China Quietly Drops Vow “Not To Flood Economy With Liquidity” As It Injects An April Record ¥3.1 Trillion In Credit

In response to a world that has unleashed a record liquidity flood in the past two months, over the weekend China’s PBoC said in its quarterly monetary policy report that it will resort to “more powerful” policies to counter the hit to growth due to the coronavirus pandemic.

Commenting – in his traditionally sarcastic style – on the PBOC’s announcement, Rabobank’s Michael Every said that the Chinese central bank has “recognized that after having ‘beaten the virus’ the Chinese economy is still so weak it requires “more powerful” monetary policies: its latest quarterly monetary policy report dropped the vow to “avoid excess liquidity flooding the economy.” That, as Every concluded, “is as bearish for CNY, and hence for EM FX and inflation prospects, as it is positive for some local assets.”

Here are some more details, sans the sarcasm, on the PBOC’s report from Goldman, which concludes that the PBOC’s dovish stance in monetary policy since February “would continue in the coming months given the need to put more emphasis on economic growth and employment.”

The report reiterated that the “prudent” monetary policy stance should be more flexible, which has been used since February, and mentioned the need to strike a dynamic balance among multiple goals and put more emphasis on economic growth and employment. From a broad perspective, the PBOC guided down the interbank interest rate significantly, with DR007 down by around 80bp from January to 1.5% on average in April, and R007 down by around 100bp to 1.6%. The PBOC also cut the OMO and MLF rates by 30bp and accordingly, guided LPR lower by 30bp, and cut the interest rate for excess reserves from 0.72% to 0.35% (for the first time since 2008). We expect another 20bp cuts in OMO/MLF rates and another 100bp of cuts in the RRR. Given the significant decline in repo rates since April, the need to boost growth in coming months and moderation in CPI inflation (see below for more discussion), we lower our forecast for DR007 to 1.5% on average for the rest of this year (from 1.9% on average previously).

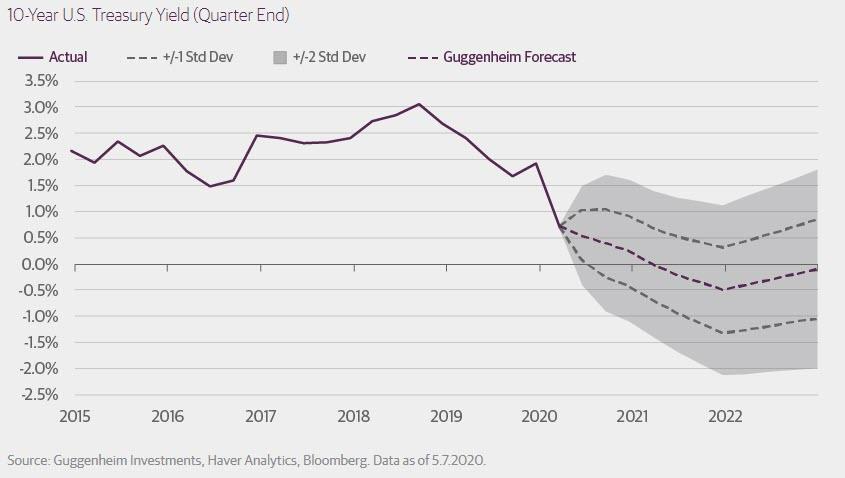

At the same time, the report also noted the PBOC’s intention to maintain a “normal” monetary policy, which only a few major economies currently have. This is consistent with what Governor Yi Gang mentioned in an article published in December last year that questioned the effectiveness of unconventional monetary policy (e.g., zero interest rates and quantitative easing) in major DMs, stating that China would not implement zero interest rates or quantitative easing. So we think the bar for large further rate cuts, particularly in short-end rates, is high in China.

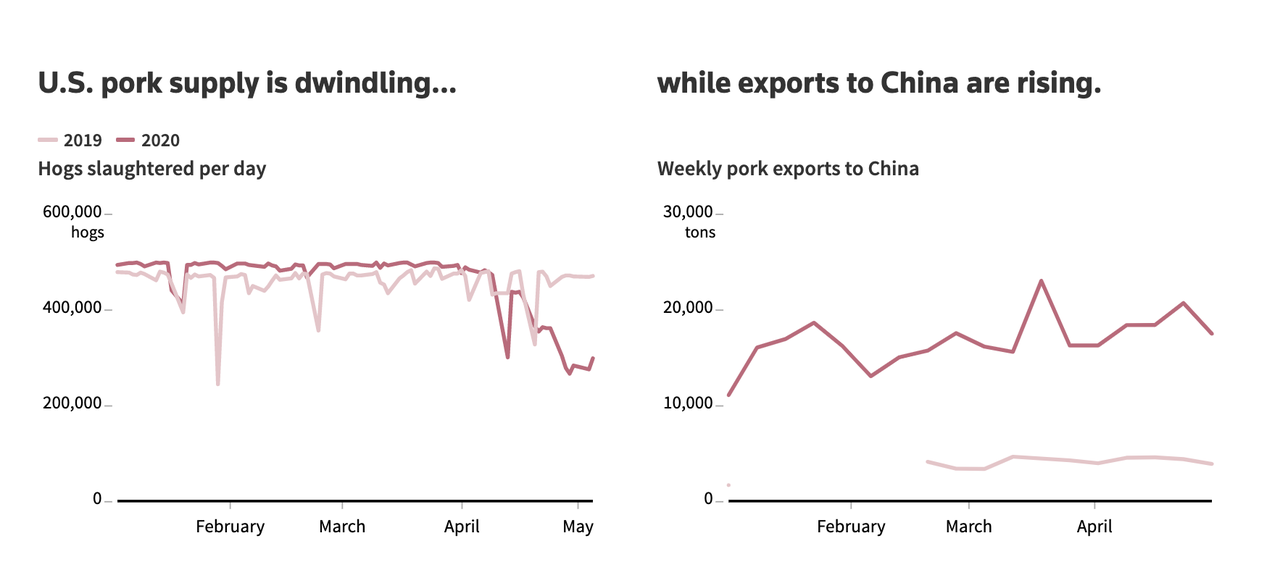

Elevated CPI inflation in recent months has been an unfavorable factor for monetary policy, even though it has largely been due to virus shock impacts (primarily the supply shock to food) and the decline of sow stock in early last year. Consistent with our forecasts, the report also noted that CPI inflation has started to go downward, and inflation expectations are currently stable. The report also mentioned that the virus may continue to affect inflation from both supply and demand sides in the coming months. As we have previously analyzed, the virus outbreak could put upward pressure on food prices (supply shocks outweigh demand shocks), but put downward pressure on service prices (where demand shocks dominate). In China, we found the net impact on CPI inflation was positive, reflecting larger impacts on food inflation (in DMs the food weight is much smaller so there is typically a negative impact). But with slowing infections (and less disturbance to the food supply) and a slow recovery in service demand, the net impact from the virus could turn negative. Thus, overall inflation could be less of a constraint for monetary easing in the coming months.

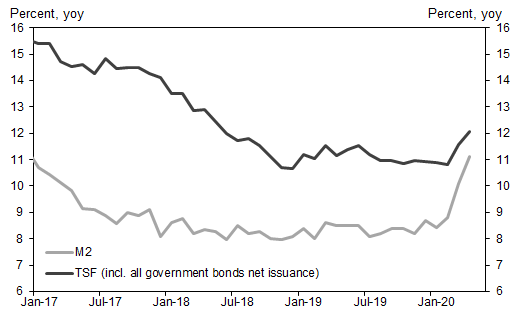

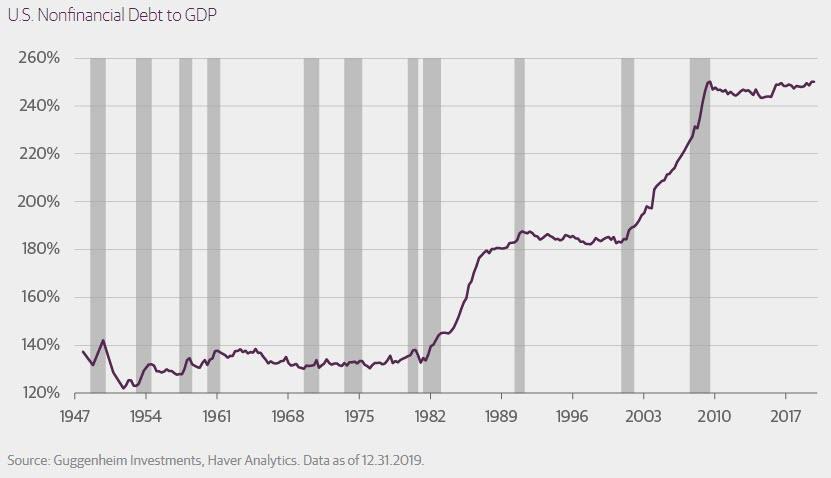

From a credit supply perspective, the report mentioned that M2 and TSF growth would “roughly match and be modestly higher” than nominal GDP growth, which of course is laughable for a nation where M2 has traditionally average about double GDP growth. That said, the PBOC has emphasized in recent years that TSF growth should be roughly in line with nominal GDP growth, leading to a much smaller deviation in TSF growth from nominal GDP growth (the ratio between TSF growth and nominal GDP growth was down from around 2 in 2016 to 1.1 in 2018, but up to 1.4 in 2019) and accordingly, less pressure on macro leverage.

While this approach could put an upper bound (range) on TSF growth, with downward pressure on growth intensifying, as we are seeing this year, the report suggests the bound should be higher to reflect the counter-cyclical requirements.

* * *

And sure enough, just hours after the PBOC statement, the central banks released its latest total social financing (TSF) and M2 data which were both well above market expectations, driven by continued growth in loans and corporate bonds, which according to Goldman “demonstrated the government has been quietly loosening policy.”

Here are the key numbers:

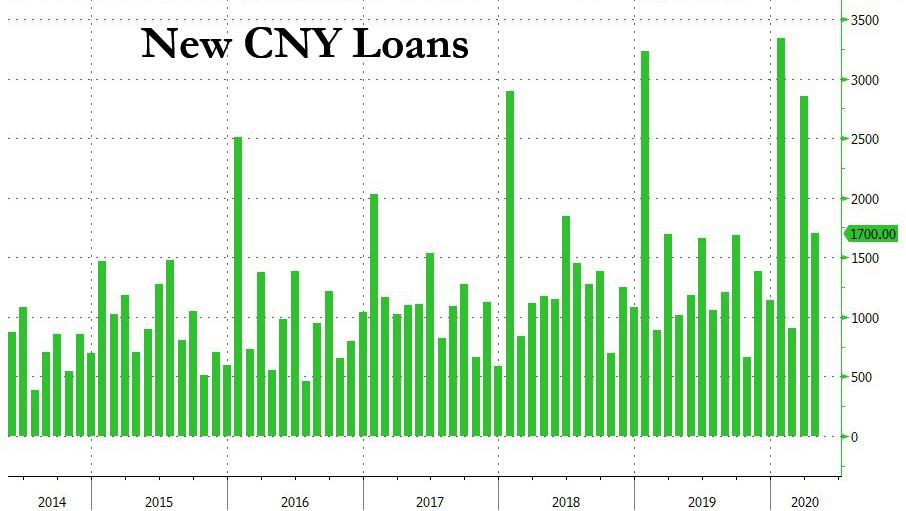

New CNY loans: CNY1700bn in April (loans to the real economy: CNY1620bn) vs. consensus exp. CNY1300bn. Outstanding CNY loan growth was 13.1% yoy in April, or roughly double China’s pre-covid GDP growth, and higher than March at 12.7% yoy. New CNY loans in April were lower than March mainly due to a sharp decline in short-term corporate loans.

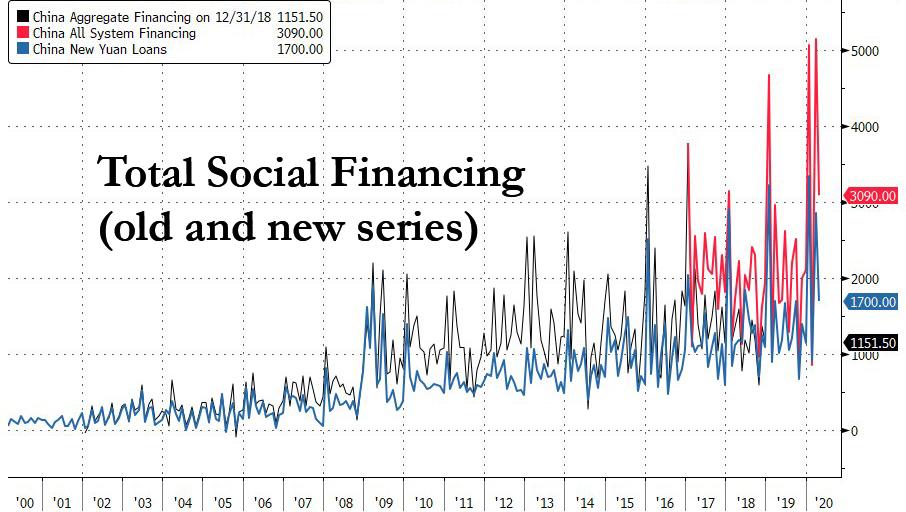

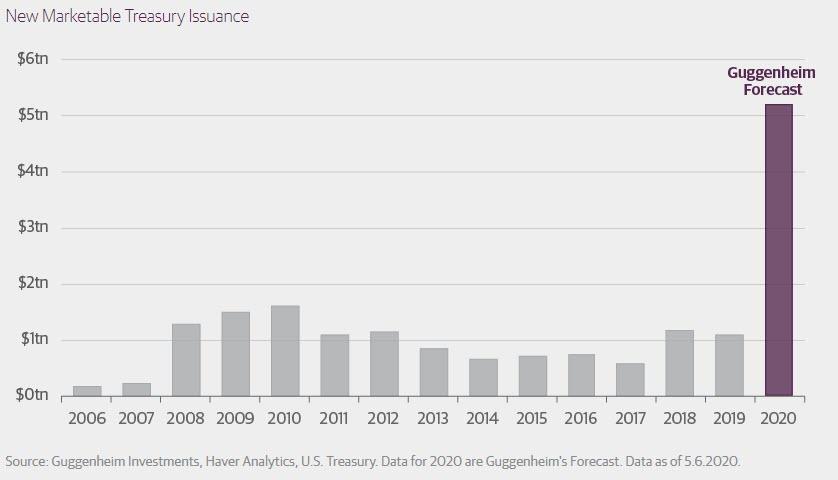

Total social financing: CNY3090bn in April, vs. consensus expectation RMB 2775bn. While below the record March TSF total of CNY5.149 trillion, this was the highest April total for the series on record.

TSF stock growth (after adding all government bonds) was 12.1% yoy in April, higher than 11.6% in March. On the other hand, the implied month-on-month growth of TSF stock moderated to 15.3% (seasonally adjusted annual rate) from 17.7% in March. If we exclude central government bonds and general local government bonds from the TSF flows, the TSF stock growth accelerated to 12.4% yoy in April from 11.8% in March.

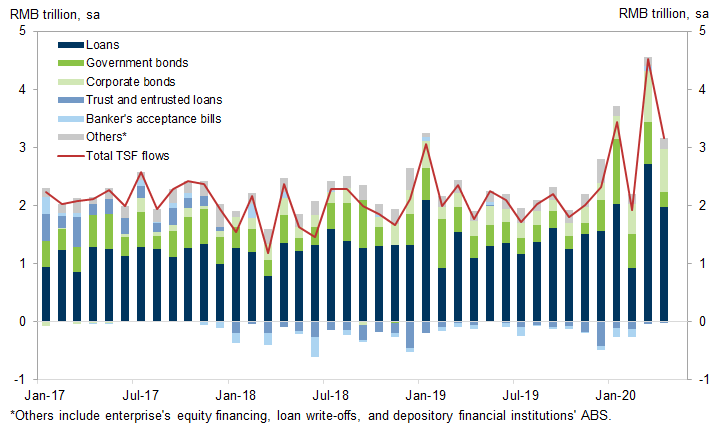

Total social financing surprised the market to the upside, driven by robust growth in loans and corporate bonds. Government bond net issuance moderated in April and shadow bank products remained muted. A breakdown of key TSF components is shown below:

Goldman expects the government to maintain the level of sequential TSF growth, especially given expected slowdown in exports growth, falling concerns about inflation, and less dramatic recovery in activity growth.

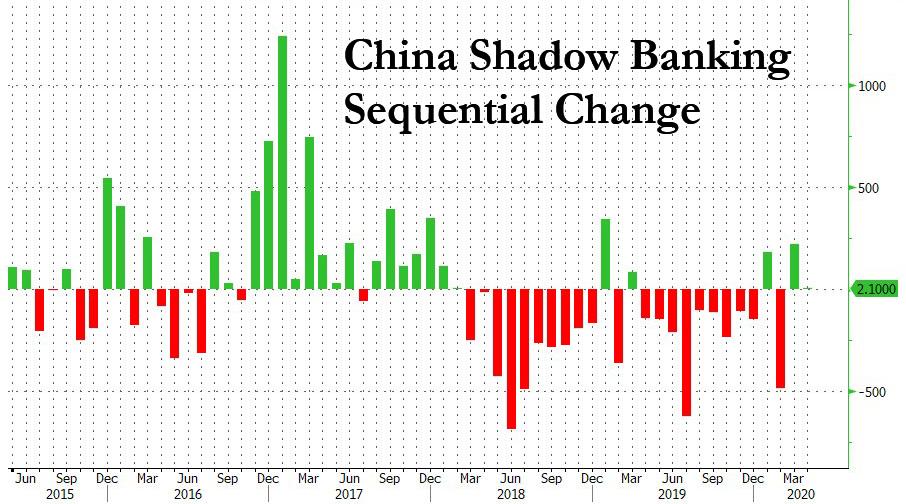

For the second month in a row, China’s shadow banking resulted in an injection in credit, suggesting that the PBOC is hardly that concerned about the current state of the shadow debt bubble. That said, the lower shadow banking activity was partially because financial institutions have concerns about regulatory repercussions. There is also less need to issue these since it is easy to extend standard RMB loans and issue bonds. Much of the shadow bank products were popular when there were tight controls on loans and bonds.

M2: 11.1% Y/Y in April (17.7% annualized) vs. Bloomberg exp. of 10.3% yoy, and above the March 10.1% yoy print.

M2’s 11.1% growth was the fastest since December 2016, above expectations, although well below the recent explosion in the US M2 (whose impact on risk assets we discussed previously).

As Goldman summarizes the April data, it demonstrated that “the government has been quietly loosening policy, more than what it may appear by looking at the magnitude of interest rates and RRR cuts.” Furthermore, there is still a clear preference to use these relatively low profile methods of loosening than tools such as RRR cuts which are often described as “heavy weapons”. Then again, how “low profile” is a CNY10 trillion credit injection in 3 months is anyone’s guess.

On the other hand, there are some concerns that there are more arbitrage activities than usual, which won’t help the real economy:

- Some firms might have borrowed at a low interest rate and then deposited the money at commercial banks.

- Other firms would then lend it to non-bank institutions instead of depositing the money at commercial banks, but this is significantly riskier since the safe borrowers such as large SOEs generally don’t need to borrow money this way.

The relatively low level of M1 is one sign indicating these arbitrary activities. If companies borrowed at a low interest rate and then deposited the money, they cannot deposit it in demand deposit accounts to enjoy the rate differential because the deposit rate is too low. The existence of some arbitrary activity almost always occurs when policy is being loosened and the interest rate is low.

So the fact that these activities exist does not mean monetary loosening is not helping the real economy – mounting evidence of stronger domestic demand growth especially in areas related to infrastructure FAI has demonstrated its usefulness. On the other hand, these concerns could add pressures on the central bank to lower the benchmark deposit rate, which hasn’t been adjusted for years, although the latest PBOC quarterly monetary policy report appeared to suggest some reluctance to cut.

However, inflation will need to drop before a wholesale rate cut. The high level of CPI inflation recently was cited by the PBOC deputy governor as a reason why they hadn’t cut the benchmark deposit rate. But there is a growing consensus that April and May CPI and PPI will likely fall further from March level. Goldman believes May CPI can be below 3.0% and PPI close to -5%. If so there will not only be a lower level of concerns about inflation, there will likely be rising concerns about deflation.

There are also more renewed concerns about the spread of virus in some areas following a mini outbreak in Jilin province. This has led to a lockdown in a low tier city—though this doesn’t have a significant economic impact, it does tend to make policy makers in other parts of the country more cautious when they need to decide on whether to relax virus control policies. It also can directly affect consumer behavior as they become more concerned.

In paring, Goldman states that its current forecast for TSF growth implies the ratio between TSF growth and nominal GDP growth will rise to around 3 this year, consistent with the view that “the demand stimulus the government needs to implement could be larger than in 2016, but smaller than the GFC.” This reflects the need to accommodate the ramping-up of infrastructure investment while mitigating the potential crowding-out of credit availability for private firms. The acceleration in local government bond issuance, along with a significant pickup in Rmb loans and corporate bond issuance…

… has driven a material pickup in TSF growth, with the TSF flow to GDP ratio up 14% in Q1. On the other hand, the report continued to emphasize consistency in housing policy and reiterated that policymakers should avoid using property as a short-term stimulus.

Tyler Durden

Mon, 05/11/2020 – 15:20

via ZeroHedge News https://ift.tt/2YODH6y Tyler Durden