Schiff: Government Is Trying To Replace The Economy With A Printing Press

Tyler Durden

Tue, 08/25/2020 – 15:50

Peter Schiff recently spoke at the “virtual” Los Vegas Money Show and explained why we are near the endgame for the dollar.

Peter opened up his talk speculating that the Money Show could be close to the end of its run.

I think the money that most people have, or at least what they think is money isn’t going to be money much longer.”

What in the world is he talking about?

The looming dollar crisis.

The dollar is going to fall through the floor and inflation is going to ravish the United States. What’s about to happen is that the world is going to go off the dollar standard and go back to the gold standard. That is where we are headed.”

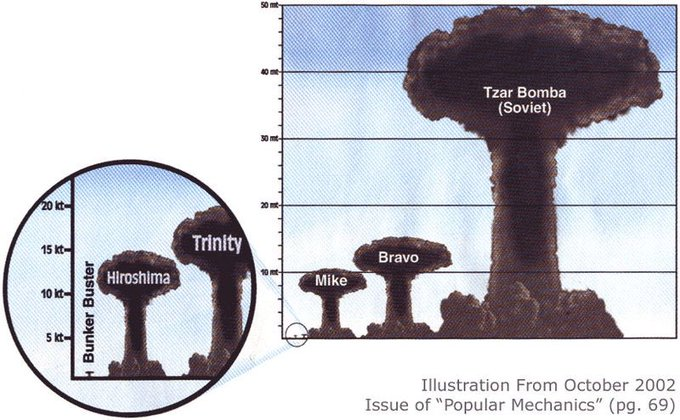

Peter warned that we’re about to see a loss of wealth on an unprecedented scale.

He reiterated that this isn’t about COVID-19. We were already on the cusp of a crisis. The coronavirus simply made it worse.

It’s one of many problems, but it’s not why we’re about to go through this massive economic collapse. But it is the monetary and fiscal policy response to COVID-19. The government’s cure is what’s going to kill the economy.”

In fact, the problems started long before the pandemic. As Peter reminds us, interest rate cuts and QE were already ongoing before the government shutdowns started last March. In fact, it goes back much further than that.

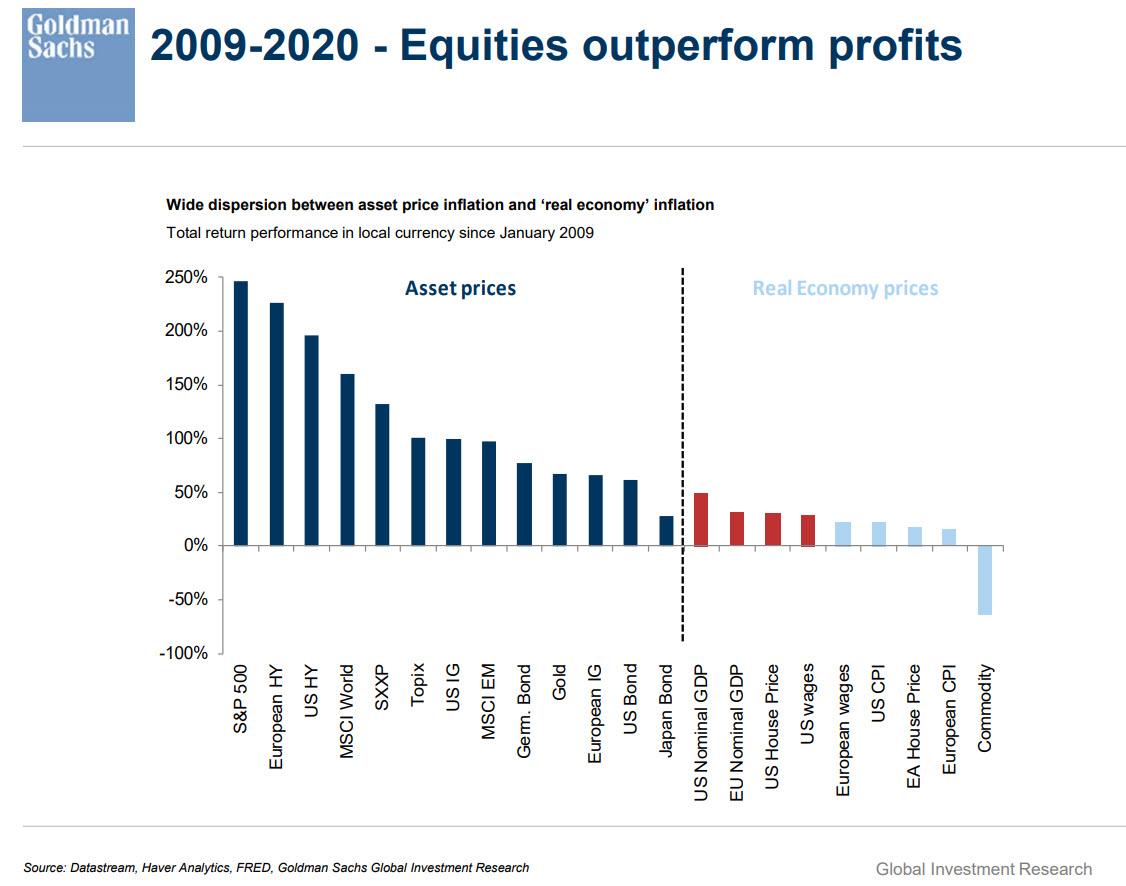

Everything the US government did in the aftermath of the 2008 financial crisis was a mistake. All the monetary policy was wrong. All the fiscal policy was wrong. As a consequence, we never actually recovered from that crisis. We simply made all of the problems that caused that crisis worse. And of course, the crisis was caused by the Fed, by the government, using the same policies that they used to respond to the crisis — only the mistakes they made after 2008 were far bigger than the mistakes they made before 2008. And therefore, the bubble that they blew up was far bigger and the collapse now that that bubble has popped is going to be catastrophic.”

Peter said that everybody is going to get wiped out, even people not in the stock market because the dollar itself is going to get wiped out.

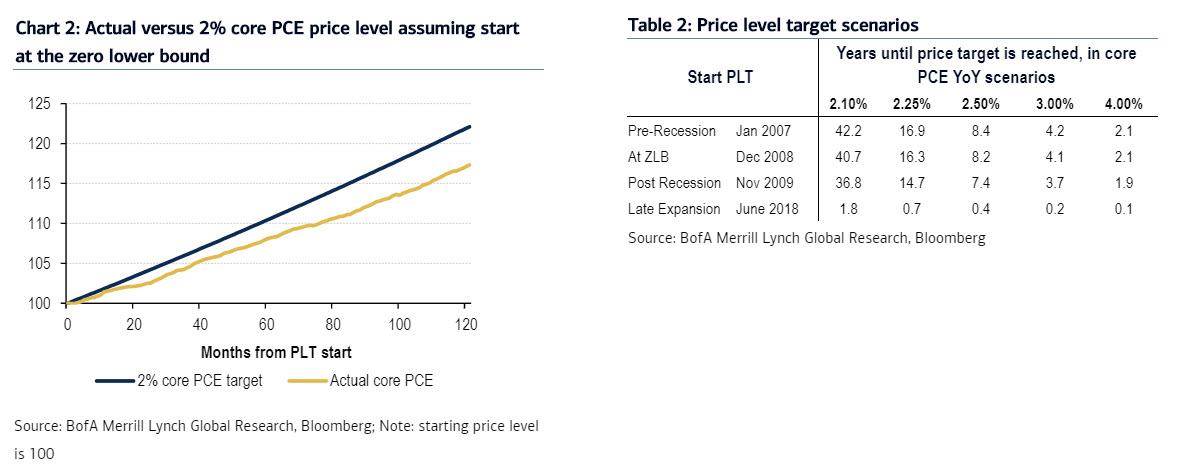

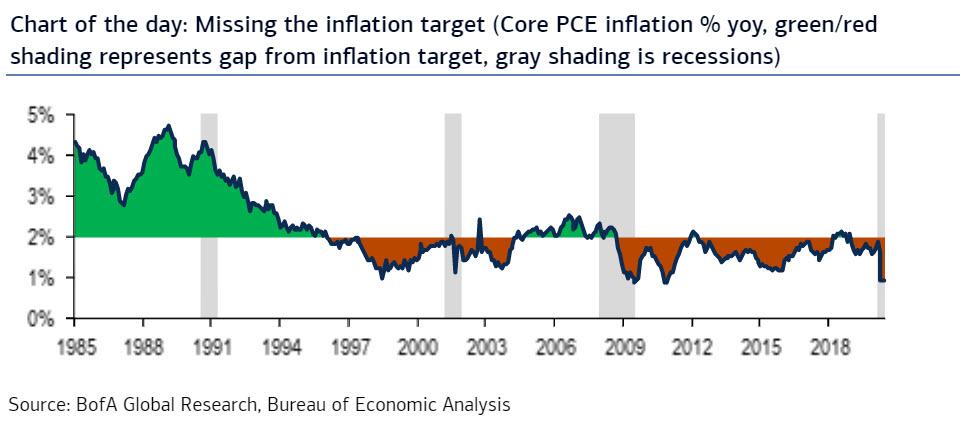

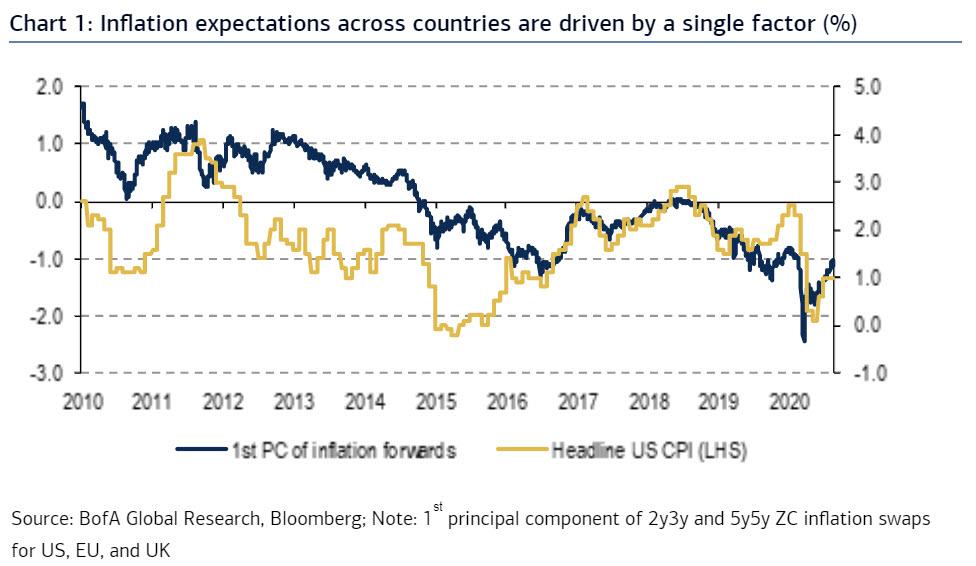

The Fed is now running QE infinity. The US government is spending money at a staggering rate. It is borrowing 60 cents of every dollar it spends. This borrowing and spending isn’t free just because Uncle Sam hasn’t raised taxes. We’ll pay for it in inflation.

There are two ways government can pay for its spending. It can collect taxes legitimately by taking your money or can do it illegitimately by taking your purchasing power. … They just print money out of thin air and they give that money to somebody else and now that somebody else spends something. But the amount of goods and services to buy hasn’t expanded. The government doesn’t print purchasing power. It just prints claims to the existing production supply of goods and services. So, what happens is the people who get the new money go out and spend it and that bids up prices. And so what happens is prices go up and so now you can buy less stuff — not because you have less money but because your money is less valuable.”

Peter warned that we are seeing inflation on an unprecedented scale. We’re going to see the cost of living skyrocket. And it will happen very, very quickly.

It’s going to hit people like a ton of bricks and they’re not going to see this coming.”

Peter said the dollar crisis will be much worse than the financial crisis. The Fed could print money to bail us out of the financial crisis.

When you have a dollar crisis that doesn’t matter anymore. You can’t print dollars because nobody wants them.”

The only way to prevent this crisis is for the Fed to let interest rates rise. The last time this happened was in the 1980s when then Fed Chair Paul Volker let rates rise to 20%. But given the level of debt in the economy, we can’t even afford 2 or 3% interest rates. If the Fed did the right thing, the US government would have to default on its Treasury bonds.

All of these empty promises are going to be exposed if the Fed does the right thing. But again, what are the odds that they do the right thing given how painful doing the right thing is going to be? So, instead of doing the right thing, they will double down on doing the wrong thing, or triple down on it, and they’re not going to let interest rates go up. So, the dollar is going to fall through the floor and inflation is going to ravage the United States.”

Peter said ultimately, the world is going to reject the dollar as the reserve currency and remonetize gold.

The entire American economy is built on the foundation of the dollar being the world’s reserve currency. That is the secret sauce that makes this economy work. Once the dollar is just another currency, then it’s all over, it’s the end of the game for America. Because now we can’t consume unless we produce. Now we can’t borrow unless we save. We’ve been getting a free ride on the global gravy train. Well, that train is coming to an end and America is going to have to deal with its greatly diminished standard of living.”

via ZeroHedge News https://ift.tt/31qdMTE Tyler Durden