Here’s Why The Economy Won’t Recover (And No, It’s Not COVID-19 Or The Lockdown)

Authored by Charles Hugh Smith via OfTwoMinds blog,

When reality and truth become the sworn enemies of society’s political and economic elites, the society is well and truly doomed.

The risks of Covid-19 and the lockdown have been explored across a wide spectrum of opinion. To hit just a few of too many to count:

— Permanent loss of civil liberties under the guise of “pandemic controls.”

— Failure of control measures to limit the pandemic in any sort of economically manageable manner.

— Schemes for ID Cards identifying those with antibodies may fail as immunity might be fleeting, or low antibody counts may not confer immunity.

These visible risks arise directly from the pandemic and efforts to control it, but the reasons why the economy won’t recover were in force long before the pandemic:

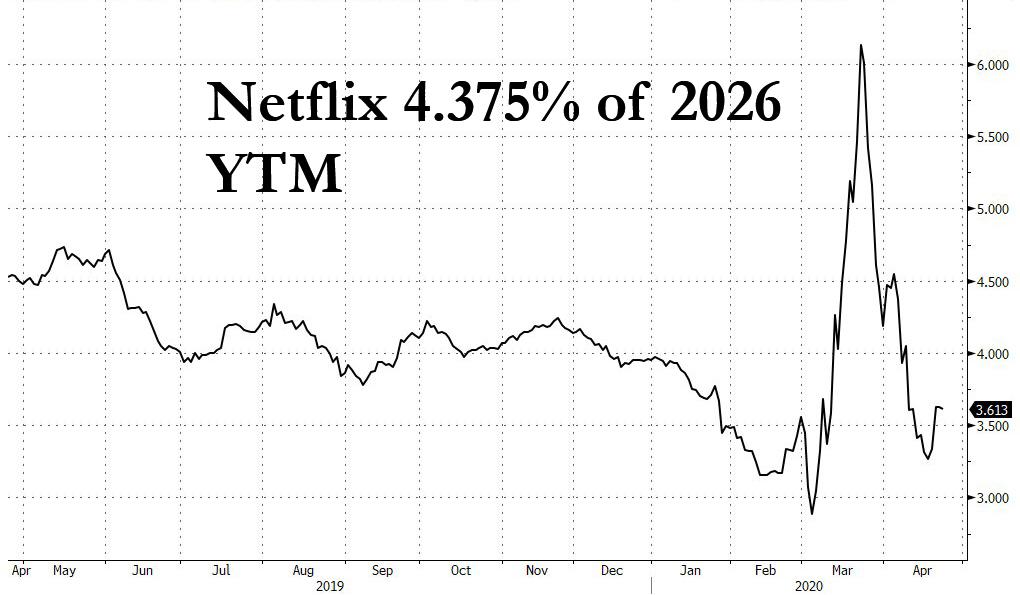

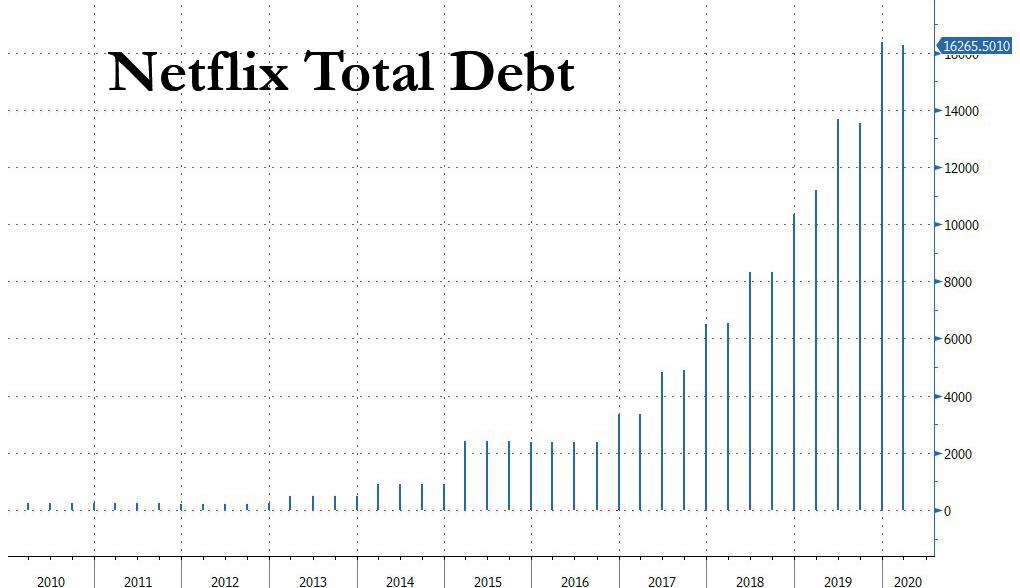

1. Unsustainable dependence on expanding debt to fund consumption as earned income stagnated.

2. Unsustainably high costs imposed by cartels, monopolies, insider-skims/scams, institutionalized fraud, hyper-financialization, exploitation, etc. (Please see What’s Collapsing Can’t Be Saved: Our Fraudulent Economy)

3. The economy-wide creation of self-serving simulations of trust, credibility, transparency and accountability as substitutes for actual trust, credibility, transparency and accountability.

This ceaseless spew of simulacra to cloak self-serving corruption is hidden from view lest the truth–that authentic trust, credibility, transparency and accountability have been dismantled because they inhibit the profiteering and exploitation of insiders and elites– undermine the entire status quo.

And so “success” (as in maximizing profits) in America is now a game of creating believable facsimiles of what was once authentic. Like all mammals, humans retain a sixth sense–commonly referred to as the “sniff test”, i.e. something doesn’t feel right–and so the simulacra are only partially successful in making us believe institutions are trustworthy, credible, transparently operated and governed in a way that enforces accountability.

As a result, the more all our dominant institutions press their claims of legitimacy, the more they erode their legitimacy.

We sense all of these facsimiles are false, but are powerless to uncover the actual machinery of corruption. We are forced to rely on insiders who release the actual processes to the public, and these whistleblowers are hunted to the ends of the Earth (Assange, Snowden, et al.) because their revealing how the status quo actually functions is the most dangerous force the status quo faces.

This requirement to hide the truth lest it collapse all the skims, scams, frauds, rackets and insider plundering and pillaging is the Monster Id of America. The more the insiders and institutional technocrat machinery attempt to censor and suppress critical inquiry, the greater the erosion of public trust in the credibility and legitimacy of the dominant institutions.

When reality and truth become the sworn enemies of society’s political and economic elites, the society is well and truly doomed. We have reached the “let them eat cake” moment in which our self-serving insiders have lost touch with the reality of their own dissonance and disconnect from the real world.

The hollowed-out brittle shell of the global economy has shattered, and no amount of simulations and bogus reassurances can restore what’s broken. Authoritarian overkill only speeds the collapse of legitimacy, trust and credibility.

* * *

My recent books:

Audiobook edition now available:

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World ($13)

(Kindle $6.95, print $11.95) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($6.95 (Kindle), $12 (print), $13.08 ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

Tyler Durden

Thu, 04/23/2020 – 16:35

via ZeroHedge News https://ift.tt/3eFLLvX Tyler Durden