Futures Tread Water As Traders Brace For More Bad News

After tumbling on Wednesday in the aftermath of the shockingly low ISM print, world stocks hovered near four-week lows on Thursday and yields on major benchmark bonds slipped further after Trump imposed $7.5 billion in new tariffs on European goods, stoking fears about global growth and dousing risk appetite.

US equity futures staged a feeble rebound on Thursday after tumbling almost 1.5% on Wednesday, their biggest drop in almost 6 weeks, and European markets drifted as investors looked ahead to key economic data which could confirm that the US economy is headed for a recession.

As DB’s Jim Reid notes, over the next few days markets have several key data points to help assess whether a global manufacturing recession is spreading into the wider economy. Before tomorrow’s much anticipated September US employment report, today we’ve got a very important ISM US non-manufacturing report to dissect. In terms of expectations, for the ISM the consensus is sitting at a still comforting 55.2 following a 56.4 print in August, however focus is on the employment component. As a reminder last month this fell to 53.1 and to the lowest since March 2017. This has historically been a leading indicator of the overall trend in service-sector job growth. So, further deterioration would send a more concerning signal to monetary policymakers about the labor market outlook.

“Risk aversion is broadly on the rise and that has been triggered by the weakness in U.S. manufacturing ISM data earlier this week,” said Manuel Oliveri, an FX strategist at Credit Agricole in London. “The outperformance of the U.S. economy compared to other major economies has held the dollar and other risky assets up but that has changed this week.”

The MSCI index of world stocks slipped 0.1%, with Asian shares plunging as Japan’s Nikkei stock index closed down 2%, its biggest one-day decline since Aug. 26; China remains closed for its Golden Week holiday. Hong Kong stocks advanced on reports the city would invoke emergency powers to ban face masks at public gatherings; this sparked some hope the city’s crushing protest siege may soon end.

Later in the session, European stocks eked out small gains after suffering their worst day since last December on Wednesday, when the US announced it would impose tariffs on $7.5 billion of European goods. On Wednesday, Washington said it will enact 10% tariffs on Airbus PA) planes and 25% duties on French wine, Scotch and Irish whiskies and cheese from across the continent as punishment for illegal EU subsidies to Airbus.

As if that wasn’t enough, the final Markit services data confirmed that the euro-area manufacturing malaise is spreading to the services sector. A Purchasing Managers’ Index for the 19-nation region slid to 50.1 in September, the lowest level in more than six years and just above the 50 mark that distinguishes between gains and declines in total output; this was pressured by a lower final services reading, which dropped to 51.6, down from the 52.0 flash print, when expectations had been for a print of 53.3. Until now, the services series has held up much better than manufacturing, and indeed the recent gap between the two is the widest since 2009. That said, the fall in the flash print to its lowest level since January has heightened concerns that services will resolve lower to catch down to manufacturing.

Despite the ongoing barrage of bad news, European stocks managed to bounce because investors saw the US tariff product list as smaller than initially proposed, which helped prop up some sectors with the regional STOXX 600 index up 0.2%, torn between falls in financials and gains in luxury goods stocks. France’s CAC index rose 0.7% while Britain’s FTSE 100 fell 0.5%. German bourses – a weather vane for exports – were closed for a national holiday.

The latest U.S.-European trade tensions added to fears over the standoff between Washington and Beijing, which has cast a shadow over global growth prospects. Earlier in the week, disappointing data on U.S. manufacturing and the jobs market suggested the trade war with China had damaged the world’s largest economy.

“The big question for a lot of folks is whether this is the third slowdown since the financial crisis or are we now heading for a global recession,” said Anujeet Sareen, a fixed income portfolio manager and global macro strategist for Brandywine Global. “The wild card in the pack is always Donald Trump and whatever he tweets next.”

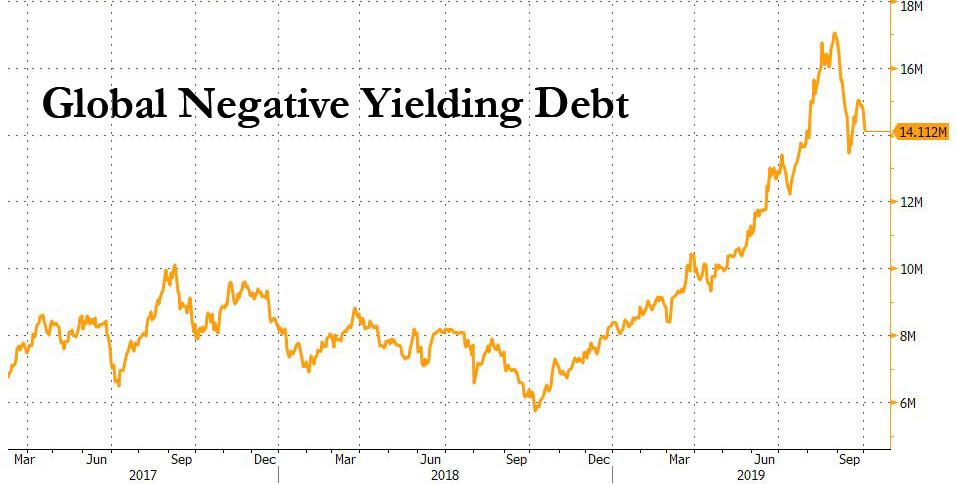

The latest flight to safety saw yields on two-year U.S. Treasury yields slip to 1.4680%, nearing a two-year low of 1.4280% as odds for more rate cuts jumped; ten-year Treasury yields dipped to their lowest in more than three weeks, trading at 1.5650% this morning. Adding to pressure on yields was a weak ADP Private Payrolls report, boosting expectations the Federal Reserve will cut interest rates this month. Traders now see a 72.8% chance the Fed will cut rates by 25 basis points to 1.75%-2.00% in October, up from 39.6% on Monday, according to CME’s FedWatch tool. Rate cut odds will spike even more if Friday’s non-farm payrolls report shows continued weakness in the labor market.

“The employment number is going to be a very important metric for the Fed,” Subadra Rajappa, head of U.S. rates strategy at Societe Generale SA, told Bloomberg TV. Rajappa said it’s the most important data point heading into the Fed’s October meeting. “If you get a weak number you’re going to get more of a bull steepening — the market starting to price in more rate cuts.”

Meanwhile, government bond yields in safe-haven Germany fell for the first time in over a week, following the recent Draghi scare that Germany will be forced to issue much more debt to boost the flagging European economy.

In geopolitical news, North Korea said it successfully test-fired new Submarine-Launched Ballistic Missile (SLNM), the tests were to contain outside forces’ threats, tests had no adverse impact on security of neighbouring counties. (Yonhap/KCNA) US and North Korea will begin working level talks on October 4th in Sweden, according to sources cited by CNN International Correspondent Will Ripley. Elsewhere, Hong Kong police have reportedly relaxed guidelines regarding the use of force in protests., according to documents.

In FX, the dollar dipped to one-week lows against the euro and yen, while the Bloomberg dollar index dropped to session lows at 1215. The greenback crossed 107 Japanese yen and touched a week low of 106.95 yen before recovering some ground. It fell to $1.0973 per euro. Meanwhile, sterling was modestly higher at $1.2320 as investors waited for a European Union response to Britain’s latest Brexit offer, which Prime Minister Boris Johnson offered on Wednesday. So far, his last-ditch Brexit proposal has received a cool reception. One senior EU official said it “can’t fly” because it was an unworkable move backwards that left Britain and the EU far apart.

In commodities, Brent was flat at $57.84 per barrel. Energy traders are worried about a slowing global economy, an over-supplied market and geopolitical friction in the Middle East.

Economic data include Markit services PMI, durable goods orders, jobless claims. PepsiCo, Costco are due to report earnings

Market Snapshot

- S&P 500 futures up 0.4% to 2,893.25

- STOXX Europe 600 up 0.2% to 378.26

- MXAP down 0.8% to 154.89

- MXAPJ down 0.4% to 495.92

- Nikkei down 2% to 21,341.74

- Topix down 1.7% to 1,568.87

- Hang Seng Index up 0.3% to 26,110.31

- Shanghai Composite down 0.9% to 2,905.19

- Sensex down 0.5% to 38,125.46

- Australia S&P/ASX 200 down 2.2% to 6,492.99

- Kospi down 2% to 2,031.91

- German 10Y yield fell 3.0 bps to -0.576%

- Euro down 0.02% to $1.0957

- Brent Futures up 0.02% to $57.70/bbl

- Italian 10Y yield rose 4.3 bps to 0.561%

- Spanish 10Y yield fell 2.8 bps to 0.141%

- Brent Futures unchanged at $57.69/bbl

- Gold spot down 0.03% to $1,498.95

- U.S. Dollar Index up 0.05% to 99.07

Top Overnight News from Bloomberg

- The euro-area economy stagnated at the end of the third quarter as factories suffered from falling global demand. A Purchasing Managers’ Index for the 19-nation region slid to 50.1 in September, the lowest level in more than six years and just above the 50 mark that distinguishes between gains and declines in total output

- The U.K.’s services industry unexpectedly contracted last month as the nation’s dominant sector became the latest victim of escalating uncertainty over the EU divorce

- Johnson’s new Brexit plan will face the scrutiny of two critical groups of skeptics on Thursday, one in the U.K. Parliament and another at the European Commission. While the British prime minister is optimistic, in Brussels officials said Johnson’s proposals are still unacceptable and there’s little chance of a deal by Oct. 31 unless the U.K. makes significant additional concessions

- The price of Scotch, French wine, cheese and other European exports is about to go up in the U.S. after the Trump administration announced new tariffs on billions of dollars of EU products starting Oct. 18

- Democrats have set a blistering pace for their impeachment inquiry of Donald Trump with a lineup of depositions — including the recently departed U.S. envoy to Ukraine — stoking the president’s fury and feeding efforts to discredit the investigation

- Hong Kong will use an emergency ordinance for the first time in more than a half a century in order to ban face masks at public gatherings, according to local media outlets including the South China Morning Post and news channel TVB

Asian equities largely tracked losses seen on Wall Street which saw the DJIA fall below its 100 DMA (~26400) and briefly dip below the 26k level as the trade landscape took a turn for the worse with the US set to impose tariffs on EU goods on October 18th. ASX 200 (-2.2%) was led lower by heavyweight financials and miners whilst the Nikkei 225 (-2.0%) was pressured by a firmer domestic currency. Meanwhile, upside in the Hang Seng (+0.3%) was hindered by losses in oil giant CNOOC following a downgrade at Daiwa Securities, whilst HSBC and other financials rested near the bottom of the index amid lower yields and against the backdrop of ongoing protests, as demonstrators staged overnight vandalism and targeted Mainland China-linked businesses, and with reports of Hong Kong studying methods to contain the protest violence. Elsewhere, Mainland China and South Korean markets are closed today due to public holidays. Hong Kong is reportedly studying a curfew to contain protest violence, according to local press. HK Chief Executive may use a ban to direct each person to remain in the specified area for the period specified in the order, until the Chief Executive revokes the curfew. The article also stated that anyone who breaks the curfew is guilty of offence and is liable on conviction to imprisonment for two years. A person such as a police or other disciplined force is not subject to a ban on duty or on his way to and from duty, the article said. Other reports stated that the government has also considered a law banning the wearing of face masks

Top Asian News

- Jokowi Promises New Labor, Investment Rules Will Be Reality

- Yes Bank CEO Sees Fundraising Done ‘Sooner Than Market Expects’

- Record Gold Prices Keep India’s Imports at Lowest in Three Years

- Pakistan’s Army Chief Holds Private Meetings to Shore Up Economy

Major European Bourses are mostly higher in lighter trade with the German bourses shut for a national holiday. Markets appear to have stabilised in wake of yesterday/last night’s steep declines seen across global equity markets, ahead of further crucial macro-economic data in the form of US ISM non-manufacturing today, and NFP tomorrow. After the WTO ruled yesterday that the US could hit the EU with tariffs on USD 7.5bln worth of imports, a retaliation for the bloc’s illegal subsidising of Airbus, the USTR office unveiled the details of the tariffs; EU aircraft will be hit with 10% tariffs, while other agriculture and industrial goods (including on Whisky, Wine and Cheese) will be hit with 25% tariffs, with the tariffs to take effect on October 18th. Europe will retaliate, when the WTO rules on its complaints over US subsidies for Boeing, although any decision is unlikely until the end of the year. European stocks feared to have been worst affected by possible US tariffs cheered the announcement, implying a softer response by the US than some had feared; aircraft maker Airbus (+3.5%), luxury goods makers LVMH (+1.8%) and Kering (+1.1%) and beverage makers Pernod Ricard (+3.2%) and Diageo (+1.5%) all outperform. The sectors paint a mixed picture; Industrials (+0.1%) and the consumer sectors are firmer, reflecting strength in the above-mentioned names. Energy (-0.4%) continued to underperform, amid a catch up to recent declines in oil prices and with the overhang of yesterday’s decision by Norway’s Wealth Fund to sell oil & gas stocks worth approx. USD 5.9bln still weighing. Other notable individual movers include; Ted Baker (-35.7%) sunk after the co. posted disappointing earnings and warned of very difficult trading conditions and that full-year results could fall short. Sika (+3.2%) caught a bid on the news that the Co. had announced a new strategy, where it increased its long-term EBIT margin target to 15-18% from the prior 14-18%. Finally, Ingenico Group (+2.7%) saw strength after Berenberg initiated the co. with a buy.

Top European News

- Polish Banks Risk Setback on FX Loan Terms After EU Court Ruling

- Seadrill Lenders Look for Exits Amid Elusive Rig Market Recovery

- U.K. Services Unexpectedly Shrink Under Weight of Brexit Fears

- Rehn Sees Limits of ECB’s Capacity to Boost Economic Growth

In FX, not to be outdone by the All Blacks, the Kiwi is outscoring rivals in the major currency stakes with Nzd/Usd extending its rebound to within a whisker of 0.6300 and Aud/Nzd down through 1.0700 as the Aussie continues to labour on the 0.6700 handle vs its US counterpart in wake of the latest RBA rate cut and reaffirmation of easing guidance.

- GBP – The Pound is holding up relatively well given another sub-50 UK PMI reading, and this time from the key services sector. The composite index has followed suite and IHS/Markit is now predicting a 0.1% q/q GDP dip for Q3 that would be enough to tip the economy into a technical recession. However, Sterling is resisting downside pressure and potential dovish BoE implications ahead of a speech by Tenreyro, as Cable keeps tabs with 1.2300 and Eur/Gbp pivots 0.8900 amidst mixed EU assessments on the latest Brexit proposals from PM Johnson. The rationale appears to be that while there is no sign that differences over the Irish backstop have been bridged, there maybe scope for further negotiation and/or sufficient grounds to warrant another Article 50 extension even if Boris is adamant about leaving at the end of this month, deal or no deal.

- CHF/CAD/SEK – The G10 laggards, with the Franc succumbing to additional negative vibes following the ECJ ruling on Polish Chf denominated mortgages, but off par-plus lows vs the Dollar that is still feeling the adverse effects of Tuesday’s downbeat US non-manufacturing PMI (DXY straddling 99.000 ahead of today’s services PMI, ISM and raft of data). Elsewhere, the Loonie has retreated further amidst ongoing weakness in crude prices, with Usd/Cad finally breaching 1.3300 and the 200 DMA (1.3295) before absorbing offers at 1.3310 on the way towards 1.3340, while Eur/NOK scales 10.0000. Nevertheless, the Norwegian Crown is faring better than its Scandinavian neighbour after Sweden’s services PMI tracked the manufacturing index into contractionary territory and propelled Eur/Sek up to almost 10.8500 and ytd peaks only a few pips above.

- EUR/JPY – The single currency has also displayed resilience in the face of mostly disappointing Eurozone services PMIs and more evidence of deflation via PPI data, although again partly if not largely at the behest or bequest of the Buck, as Eur/Usd trades on the 1.0950 axis and eyeing decent option expiries at 1.0970 (1.2 bn) and 1.1000 (1.7 bn). Similarly, the Yen is confined between 107.30-106.98 parameters, albeit the headline pair in a lower band with expiry interest layered from 107.00-05 (1.2 bn) through 107.50-60 (1 bn) to 107.65-75 (1.2 bn). Note also, a big expiry in Eur/Jpy resides at the 117.00 strike (1.5 bn) and the cross is currently at the lower end of a 117.64-26 range.

- EM – Usd/Try remains in retracement mode after upside resistance was respected/rejected yesterday, but off lows in wake of Turkish CPI that missed already very soft expectations and could force the CBRT to ease further, or at least up Government pressure on the CB to cut rates again.

In commodities, following yesterday’s steep declines, a result of a global sell off in risk assets and bearish EIA data, crude markets firmly in negative territory, albeit off yesterday’s. WTI Nov’ 19 and Brent Nov’ 19 futures for now appear bound within USD 52.20/bbl – USD 52.90/bbl and USD 57.20/bbl – USD 57.90/bbl parameters respectively. Comments/updates from energy ministers did little to move the dial for the complex; the Saudi Energy Minister Abdilaziz said the country has capacity back at 11.3mln BPD, although production has stabilised at 9.9mln BDP (in line with OPEC+ production cut commitments), while Venezuela’s Energy Minister said production is currently below 1mln bpd. Russian Energy Minister Novak, speaking about global demand, said 2019 global oil demand is to grow by 1.0-1.1mln BPD and oil demand growth is to recover in 2020 following a weak 2019. He added that there is no need for an extraordinary OPEC+ meeting at the present. With Saudi production now back at pre-attack levels, and geopolitical risk premia appearing to recede, the focus of crude markets appears to have returned to the global economy; as such, todays US ISM non-manufacturing and tomorrow’s NFP are likely to be pivotal determinants of near-term direction. Following yesterday’s bid that took the precious metal back above the USD 1500/oz mark, Gold prices appear to have stabilised, awaiting further impetus in the form of the important aforementioned economic data releases over the next two days. Copper, meanwhile, slid towards yesterday’s lows around the USD 2.550/lbs mark, as a boost to the red metal from a softer buck faded.

US Event Calendar

- 8:30am: Continuing Claims, est. 1.65m, prior 1.65m

- 8:30am: Initial Jobless Claims, est. 215,000, prior 213,000

- 9:45am: Bloomberg Consumer Comfort, prior 61.7

- 9:45am: Markit US Services PMI, est. 50.9, prior 50.9; Markit US Composite PMI, prior 51

- 10am: Cap Goods Ship Nondef Ex Air, prior 0.4%

- 10am: Factory Orders, est. -0.2%, prior 1.4%; Factory Orders Ex Trans, prior 0.3%

- 10am: Durable Goods Orders, prior 0.2%; Durables Ex Transportation, prior 0.5%

- 10am: Cap Goods Orders Nondef Ex Air, prior -0.2%

- 10am: ISM Non-Manufacturing Index, est. 55, prior 56.4

Fed Speakers

- 8:30am: Fed’s Quarles Speaks at Banking Conference in Brussels

- 12:10pm: Fed’s Mester takes Part in a Panel Discussion on Inflation

- 1pm: Fed’s Kaplan Speaks at Community Forum in Houston

- 6:35pm: Fed’s Clarida Discusses Economy, Monetary Policy in New York

DB’s Jim Reid Concludes the overnight wrap

Markets have spent another 24 hours dealing with the reverberations from Tuesday’s shocking ISM manufacturing print. We showed yesterday that on this and the other global PMIs, equities look overvalued at the moment. Over the next couple of days markets have several key data points to help assess whether a global manufacturing recession is spreading into the wider economy. Before tomorrow’s much anticipated September US employment report, today we’ve got a very important ISM US non-manufacturing report to dissect as well as the final services PMIs in Europe.

In terms of expectations, for the ISM the consensus is sitting at a still comforting 55.2 following a 56.4 print in August however our US economists are more bearish at 54.1. That being said, they’re most interested in the employment component. As a reminder last month this fell to 53.1 and to the lowest since March 2017. Our colleagues note that while this series does not tell us much about the monthly changes in employment, it has historically been a leading indicator of the overall trend in service-sector job growth. So, further deterioration would send a more concerning signal to monetary policymakers about the labour market outlook. In terms of Europe, remember that the flash services reading 10 days ago saw a surprise and worrying fall to 52.0, when expectations had been for a print of 53.3. The services series has held up much better than manufacturing, and indeed the recent gap between the two is the widest since 2009. That said, the fall in the flash print to its lowest level since January has heightened concerns that services will resolve lower to catch down to manufacturing. For today’s print, consensus expectations are for no changes from the flash print.

Ahead of the bumper data barrage it’s fair to say that October hasn’t been too kind for markets so far with the S&P 500 (-1.78%) and NASDAQ (-1.56%) enduring another painful day yesterday. Auto names (-3.55%) struggled following the latest vehicle sales numbers and a -2.21% drop for oil hurt the energy sector (-2.61%), after inventory data showed another surprising build in US stockpiles. A very slightly below-market ADP print (135k vs. 140k expected but with -38k of revisions) didn’t help either. Despite a modest rebound in the late afternoon to close above their lows, the three major US indexes, the S&P 500, NASDAQ, and DOW all had their worst day since August. The moves were even worse in Europe where the STOXX 600 closed down -2.70% – the worst day since last December and that now means the two-day decline for the index is -3.98%. The moves also followed the WTO Airbus ruling going in favour of the US, albeit an outcome that was expected. That said, the US did move swiftly toward retaliatory tariffs, which the White House will reportedly announce today. The measures are said to include 10% duties on aircraft and 25% on agriculture and other products, covering $7.5 billion of imports from Europe and will go into effect on October 18. Unlike other tariffs instituted by President Trump, these measures are sanctioned by the WTO in response to excessive subsidies to Airbus. The question now though is what the EU does in response. Further, in an overnight statement Airbus CEO Guillaume Faury said that the levies will “have a negative impact on not only U.S. airlines but also U.S. jobs, suppliers and air travelers,” adding that they’ll bring “insecurity and disruption” to the wider aerospace industry.

Meanwhile the VIX jumped above 21 for the first time in over a month while credit markets were also weaker with US HY spreads +14.2bps wider. Treasuries continued their post ISM rally with 2y and 10y yields down -6.8bps (down a further -1bps this morning) and -4.3bps (down a further -1.4bps) yesterday which means the 2s10s curve is back above 10bps for the first time since 7 August. Some good news, but the flattening damage may well have been done several months and quarters ago given the usual lag. Other safe havens that saw a bid yesterday were Gold (+1.43%) which is pushing above $1,500/oz again and safe haven currencies like the Yen (+0.56%).

This morning in Asia markets are following Wall Street’s lead with the Nikkei (-2.03%), Hang Seng (-0.48%) and ASX (-2.16%) all heading lower. Markets in China and South Korea are closed for holidays. Yields on 10yr JGBs are down -1.9bps this morning to -0.191%. Elsewhere, futures on the S&P 500 are up +0.23%.

As for overnight data releases, Japan’s final September services and composite PMIs came out in line with the initial read at 52.8 and 51.5 respectively.

The UK government formally published their proposals yesterday to replace the Irish backstop provision in the Withdrawal Agreement, which has proven the most contentious part of the Brexit deal reached under former Prime Minister May. Under the new proposals there would be a single regulatory zone covering both Northern Ireland and the Republic of Ireland for goods, aligning Northern Irish regulations for goods with those of the EU. However, the single regulatory zone would rest on the consent of the Northern Ireland Assembly and Executive, both before the end of the transition period and “every four years afterwards.” The other proposal of interest is that Northern Ireland would remain part of the UK’s customs territory, rather than the EU one. In order to avoid customs checks at the border, the letter proposed that customs processes “should take place on a decentralised basis, with paperwork conducted electronically as goods move between the two countries, and with the very small number of physical checks needed conducted at traders’ premises or other points on the supply chain.”

In his conference speech earlier in the day, Prime Minister Johnson described the proposals as “constructive and reasonable”, but also said in reference to a no-deal Brexit that “it is an outcome for which we are ready”. In a promising sign if a deal is to be passed through Parliament, the Conservatives’ allies from the DUP in Northern Ireland voiced support for the proposals. However their votes will count for nothing unless the EU are actually willing to agree a deal along these lines with the UK. Remember there are just 4 weeks remaining until the current Brexit deadline on October 31. But the passage of the Benn Act complicates matters, as MPs have legislated that if Johnson hasn’t got a deal agreed by the 19 October, he has to ask for a 3-month extension to the Article 50 process.

The initial responses from the European side has been mixed. Top EU negotiator Michel Barnier said that “there is progress” being made, but “lots of work still needs to be done,” while Commission President Juncker welcomed the “positive advances” but he maintained that there are still issues over the proposed customs arrangements. Juncker emphasized that he will “listen carefully” to Irish Prime Minister Varadkar’s opinions. For his part, Varadkar said that customs checks between Ireland and Northern Ireland would show “bad faith” compared to prior commitments. Elsewhere, the European Parliament’s Brexit coordinator Guy Verhofstadt said late yesterday that the initial reaction to the UK proposals is ‘not positive’. It’s supportive that the EU haven’t rejected the plans out of hand, but it still feels hard to see how the EU can support them. The best case scenario is surely that it’s the basis for more negotiations and that the stars can somehow be aligned in more intense negotiations. A long shot still. Meanwhile, the Times of London reported overnight that the EU is ready to grant another Brexit extension beyond October 31 even if PM Boris Johnson doesn’t sign the letter making the request. As for the market impact, the pound initially weakened -0.61% but ultimately retraced this to close flat after the proposals were not completely dismissed by the Europeans. The FTSE (-3.23%) actually had its worst day since 20 January 2016 as it slightly underperformed it’s peers as a no-deal Brexit probability seemed to increase slightly.

Over in the US, Senator Bernie Sanders halted his presidential campaign events after he was hospitalised with a heart issue. His campaign said that he had two stents inserted into a clogged artery and will be recovering for at least the next few days. At the margin, the news could benefit other candidates’ campaigns, perhaps especially that of Senator Elizabeth Warren. The betting market-implied odds that Warren wins the Democratic nomination rose 7 percentage points yesterday to 52%.

The most notable Fedspeak came from NY Fed President Williams, who struck a surprisingly noncommittal tone. He said the employment situation is strong, but global growth is lagging and trade uncertainties linger. It’s likely that he wants to wait for tomorrow’s payrolls report before firmly committing to a rate cut, or to a hold, for this month’s meeting. He was also asked about disruptions in repo markets, and only responded by talking about what has recently happened, with little in the way of forward-looking comments. At the margin, this lowers the odds that the Fed will announce a resumption of balance sheet growth at this month’s meeting.

To the day ahead now, which for data this morning includes the final September services and composite PMIs in Europe along with August PPI for the Euro Area. This afternoon in the US all eyes will be on the aforementioned September ISM non-manufacturing, while other data due out includes final August factory, durable and capital goods orders, along with the latest jobless claims reading. Away from the data the next line of Fed officials due to speak include Evans this morning and then Quarles, Mester, Kaplan and Clarida this afternoon. Over at the ECB we’re also due to hear from Guindos, Rehn and Holzmann while the BoE’s Tenreyro speaks this afternoon.

Tyler Durden

Thu, 10/03/2019 – 07:56

via ZeroHedge News https://ift.tt/2oIG62L Tyler Durden