Debt Is Neither Free Nor Irrelevant

Tyler Durden

Wed, 07/22/2020 – 15:01

The world is drowning in debt.

And central bank policies globally are encouraging even more borrowing. Most people don’t seem to care. “This is necessary during this time of crisis,” has become the mantra. But the ugly truth is the world was already drowning in debt before the coronavirus pandemic. The government response to COVID-19 has merely exacerbated the problem. And it’s important to understand that debt is neither free nor irrelevant.

Just look at the US government budget deficits. The shortfall in the month of June totaled nearly the entire 2019 fiscal year deficit and would rank sixth largest-ever if it were a yearly deficit.

The June deficit came in at $864.1 billion dollars. To put that into perspective, here are the biggest annual budget deficits in US history.

-

2009 – $1.413 trillion (G.W. Bush/Obama)

-

2011 – $1.300 trillion (Obama)

-

2010 – $1.294 trillion (Obama)

-

2012 – $1.077 trillion (Obama)

-

2019 – $984 billion (Trump)

-

June 2020 – $864 billion (Trump)

Of course, Uncle Sam was already hurtling toward a $1 trillion deficit for fiscal 2020 before the pandemic.

It’s not just governments running deeper and deeper into the red. The second quarter was the busiest ever for corporate debt issuance. Approximately $1.2 trillion of investment-grade paper was sold in the first half of the year. It was the highest issuance volume recorded by the Securities Industry and Financial Markets Association.

Corporations were leveraged to the hilt before the pandemic. So much so that the Federal Reserve issued warnings about the increasing levels of corporate indebtedness late last year.

Borrowing by businesses is historically high relative to gross domestic product (GDP), with the most rapid increases in debt concentrated among the riskiest firms amid weak credit standards.”

The Fed’s response to COVID-19 was to wade into the corporate bond market and this has only exacerbated the debt problem.

Economist Daniel Lacalle highlighted just how much global debt has grown in an article published by the Mises Wire.

According to the International Monetary Fund (IMF), global fiscal support in response to the crisis will be more than $9 trillion, approximately 12 percent of world GDP. This premature, clearly rushed, probably excessive, and often misguided chain of so-called stimulus plans will distort public finances in a way which we have not seen since World War II. The enormous increase in public spending and the fall in output will lead to a global government debt figure close to 105 percent of GDP.

“If we add government and private debt, we are talking about $200 trillion of debt, a global increase of over 35 percent of GDP, well above the 20 percent seen after the 2008 crisis, and all in a single year.”

It’s easy to simply shrug off the debt. People have been warning about it for years. But as Peter Schiff has said, it’s not a problem until it is.

Lacalle called it a “brutal increase” in indebtedness. And here’s the bad news. It’s not even going to prevent economies from falling rapidly.

Most of this new debt has been created to sustain a level of public spending that was designed for a cyclical boom, not a crisis, and to help large companies that were already in trouble in 2018 and 2019, the so-called zombie companies.

“According to Bank of International Settlements, the percentage of zombie companies—those that cannot cover their debt interest payments with operating profits—has exploded in the period of giant stimuli and negative real rates, and the figure will skyrocket again.

“That is why all this new debt is not going to boost the recovery; it will likely prolong the recession.”

“Debt is neither free nor irrelevant, as interventionists want us to believe, even if interest rates are low. More debt means less growth and a slower exit from the crisis, with lower productivity growth and a tepid employment improvement.”

Schiff has also said that the central bank policy of creating money out of thin air and encouraging more debt isn’t helpful. It’s merely creating inflation.

Well, if you just increase the supply of money, it doesn’t do anything to change the supply of goods and services. So now, when you divvy those goods and services up, you just have to assign a higher price to all of those goods and services so that the market clears. But nothing of real value is actually added.”

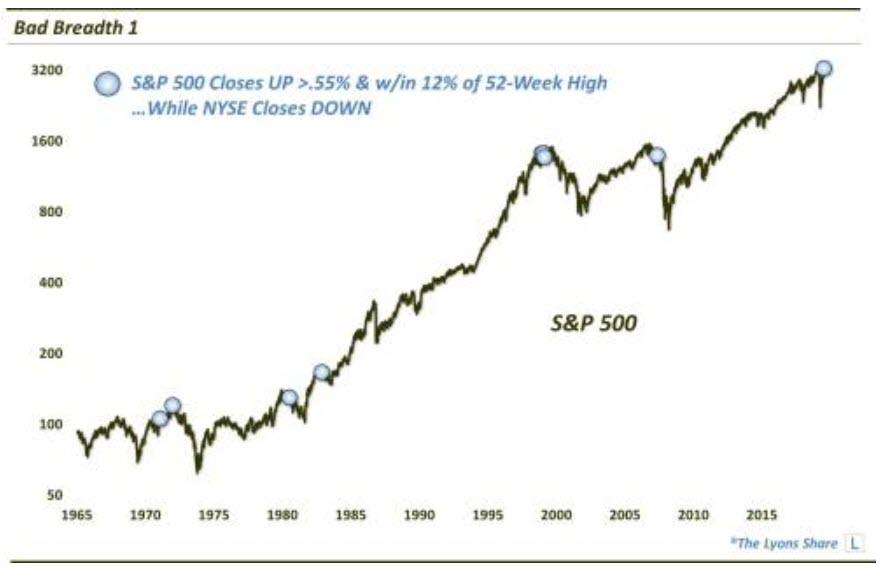

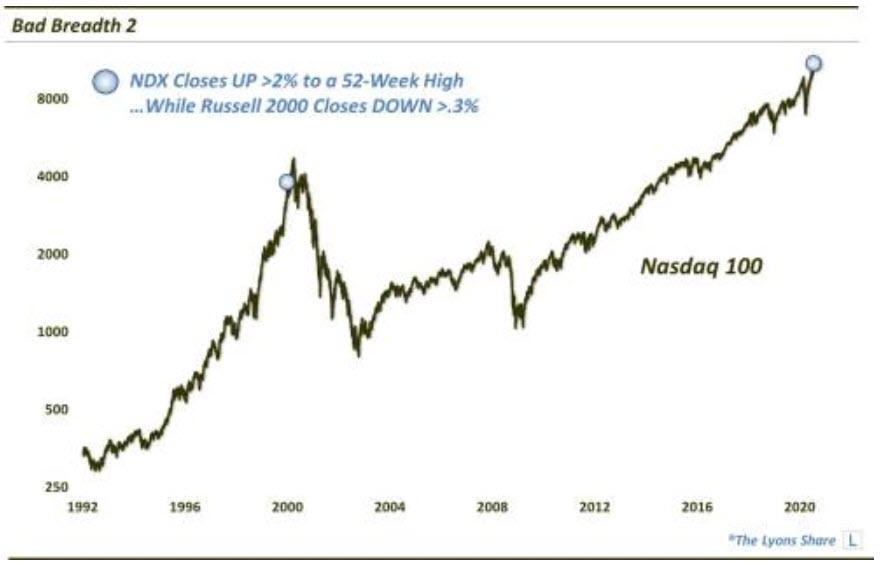

Lacalle said the borrowing and spending with its accompanying ballooning level of indebtedness are exacerbating the disconnect between financial markets and the real economy. It has reached record levels and is presenting “bubble-like features.”

First, these huge stimuli are probably too big, too soon, and clearly geared toward sustaining low-productivity sectors. All this is supported by a monetary policy that has gone from providing liquidity to being the enabler of asset bubbles.

“The balance sheet of the European Central Bank has increased by almost €2 trillion so far this year and is already more than 52 percent of the eurozone’s GDP, much higher than that of the Federal Reserve, which is 32.6 percent of the US GDP, or the Bank of England, which is 31.1 percent. The Bank of Japan’s balance sheet already accounts for 117 percent of GDP, and its consequences should be a warning sign to all nations. Consumption has plummeted again in May and the country has been stagnant for two decades, with debt that will exceed 260 percent of GDP. Copying Japan is the recipe for secular stagnation.

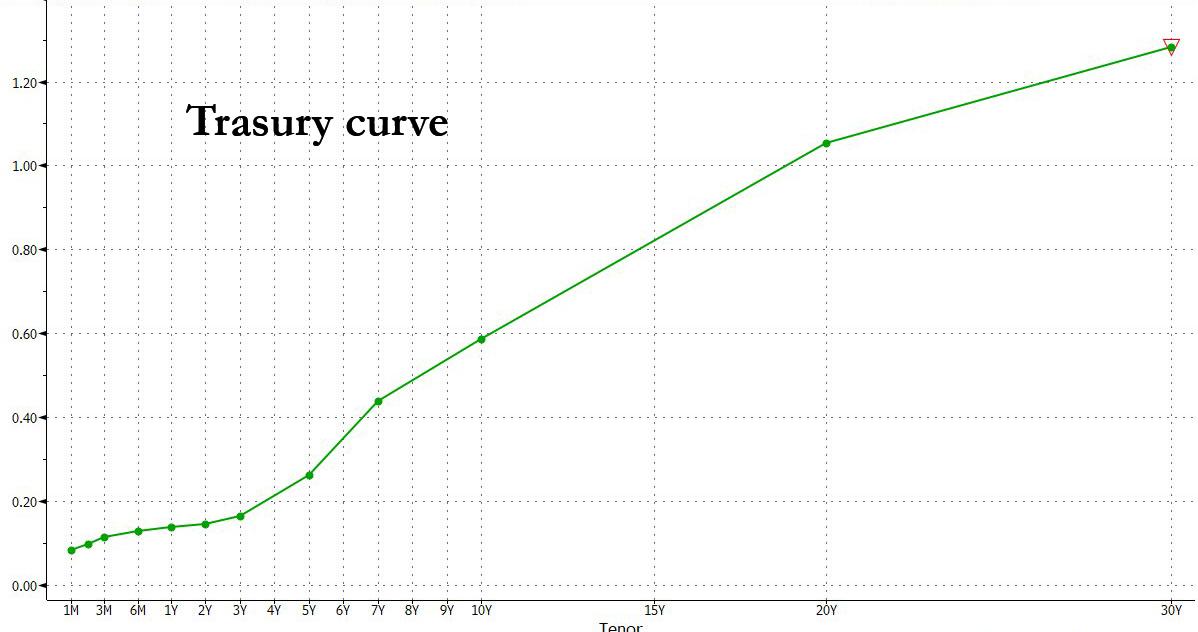

“The huge increase in the balance sheets of central banks to artificially keep bond yields low has pushed stock markets higher just as 80 percent of listed companies have abandoned their business profit targets and analysts are slashing estimates for 2020, 2021, and 2022 at the fastest speed in the past decade, according to JP Morgan and Bank of America.

“This enormous action of central banks leads to an unprecedented disconnect between the real economy and the stock markets. The expansion of multiples has accelerated just as earnings estimates plummet.

“By making sovereign bonds prohibitively expensive, two dangerous things happen: governments believe that low bond yields are due to their policies, and investors take much more risk than what they think they have in their portfolios.

“All of this looks harmless if the bubble expands and the placebo effect works, but if macro earnings and employment data remain disappointing, the next crash may be worse than the economic shutdown, because it may add a financial crisis to the already weak economy. Unfortunately, when the next crash happens, governments and central banks will tell us that more stimulus is warranted.

via ZeroHedge News https://ift.tt/2CtzxZ7 Tyler Durden