Fannie, Freddie Will Need $240BN In Capital As Private Companies: Regulator

Tyler Durden

Wed, 05/20/2020 – 16:25

The 12 year exile of the formerly-insolvent GSEs, Fannie and Freddie, from private markets following their nationalization by the government in 2008 is almost over. There is only the small question of some $240 billion in capital they will need, in order to regain control of their own fate.

According to Bloomberg, Fannie Mae and Freddie Mac’s regulator is proposing that the mortgage giants be required to hold a quarter trillion in dollars in capital to guard against losses, “a step that could have an impact on mortgage interest rates and on the Trump administration’s efforts to free the companies from U.S. control.” A rule proposal by the Federal Housing Finance Agency released Wednesday outlines how much capital the GSEs would have to retain against their total assets as fully private companies. Based on their September 2019 asset totals, the companies would have to have a combined total of about $240 billion.

How was this number reached? According to a senior FHFA official, the ultimate goal of the rule is to ensure that the companies are never leveraged more than 25 to 1, or 4%. As of September 2019, that would have meant they needed about $243 billion in capital backing some $6.1 trillion in mostly mortgage assets, according to the FHFA, and as with other financial firms, “Fannie and Freddie would face different requirements depending on market conditions and their books of business, the agency said.”

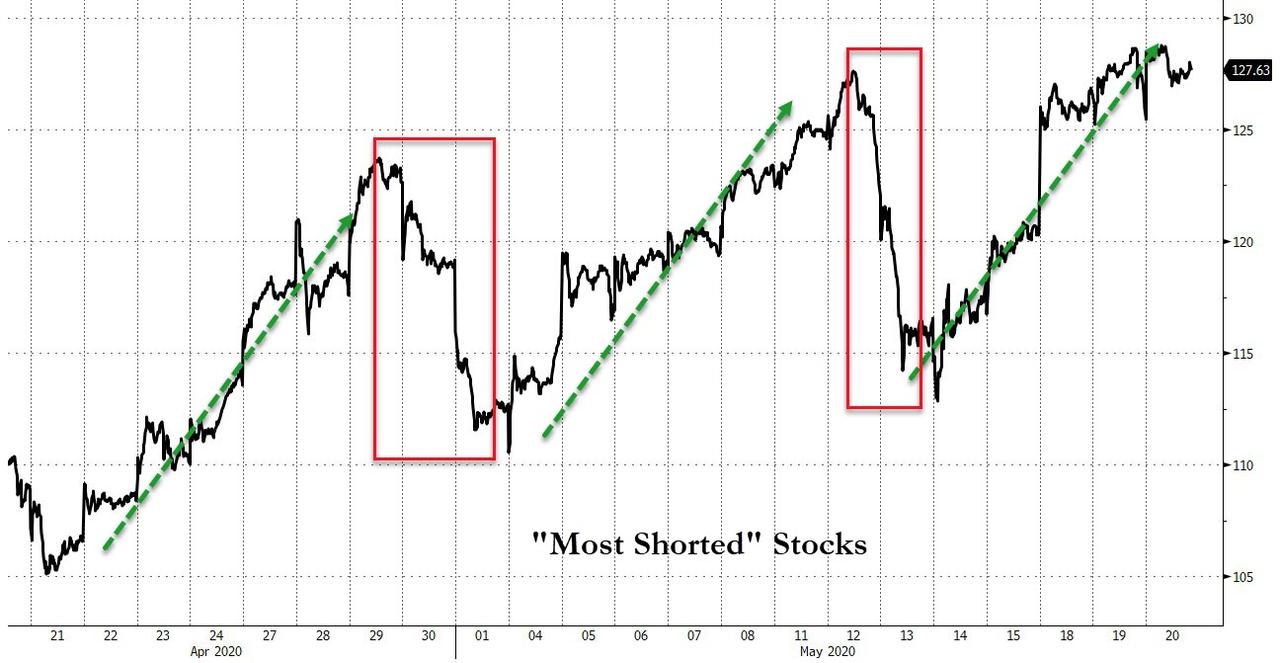

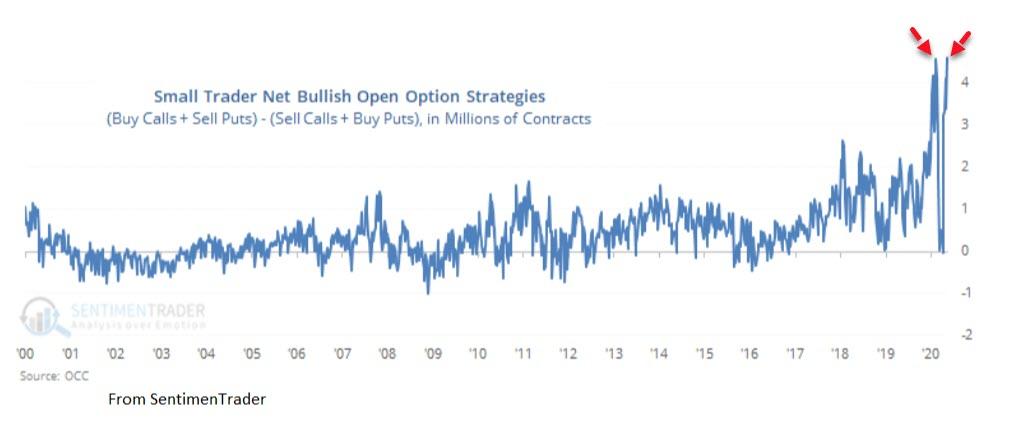

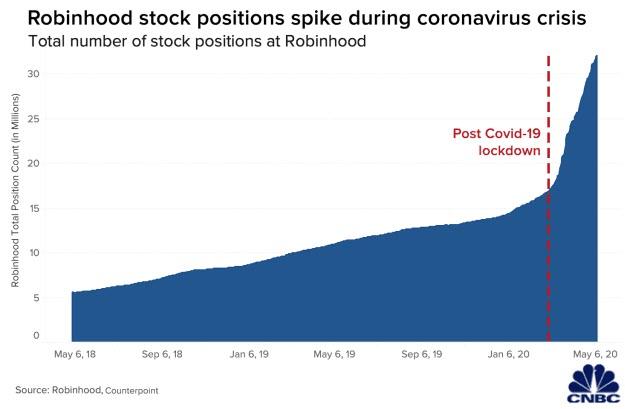

Curiously, if Fannie and Freddie had been subject to the proposed requirement before the 2008 financial crisis, neither company would have been at risk of going under, the senior official told Bloomberg, and that makes sense: the current plan only accounts for a max 4% drop in values of mortgages held by the GSEs (a number which will likely prove overly optimistic); back during the financial crisis, however, the impairments on the US housing sector were far greater since most Americans were using real estate as the bubble assets. This time around, the real estate euphoria is far less (although it is unclear if that means the loss potential is also lower) as most Americans have lost their passion for levered home flipping, and instead appear to be giving the Fed-backstopped stock market a go instead.

“We must chart a course for the Enterprises toward a sound capital footing so they can help all Americans in times of stress,” FHFA Director Mark Calabriasaid in a statement. “More capital means a stronger foundation on which to weather crises. The time to act is now.”

The proposal is the latest sign of progress toward Calabria’s goal of freeing Fannie and Freddie from nearly 12 years in federal conservatorship. Private shareholders, including hedge funds and other investment firms, could make billions of dollars when the companies are released, and the public stock offerings would likely be among the largest ever.

During the 2008 financial crisis, Fannie and Freddie received more than $187 billion in taxpayer money after they were seized by regulators. They have since returned more than that in dividends to the U.S. Treasury in fulfilling the terms of their bailout agreements, a return that was only made possible by the Fed’s injection of trillions in liquidity in the broader market and the issuance of a record amount of debt which nobody seems to be concerned about.

Understandably, the companies maintained thin levels of capital while under U.S. control. In 2012, the government amended the bailout terms in a way that effectively eliminated their capital buffers. The terms were changed again last year to let the companies keep as much as $45 billion in earnings combined. As of March, Fannie’s net worth was about $13.9 billion while Freddie’s was $9.5 billion.

So what does the current proposal mean for the GSEs return to the private sector?

Well, according to FHFA officials, it could take years and more than one public offering for Fannie and Freddie to reach the capital levels they’d need to function outside of conservatorship. The capital levels and investors’ return expectations would affect the fees Fannie and Freddie charge to back mortgages and, by extension, the rates charged to borrowers. Spoiler alert: mortgage rates are not going to go down if a government backstop is removed.

The public will have 60 days to comment on the proposed rule after it’s published in the Federal Register, which itself could take a month. A senior FHFA official said the agency hopes to finalize the rule by the end of the year.

In any case, hopes for a quick return to normal have likely been dashed: Calabria said at an online Mortgage Bankers Association event on Tuesday that the coronavirus pandemic had delayed the FHFA’s timeline to capitalize Fannie and Freddie by three to four months, but that it could take even longer if the economy worsens.

The senior FHFA official said the agency still expects Fannie and Freddie to begin raising capital from the public markets sometime next year. He said it could take years for them to reach the capital goal.

Meanwhile, as Bloomberg notes, with the Trump administration moving forward on releasing Fannie and Freddie, it might be running low on time. While Calabria’s term runs for about four more years, he might run into difficulty if Trump fails to win re-election and a Democratic administration doesn’t want to release the companies.

A different senior FHFA official said the agency is operating with the expectation that Calabria will have the remainder of his term to either release the companies from conservatorship or at least cement his plans. He said that Fannie and Freddie could be released before reaching the capital minimums under some sort of consent order, but that no decisions surrounding that had been made.

Of course, if the coronavirus pandemic leads to a longer adverse impact on the economy, and the recession is here to stay, investor hopes that Fannie and Freddie will return to capital markets at some point in the foreseeable future will be promptly squashed.

via ZeroHedge News https://ift.tt/3gbhxBx Tyler Durden