Robinhood’s “Infinite Money Cheat Code” Gives Traders Access To Unlimited Funds

If one is a central bank – such as the SNB and BOJ – life is easy: you just print as much money as you need out of thin air, and buy whatever you want, without regard for price. For those who are not central banks, having access to unlimited borrowed money may be the next best thing.

It now appears that the millennial-targeting brokerage Robinhood, which offers its users “free” online trades in exchange for quietly selling their orderflow to frontrunning HFTs, has a “glitch” that affords its users to experience just what being a central bank means, by allowing users to trade stocks with virtually infinite leverage, giving them access to what amounts to free money.

First discussed on Reddit’s WallStreetBets forum, the bug was called the “infinite money cheat code.”

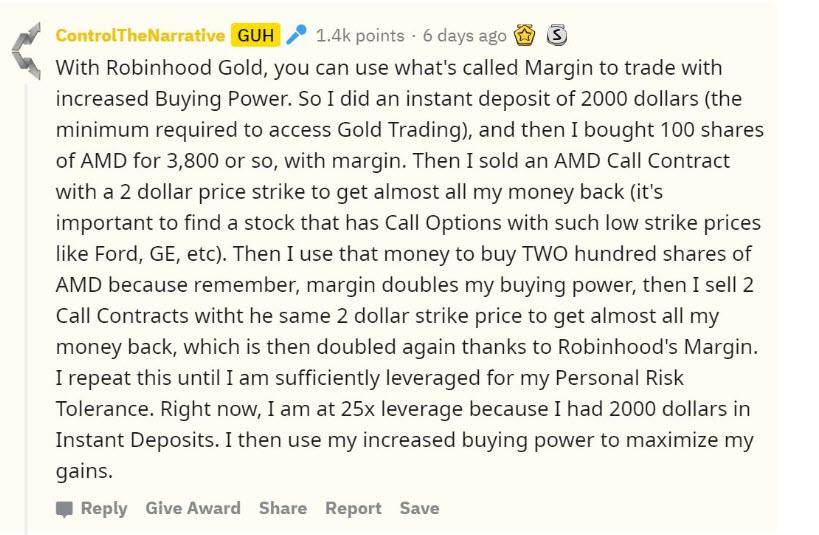

As summarized by Bloomberg, here’s how the trade works: “Users of Robinhood Gold are selling covered calls using money borrowed from Robinhood. Nothing wrong with that. The problem arises when Robinhood incorrectly adds the value of those calls to the user’s own capital. And that means that the more money a user borrows, the more money Robinhood will lend them for future trading.”

In short, a feedback loop where the more one borrows, the more one can borrow. One can imagine how it ends.

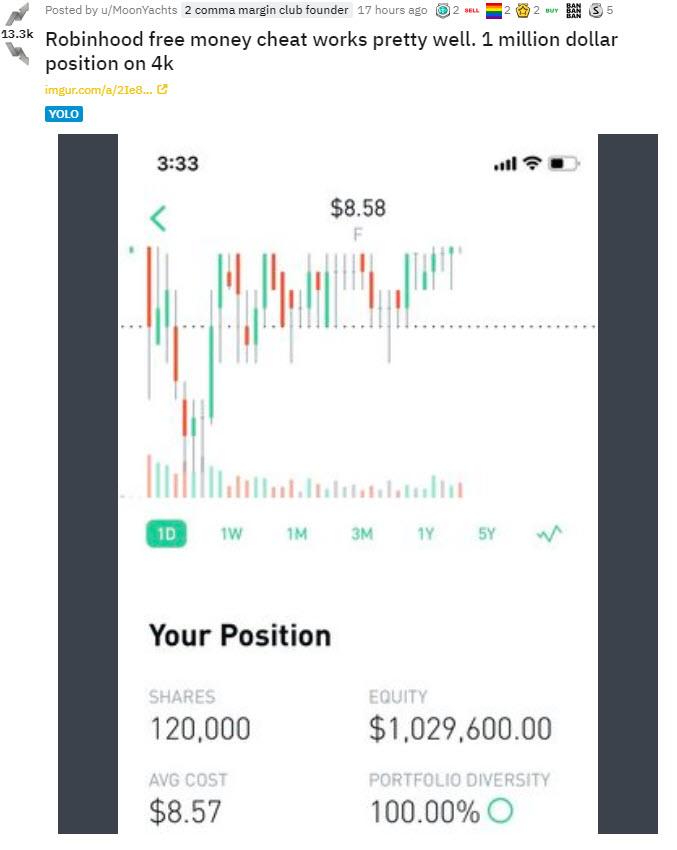

In one case it ended when a user converted a $4,000 position into $1+ million in equity.

Another trader managed to turn his $2,000 deposit into $50,000 worth of purchasing power, which he used to buy Apple puts. Naturally, he then lost that money and posted a video of the wipe-out on YouTube.

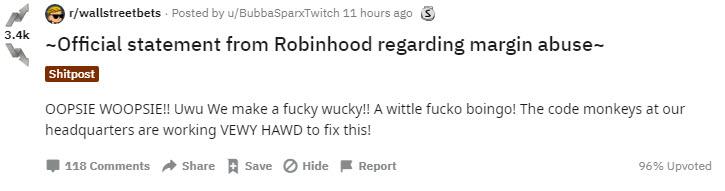

When contacted by Bloomberg, Robinhood said it was “aware of the isolated situations and communicating directly with customers,” spokesperson Lavinia Chirico said in an email response to questions. Meanwhile, Reddit users had their own “version” of the official statement.

Robinhood Gold customers of the Menlo Park-based company are invited to “supercharge” their investing by paying $5 a month to trade on margin, or money borrowed from the company. In return, they get access to virtually unlimited funds.

Speaking to Bloomberg, Donald Langevoort, a law professor at Georgetown University, said that traders using the “infinite leverage” bug to supercharge their wagers could be held liable for the money and guilty of securities fraud: “If there’s an element of deceit, that you got this by exploiting a loophole in a system, I can see how that could become a securities fraud case,” Langevoort said. “The other possibility is just the basic common law of restitution. If you take advantage of someone’s mistake to line your own pockets, you need to pay them back.”

The question, of course, is how is it fraud if traders are merely taking advantage of a glitch that has been handed to them on a silver platter by the firm itself.

Ironically, in a world where 97% of retail traders end up losing money in the long run, giving them unlimited funds to lose means that Robinhood should probably change its name, as not only does it take from the poor and give to the rich, but it is now doing so at an infinite scale.

Tyler Durden

Tue, 11/05/2019 – 12:24

via ZeroHedge News https://ift.tt/36zU6Nz Tyler Durden