I’ve been dreading this. In the midst of all the policy responses to the collapse of the mortgage finance Bubble, I recall writing something to the effect: “I understand we can’t allow the system to collapse, but please don’t inflate another Bubble.” It was obvious early on that policymakers had every intention to reflate Bubbles.

There was a failure to grasp the most critical lessons from that terrible boom and bust episode: Aggressive monetary stimulus foments market distortions, while promoting risk-taking, leveraged speculation and latent risk intermediation dysfunction. Years of deranged finance ensured unprecedented economic imbalances and deep structural impairment. There was no predicting a global pandemic. Yet today’s acute financial and economic fragility – and the risk of financial collapse – are directly traceable to years of negligent monetary management.

I have to adjust my message for this post-Bubble backdrop: I understand we can’t allow the system to collapse, but Please Don’t Completely Destroy the Soundness of Central Bank Credit and Government Debt. Does anyone realize what’s at stake?

I don’t see another Bubble on the horizon. Each reflationary Bubble must be greater in scope than the last. Mortgage finance was used for post-“tech” Bubble reflation. Policymakers unleashed the “global government finance Bubble” during post-mortgage finance Bubble reflation. Massive international inflation of central bank Credit and sovereign debt went to the heart of global finance – the very foundation of “money” and Credit.

There is no greater Bubble waiting in the wings to reflate the collapsing one. We are instead left with desperate measures to expand central bank “money” and government borrowings that will surely appear absolutely reckless in hindsight.

Let’s touch upon prospects for Bubble reflation. There was an abundance of positive spin coming out of the previous bust period. “If only the Fed hadn’t incompetently failed to bail out Lehman, crisis could have – should have – been avoided.” Reckless home lending caused the crisis, and regulators will never tolerate a replay. Prudent “macro-prudential” policies and an abundantly capitalized banking sector ensure stability. From the crisis experience, central bankers learned to move early and aggressively to nip market instability in the bud.

The previous crisis was labeled “the 100-year flood.” Onward and upward, with enlightened central banking both leading the way and ensuring a smooth ride.

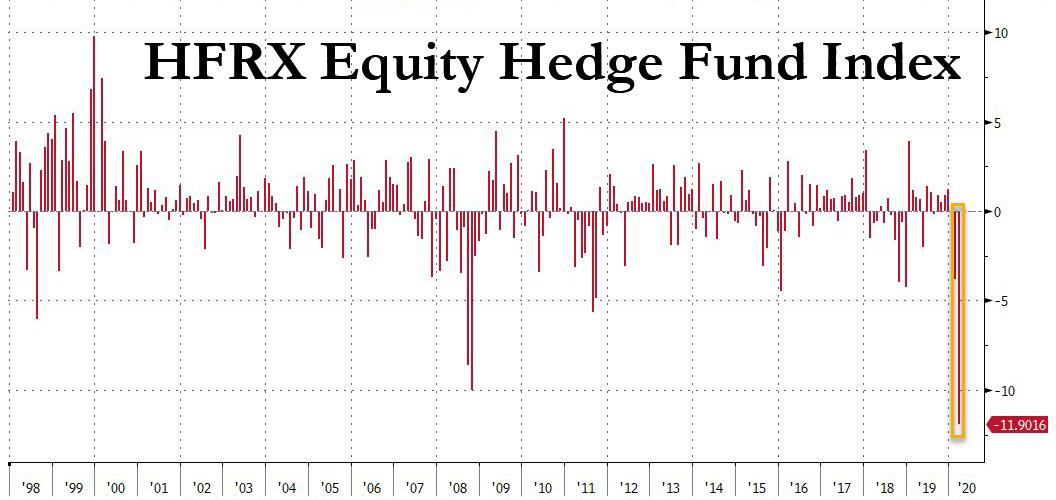

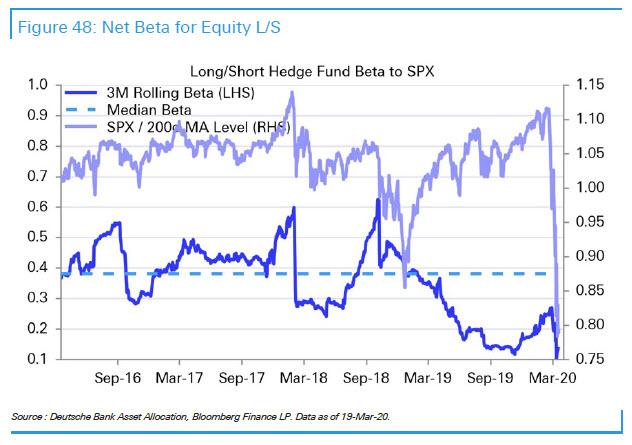

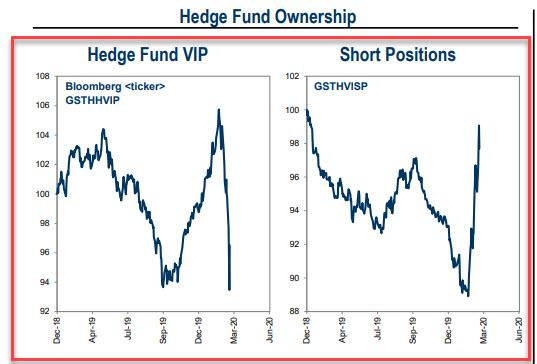

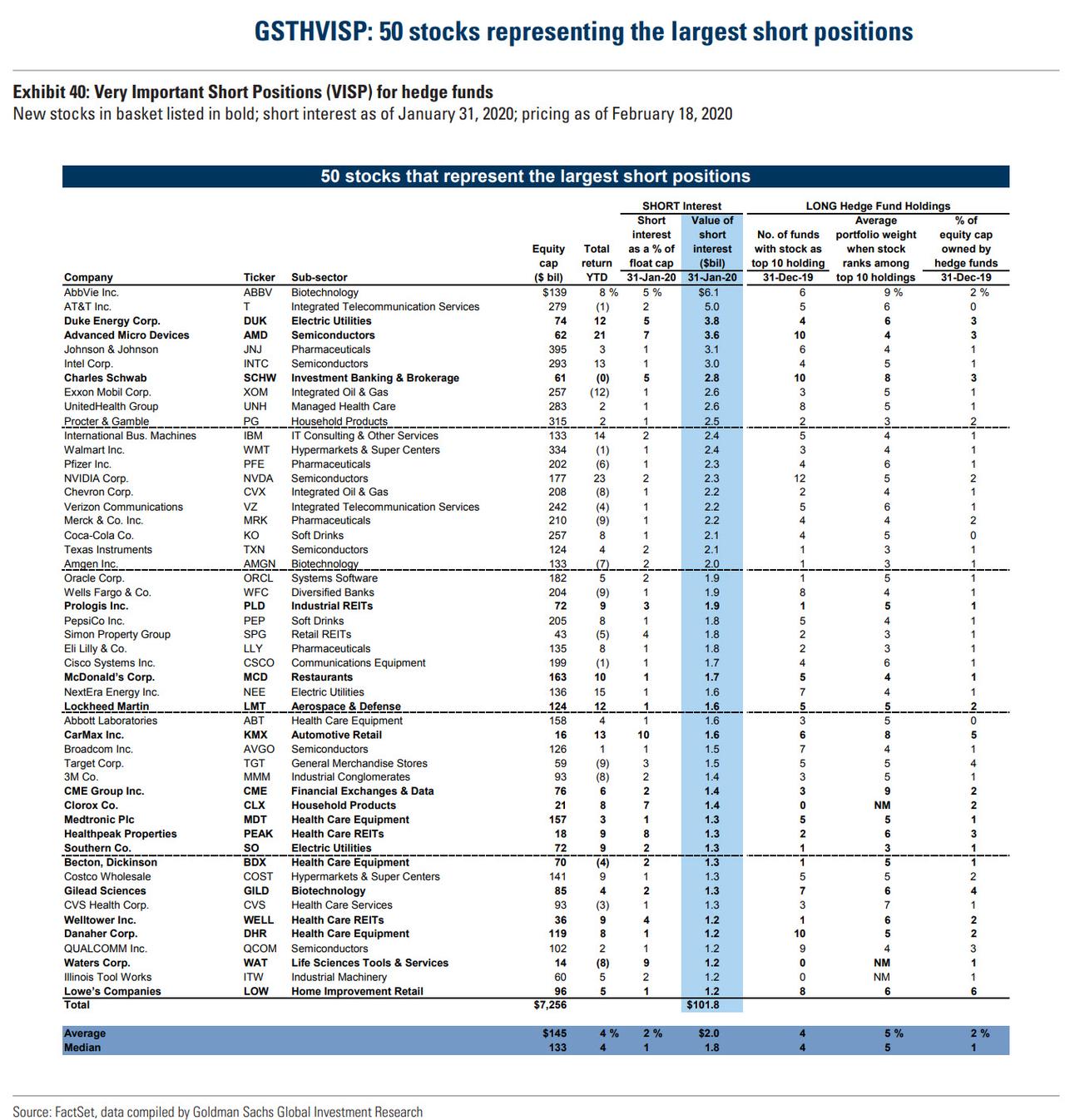

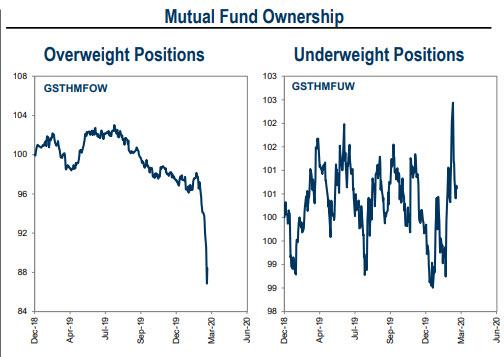

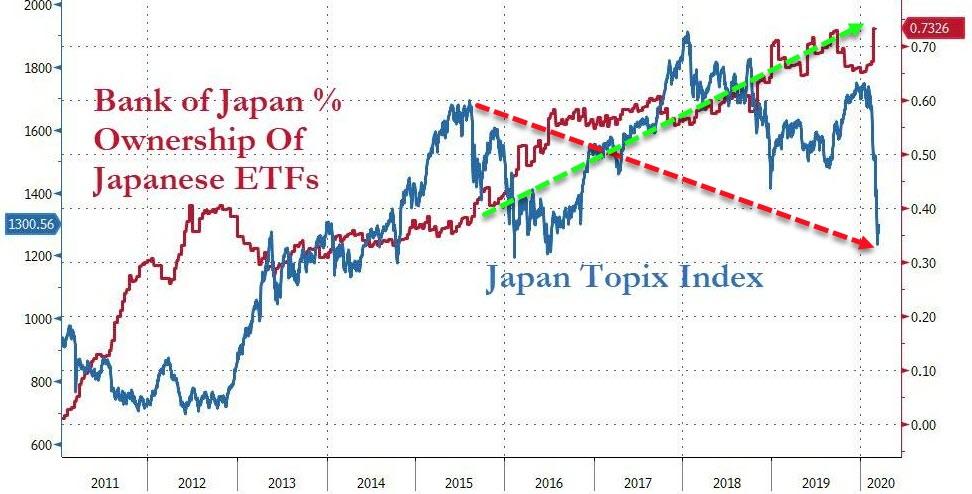

With assurances of central bank liquidity and market backstops, an unprecedented Bubble inflated throughout global leveraged speculation. Popular “carry trades,” foreign-exchange “swaps” and myriad derivatives (incorporating leverage) and such morphed during this cycle into a colossal self-reinforcing Credit Bubble. The resulting liquidity became a prominent fuel source for asset and economic Bubbles, reminiscent of the late-twenties.

Can’t a massive expansion of central bank Credit (securities purchases, lending facilities, swap lines, etc.) now reflate the Bubble? I seriously doubt it. Risks associated with various strategies have been revealed. Leverage in its many forms has been, once again, shown to be a serious problem. Rather than the proverbial “100-year flood,” for the second time in less than 12 years the world is facing the worst financial crisis since the Great Depression. Burn me once, shame on you. Fool me twice…

It’s not hyperbole today to use “depression” to describe the unfolding deep global economic downturn. Coronavirus uncertainty makes it impossible to forecast the length and severity of the economic collapse. In the best case, the rapidly expanding outbreak in Europe and the U.S. subsides over the coming weeks. Even so, economies around the world will take huge hits. And prospects for the coronavirus to reemerge next winter (and emerge more powerfully during the southern hemisphere’s approaching winter season) will keep risk-taking well-contained for many months to come.

Coming out of the previous crisis, the global economy had the benefit of a powerful “locomotive” of accelerating expansions in China and the emerging markets more generally. Importantly, post-Bubble reflationary measures came as these fledgling Bubbles were attaining powerful momentum. Beijing pushed through an unprecedented $600 billion stimulus package, while aggressive monetary policy stoked EM booms generally. Keep in mind that total Chinese banking system assets inflated from about $7 TN to $40 TN since the crisis.

Looking ahead, the global economy is without “locomotives.” It evolved into one massive global financial Bubble financing a precarious synchronized global economic expansion. And I believe speculative finance became a prevailing source of Global Bubble Finance.

Here’s where I could be wrong. I seriously doubt this Bubble is revivable. The unwind will likely unfold over weeks and months. Extraordinary central bank measures will spur rallies and hopes for recovery. At times, it will appear that liquidity is returning. Yet the Bubble will not be reflated.

Confidence has been shattered. Faith that central banks have everything well under control has been broken. Myriad fallacies have been exposed. Central banks can’t guarantee liquid markets, especially in a Bubble-induced highly levered speculative environment. The entire derivatives universe has been operating on the specious assumption of liquid and continuous markets. History is unambiguous: markets experience bouts of illiquidity, dislocation and panicked crashes. The fantasy that contemporary central bank monetary management abrogates illiquidity and market discontinuity risks is being debunked. The mania in finance has, finally, run its course.

Leverage has to come down – and I believe it will stay down for years to come. A month ago risk could be disregarded – had to be disregarded. Market, financial, economic, social and geopolitical risks matter tremendously now, and they will matter going forward. In the best-case scenario, the coronavirus peaks over the coming weeks. I don’t want to ponder the worst-case.If financial collapse can be avoided, an altered financial world awaits. The old scheme doesn’t work any longer. The era of cheap money financing massive stock buybacks has ended. Leveraged speculation creating self-reinforcing liquidity abundance and asset inflation – over. Buy and hold and disregard risk has been discredited. Blindly plowing savings to perceived safe and liquid ETFs is a thing of the past. In the new financial landscape, can derivatives be trusted? How about the private equity Bubble? The age of endless cheap finance for virtually any borrower or equity issuer (irrespective of cash flow or earnings) has reached its conclusion.

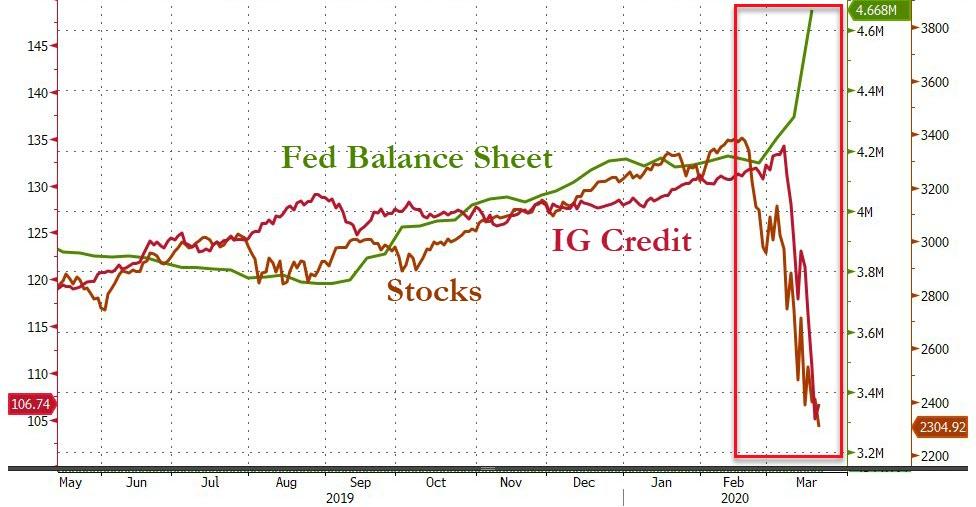

Meanwhile, “helicopter money” has arrived. Seemingly outrageous on Monday, Senator Schumer’s proposal for a $750 billion stimulus package was small potatoes compared to spending plans contemplated by week’s end. Federal Reserve Assets surged $356 billion the past week to a record $4.668 TN. Fed Assets were up $907 billion over the past 28 weeks, as it becomes clear a $10 TN balance sheet will unfold more quickly than I have anticipated.

The inexhaustible inflationists and eager MMT adherents see their opening. “Please Don’t Completely Destroy…” will haunt me – and the world. In a crisis, no one was willing to stand up to Bernanke. Today, “Helicopter Ben” looks fainthearted compared to what today’s central bankers are about to attempt. The experiment has gone terribly wrong, just as foolhardy bouts of inflationism have throughout history.

If they actually believe the massive inflation of central bank and government Credit will reflate markets and economies, they will be grievously disappointed. Government debt and central bank balance sheets have commenced what will be a frightening buildup. The inflationary consequences are today unclear. What is clear is it will be anything but confidence inspiring. The desperate inflation of perceive money-like Credit will not encourage the leverage speculating community to re-leverage. It will not entice burned investors back into perceived money-like ETFs. It will not stabilize currency markets. However, it does risk a bond market debacle.

History’s greatest Bubble is nearing the end of the line. It’s all left to central bank credit and sovereign debt – the massive inflation of Credit at the very foundation of global finance. This experimental strategy is so fraught with peril that it is difficult to believe that risk will be disregarded – that things can somehow stabilize and return to normal. Confidence in central banks’ capacity to control global markets has been irreversibly damaged – and a long overdue market reassessment of the value of financial instruments has commenced.