Variant Perception Macro Chief Discusses The Reinflation Trade And Looming ‘Commodity Supercycle’

Tyler Durden

Sun, 11/01/2020 – 14:30

For weeks now, we’ve been been pointing to expectations that a Joe Biden victory, accompanied by a Democratic sweep of the Senate, could accelerate a “reflation” trade, as the world witnesses the shift toward fiscal policy in the form of massive fiscal stimulus supplant QE as the preferred vehicle for the central bank carrying out its monetary policy objectives.

This fusion between fiscal and monetary policy is an inevitable consequence of the Fed’s shouldering the burden of promoting economic “equality”, or at least combating “inequality” – a laughably ironic objective for the Fed, which has done more than any other single entity in blowing the equity asset bubble that’s driven economic inequality in the US back to levels last seen during the Gilded Age.

Well, after having MMT pioneer Stephanie Kelton, best known as the go-to economic policy advisor for AOC and Bernie Sanders, on the show, MacroVoices this week followed up with an individual who has examined the potential blowback caused by this historic policy shift.

This week, MV host Erik Townsend interviewed Tian Yang, the head of macro at Variant Perception, an established research shop that frequently produces opinion columns in the financial press. During this week’s interview, Yang outlines the findings from a slide deck that was provided free by MacroVoices to all members (membership is free)

After the historic drubbing endured by crude in the US earlier this year, Yang is among a group of strategists who have been warning about the reflationary blowback that the Fed is risking now that it has explicitly decided to allow inflation to run hot.

Yang outlines some of these concepts in the interview, which we have excerpted below:

* * *

Erik: And where do you see the inflation story coming into this?

Central Banks Must ‘Play Their Part’

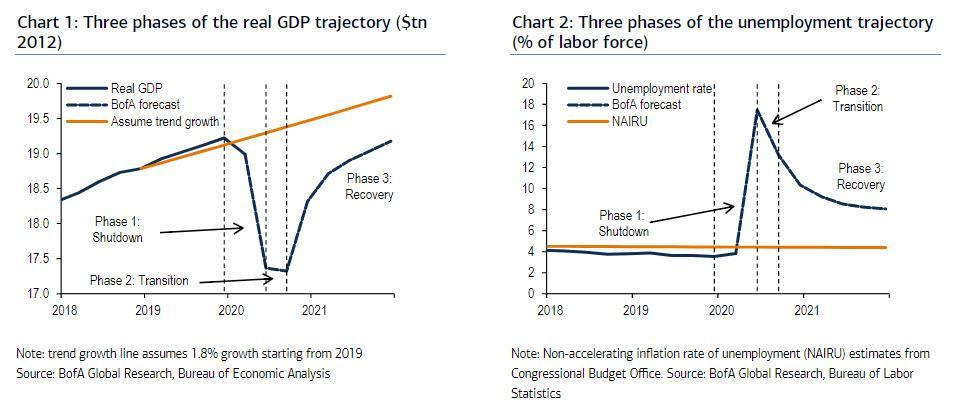

Tian: So I think we need to think about inflation both from a structural point of view and a cyclical point of view. So the thing to say is cyclically, when unemployment rates are still quite high, when there’s still capacity in the economy, you don’t expect to see kind of immediate pickup in core inflation. Headline could tick up a little bit when commodity prices industrial commodity, so forth, initiate pickup, so on the cyclical front, there’s not necessarily as much inflation pressure right now.

But structurally, we’ve seen some truly seismic shifts in the kind of policy landscape and the structure of the economy actually just this year. When you see governments and developed market governments around the world start to run giant fiscal deficits funded by central banks, that’s obviously a very dramatic shift away from independent central banking and the focus on inflation.

This is very much going back to the old Keynesian kind of playbook of essentially, fiscal led growth and at the same time, we’ve seen the US Federal Reserve do a number of quite dramatic shifts this year. Firstly, moving to average inflation targeting is obviously quite a big mission that they don’t really know where the NAIRU (Non-accelerating inflation rate of unemployment) is, they don’t really care what the NAIRU is, they are just going to run the economy and let it run hot.

And such a policy is also pretty timing consistent because it’s not well defined, what’s the period over which we’re targeting average inflation. The incentive will always be as inflation picks up for policymakers to just run their heart because it’s easier to kind of keep the party going.

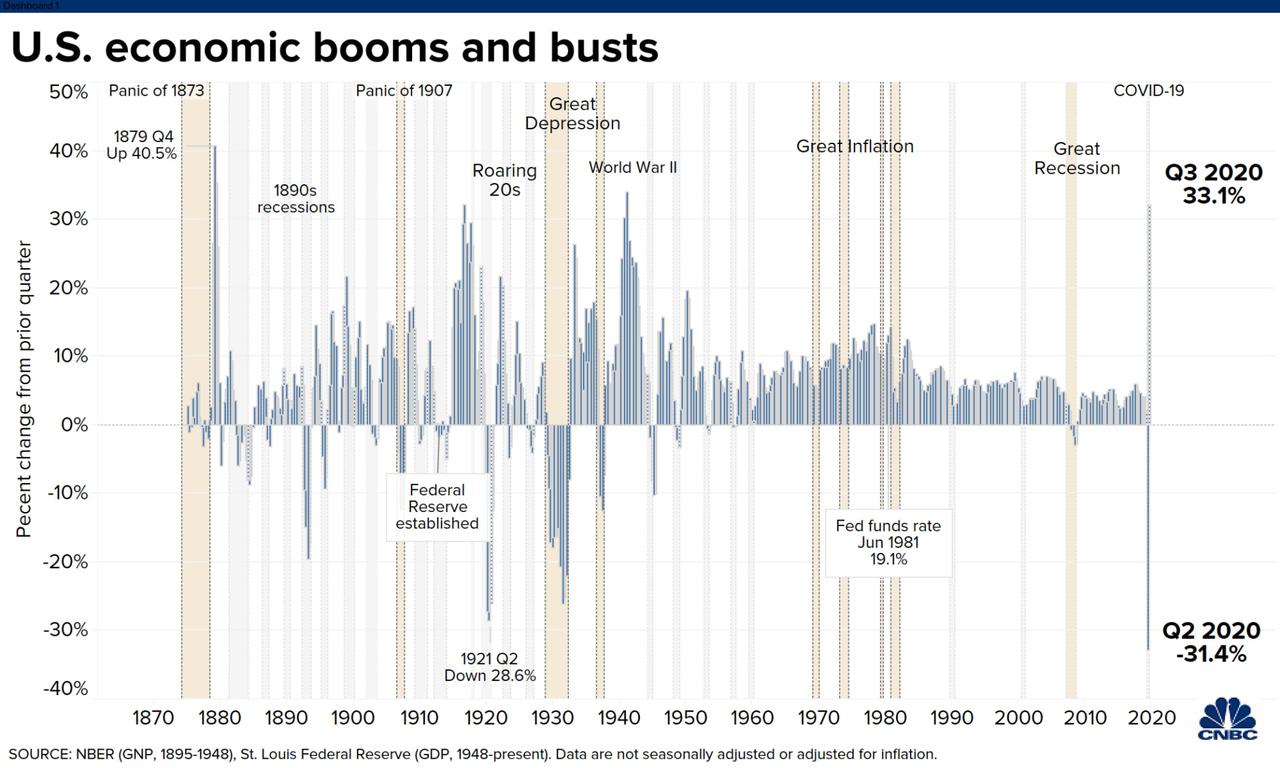

So, both fiscal and monetary policy are starting to become a lot more expansionary and loose. And the historical precedents for this kind of price action would probably go back to World War 2 with a fair-trade record, that essentially meant fiscal deficits would be very large. But there was a moral imperative for the central banks to finance the government deficits, and that ended up creating a lot of inflation.

And this time around, the moral imperative is that the central bank’s got to play their part with the pandemic. And going into the future, the central bank probably has to play their part was addressing inequality, climate change, or any of these big issues that essentially justifies why central banks should finance government deficits.

So that’s quite dramatic policy shift, the other thing that’s happened is that the Fed is now proactively kind of destroying the quality of its balance sheet. So again, as extreme, we could go back to when we were on the gold standard, if you look at central bank balance sheet, most currencies backed by gold, right.

So $1 is an asset for us but for the central bank $1 is a liability so previously they backed it on the asset side of their balance sheet with gold. Obviously, over time we abandoned the gold standard, so forth, the quality of assets on the central bank’s balance sheet is getting worse and worse. And obviously, this year, the fact that they started buying corporate bonds, the fact that, they’re willing to take on fallen angels, hide your debt and take on more credit risk is just another reflection of just the weakening central bank balance sheets.

It’s not necessarily a immediate concern, but it lays the foundations for people to kind of increase inflation expectations and to really worry about what the value of the dollar is. And so when you have these kind of structural shifts in policy coming together in a couple ways to make a kind of deterioration in central bank balance sheets and government balance sheets. That’s typically been the recipe for inflation expectations to become unhinged.

From A Lake To An Ocean

Erik: Tian, I love the picture on page five where you’re talking about lake and ocean regimes of inflation. Needless to say, you’re not talking about a necessarily a really calm easy day out on the ocean, but maybe a stormy day.

Now I want to go back to what you said because it seems to me that the game is very different this time around in that you drew an analogy to, okay, after World War 2 we move to a whole lot of deficit spending, which should be inflationary. The thing is, after World War 2 we were still, as you said, on a gold standard. And the big inflation didn’t really get unleashed until we came after the gold standard with the breakdown of Bretton Woods in 1971.

Now, this time around, we’re going to have I think the same if not a greater shift to a public policy emphasis on major spending programs with a lot of deficit spending. But we’re already in a pure fiat environment, so nobody’s pretending there’s a constraint on how much money you can print in order to finance government spending.

I would think that means that the inflation is certainly not delayed by 20 years the way it was after World War 2, but is it immediate? Or is there still a lag of several years before that inflation really hits the system in terms of consumer price inflation after those pre generated factors like deficit spending kick in? How long does it take before we really see the inflation start to get away?

Tian: Yeah, I mean, that’s a great question. I guess it’s a little bit like when they think about how people go bankrupt, right, it happens very slowly and or all at once. I think this is kind of the analogy we’re kind of drawing here because we’re talking about a shift in inflation expectations, which is obviously predicated on just the general belief in the system.

These things are obviously inherently fairly hard to predict but what we can do is kind of position for when it already makes sense. So when markets are already not pricing in much inflation risk premiums and also as the economy cyclically picks up, those things are going to help just drive a more normal reflation cycle.

So right now, if you position for that, then when the tail comes through and potentially more inflation picks up later, you’re kind of on the right side of it. In terms of the mechanism it could, as you say, potentially happen quickly or you could take a few years. I mean, if we’re in this kind of 1960 style environment then what you need to do is go along for the excess capacity in the economy to be used up first, and then have inflation pick up.

And then you will need that to feed into shifting hecs inflation expectations higher, and then you should move into more of a wage price spiral. Then when people think inflation is going higher, they’re going to demand higher wages and that’s what really kicks off the more uncontrolled inflation right now.

Arguably right now for a lot of people, you know say live in the United States, the actual cost of living inflation is actually already been a lot higher than what CPI would be saying if you look at shadow stats, inflation and these kind of different projections. They would say inflation has be running a 4-5% annually for the past 20 years, if you get rid of a lot of the hedonic adjustments and so forth. And arguably, it’s actually this mismatch between what official CPI says and what people feel is their true cost of living. That gap is also fueling a lot of the populism and the kind of general discontent that we have been seeing in society and, by the way, this isn’t a new, it’s just quite rare that we see it in developed markets.

If you take emerging market economies like Argentina or these places that have been known to have huge inflation’s, this is typically what happens. The population doesn’t believe in the CPI, they think their real cost of living is going up a lot higher, so when it comes to wage negotiations, they demand CPI plus 5-10%.

No more ’60/40′?

Erik: Tian, let’s talk about how this translates for portfolios, it sounds like we’re very much in agreement that inflation is coming, but it’s kind of hard to know exactly when and how it shows up. Probably when it does show up, it shows up in a big way, you don’t want to be caught by surprise, but you don’t know that it’s happening right away. So what do you do in terms of your portfolio in order to be ready for that?

Tian: Yeah, well that’s kind of the million-dollar question at the moment isn’t it? So the first thing to know is, I think I mentioned briefly at the start, clearly more traditional portfolio construction, the kind of 60/40 or the heavy allocation to fixed income, it’s naturally kind of getting to the end of the road. I think most people recognize that as yields bump up against the zero bound, the ability for your fixed income portion to really offer a diversified impact or a hedge to equity risk is going to diminish.

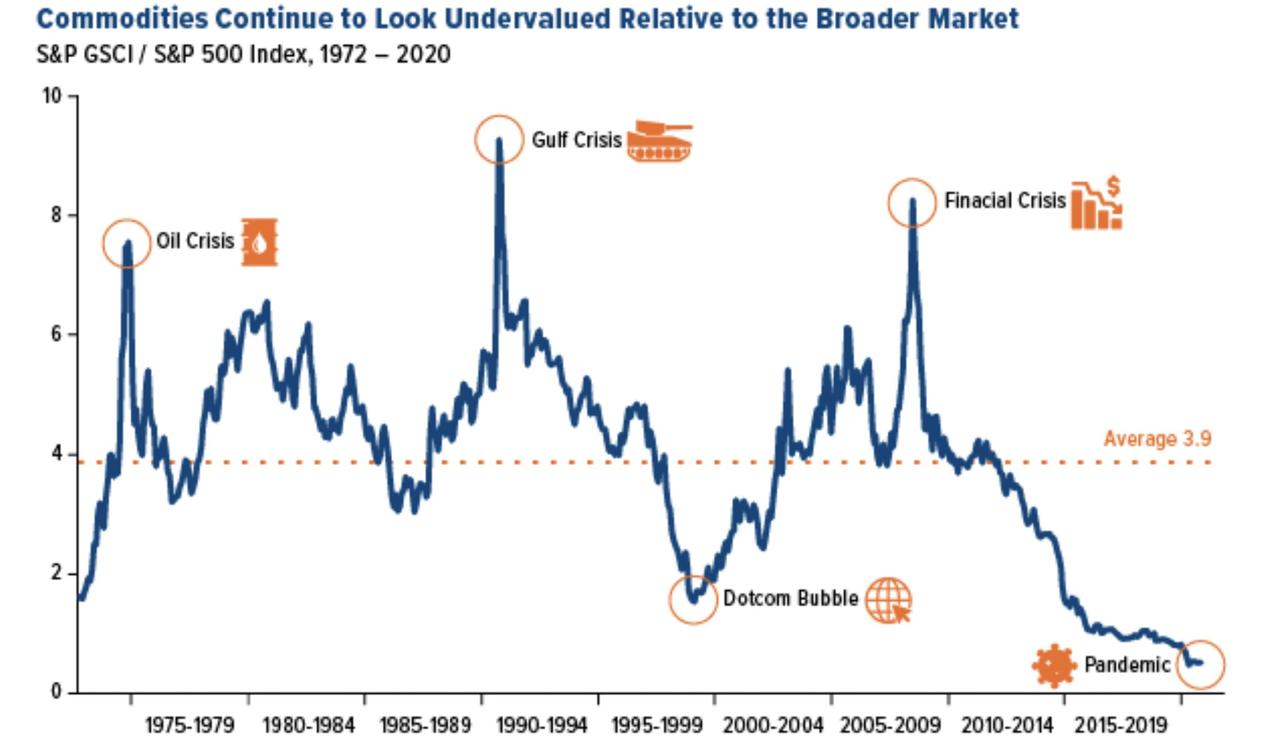

So, going forward, what’s very interesting about commodities is that one of the unique properties of commodities is typically when commodity volatility is high commodity prices actually tend to go up a lot. And this is quite different to equities because normally for equities only when equities are crashing that volatility picks up, whereas for commodities, the volatility tends to be to the upside. Now, the thing to say about commodities is that one of the big reasons why it tends to be very high volatility is that there tends to be quite prolonged periods of demand and supply mismatches for the industry. Just because typically supply responses can take a long time if you’re going to build a new mine, or drill a new well, or build a new plant, it could sometimes you could take up to three to five years. Obviously, if it’s like the super-efficient shell well, maybe it takes one year to get to get it going.

But for a lot of commodity sites if you’re going to build a refinery or build a chemical plant or things like that, it’s going to be three to five years. And because of that very delay supply response it is where you end up with this prolonged period of demand supply mismatches. And so that that’s kind of what we’re starting to see right now, where for a lot of commodity sectors are more capital scarce.

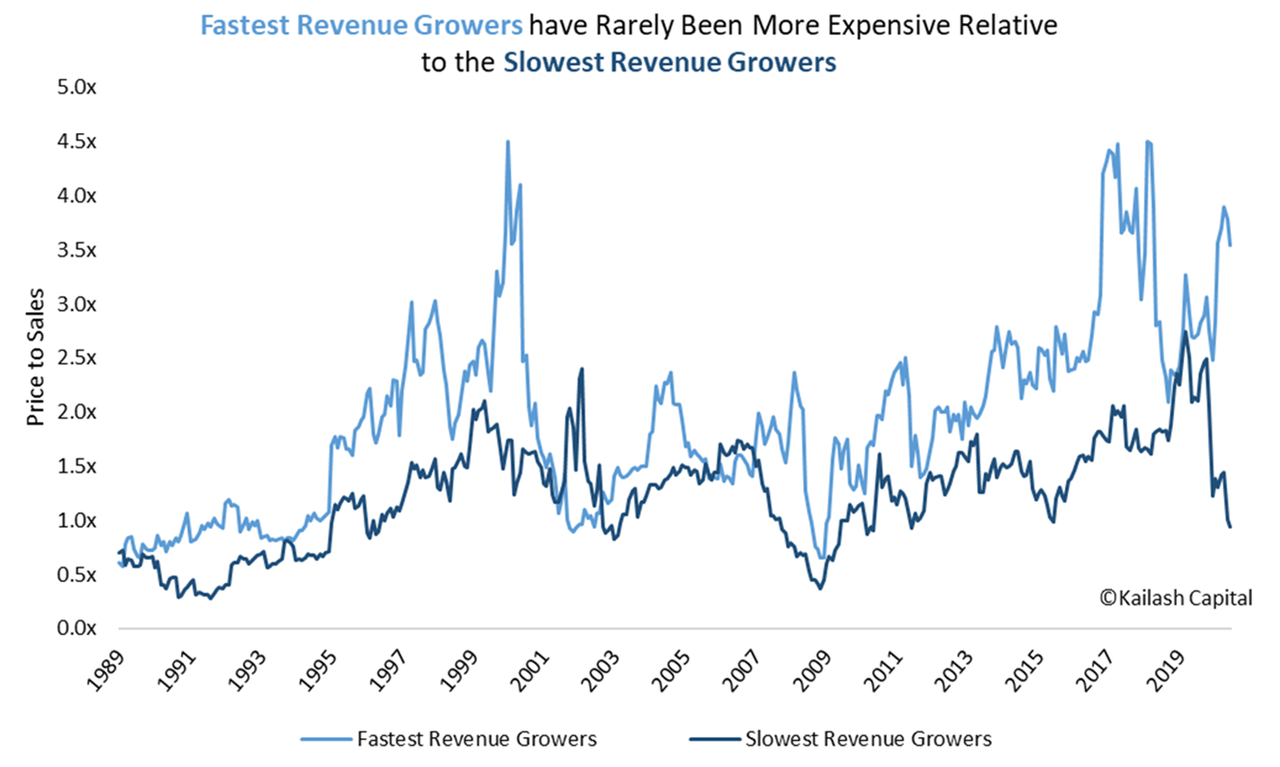

This being a prolonged period of a lack of investment, a lack of capex, and so these are sectors that we would expect to have quite explosive upside as the as the economy recovers and as demand comes back. So I think in the slide deck there’s a section on page 15 where I mentioned the capital cycle. So, I think this is a very interesting framework to actually think about when we’re trying to decide where to invest in.

So for the capital cycle I think that the best thing that I’ve read that’s really inspired us on this was some pieces written by Marathon Asset Management. And it was basically collated together in a book called “Capital Returns: Investing Through the Capital Cycle”, and the book was put together by Edward Chancellor. And so the basic idea is that, if there’s a lot of money flowing to a particular industry or sector, then that inflow of money will cause a lot more competition within that industry which drives down returns and then as returns fall very low then nobody in the industry can make a profit.

Listen to the rest of the interview below:

via ZeroHedge News https://ift.tt/3kPHOqX Tyler Durden