Joe Biden scored a much needed victory in Saturday’s South Carolina primary, giving his flagging presidential campaign a boost just days before Super Tuesday, when more than a dozen states will hold primaries or caucuses.

The former vice president’s victory in South Carolina also blunted the momentum of Sen. Bernie Sanders (I–Vt.), who had won each of the first three contests (or two, depending on how you count Iowa’s results) and who is favored to win many of the states voting on Tuesday.

Joe Biden wins South Carolina Democratic primary in his first victory of 2020 campaign. #SCPrimary #Election2020 https://t.co/x8MtepMsr7

— The Associated Press (@AP) March 1, 2020

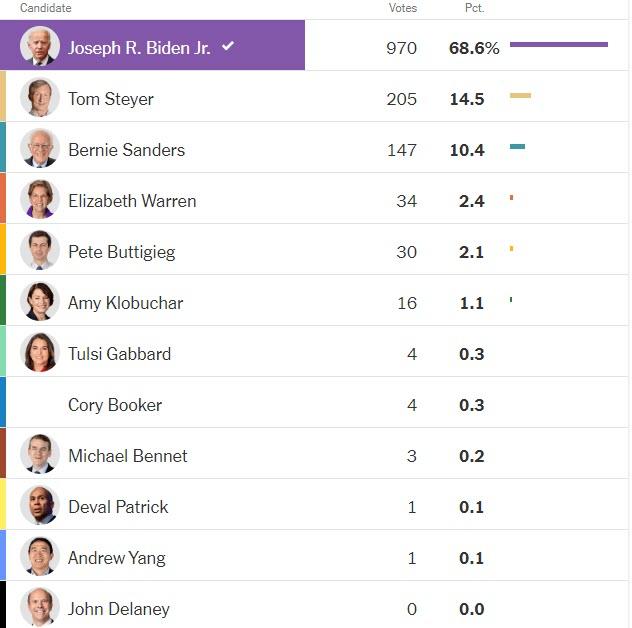

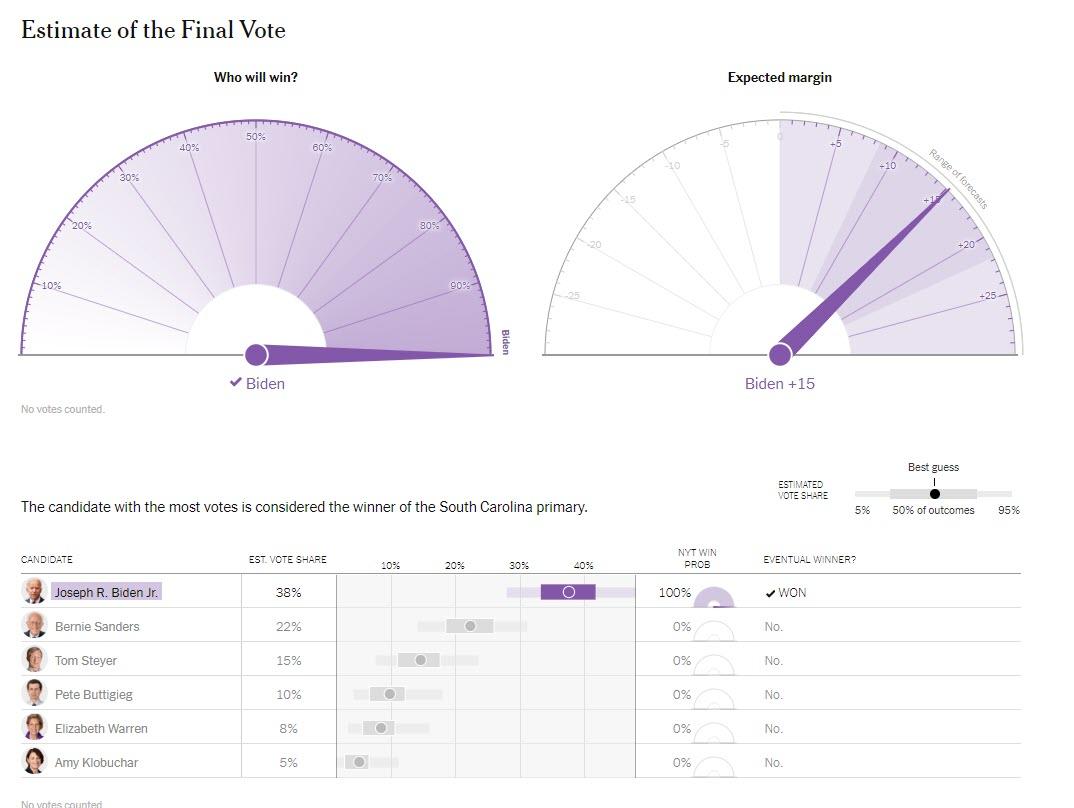

With 5 percent of precincts reporting at 8 p.m., Biden had more than 53 percent of the vote in South Carolina. Sanders was running second with 15.3 percent.

While Sanders seems poised to remain the Democratic frontrunner for the time being, the bigger question now is whether he can garner enough delegates to secure the party’s nomination without a convention floor fight. Biden’s win increases the chance of a brokered convention—something that the forecasters at FiveThirtyEight now say is the most likely outcome. To win the nomination outright, a candidate must secure at least 1,991 of the 3,979 pledged delegates that are up for grabs in state primaries and caucuses. Heading into South Carolina, Sanders had won 45 delegates while Biden had won just 15. (Former South Bend Mayor Pete Buttigieg was in second place with 26 delegates.)

It is not immediately clear how many of South Carolina’s 54 delegates will go to which candidate, since delegates are awarded based not just on the statewide results but also on results within each of the state’s seven congressional districts.

The 19 delegates connected to the statewide results are awarded proportionally to any candidate who gets at least 15 percent of the vote. Only Biden and Sanders (and possibly Tom Steyer) appear on track to score, with Biden getting the largest share. The same 15 percent threshold exists in each congressional district, making it possible that lower-polling candidates such as Buttigieg, Sen. Amy Klobuchar (D–Minn.), and Sen. Elizabeth Warren (D–Mass.) will be shut out entirely. Former New York City Mayor Michael Bloomberg was not on the ballot in South Carolina.

One thing to watch as the South Carolina results come in is Steyer’s results. If he can clear the 15 percent threshold—and polls suggest he has a decent chance to do so—it could provide a lifeline to his campaign. He’s not going to be the Democratic nominee, but failing to hit the 15 percent threshold in South Carolina would mean he might as well exit the race.

I swear to god this primary is trying to kill me pic.twitter.com/QWVfYNBl9I

— Meena Harris (@meenaharris) February 29, 2020

The number of delegates awarded in the first four contests will soon seem somewhat insignificant. Tuesday’s primaries and caucuses will award 1,357 delegates, with about a third of all the pledged delegates up for grabs.

So it’s possible that Biden’s South Carolina renaissance will quickly be overwhelmed by a wave of Sanders victories. It’s also possible that this will be the key turning point in the race, one that shows centrist Democrats—who have been casting about for a candidate capable of stopping Sanders—that Biden is their best bet. A quick consolidation of support away from non-Sanders candidates and toward Biden was evident in late-breaking polling of the South Carolina race. Now the question is whether that same phenomenon can be repeated nationally.

Anti-Bernie Democrats are probably right to worry about a general election between Donald Trump and a 78-year-old self-proclaimed socialist who honeymooned in the Soviet Union, praised some of Fidel Castro’s policies, and is promising an economic revolution at a time when unemployment is at a near-record low.

And it should go without saying that a Sanders-Trump general election is a no-win scenario for anyone who cares about reducing the size and scope of the federal government. It would be a choice between a socialist and a nationalist—both of whom admire freedom-crushing regimes around the world and oppose the free movement of goods and people.

As The New York Times reported this week, many so-called “superdelegates”—unpledged delegates at the convention, mostly Democratic Party officials—are opposed to nominating Sanders even if he arrives at the convention with a plurality of delegates.

After the 2016 election, the Democratic National Committee changed its rules to prevent superdelegates from voting on the convention’s first ballot—a change that was made, in large part, because Sanders and his supporters worried that superdelegates could block their candidate during the 2016 contest. The new rules effectively mean that any candidate who secures more than 50 percent of the pledged delegates awarded through the primary process would secure the nomination even if he or she were opposed by all superdelegates. The superdelegates will enter the picture only if no candidate secures an outright majority of the pledged delegates.

But now Sanders is making the argument that he should be the nominee even without a majority.

“Bernie wants to redefine the rules and just say he just needs a plurality,” Jay Jacobs, a superdelegate who chairs the New York Democratic Party, told the Times. “I don’t think the mainstream of the Democratic Party buys that. If he doesn’t have a majority, it stands to reason that he may not become the nominee.”

Would Democratic Party officials really deny Sanders the nomination if he arrives at the convention with the largest share of delegates but remains short of a majority? It’s impossible to know right now, though the answer likely depends on how large of a lead Sanders has and how close to the magic number of 1,991 he is. Chaos is guarenteed either way, but if another candidate can keep the race close, the superdelegates will have a better argument for swinging the convention away from Sanders.

The South Carolina results make it more likely that the superdelegates will enter the picture this summer in Milwaukee. In that regard, Biden’s win may prove—in the long run—to be less significant than Sanders’ loss.

from Latest – Reason.com https://ift.tt/3cjxBzl

via IFTTT