, though again one that’s chiefly used as political spin.)

But “Chinese virus” or the less precise “Chinese flu” seem to me to be quite legitimate political spin—trying to blame China (the political entity) for its role in the spread of the virus—and of course fully protected speech. “Sinophobia” in the sense of fear of Chinese people is irrational, but “Sinophobia” in the sense of fear or dislike of the People’s Republic of China is quite sound, though, like all fear or dislike, needs to be treated sensibly.

Blame placed on Jews or Asian-Americans or others for the epidemic is nonsense. Blame placed on China for various of its actions is not nonsense (see, e.g., this), though of course there is a great deal of uncertainty about exactly how much fault China bears here.

And while of course criminal attacks on Asians (or my own group, Jews, or any other group) are bad, that a tiny fraction of the public might react badly as a result of the label “China virus” doesn’t strike me as a reason to avoid the speech. Compare, for instance, Wisconsin v. Mitchell (1993), the Supreme Court’s leading “hate crimes” case, which upheld Todd Mitchell’s enhanced sentence based on Mitchell’s having chosen his target based on the target’s race:

On the evening of October 7, 1989, a group of young black men and boys, including Mitchell, gathered at an apartment complex in Kenosha, Wisconsin. Several members of the group discussed a scene from the motion picture “Mississippi Burning,” in which a white man beat a young black boy who was praying.

The group moved outside and Mitchell asked them: “‘Do you all feel hyped up to move on some white people?'” Shortly thereafter, a young white boy approached the group on the opposite side of the street where they were standing. As the boy walked by, Mitchell said: “‘You all want to fuck somebody up? There goes a white boy; go get him.'” Mitchell counted to three and pointed in the boy’s direction. The group ran toward the boy, beat him severely, and stole his tennis shoes. The boy was rendered unconscious and remained in a coma for four days.

The blame was rightly placed on Mitchell, not on “Mississippi Burning”; likewise for talk of the “Chinese virus,” or for harsh criticisms of police officers that lead a tiny fraction of the public to react by attacking police officers (or violently resisting them during police stops).

Here’s the full resolution (minus some procedural details at the end):

WHEREAS, since the outbreak of the COVID-19 virus, more than 3,222,107 cases and more than 228,756 deaths have been confirmed worldwide as of April 30, 2020, according to the Johns Hopkins University Coronavirus Resource Center, and according to the Centers for Disease Control and Prevention, 1,005,147 cases and 57,505 deaths have been reported in the United States as of April 30, 2020; and

WHEREAS, COVID-19 will not be stopped by political boundaries and was not created or caused by any race, nationality or ethnicity, and the World Health Organization has cautioned against using geographic descriptors that can fuel ethnic and racial discrimination; and

WHEREAS, COVID-19 has infected people from all racial, national and ethnic backgrounds; and

WHEREAS, the City of San Antonio is fully committed to the safety, security, and equal treatment of its residents as it confronts the COVID-19 pandemic; and

WHEREAS, each individual has the ability to promote inclusiveness, celebrate diversity, support all fellow community members, prevent the spread of misinformation, and reject hate and bias in all forms; and

WHEREAS, hate crimes, discrimination and aggression against Asians and Jews are on the rise throughout the country as these groups are being blamed for the COVID-19 outbreak and spread; and

WHEREAS, as our history has shown, times of great fear, uncertainty and unrest can lead to the demonization, blaming, and scapegoating of groups as the “other;” and

WHEREAS, extremists are taking advantage of COVID-19 to spread their hateful ideologies, including antisemitism, racism, Islamophobia, and Sinophobia; and

WHEREAS, amid the growing spread of COVID-19, there are surging reports of bias-motivated incidents targeting members of the Asian and Pacific Islander community in the U.S.; and

WHEREAS, COVID-19 is a public health issue, not a racial, religious or ethnic one, and the deliberate use of terms such as “Chinese virus” or “Kung Fu virus” to describe COVID-19 only encourages hate crimes and incidents against Asians and further spreads misinformation at a time when communities should be working together to get through this crisis; and

WHEREAS, the Jewish community has been targeted with blame, hate, antisemitic tropes and conspiracy theories about their creating, spreading and profiting from COVID-19; and

WHEREAS, to target and stigmatize specific communities for the COVID-19 outbreak and world- wide spread creates an inexcusable risk to all community members; and

WHEREAS, it is critical that the City of San Antonio take leadership and stand in solidarity with its Asian and Jewish communities to send a message that discriminatory and hate-motivated behavior or violence will not be tolerated; and

WHEREAS, all persons are encouraged to report any such antisemitic, discriminatory or racist incidents to the proper authorities for investigation; and

WHEREAS, the City of San Antonio wishes to affirm its commitment to the well-being and safety of its Asian and Jewish community members and ensure they know they are not alone and that the City of San Antonio is committed to ending the spread of all forms of hate and bigotry; NOW THEREFORE,

BE IT RESOLVED BY THE CITY COUNCIL OF THE CITY OF SAN ANTONIO:

SECTION 1. The City of San Antonio denounces antisemitism, anti-Asian bigotry, and all hateful speech, violent action and the spread of misinformation related to COVID-19 that casts blame, promotes racism or discrimination or harms the City of San Antonio Asian and Pacific Islander, Jewish, immigrant or other communities.

SECTION 2. The City of San Antonio joins cities, counties and states across the country in affirming its commitment to the safety and well-being of all community members, including the Asian and Jewish communities, and in combatting hate crimes targeting Asians, Jews and Pacific Islanders.

SECTION 3. The City of San Antonio will continue its efforts to protect residents and targets and victims of hate, and to prosecute and curb hate acts related to COVID-19 in partnership with nonprofit organizations, the Bexar County District Attorney’s Office, the San Antonio Police Department and other law enforcement partners.

SECTION 4. The City of San Antonio pledges to support the inalienable rights of all people in our community, who should be treated with respect and must remain safe during this pandemic. We call upon all our residents to treat each other with respect.

SECTION 5. The City of San Antonio urges residents to join us in calling attention to these harms and denouncing hate to help keep us all safe during this unprecedented pandemic and beyond….

from Latest – Reason.com https://ift.tt/2LbyMo9

via IFTTT

Despite FDA Claims Of Clamping Down On COVID-19-Scams, One Dodgy Company Remains On Its Website

Early on during the coronavirus pandemic, the FDA had been criticized for its restrictive approach for testing. As a result, it wound up swinging the other way, allowing virtually any manufacturer to develop and distribute serological (antibody) tests.

The agency established that manufacturers simply needed to notify the agency that it was offering tests and include basic boilerplate disclaimers such as the products not being FDA approved.

Naturally this led to a flood of fraudulent tests and shoddy products being made available throughout the U.S. and imported from China. There are now about 160 serological tests being marketed across the country that have not received formal authorization from the FDA.

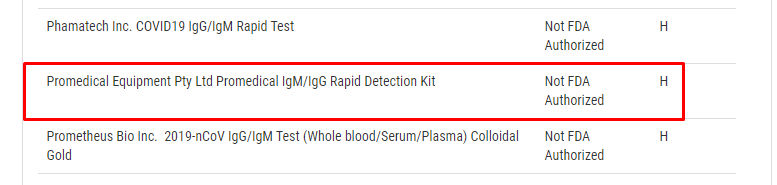

And so, the FDA has now said it is clamping down on test manufacturers making exaggerated claims and will require manufacturers to submit data validating the accuracy of its tests. But some dodgy actors remain on the FDA’s website, including what appears to Zero Hedge to be some low hanging fruit.

Take, for instance, Promedical Equipment Pty Ltd, a relatively unknown company prior to the coronavirus pandemic. Prior to the coronavirus, the company specialized in “cryogenic, massage therapy and erectile dysfunction machines.”

Promedical has been the subject of a series of investigative articles by The Guardian (like this one and this one), who pointed out in late April that the company – headed up by a convicted rapist with “no obvious experience in medical diagnostics” – was under investigation by Australian medical regulators.

The company had reportedly entered into a contract with the Australian government to sell them 500,000 coronavirus tests made by well-known Chinese manufacturer, Guangzhou Wondfo Biotech. The Chinese test had already been approved for use in Australia and the U.S. and Promedical was acting as the middle-man.

But then, the relationship between Wondfo and Promedical broke down in spectacular fashion, with Wondfo revoking authorization to distribute its products from Promedical. The order for the Australian government was never fulfilled.

“To date, the tests have not arrived in Australia and no payment has been made,” a government spokeswoman said in April.

Puerto Rico, which is in the midst of a “testing crisis”, saw a similar deal with Promedical collapse.

The company had promised the Puerto Rican government a large quantity of tests as part of a $38 million deal. The company promised Puerto Rico “large shipments” but at the time only held “a small batch” of testing kits in its Brisbane warehouse, according to the Guardian.

In the interim, Bradley Mayo, former manager of exports and logistics for Promedical, said he has distanced himself from the company. He told the Guardian:

“In these unprecedented and extremely challenging times, the medical supply chain industry is volatile at best, with many opportunists who aim to use this time of crisis to … enrich themselves. After lengthy investigation and due diligence, I have decided to distance myself from Promedical.”

In addition to being a convicted rapist, Promedical CEO Neran de Silva has reportedly also made claims to be a doctor, posting qualifications from the University of Queensland and Griffith University on his LinkedIn. The Guardian says that neither university has a record of him in their online graduation verification systems.

de Silva’s previous venture, a cryo company, also collapsed.

Finally, on Thursday morning, The Guardian reported that Promedical had been fined $63,000 for “false claims” about their test kits.

But the U.S. FDA, which claims to have an eye out specifically for these types of potentially dodgy companies, hasn’t seemed to take notice.

While reviewing the list of test manufacturers on the FDA site listed under the question “Q: What commercial manufacturers are distributing serology test kits under the policy outlined in Section IV.D of the Policy for Coronavirus Disease-2019 Tests? (Updated 5/6)”, Promedical’s name pops right up:

“Promedical Equipment Pty Ltd Promedical IgM/IgG Rapid Detection Kit”

Tyler Durden

Fri, 05/08/2020 – 17:05

via ZeroHedge News https://ift.tt/2SL92mU Tyler Durden

America Has Become A Powder Keg That Is Ready To Explode At Any Time

Authored by Michael Snyder via TheMostImportantNews.com,

Have you noticed that people are a lot more emotional these days?

People are angry about the lockdowns, people are angry because others are not “properly” observing the social distancing rules, people are angry about losing their jobs, people are angry about the shortages in the stores, and more than anything else people are angry at our politicians.

Even before COVID-19 came along, I was repeatedly warning my readers that anger was rising to a very dangerous level in this country, and now this pandemic has made things far worse. If you doubt this, just log on to Facebook and read some of the “discussions” that people are having about this coronavirus. Many of those “discussions” rapidly devolve into venom spewing contests, and sometimes this is still true even if people are theoretically on the same side. There is so much anger and frustration out there right now, and it is only going to get worse the closer that we get to election day.

Thankfully, so far we don’t have the sort of widespread civil unrest that we are already seeing in other nations, but the stage is certainly being set for it. The American people don’t like being forced to put their lives on hold, they don’t like all of the new rules that have been forced upon them because of this pandemic, and they are deeply frustrated with our politicians for being unable to instantly fix things.

Of course there aren’t going to be any easy answers. The U.S. economy has already lost 33 million jobs, and millions more will be lost in the weeks ahead. Meanwhile, more than 76,000 Americans have already died from the coronavirus, and the overall death toll in this country is likely to be in the hundreds of thousands.

In an environment such as this, people are going to have shorter fuses than usual, and it isn’t going to take much to get people to lash out in frustration. One of the most prominent examples of this that we have witnessed lately occurred in Austin, Texas…

Austin police have arrested a man who allegedly pushed a park ranger into a lake.

The incident occurred on Thursday at Commons Ford, a public park that is home to Lake Austin, and was captured on a video posted on social media. In the video, a park ranger is seen standing near the lake’s edge telling a crowd of people to stand six feet apart when a man pushes the ranger into the water and falls in himself.

It is quite foolish to push a law enforcement officer into a lake, but the social distancing restrictions are frustrating people so much that many of them are not thinking rationally.

And in this environment it certainly isn’t going to take much to push law enforcement officials over the edge either. Americans were stunned when video footage emerged of New Jersey police officers relentlessly beating young men with their batons for violating the social distancing rules…

Footage from a street fight on Tuesday afternoon shows a Jersey City police officer – who is white – repeatedly hitting a man – who is African American – while he’s pinned to the ground, and now activists are calling for the cops to be fired.

The clip filmed by a witness captured the man trying to raise his arms to protect his face as the law enforcement officer strikes him over and over again.

Sadly, I expect to see a lot more wild scenes in our streets like that in the months ahead.

Right now, virtually the entire country is in a really bad mood, and unfortunately some people will choose to resort to violence.

And it can happen in places that you might not expect. For instance, an argument over social distancing rules at a McDonald’s in Oklahoma resulted in three people getting shot…

Three workers at an Oklahoma City McDonald’s were injured Wednesday by gunfire and a scuffle that appeared to have started because the restaurant’s dining area was closed for social distancing during the coronavirus pandemic, police said.

I’ll never understand why people commit these sorts of acts of senseless violence.

But as our world gets even crazier, more people than ever are going to be going off the deep end.

Our nation is so deeply divided, and explosions of anger and hatred are becoming increasingly common. So many Americans are willing to “shoot first and ask questions later”, and the shooting of a 25-year-old African-American man in Georgia is causing a national uproar…

Ahmaud Arbery was fatally shot while running in a neighborhood after a former police officer and his son chased the 25-year-old man down, telling officers later that they thought he looked like the suspect in a series of recent break-ins in the area, authorities said.

On Thursday, we learned that the father and son that chased Arbery down have been arrested. But even though they have been arrested now, it appears that this case will deepen the very deep racial tensions that already exist in this country.

I truly wish that we could all learn how to love one another, but instead I continue to see hatred rise all over America.

Needless to say, one of the big reasons why Americans hate one another these days is because of politics. November is right around the corner, and we will likely see tremendous outbursts of anger and frustration both before and after the election.

Meanwhile, economic conditions will continue to deteriorate, and millions of Americans will become increasingly desperate.

Already, meat shortages are making headlines all over the nation…

Farmers and ranchers have hogs, cattle and chicken that they feed, but can’t sell. Meatpacking plants don’t have enough workers as they get sick and have heightened anxiety. And grocery shoppers and restaurants can’t get their typical cuts or supply of meat.

Major grocers, including Kroger and Costco, added purchase limits this week for meat to prevent hoarding and help keep it in stock. Nearly a fifth of Wendy’s U.S. restaurants removed hamburgers and other beef products from their online menus, according to Stephens Inc. And another chain, Shake Shack, said rising beef prices have taken a bite into its profits.

Many Americans can deal with short-term shortages, but if these shortages stretch into the summer months a whole lot of people are going to become extremely frustrated.

Overall, I have never seen so much anger and frustration in the United States in my entire lifetime, and it is truly a recipe for disaster.

Unfortunately, I expect anger and frustration to continue to grow in the months ahead, and we could be building up to a very dangerous crescendo later in the year.

Tyler Durden

Fri, 05/08/2020 – 16:45

via ZeroHedge News https://ift.tt/2zlvyMg Tyler Durden