Authored by Mark Orsley of PrismFP.com

Back after some time on the beach and while the data deterioration/stagflation theme was neither solidified nor nullified while I was gone, there were two major events that transpired:

- Powell’s Jackson Hole folly

- Further escalation in China/US trade wars

Regarding #1, Powell gave the nod to significant geopolitical risks abroad but his error came in continuing his intellectually dishonest comments about the “strength” of the US economy. His entire thesis hinges on:

- A strong labor market – Yes, the Unemployment Rate remains at historic lows (lagging indicator) but job growth has undeniably already slowed. Note the NFP chart does not include the enormous 500k of downward revisions that are coming soon…

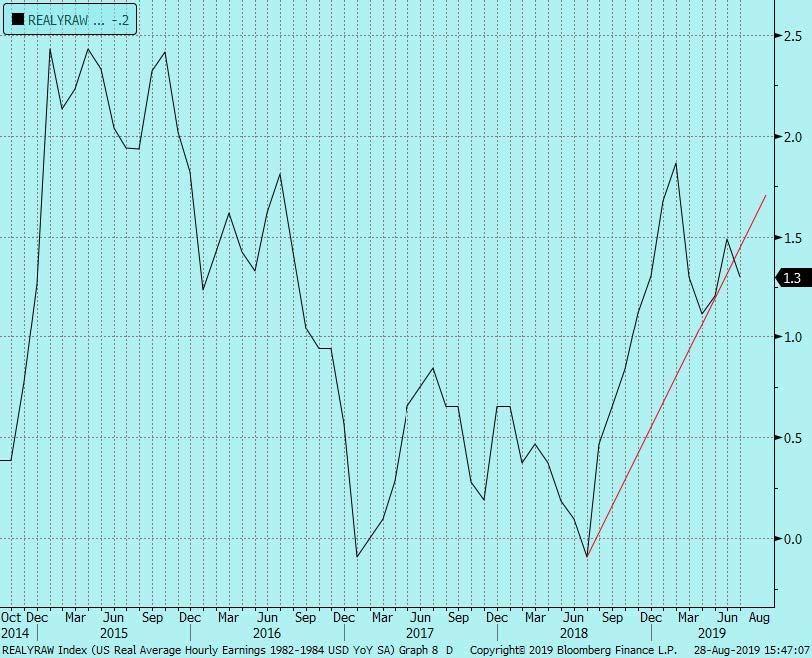

- Rising wages – certainly not a disaster but the uptrend has been broken…

In effect, Powell double downed on his “mid-cycle adjustment” rhetoric which as I showed on August 13th is economically inaccurate. All indicators point to the US being in late cycle with early warning signals of recession. The market verified this error by further inverting 3m10y another 12bps since Jackson Hole.

All told, since Powell’s now infamous “mid-cycle adjustment” misstep on July FOMC day, he has flattened 3m10y by 45bps which is only working to exasperate recession fears. As most of us know, recessions can become self-fulfilling prophecies and the Fed does not seem to get this yet.

Until Powell cleans up that mid-cycle language or the data worsens enough where the market will assume Powell will clean up the language imminently; curves will continue to invert.

* * *

Powell’s folly then forced a frustrated Trump to further increase tariffs (with some China retaliation). In effect, POTUS is working to slow the economy to force the Fed to cut but at the same time tweeting positive headlines to keep equity markets up.

We will see if the increase goes into effect this weekend but ignore the smoke and mirror “things have never been better” tweets that are designed to prop up the equity market. Instead focus on this analysis from Axios that was not picked up by financial media:

“U.S. intelligence officials are worried about Hong Kong further deteriorating, and about the risk of the Chinese military overreaching in Hong Kong — and perhaps even in Taiwan.

Lots of members of Congress care about the U.S. protecting Taiwan from Chinese aggression, and Trump has enraged Beijing by increasing military sales to the Taiwanese from the Obama era.

And national security adviser John Bolton is a strong advocate for Taiwan.

Trump had been resisting chastising Chinese President Xi Jinping over his human rights abuses and his treatment of Hong Kong protesters. But he’s inched further toward criticizing the Chinese than he normally would in recent days.

Trump even hinted the Chinese wouldn’t get their trade deal unless they peacefully resolved the situation in Hong Kong — a move that pleasantly surprised China hawks.

When Secretary of State Mike Pompeo and Defense Secretary Mark Esper visited Australia earlier this month, they delivered an unequivocal message to senior Australian officials: The U.S. plans to forcefully push back against China’s destabilizing behavior in the Asia-Pacific.

Some left those meetings with the impression that the U.S. was serious about confronting China militarily.”

That all means the likelihood of a trade deal with China in the next, let’s say, 6 months is highly improbable. Trade wars were hard enough to settle with issues like IP and enforcement, but now national security and sovereignty issues have also been twisted into the negotiations.

It will be interesting to see what transpires in Hong Kong this weekend with a major protest planned at the same time China has increased its military presence in the area. Hong Kong has already arrested a few protest leaders in front of the weekend protests.

* * *

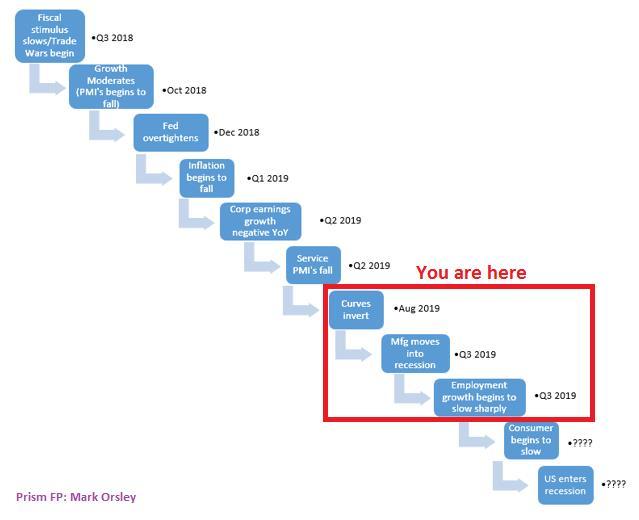

Therefore, the roadmap that has been in place for the US economy for the last year is almost certainly going to continue. That means a recessionary or stagflationary state.

The anatomy of a US slowdown…

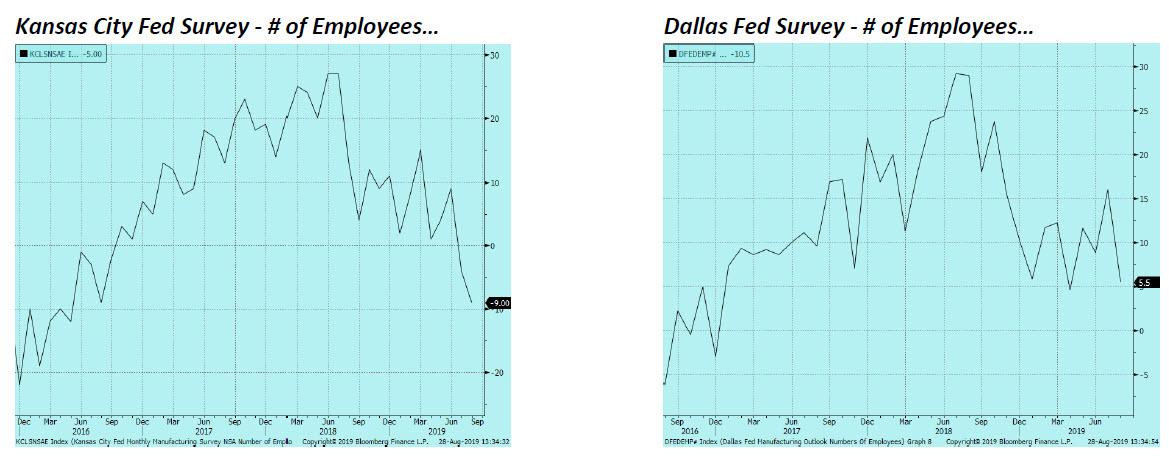

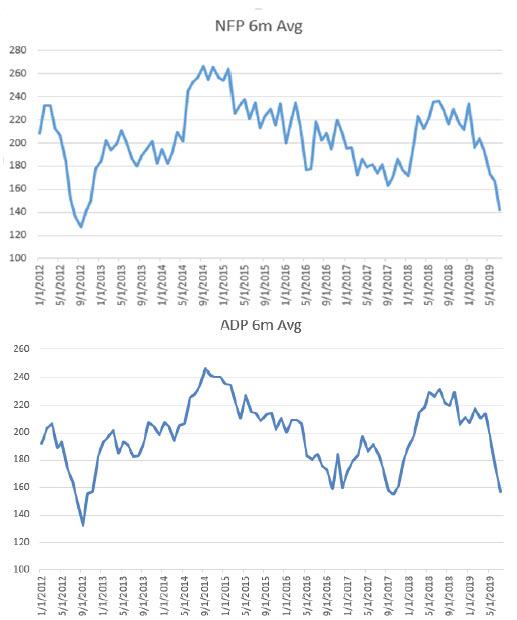

As you can see, we are at the point where curves have inverted signaling a coming recession, the Manufacturing sector is likely already in a recession (Markit says it is, ISM to follow) which is bleeding into the Service sector, and in the early stages of the labor market weakening. I showed the 6m average of ADP and NFP rolling over above and here are more signs of a coming labor market slowdown. First, in the regional Fed surveys, business are indicating they are going to hire less:

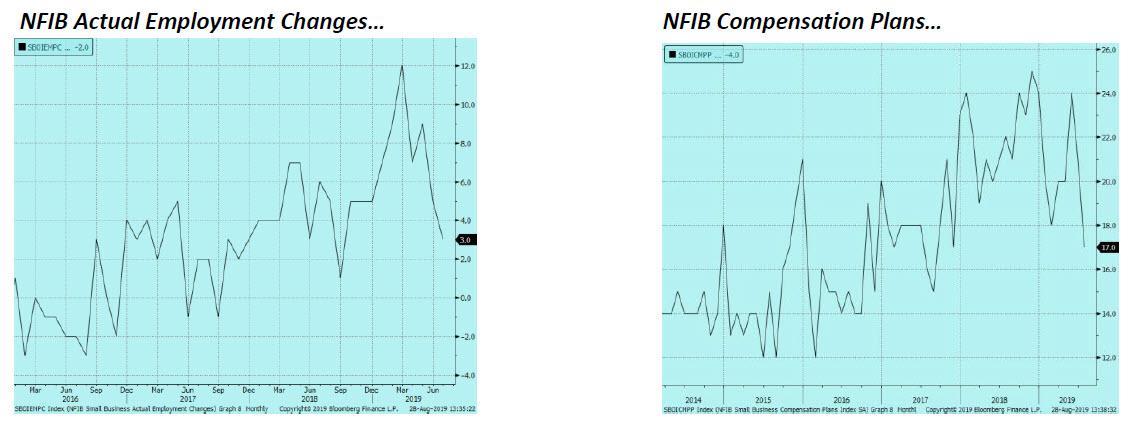

Small businesses are also showing they are hiring less and will pay less:

How about some solid empirical evidence of the weakening labor market. Paychex, using their payroll data, created a small business index that tracks the change in employment…

Therefore, seeing NFP getting revised down by 500k should not surprise us. There should now be a clear weakening trend in the labor data going forward.

The labor market slowdown will be significant because it will lead to the final domino to fall; the consumer. The most consensus comment I get from clients and that I hear around the street is “there will be no recession because the consumer is strong.”

Consumer data has certainly been firm, but folks, the consumer is always the last to know when the economy is headed towards a recession. When will they know? When they lose their jobs or fear losing their jobs. That is why these labor indicators are going to become so important over the next few months – they will tell us if the “strong consumer” theory is about to be invalidated.

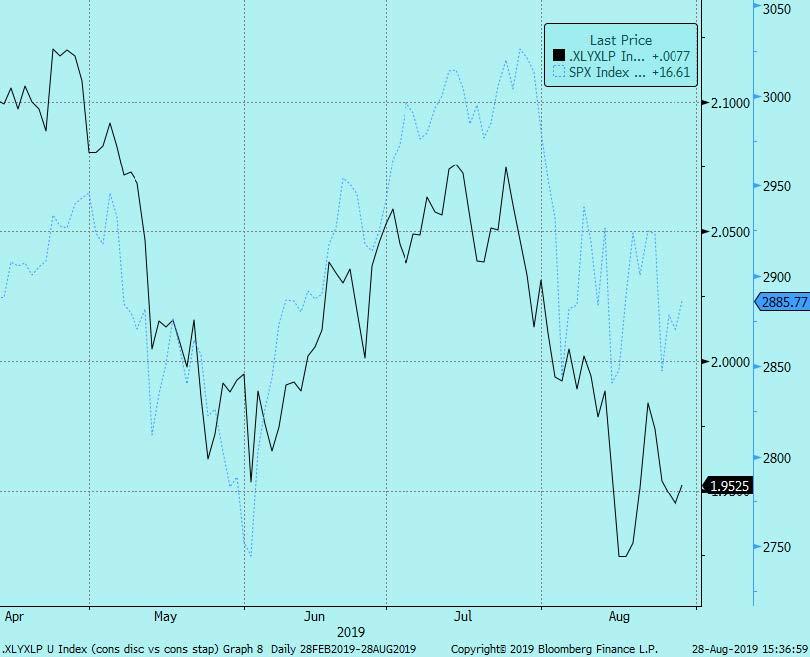

Are there any early warning signals that says the US is in the early stages of consumer retrenchment? A few:

Consumer Discretionary/Consumer Staples ratio (black) and S&P’s (blue) – rotation out of discretionary and into safety which is something you would not expect if consumer expectations were strong…

Amazon – I can understand why brick and mortar companies are under pressure and going bankrupt, but how is the disruptor causing all of that breaking down? It is implying that the best of times for the consumer is behind us as it has broken its uptrend from December…

Real Average Hourly Earnings – I showed how AHE is not rising as Powell stated they were, but to make matters worse, when adjusting for inflation (which will be a major problem if tariffs lead to even higher inflation), the consumer is only seeing a meager 1.3% YoY wage increase and falling…

Personal Income continuous to decline

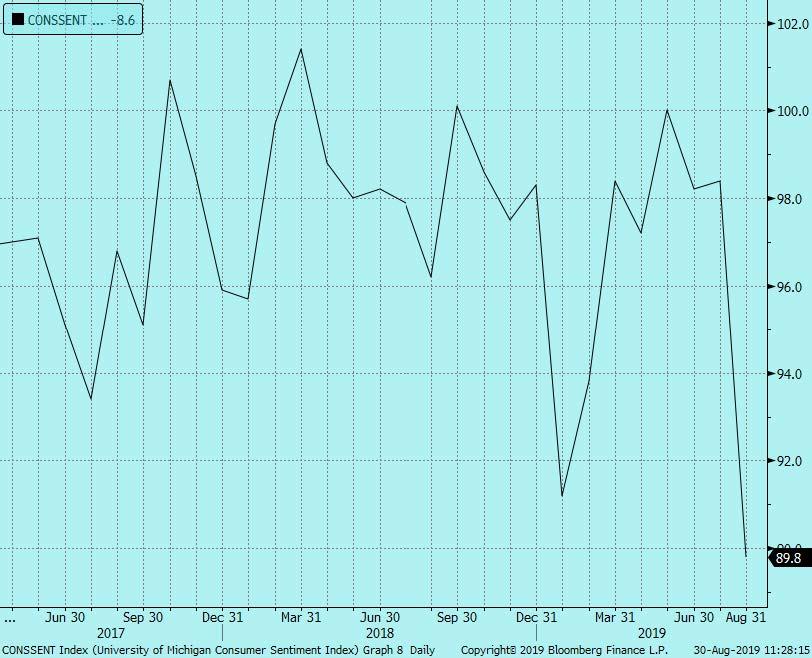

UMich Consumer Expectations

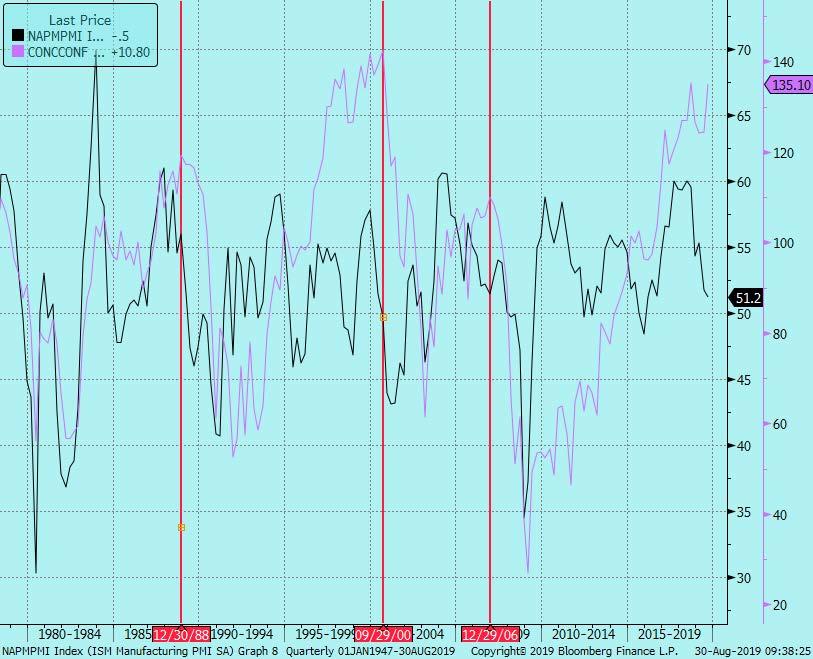

Now Consumer Confidence just came in at a robust level this week. I would just caution that the consumer eventually follows the economic data. For instance, you can see here that there have been times when consumer confidence was making highs while the ISM Manufacturing PMI was declining. All those times, the consumer data eventually caught up. In other words, the consumer is a lagging indicator.

ISM Manufacturing PMI (black) vs. Consumer Confidence (purple) – red lines denote instances when Consumer Confidence was spiking while PMI data was falling substantially – every time the consumer corrects lower…

* * *

One thing that could extend the cycle a bit is the brewing mortgage refi wave.

MBA Refinancing Index…

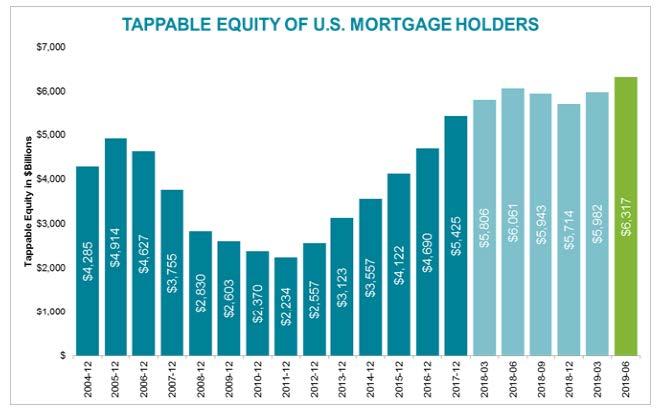

This is what cutting rates is supposed to do. Lower mortgage payments is good news and as I am sure you saw in the Black Knight data, people have a record amount of home equity to draw from:

A cash out refi wave will likely give the economy a much needed jolt so it is no wonder Home Depot stock is making new highs as folks extract equity and spend it improving their home.

The only concern is if consumers go on a cash out refi binge; that will only add to their overleverage problem. Said another way, taking out additional loans at the end of an economic cycle with the labor market staring to roll over and house prices sagging is risky to say the least.

Therefore, this refi wave should be short-term positive, but long-term increases the risk to the consumer. The consumer is getting sucked into more debt at the worse time.

* * *

While the refi wave is going to be a little boon for the consumer, it’s a problem for the market. In this world where the saturation of Treasury supply is sapping up liquidity, how will the market handle MBS origination coming in at a daily pace of say $5 billion?

More MBS supply means dealers will have to take down more paper which means reserves continue to decline which creates funding issues. You are already starting to see that in the year-end FRA-OIS spread which is approaching YTD highs.

December FRA-OIS spread starting to show year-end funding stress…

Which brings us to the US Dollar. The Dollar is bid and it appears to be non-economic driven. For example, if you looked at USD/SEK cross which is leading the Dollar rally, you would assume things are going poorly in Sweden. But over the last month, the data in Sweden has actually be pretty good. They had a blowout retail sales, an inflation surprise to the upside, and a huge bounce in Industrial Orders. Yet SEK is depreciating.

Therefore, more likely is the Dollar “shortage”/funding issues are starting to make its way into the currency market. That means the DXY is likely to continue its ascent inside its bull channel

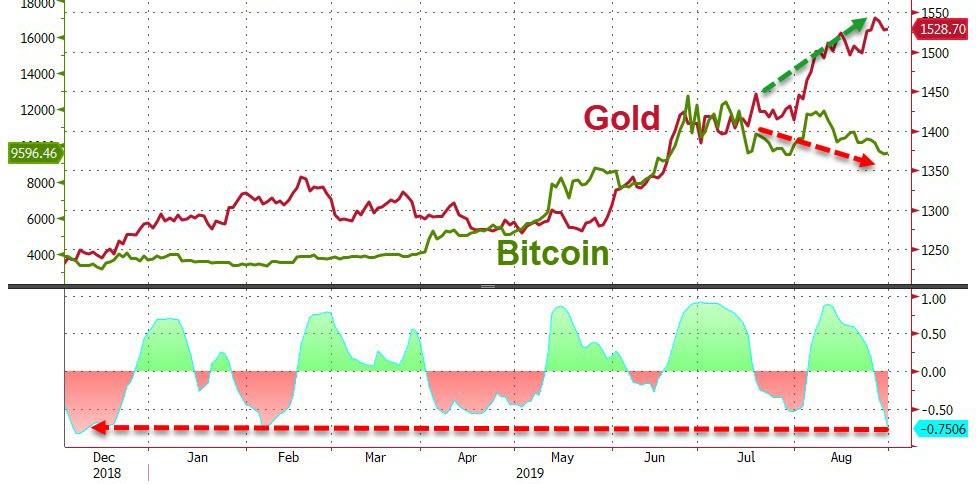

That Dollar rally could put an end to the rally in Gold. I have been bullish Gold for a couple months now but its time to take profits. It is extended, the Fed is behind the curve, the Dollar looks set to rally more, and the technicals have fully played out.

The bullish inverse head and shoulder pattern targeted 1550 which has now been hit. Take profits…

As you can see by the length of this note, there is a lot going on. To succinctly summarize:

- The long term economic data deterioration theme for the US has not changed and there are now signs the labor market could be the next part of the economy to turn

- In the near term, the cycle can get extended a bit due to the coming mortgage refi wave that will make the consumer feel economically better (along with gas prices still pretty low)

- That refi wave adds to the supply glut the Treasury market is already causing as there will now be a flood of MBS supply

- That MBS supply on top of UST supply will increase funding concerns

- Those funding concerns will keep the Dollar bid

- The Dollar bid will weigh on gold which is extended and reached its upside target

via ZeroHedge News https://ift.tt/2HCid3j Tyler Durden